Weekly Global Economic Data and its Impact

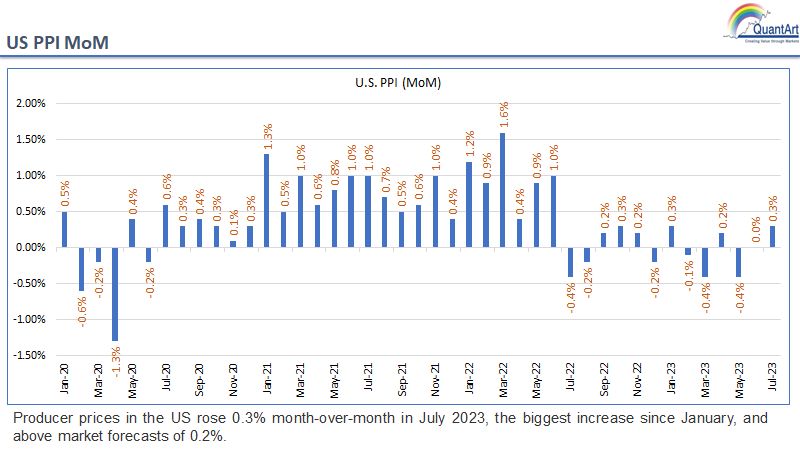

US PPI MoM

This chart displays the monthly changes in the U.S. Producer Price Index (PPI) from April 2020 to April 2024. The PPI measures the average change over time in the selling prices received by domestic producers for their output. Notably, April 2024 saw a 0.5% month-on-month increase, which was higher than the expected 0.3%. This followed a modest decrease of 0.1% in March 2024. The data exhibits fluctuations, with several peaks and troughs indicating varying inflationary pressures in the U.S. manufacturing sector. This visual analysis provides investors and economists insights into trends in factory gate prices, helping gauge economic health and inflationary trends in the United States.

