Read this Reuters article about the use of Target Redemption Forward (TARF) during the stable period of the INR. The article looks in to why TARF is appealing and the challenges it may pose in different situations. QuantArt’s Managing Director, Samir Lodha shares his views in the article highlighting how important it is to plan the structure of the TARF well to optimise return while mitigating risks.

Financial Markets 2024

Market Holidays

Trending Insights

Currency and Market Outlook

For comprehensive insights into currency and commodity markets, explore our latest series of reports in QuantArt Hedgenius. Covering 14 currencies and 9 commodities, these reports are meticulously researched to provide you with critical market intelligence. To delve into the full analysis, access the detailed reports by logging into Hedgenius.

Global Markets

To read the full report log in to QuantArt Hedgenius.

Seeking insights into Turkey’s economic landscape? Dive into our comprehensive report for a detailed analysis of recent developments shaping the nation’s financial trajectory. From economic growth and monetary policy to foreign direct investment and exchange rate outlook, our report covers key topics impacting Turkey’s economy.

The January 2024 CAD Outlook delves into Canada’s economic landscape, marked by unexpected core inflation rises and a mixed sectoral performance, hinting at a cautious approach towards interest rate cuts. With the economy showing signs of slowing down amidst high interest rates, the Bank of Canada faces a complex balancing act. The report also highlights challenges in the labor market, trade dynamics, and the impact of global economic conditions on the CAD, offering a comprehensive analysis for investors and corporates navigating these uncertain times.

In February 2024, the CHF Outlook reveals Switzerland’s adept navigation through global economic turbulence with a strategic blend of fiscal prudence and monetary acumen. As the Swiss National Bank (SNB) fine-tunes its policy levers, balancing a 1.75% key rate against inflationary pressures, the CHF stands as a bastion of stability. Amidst fluctuating trade dynamics, the report underscores a noteworthy trade surplus and robust retail sector resilience, setting a precedent for investors and policymakers eyeing the alpine nation’s economic trajectory and its implications on global financial currents,

In the ever-changing economy, the Australian Dollar (AUD) is taking a careful approach. As inflation moderation and hawkish central bank moves intersect with retail and housing market pressures, the AUD’s journey is poised for short-term appreciation, with a cautious eye on longer-term horizons. It’s crucial to balance strategies, using hedging wisely as we ride through these economic waves.

In January 2024, South Africa’s economy confronts several hurdles. The GDP contracts by 0.2% in Q3 2023, influenced by power challenges and a difficult global environment. Manufacturing PMI remains in contraction for ten months, although slightly improving to 48.2. The nation also faces a surprising trade deficit of ZAR 12.7 billion. However, easing inflation at 5.5% and a stable key repo rate of 8.25% provide some optimism. With these mixed indicators, the South African Rand (ZAR) is expected to move towards 18 in the short term, reflecting the economy’s complexity and resilience.

In January 2024, the Chinese economy demonstrated resilience and strategic shifts. Surpassing growth predictions with a 4.9% increase, the country tackles trade and property challenges. Amidst these developments, the People’s Bank of China maintains low interest rates, influencing both domestic and international financial strategies. This presentation delves into these dynamics, offering insights for investors and businesses navigating the evolving economic landscape of China.

Foreign Exchange

To read the full report log in to QuantArt Hedgenius.

Foreign Exchange

Power companies, irrespective of their reliance on renewable energy or coal, encounter foreign exchange risks. Coal-dependent firms frequently import coal, exposing them to exchange rate fluctuations every few months. Renewable energy companies also face this risk because they might import solar panels, or even if they buy them locally, their prices can be affected by currency changes.

Reducing interest costs is crucial for all power companies because it helps them make more money from their investments. At times, leveraging external commercial borrowing (ECB) alongside effective hedging mechanisms can prove more economical than borrowing in the local currency, often resulting in savings of 1.50% to 2.50%. So, it’s imperative for renewable energy firms to adeptly manage foreign exchange risks. Additionally, prudent management of interest rate risks, whether concerning local rates or benchmarks like the SOFR (Secured Overnight Financing Rate), is crucial.

This document elucidates these risks and proposes various risk management strategies, including the costs associated with different hedging instruments and prevailing market conditions.

The report provides insightful hedging strategies for various market participants against INR fluctuations. For importers, it suggests seagull structures offering downside protection and upside potential. Exporters are advised to use seagull options to hedge against INR appreciation while capitalizing on depreciation. Traders are recommended to employ strategies like Short Straddle with Protective Put in low volatility environments, ensuring premium income and protection against significant INR movements.

Commodity and Interest Rates

To read the full report log in to QuantArt Hedgenius.

February’s Copper Outlook 2024 teases a dynamic shift, with copper prices on a climb. Despite China’s slowdown, demand surges, especially from the renewable energy sector. A major mine closure in Panama hints at a shift from surplus to shortage. Plus, an anticipated 5.8% bump in global production might not keep pace with the booming EV market’s copper hunger. Will this mean greener tech at higher costs?

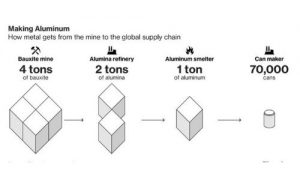

The “Aluminium Outlook Report January 2024” examines the global aluminum market’s dynamics. Key points include China’s declining property sector impacting 40% of domestic aluminum demand, a 7.31% year-on-year drop in LME 3-month aluminum prices, and global supply constraints due to Chinese smelter production caps. Additionally, UK sanctions on Russian aluminum and the Guinea oil depot explosion may limit supply, influencing prices. Global macro-economic factors like a dovish Fed and potential rate cuts will also influence prices in the medium term. The report is crucial for stakeholders to navigate these market changes and plan accordingly.

Unlock the secrets to smart borrowing in 2024 with our analysis of global interest rates. Discover why USD, GBP, AED, and INR have higher rates, while EUR, CHF, and JPY are more affordable. Learn how to navigate the tricky landscape of interest rate swaps and currency risk management to optimize your borrowing costs. Our guide provides crucial insights into managing loans in a high-interest rate environment while adhering to local regulations, making it an essential tool for savvy financial planning.

Foreign Exchange

Commodity Market

Interest Rates

Regulations

Keep yourself updated with Global Regulations on Hedging Risk Management & Interest Rate

Risk Management and Inter-Bank Dealings – Hedging of foreign exchange risk

Reserve Bank of India Bulletin

Minutes of the Federal Open Market Committee, December 12–13, 2023

Master Direction – Reserve Bank of India (Market-makers in OTC Derivatives) Directions

Comprehensive guidelines on derivatives

Master Direction – External Commercial Borrowings, Trade Credits and Structured Obligations