FAQs on Interest Rate Derivatives

1. What are Interest Rate derivatives and what are their types?

An interest rate derivative is a financial contract that derives its value from an underlying interest rate or an interest-bearing asset. Interest rate derivatives are often used to insure against interest rate risk through hedging or to speculate on the future interest rate movement. The underlying interest rates can be LIBOR/RFR, domestic interbank offered rates, Fed Funds Rate, etc.

Interest rate derivatives, like any other derivatives, are of two types: linear and non-linear. Linear IRD is one where there is a direct relationship between the value of the derivative and the underlying interest rate. Examples of linear IRDs are; interest rate swaps (IRSs), forward rate agreements (FRAs), and cross-currency swaps, currency basis swaps. Nonlinear IRDs are those which include optionality on interest rates in some or other form. In this case, there exists a nonlinear relationship between the value of the contract and the underlying since there is a probability of exercise attached to the contract. Examples of non-linear IRDs are; swaptions, interest rate caps and floors, and constant maturity swaps (CMSs).

Derivatives also are traded on bonds directly and they reference the bond prices instead of an interest rate. Examples of such contracts include bond forwards, bond options, and call/put features in a bond.

2. What are the advantages of Interest Rate derivatives?

- Hedging through Interest Rate Derivatives helps in mitigating the risk of unfavourable movements in the interest rates and bond prices as the case may be.

- They help in lowering the cost of funding by helping the borrower convert fixed liability to floating or vice versa depending on the position and view.

- Further, they can help in optimizing the cost of funding through a choice of currency through a swap mechanism.

- IRDs can be used to speculate and make a profit by timing the market and take a view on the interest rate movements in the future.

- Interest rate derivatives as an over-the-counter instrument can be tailored according to the user’s preferences and have a wide variety of vanilla and exotic instrument choices available.

- The market for Interest Rate Derivatives is quite liquid given the volumes of transactions taking place which makes it easy to take an offsetting position to exit the contract.

3. How do Interest Rate derivatives work?

Interest Rate Derivatives can protect one against rising or falling interest rates. One such common derivative is an interest rate swap. It can be used to convert a fixed liability to a floating rate liability and vice versa depending on the position and view.

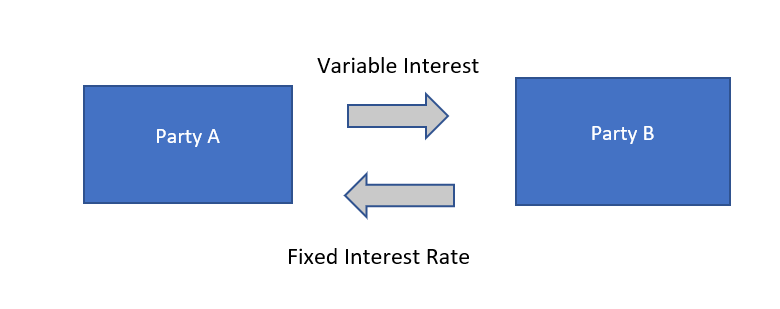

Two counterparties agree to exchange future interest payments for another, based on a pre-specified principal amount for a period of time. Both parties are bound by the terms of the agreement until the maturity date. The parties do not take ownership of the other party’s debt, only the interest amount is exchanged. There are many different types of Interest Rate Derivatives. The most common of these is the Interest Rate Swap.

Let us assume a floating rate liability. The floating interest rate in which the interest payments are to be made can either fall or rise. An Interest Rate Swap will protect against a rise in interest rates. Using an Interest Rate Swap, you exchange the variable interest rate (such as Euribor) for an agreed fixed interest rate.

In effect, a floating interest rate will be swapped for a fixed interest rate. A possible disadvantage is that the floating interest rate could drop below the fixed interest rate that was agreed to pay.

4. What are the disadvantages of Interest Rate Derivatives?

- Interest rate derivatives derive their value from the underlying interest rate hence they remain prone to interest rate volatility and can be prone to large movements during extreme market situations. Any adverse movements can result in massive losses.

- Hedging through Interest derivatives limit the possibility of benefiting from a favourable interest rate movement during the contracted period since the rate is locked in advance. Hedging activity, per se, can result in opportunity loss due to failure to benefit from a favourable market movement.

5. About Interest Rate derivatives statistics – Bank for International Settlements

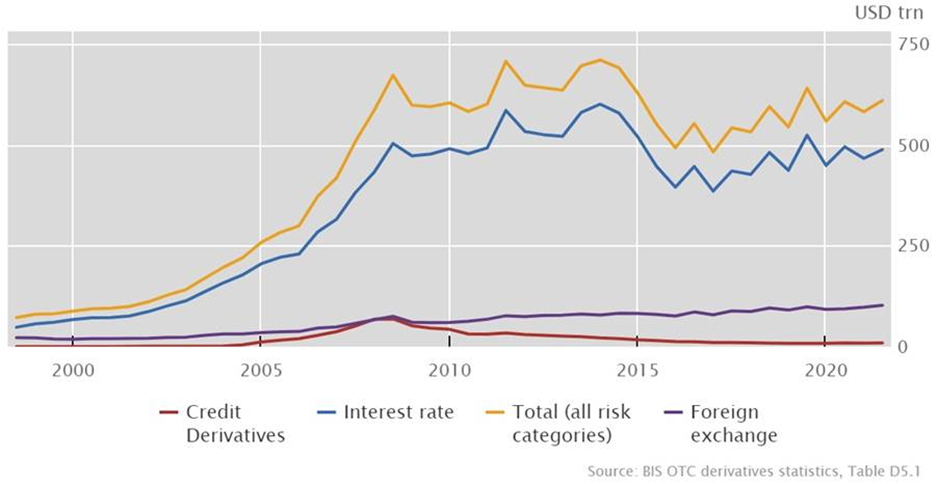

Interest Rate derivatives statistics cover derivatives traded on organized exchanges, outstanding positions in over-the-counter (OTC) derivatives markets, and turnover in foreign exchange and OTC interest rate derivatives markets. They aim to provide comprehensive measures for the size and structure of global derivatives markets.

6. What are OTC Interest Rate derivatives outstanding?

The OTC derivatives statistics published by the Bank for International Settlements capture the outstanding positions of derivatives dealers, mainly banks. They cover the outstanding notional value, market value, and credit exposures of OTC interest rate, derivatives, as well as concentration measures. The statistics are composed of data reported every six months by dealers in 12 jurisdictions (Australia, Canada, France, Germany, Italy, Japan, the Netherlands, Spain, Sweden, Switzerland, the United Kingdom, and the United States) plus data reported every three years by dealers in more than 30 additional jurisdictions. The same can be viewed in the link below.

https://stats.bis.org/statx/srs/table/d7?f=pdf

OTC derivatives notional amount outstanding by risk category