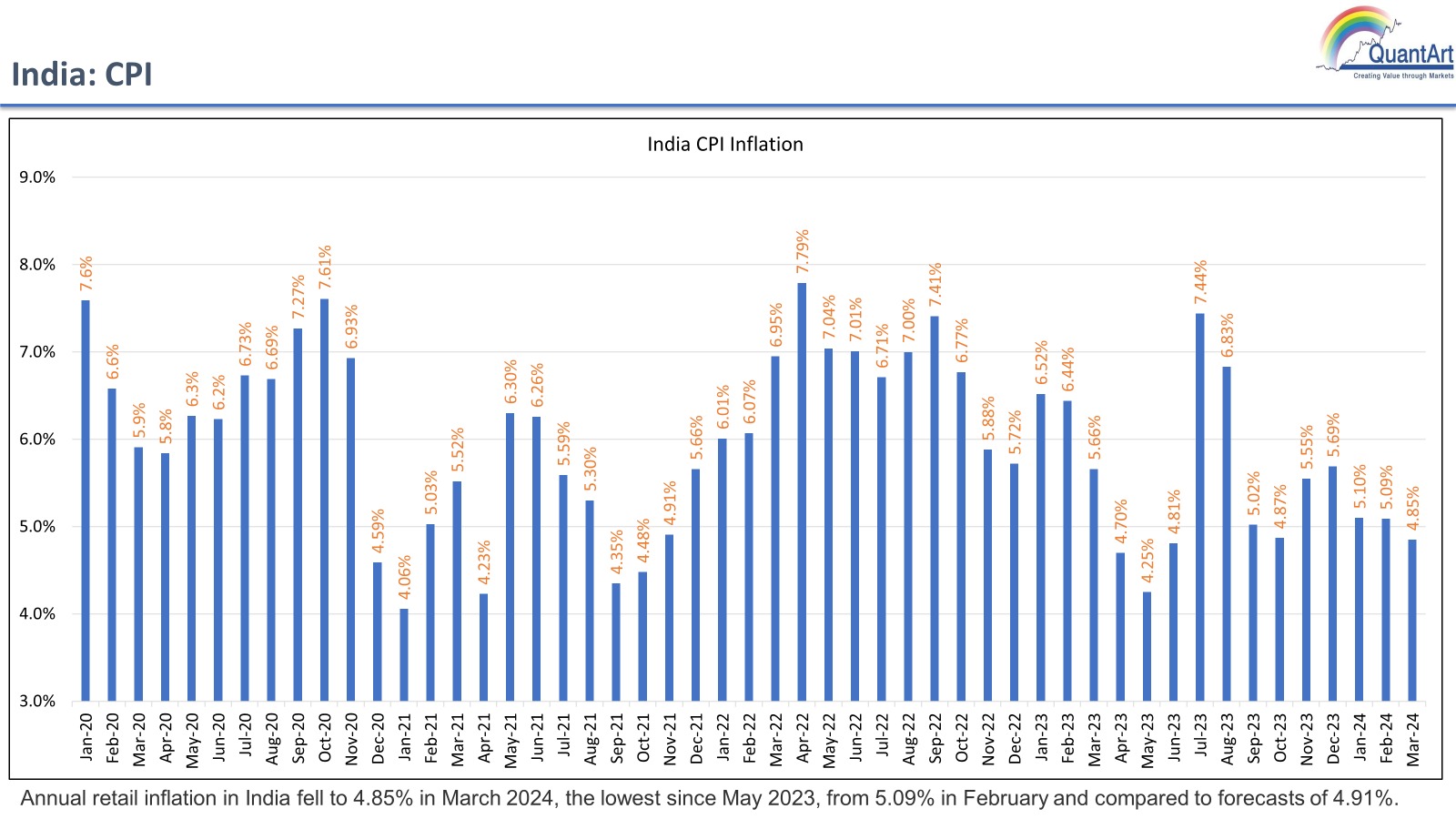

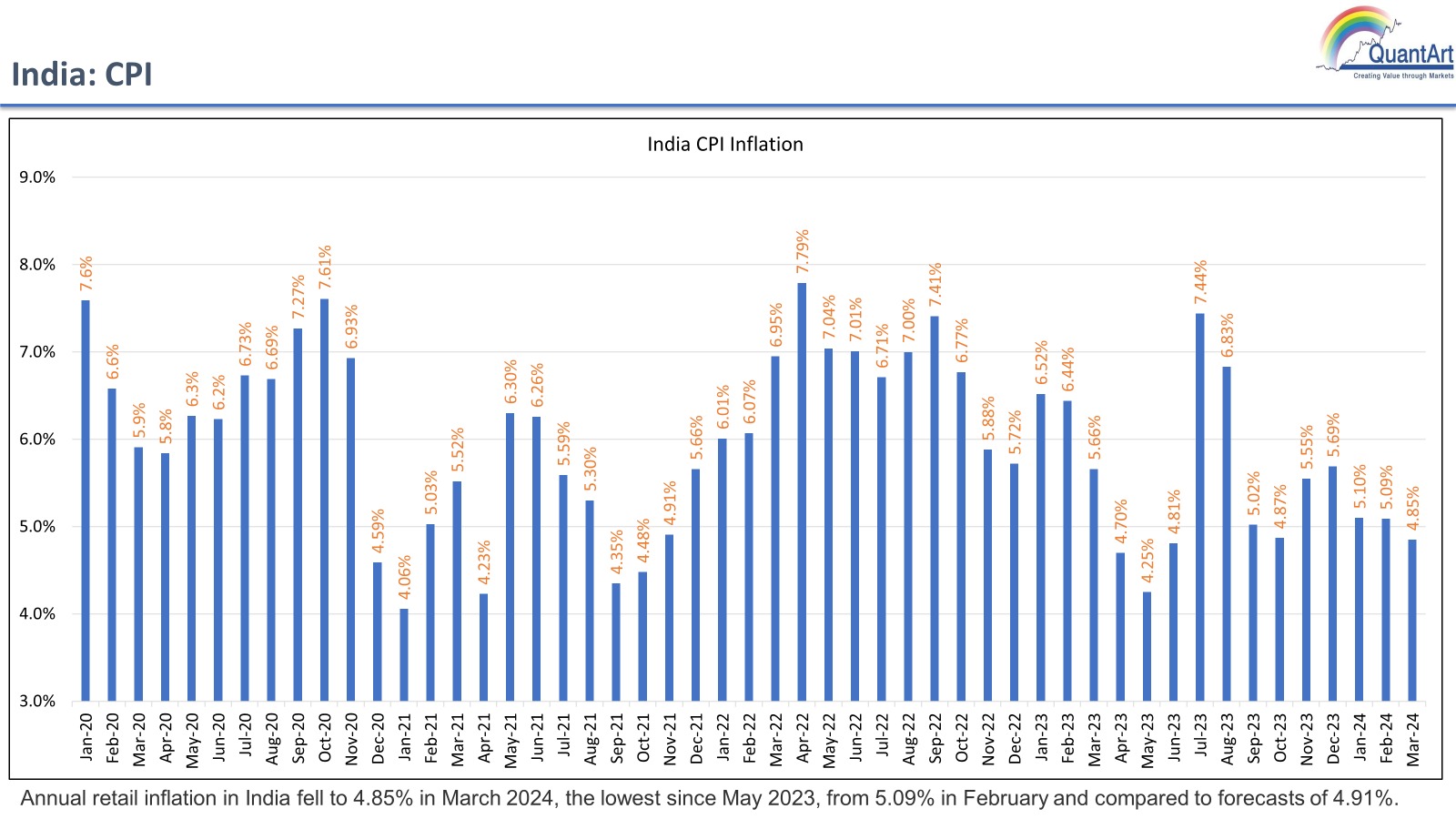

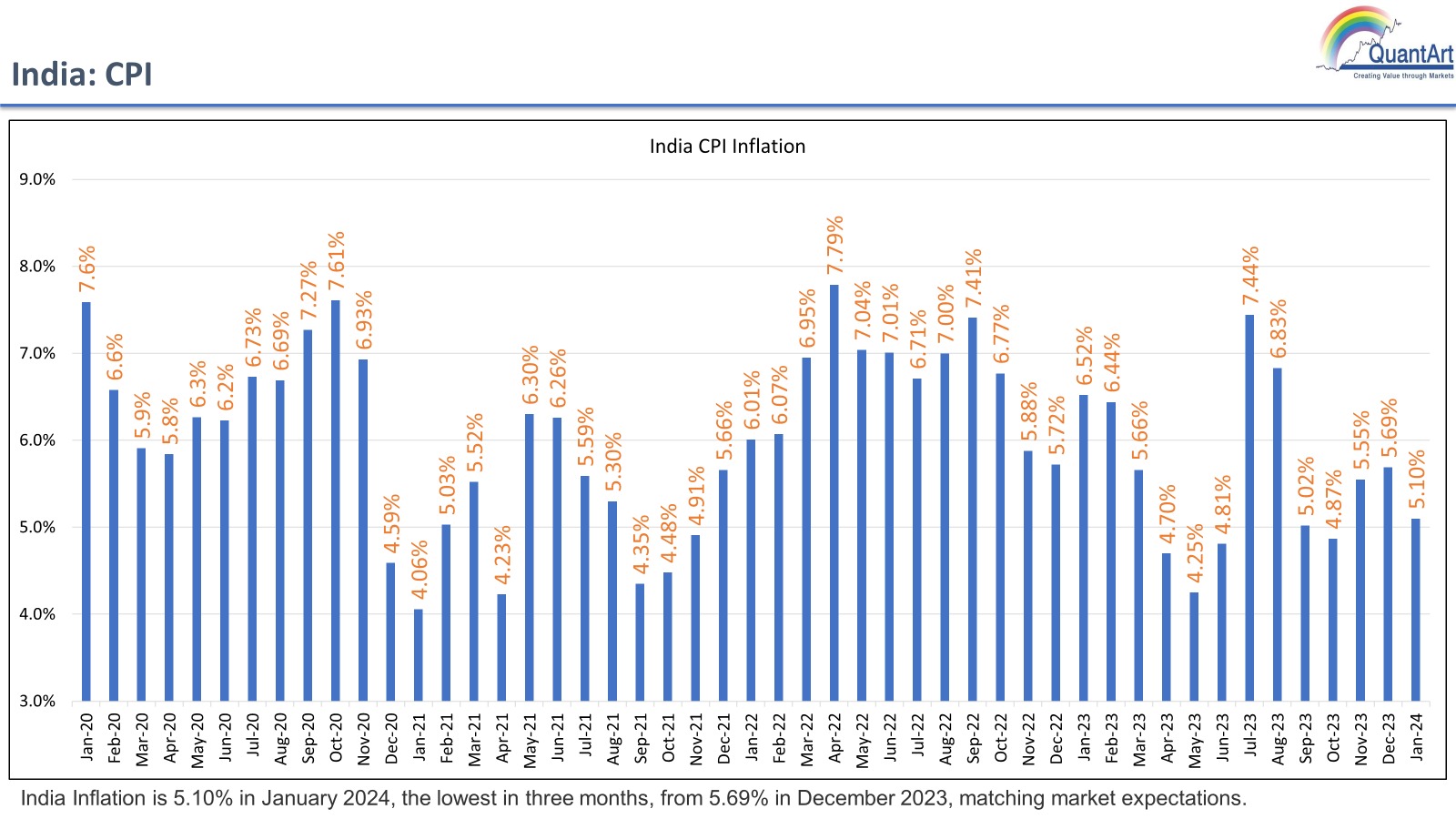

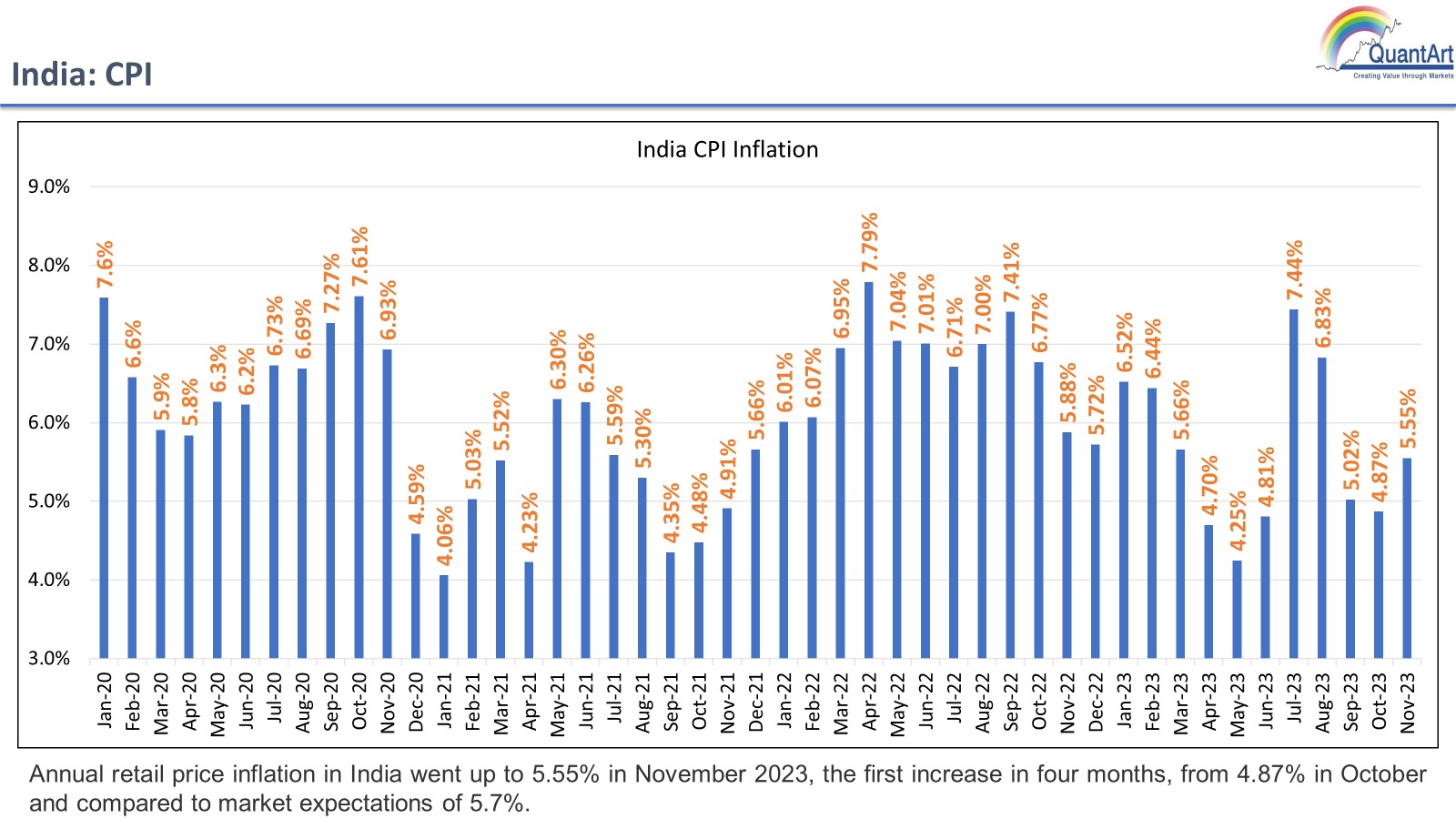

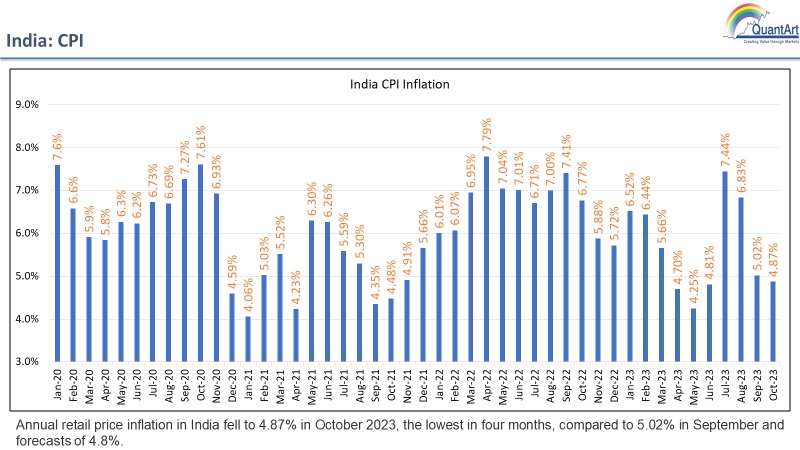

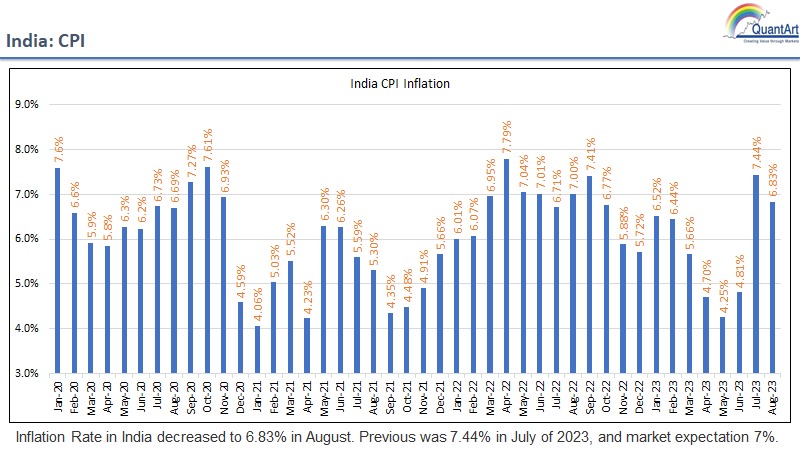

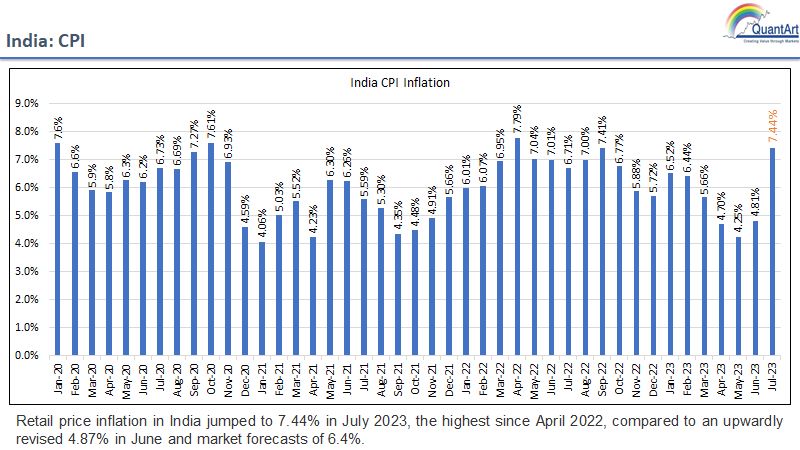

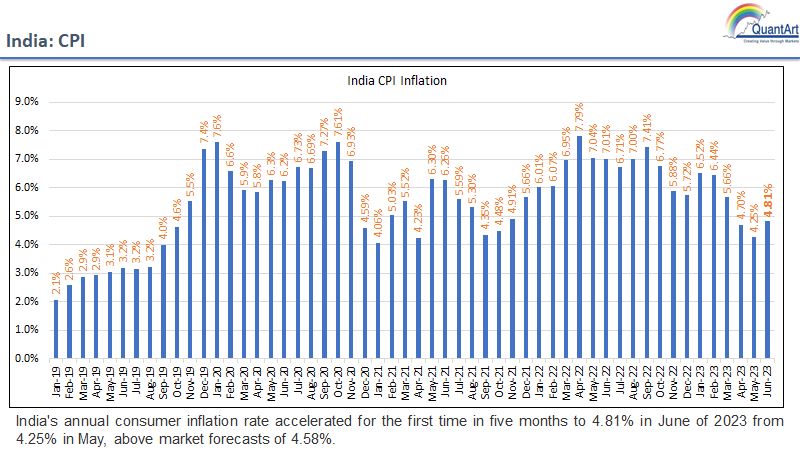

India: CPI

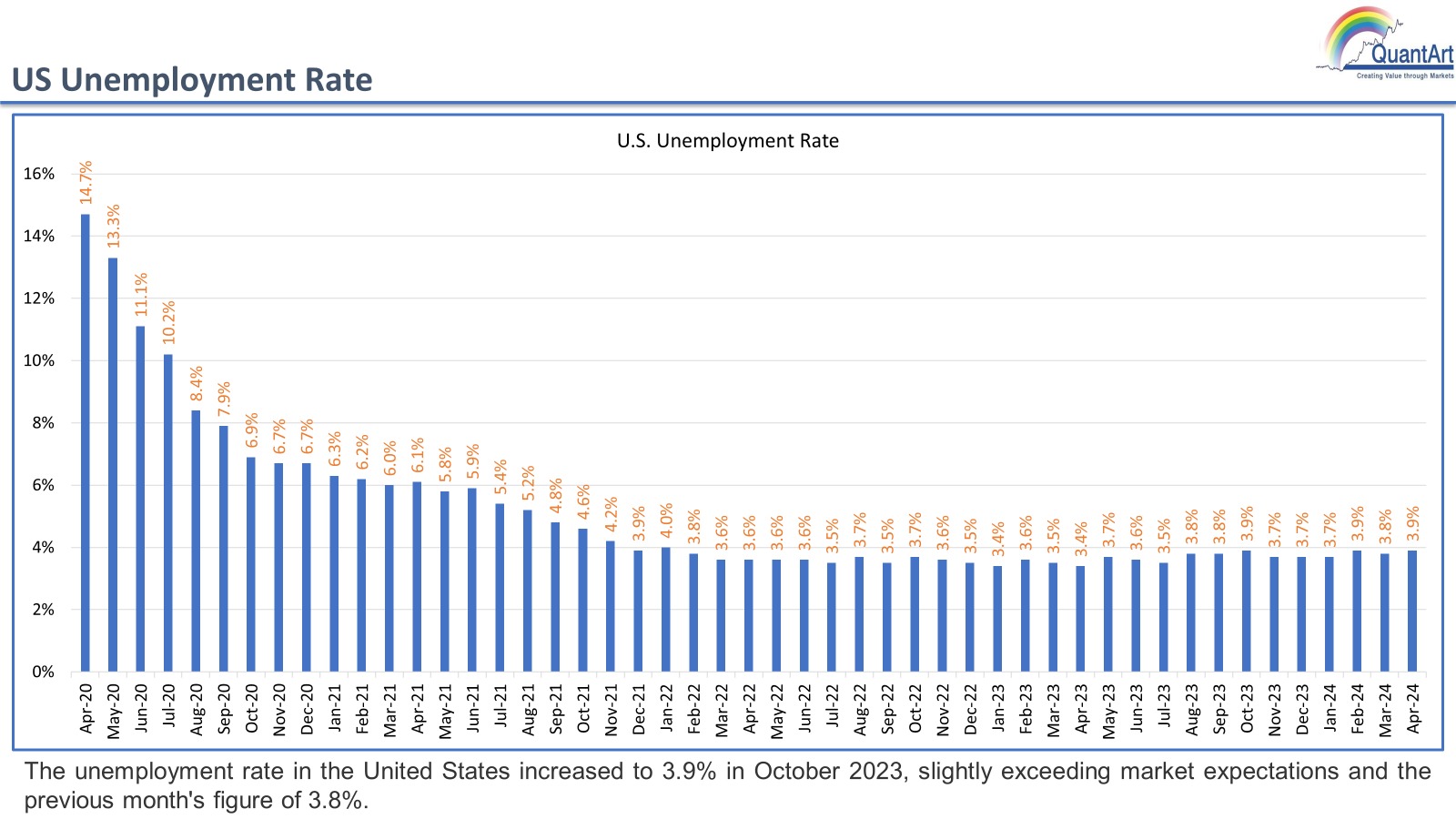

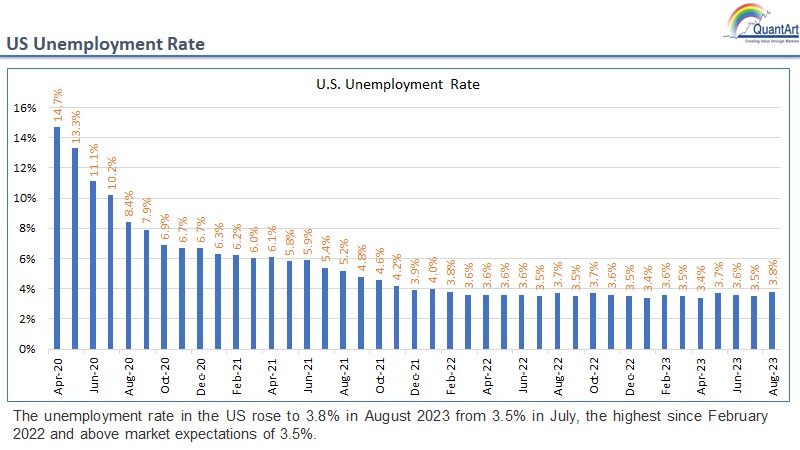

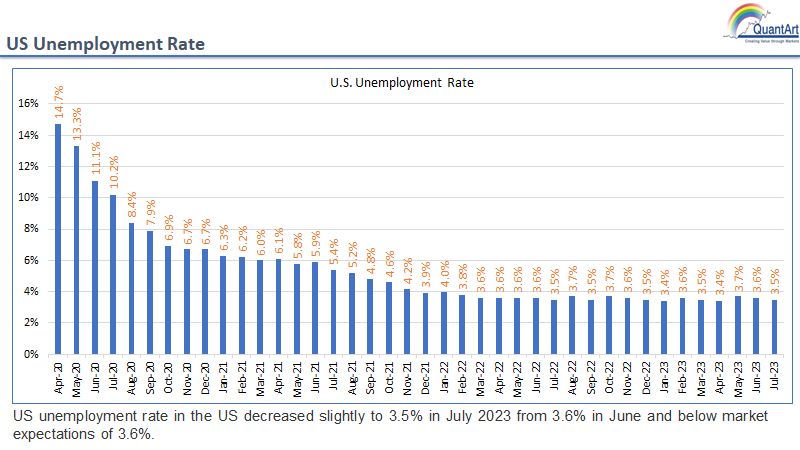

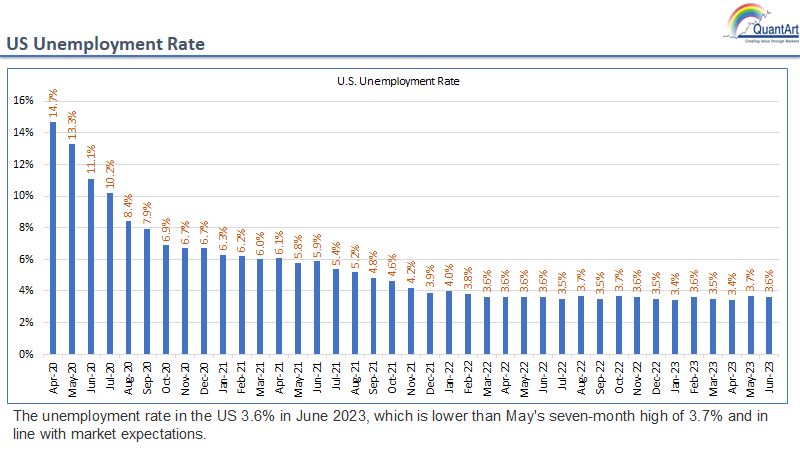

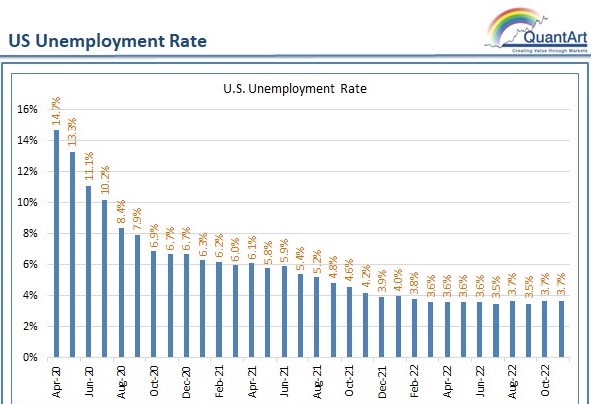

US. Unemployment Rate

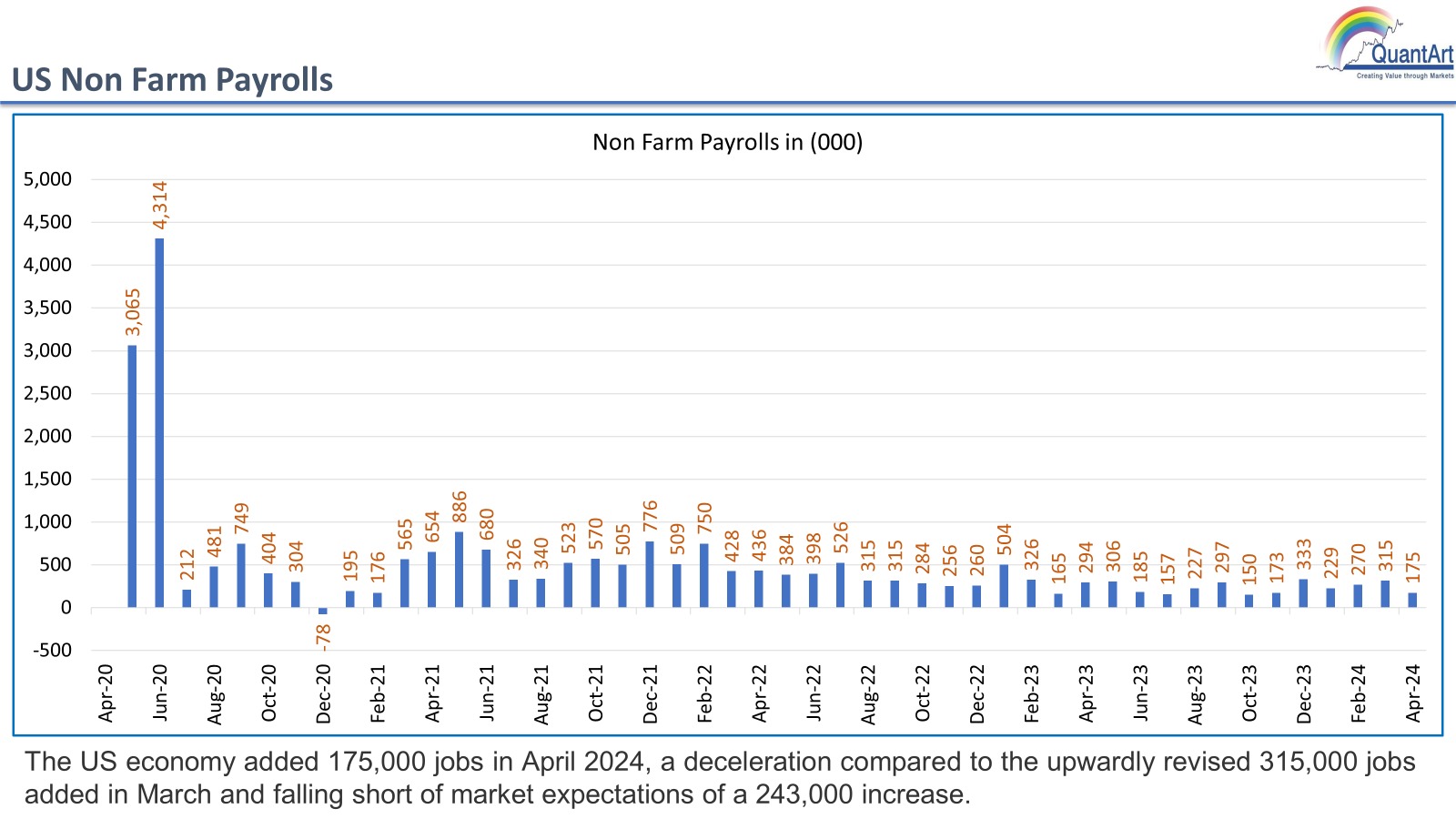

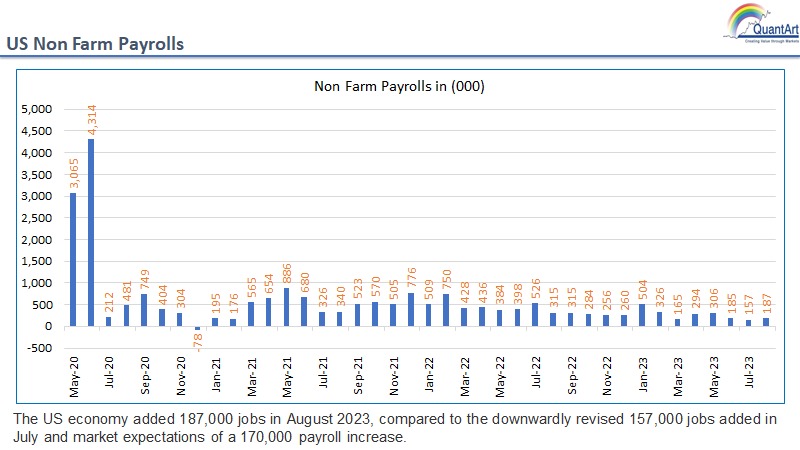

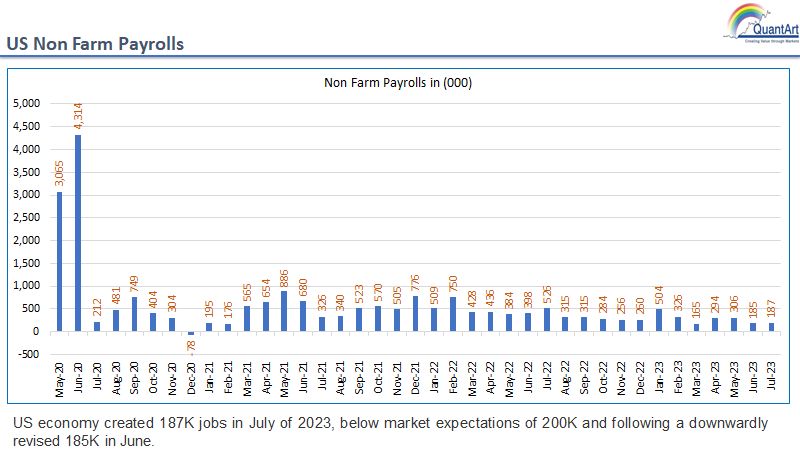

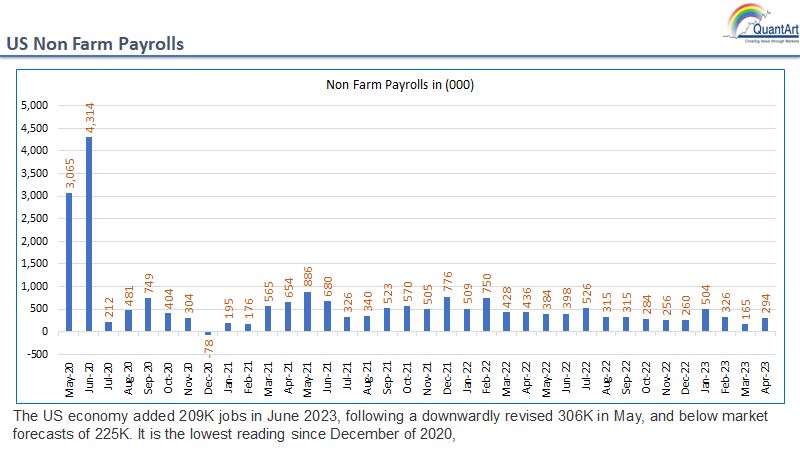

