Hedging the high SOFR rate burden

Published on: 11th January 2023

By: Srinivas Puni

Of late, courtesy the Fed, the SOFR rates have shot up significantly, with the latest Fed projections talking about a 5% terminal rate. In this article, we will discuss the various hedging alternatives available to manage the increasing interest rate risk of Dollar loans (specifically linked to SOFR). While the discussion focusses on SOFR, one can easily replace SOFR with Libor and adjust the rate accordingly using ISDA spreads (more on that in another article) and then follow the steps outlined below.

SOFR in Arrears:

SOFR (Secured Overnight Financing Rate) in simple terms, is the benchmark rate derived and published by the NY Fed, based on the overnight repo transactions in the US market. Post the ARRC recommendations on Libor replacement rates, the USD SOFR has come to replace Libors in both cash market (lending) and consequently in the derivative market.

Since SOFR is an overnight rate, loans and swaps/derivatives use SOFR compounded in arrears over a term (3m or 6m for instance) as the floating interest rate. The O/N daily SOFR is compounded each day to arrive at the final interest amount at the end of the interest calculation period, hence the term “in arrears”. Any SOFR hedging choice must ensure that the hedge instrument caters to a similar compounded SOFR rate in line with the hedged item.

To make things easier for borrowers, Term SOFR market has been evolving, but the derivative market is more comfortable with the daily compounded SOFR still. Term SOFR hedging is also like the O/N compounded SOFR hedging, in that the prices of swaps and other instruments are similar, but for a small basis risk spread traders might add for Term SOFR based transactions. The basis is owing to the fact that the Term SOFR is based on CME future transactions where as O/N SOFR is based on the daily cash SOFR from the repo market.

SOFR Hedging

SOFR hedging is similar to erstwhile Libor hedging in that all the instruments traded on Libor are available on SOFR. Akin to Libor based interest rate swaps (IRS), SOFR swaps exist in the market, which can be used to covert a floating cash flow to a fixed cash flow. In addition to swaps Caps/Floors/Collars, which are options on the SOFR benchmark are also traded in the market.

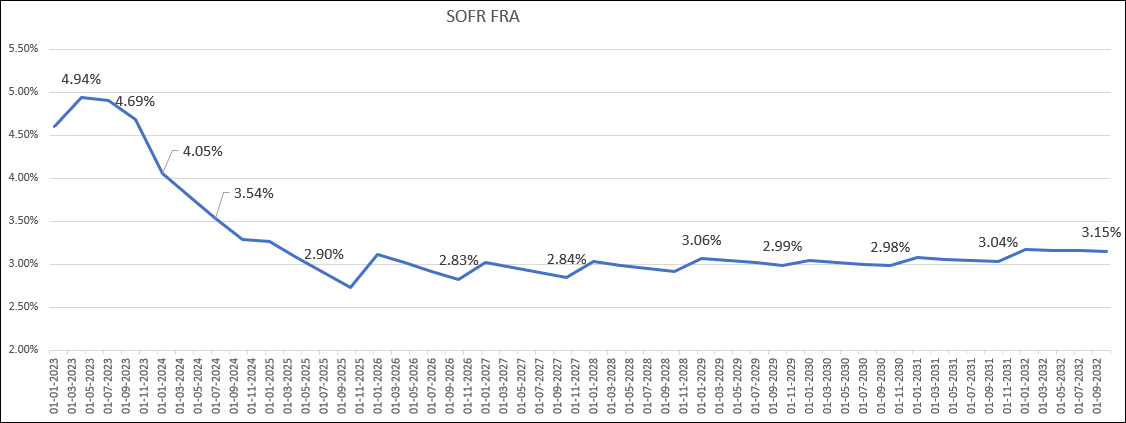

The current SOFR FRA (forward rates derived from current swap curves) which indicate the rate market is willing to pay/receive for a given future maturity, can be helpful in decisions about whether to hedge and if so, to what tenor. Below graph indicates the current SOFR market FRAs. As can be seen, the market is expecting rate cuts from the Fed starting in 2023 and a long-term SOFR rate of 3% odd.

The hedge decision should now be based on how the company’s expectation is vis-à-vis the market. If one believes that the market is over-estimating the short-term Fed dovishness and under-estimating the potential for a large cut in rates in the long-term, the hedge decision would be to hedge short-term risk and leave the long-term risk. The view on rates should be married to the current market costs of hedging in such decisions.

In addition to the plain swaps, one can use Caps/Collars or even Cap spreads to hedge the SOFR risk. For instance, a Cap which protects the maximum rate to 4% would cost 0.65% per annum. Such a Cap ensures that the maximum rate for the company is 4.66% in effect. If one wants to ensure that any upside benefit or a future fall in rates accrues fully, a Cap is a good alternative. There are partial protection products like Cap Spread which protect in a range of rates can be used if the view is that the long-term SOFR rates are not going to go much higher from here. For instance, a 3%-5% cap spreads helps protect the SOFR variations within a band, provide an upside if rates were to fall and cost relatively cheaper (0.9%) compared to a full IRS hedge.

SOFR Hedge Accounting

Both IRS and Cap deals can be accommodated under hedge accounting framework. But, aspects such as the benchmark similarity (term SOFR and O/N SOFR), frequency, any lag/leads in the underlying loan has to be matched in the hedge to ensure hedge effectiveness. It is in fact advisable that hedge accounting is adopted while engaging in long-term interest rate hedging, since the changing swap rates move the MTM significantly and lead to material volatility in the quarterly P/L. Effective hedge accounting helps in smoothening out the finance cost for the company in a seamless fashion.

About QuantArt

QuantArt is a forex, interest rates and commodity advisory firm specialized in helping clients mange their financial risks in an optimal fashion. At QuantArt, our experts can provide well-rounded advice on the various alternatives available in hedging interest rate risk out of SOFR. We can price complex instruments, advise on hedge timing and ensure that accounting and cash flow considerations are optimized so that a well thought-out hedge can be adopted by our clients.