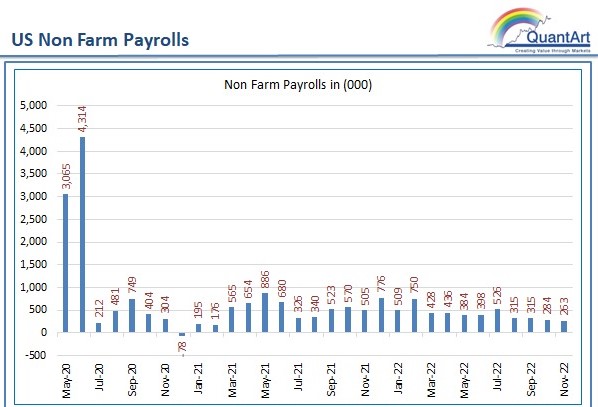

US Non Farm Payrolls

This chart presents data on U.S. Non-Farm Payrolls, showing the monthly job additions from April 2020 through April 2024. The figures represent the number of jobs added in thousands. April 2020 shows a significant job loss, depicted by the negative bar, while the following months show recovery and fluctuations in job growth. In April 2024, the economy added 175,000 jobs, which is a slowdown from the revised 315,000 jobs in March 2024, and below the market expectations of a 243,000 job increase. The chart is a visual representation of the employment changes over the period, highlighting the volatility and recovery in the U.S. job market.

India: CPI

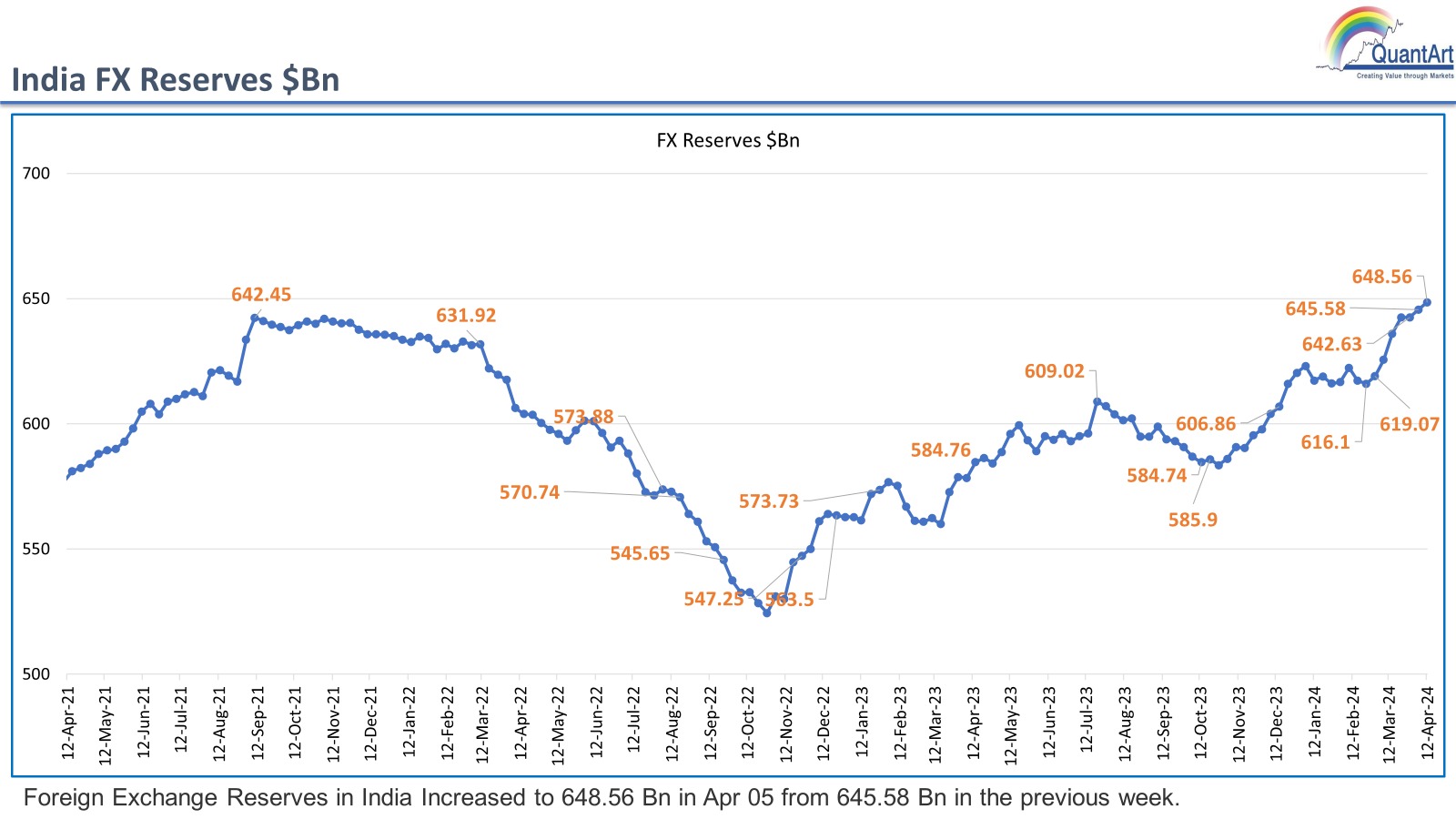

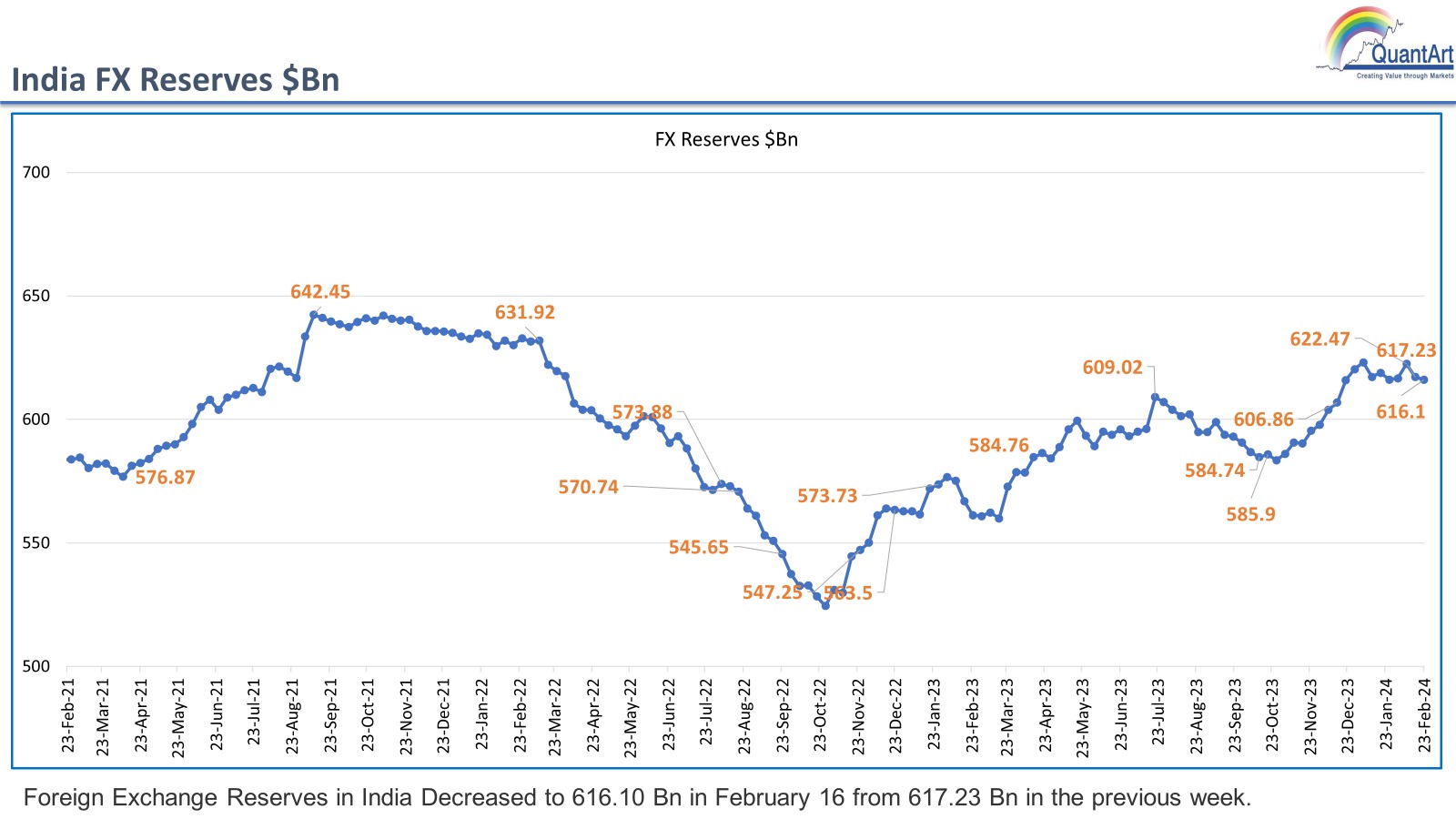

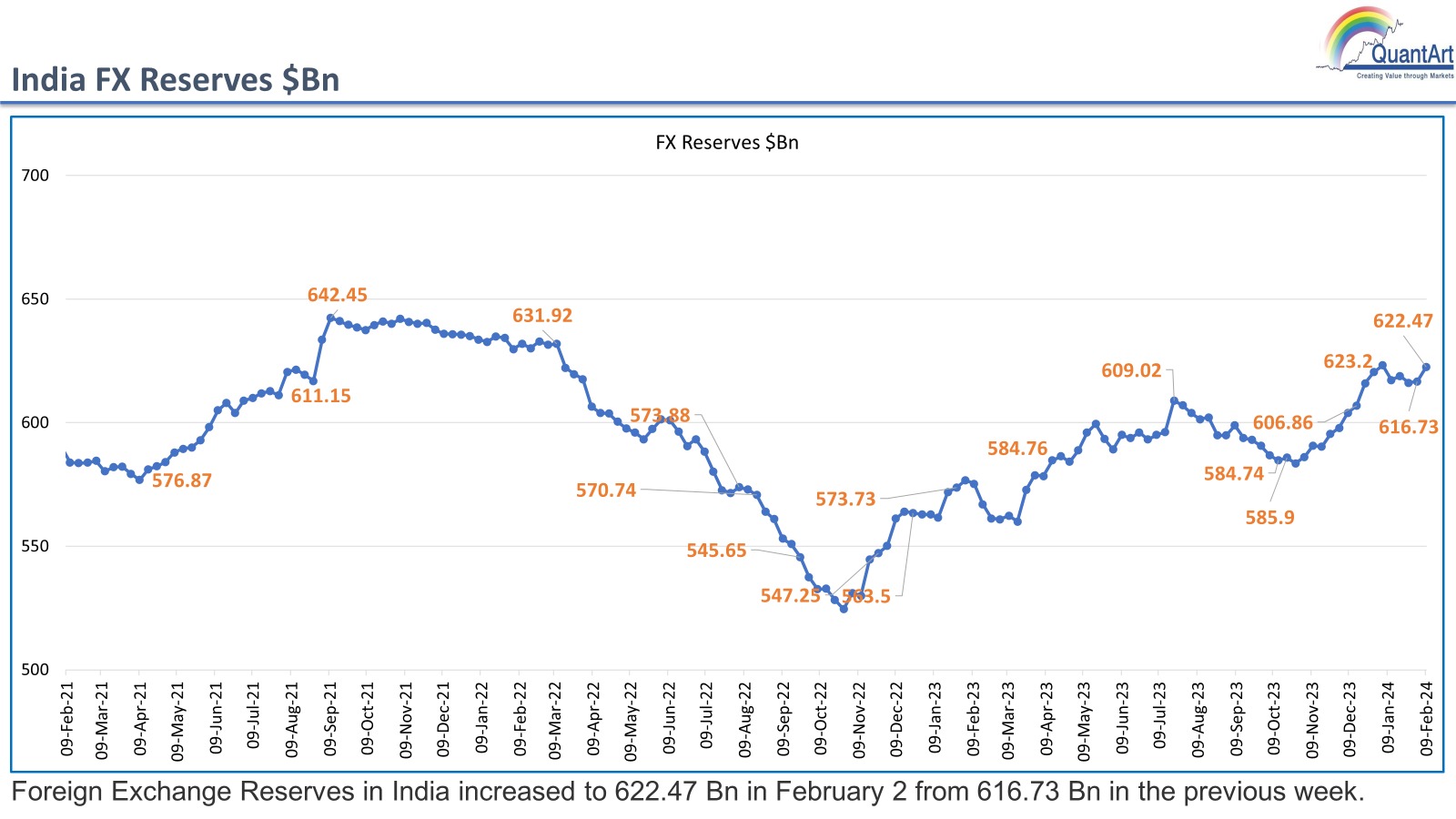

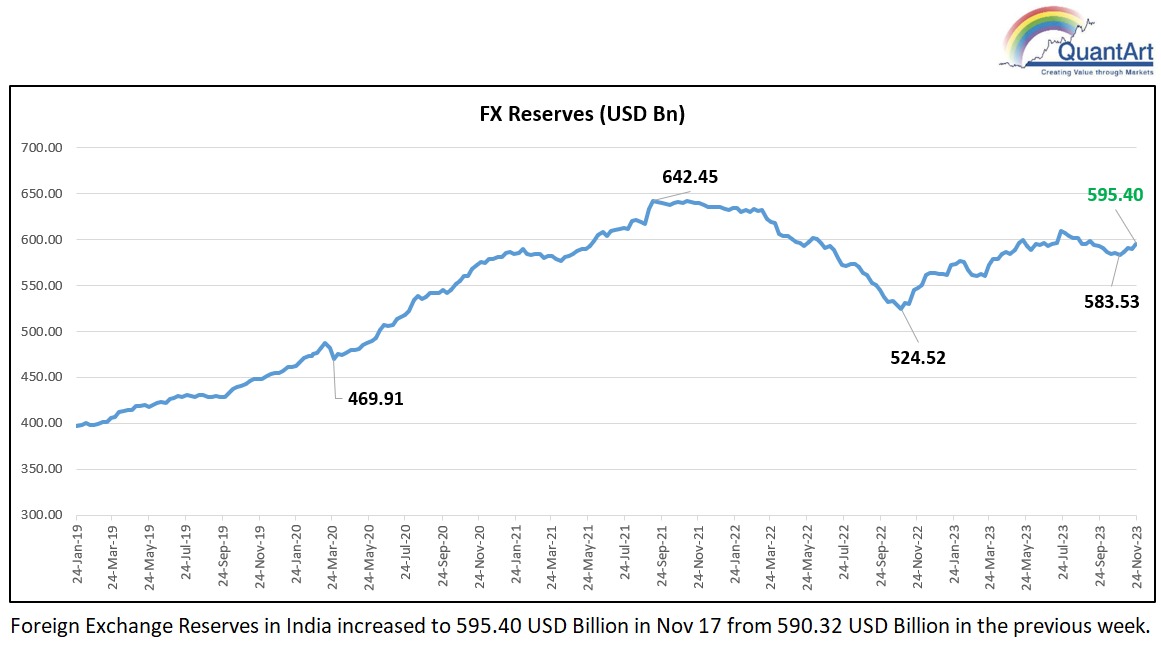

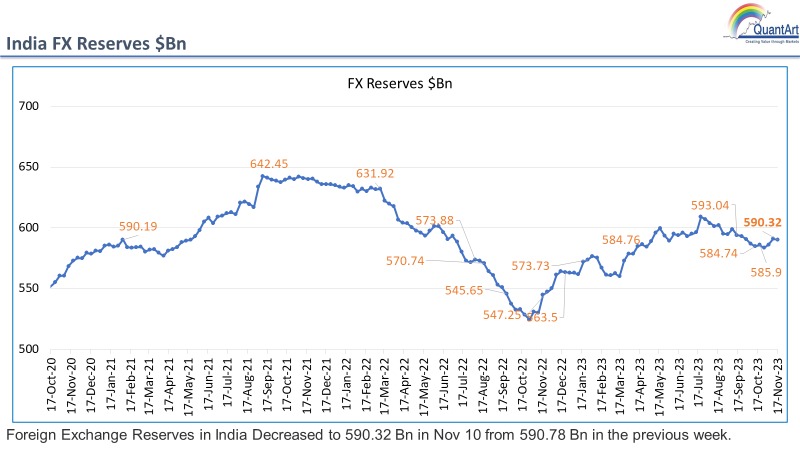

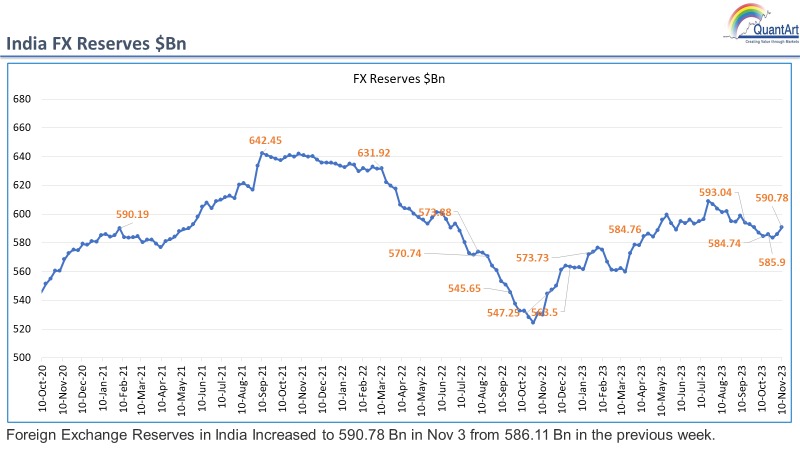

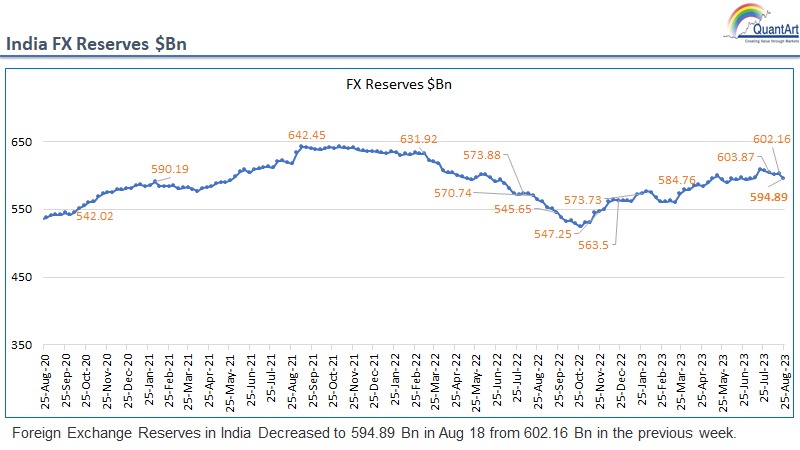

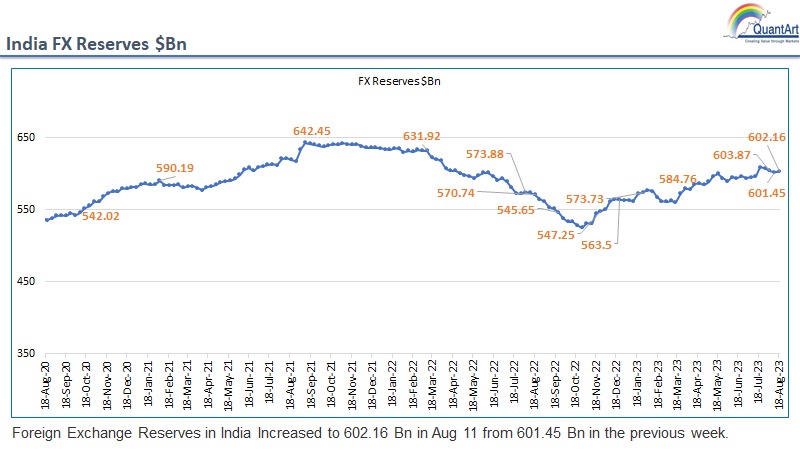

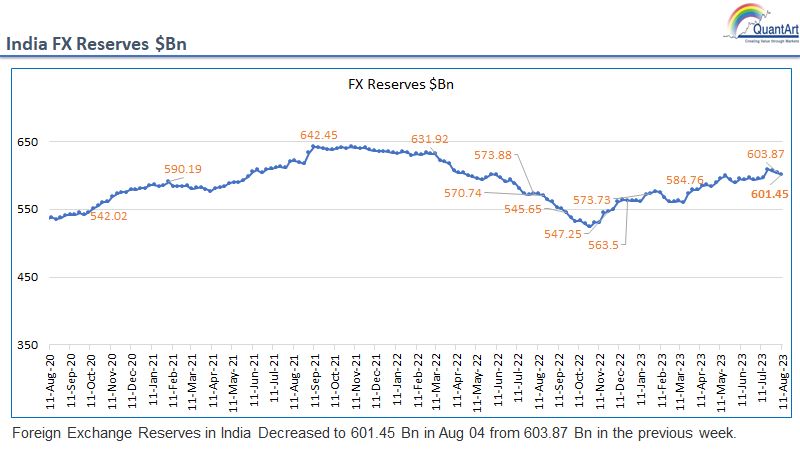

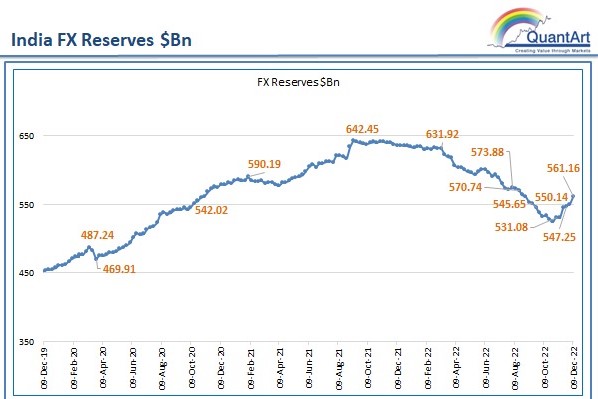

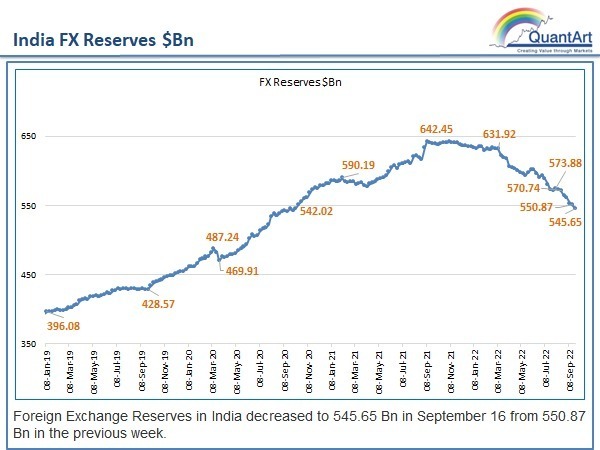

India Fx Reserves $Bn

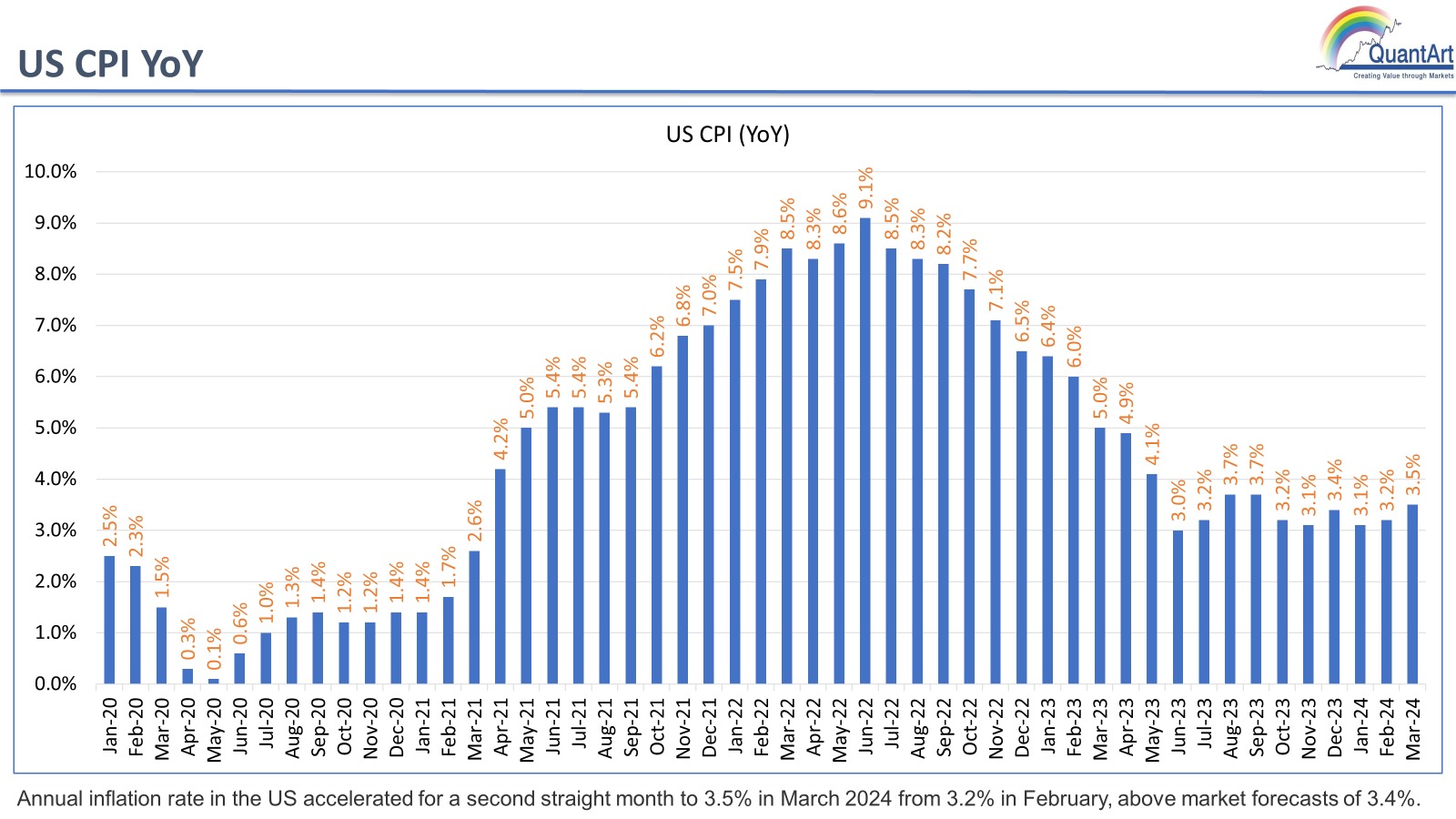

US CPI (YoY)

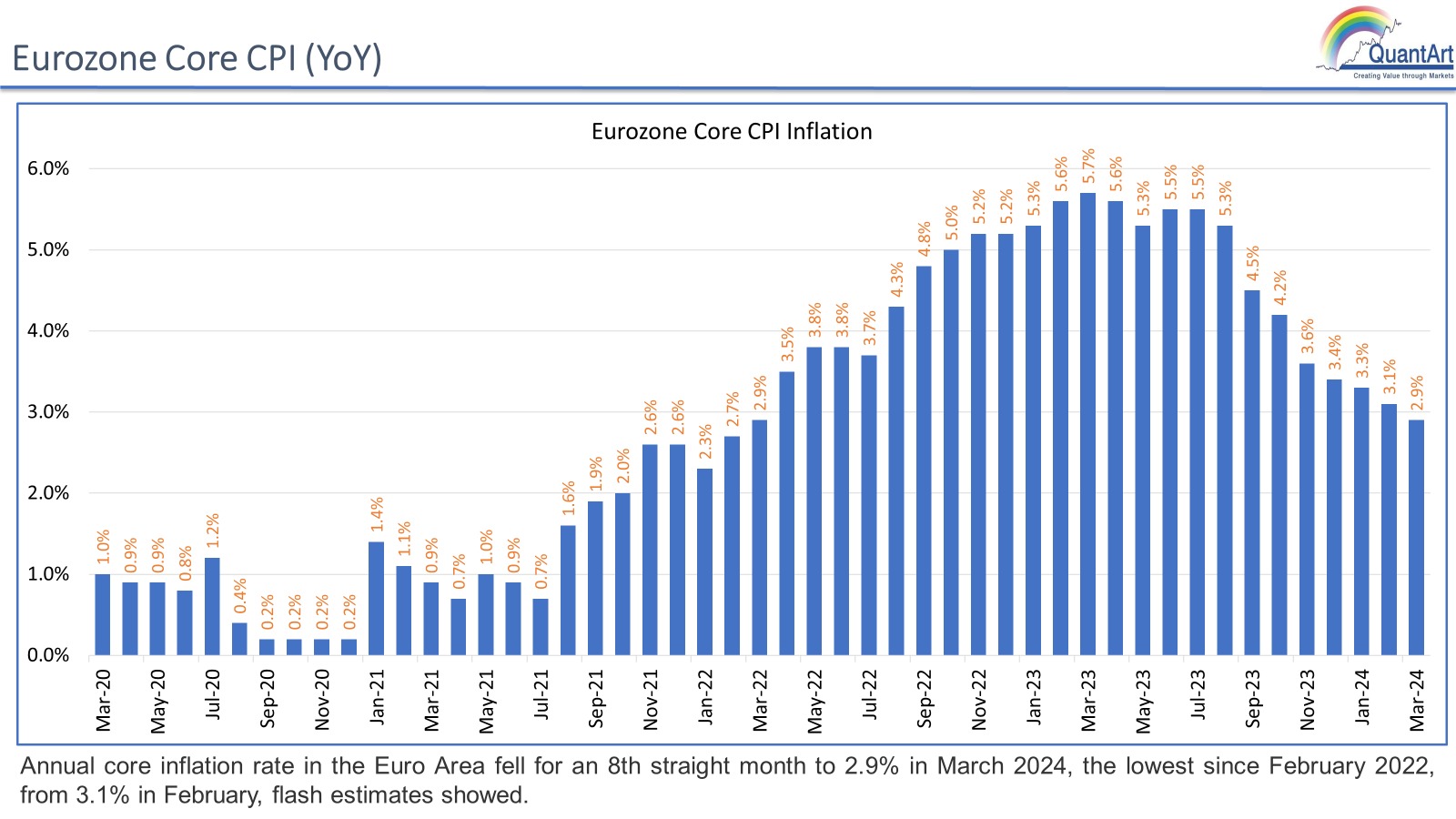

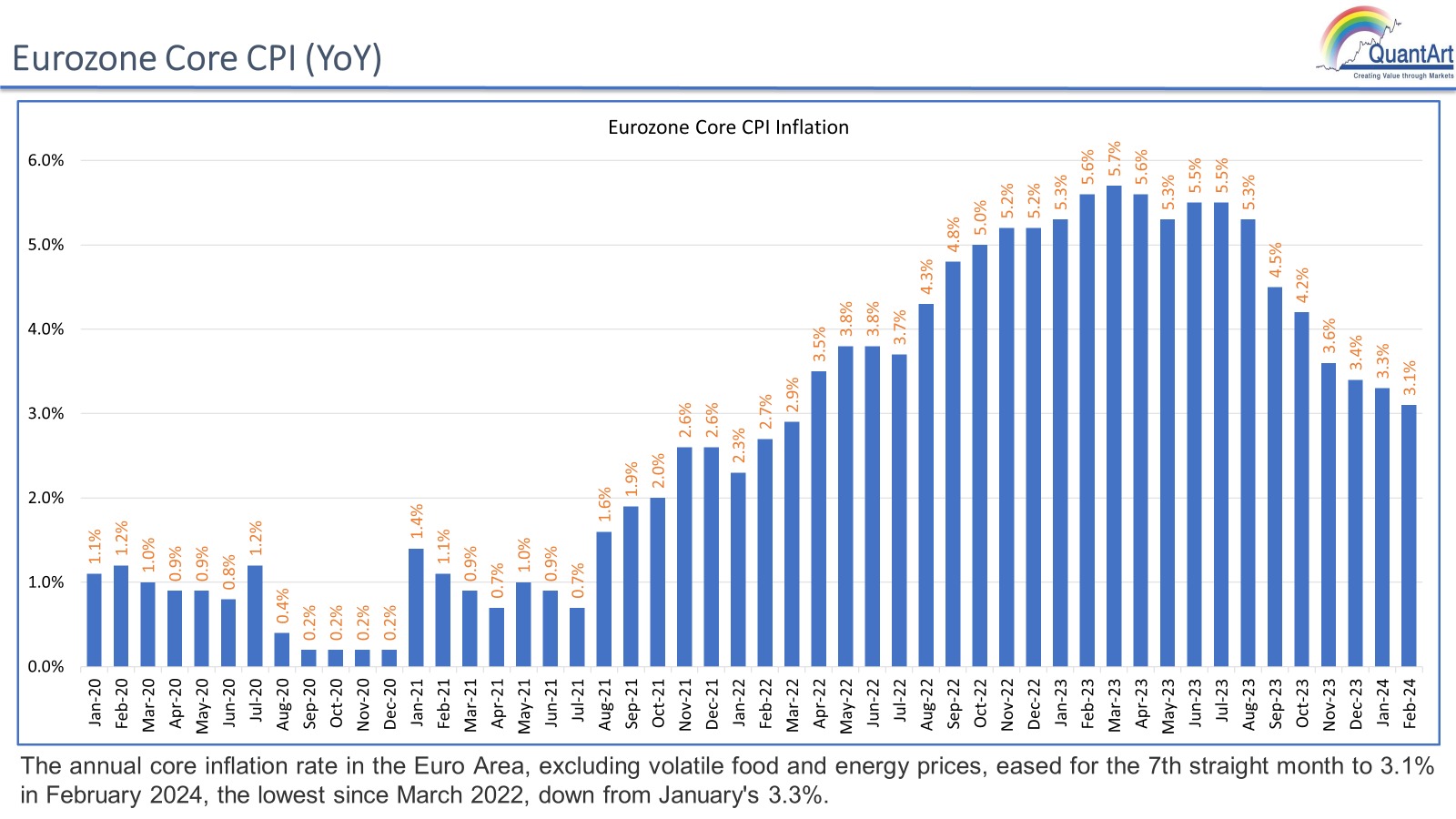

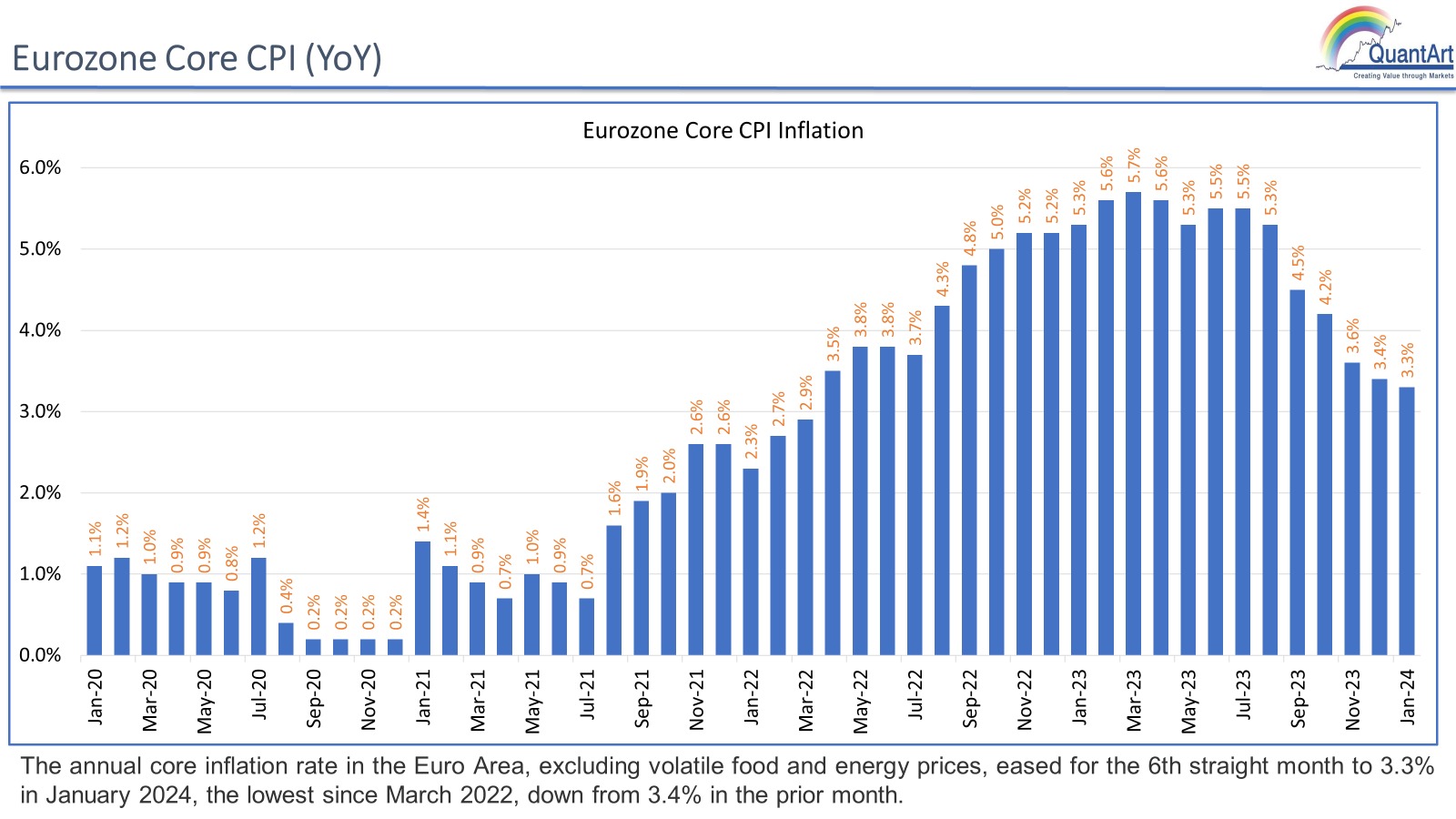

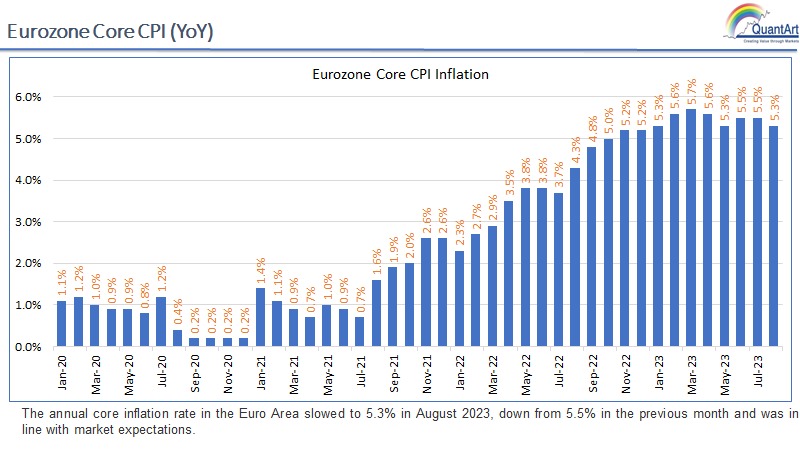

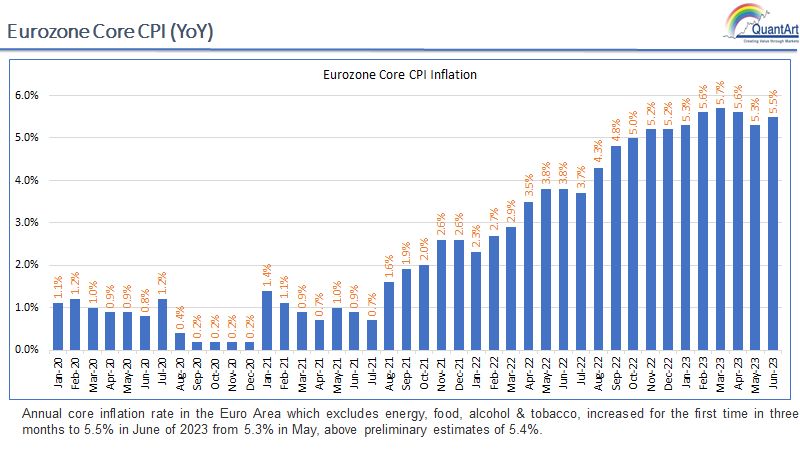

EUROZONE Core CPI (YoY)

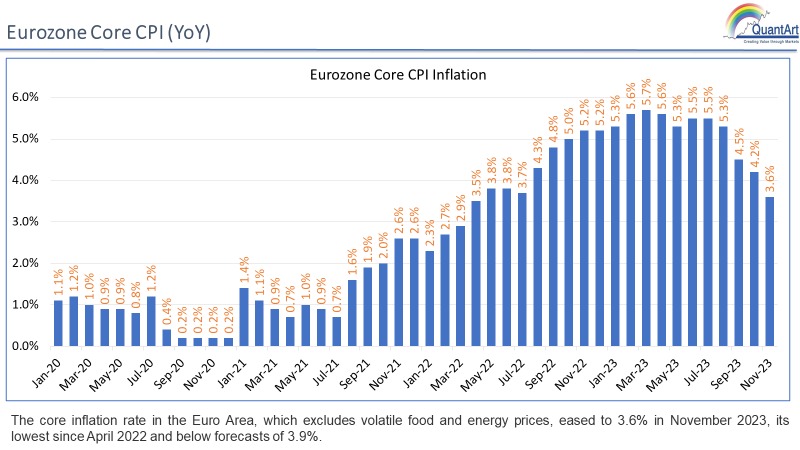

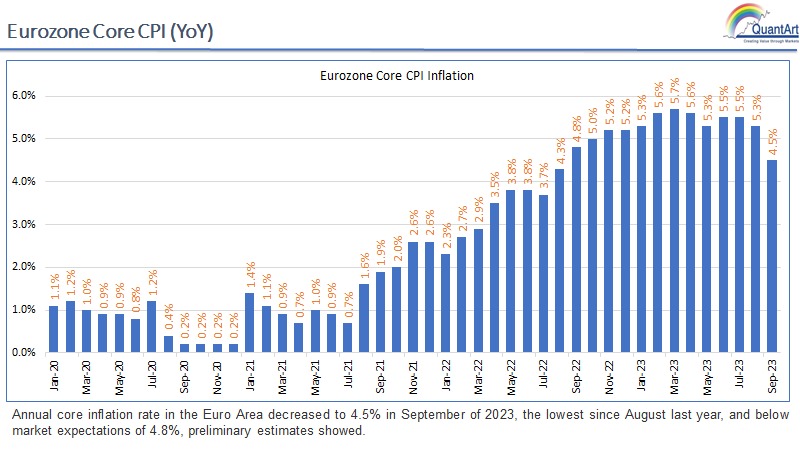

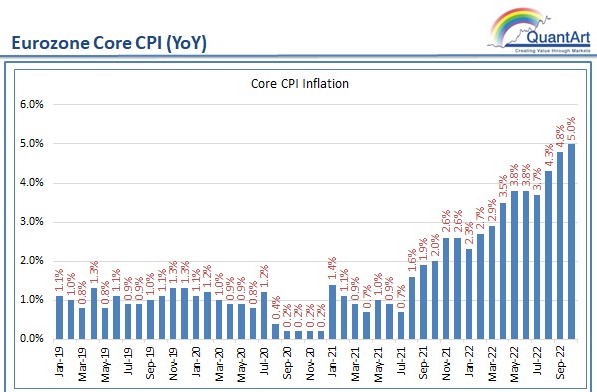

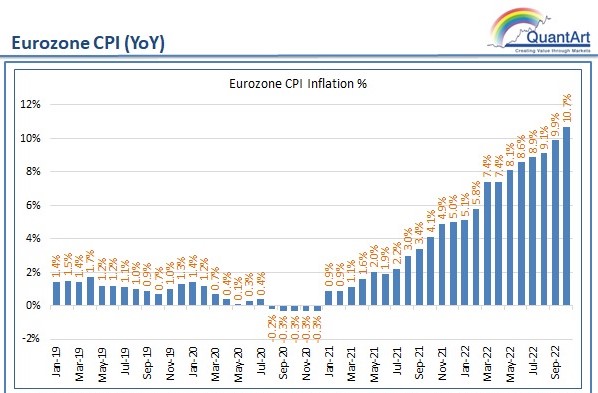

The graph presents the year-over-year Eurozone core inflation trend, demonstrating a continuous decrease over an eight-month stretch, culminating in the lowest rate since early 2022. This data is vital for analysts tracking economic stability and forecasting financial markets in the region, offering insights into consumer price movements and central bank policy implications.

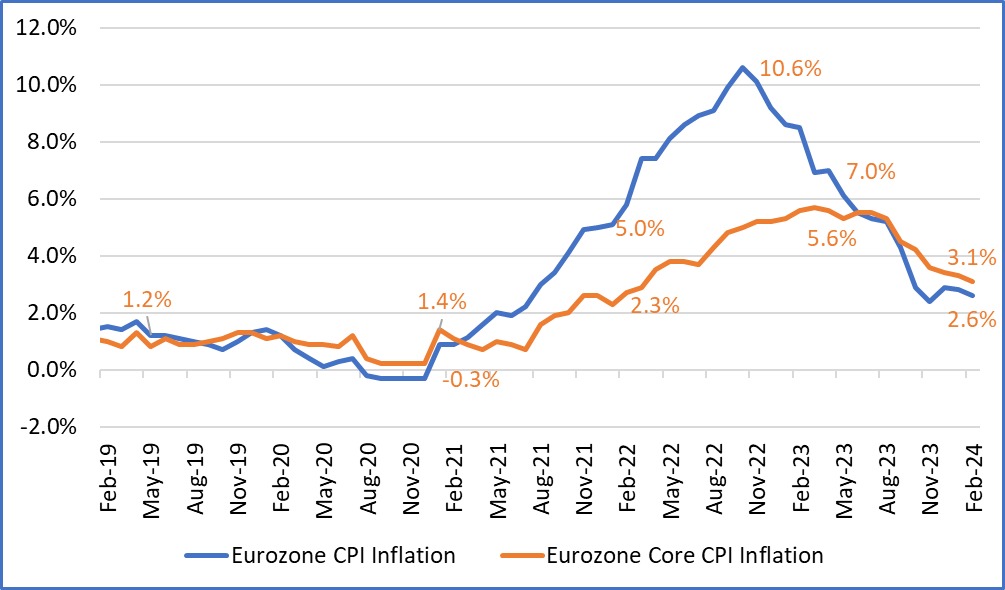

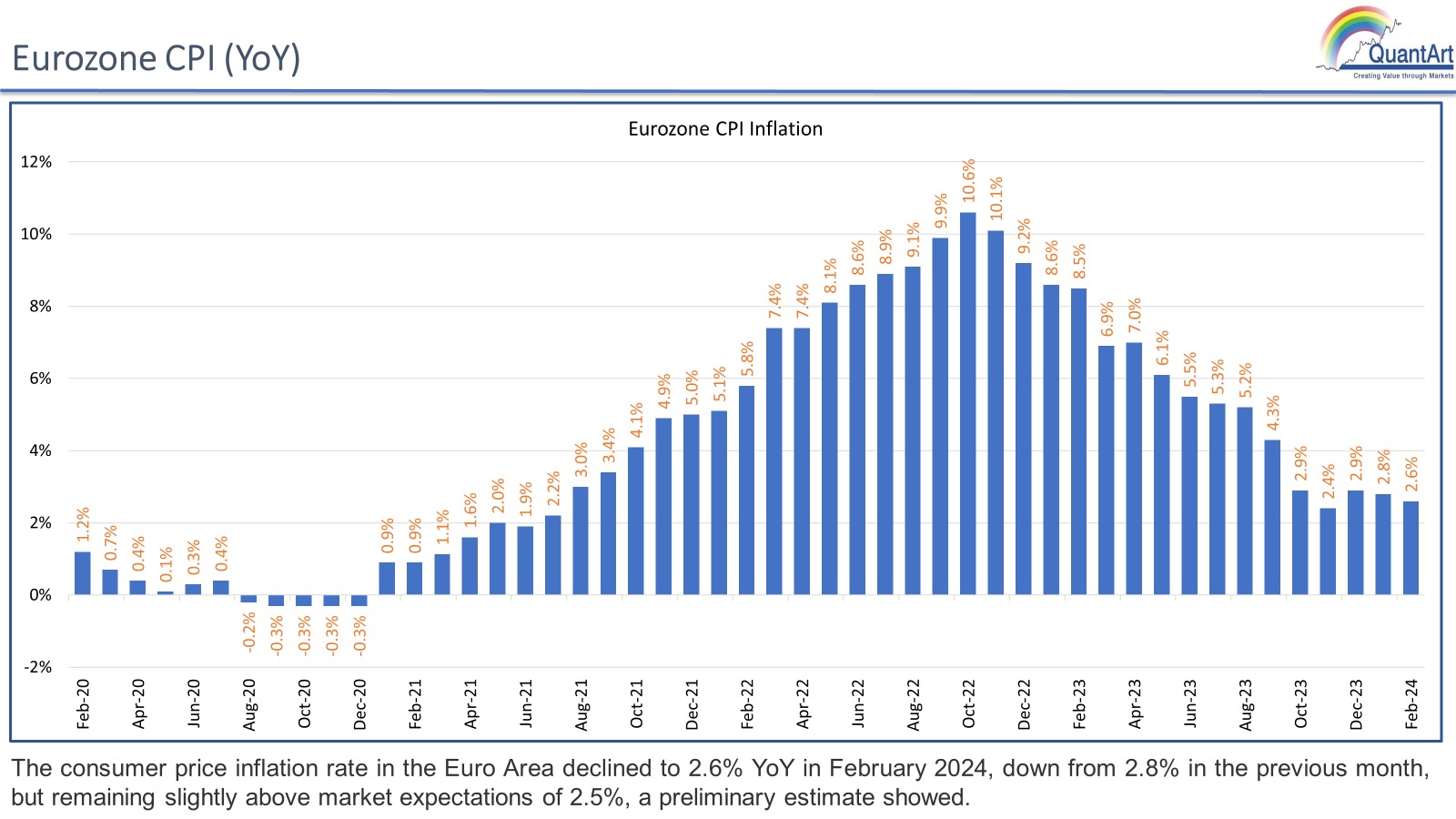

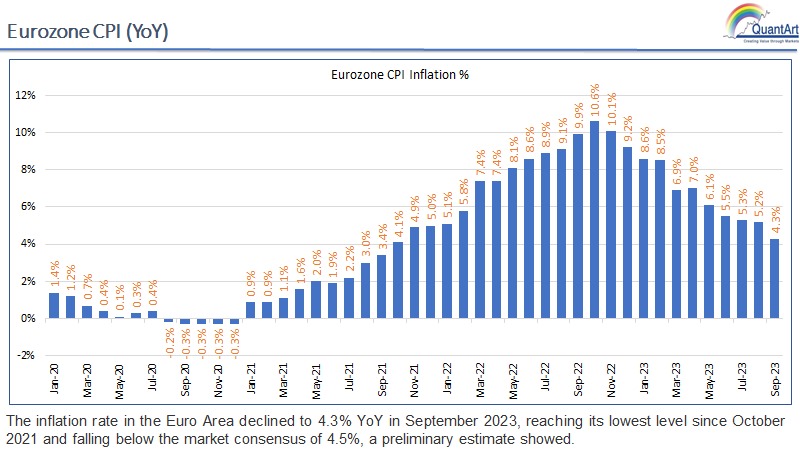

In February 2024, the Euro Area’s annual inflation rate was 2.6%, above the ECB’s 2% goal. Energy prices fell by 3.7%, while food, alcohol, and tobacco costs rose by 3.9%, and non-energy industrial goods by 1.6%. Services inflation remained at 4.0%. The core inflation rate, which excludes food and energy, was 3.1%. Monthly, consumer prices went up by 0.6% after January’s 0.4% decline.

This decrease in inflation has also risen the probabilities of a rate cut. While most policymakers favor a rate cut in June, some suggest April. Hawks like Schnabel and Lagarde warn against early cuts due to inflation concerns, advocating for a cautious approach to achieve the 2% target. Conversely, dovish members call for earlier cuts, pointing to significant disinflation and the risk of falling short of the inflation goal. The market is split, with a 50% probability assigned to an April rate reduction, indicating a disconnect with some ECB officials.

Eurozone Core CPI YoY

Eurozone CPI Inflation

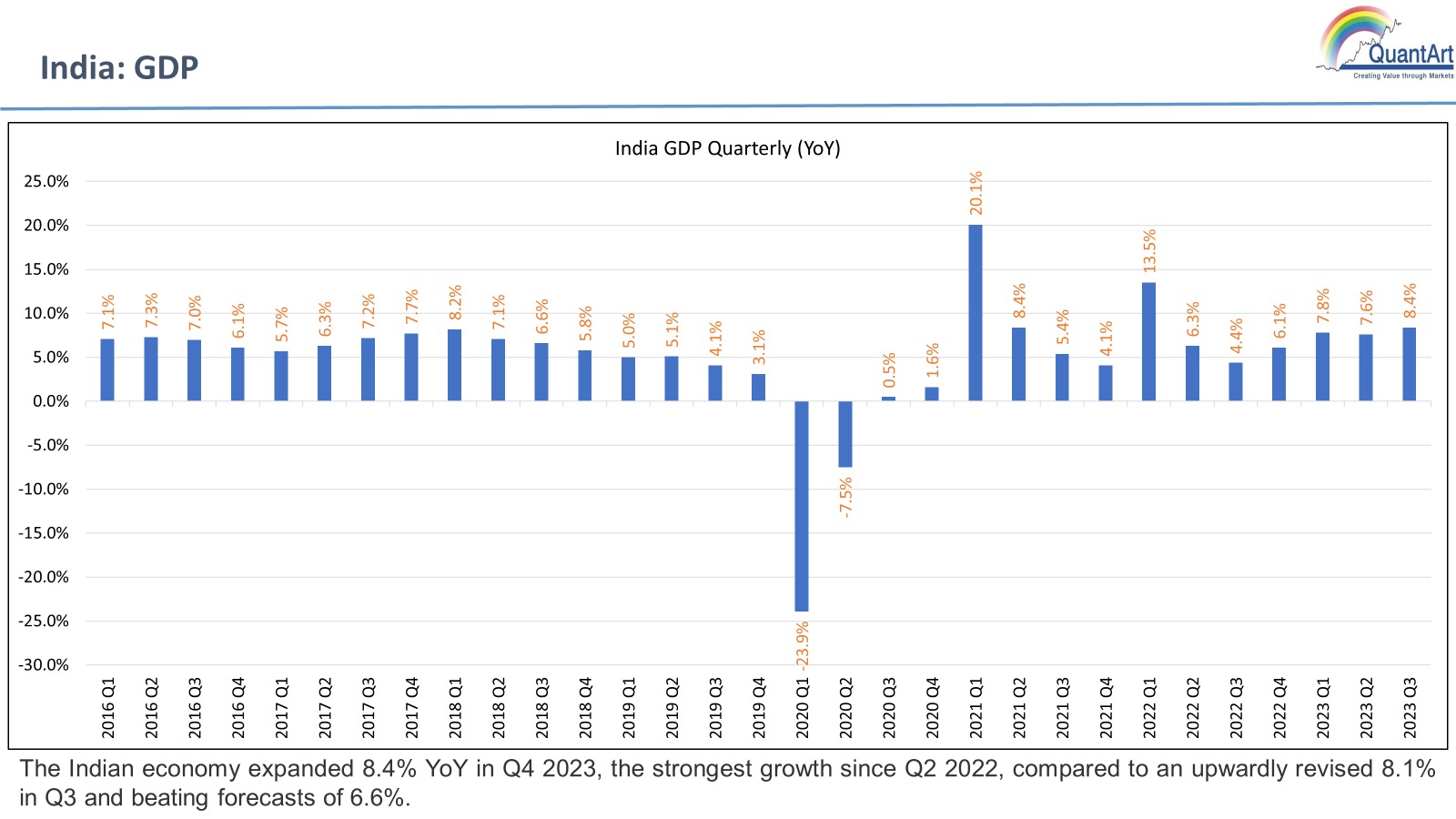

India – GDP

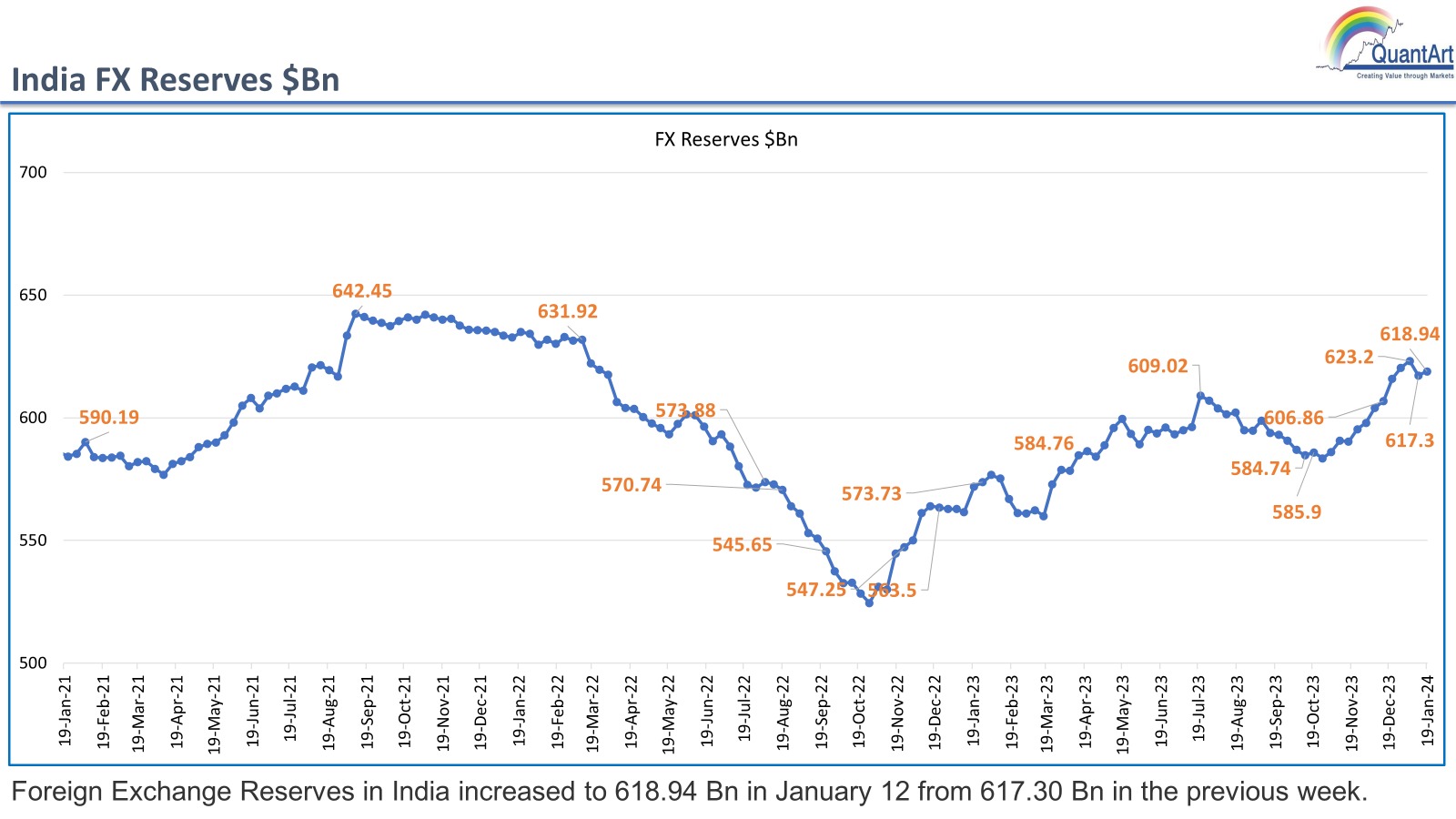

India Fx Reserves $Bn

Eurozone Core CPI (YoY)

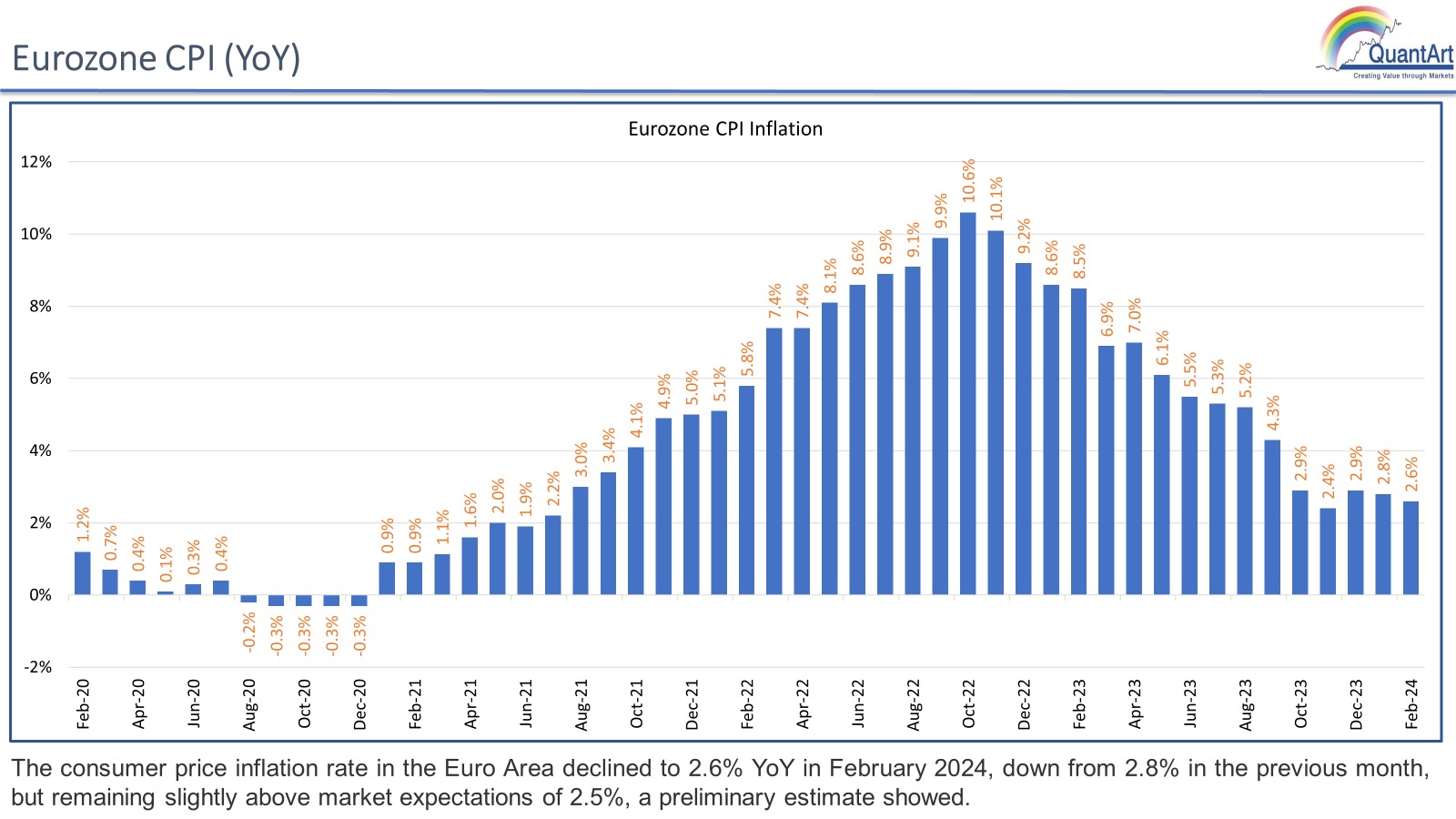

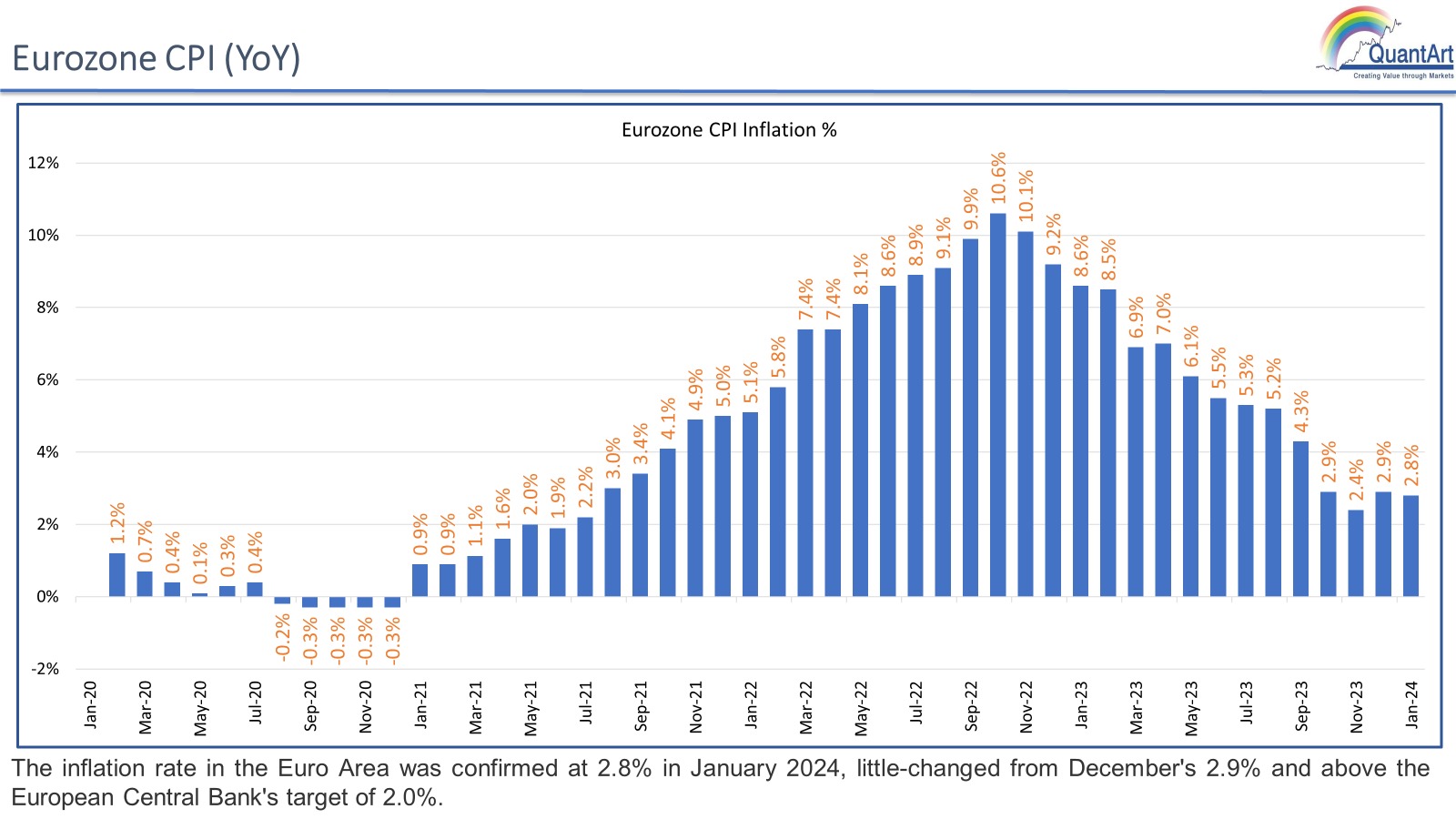

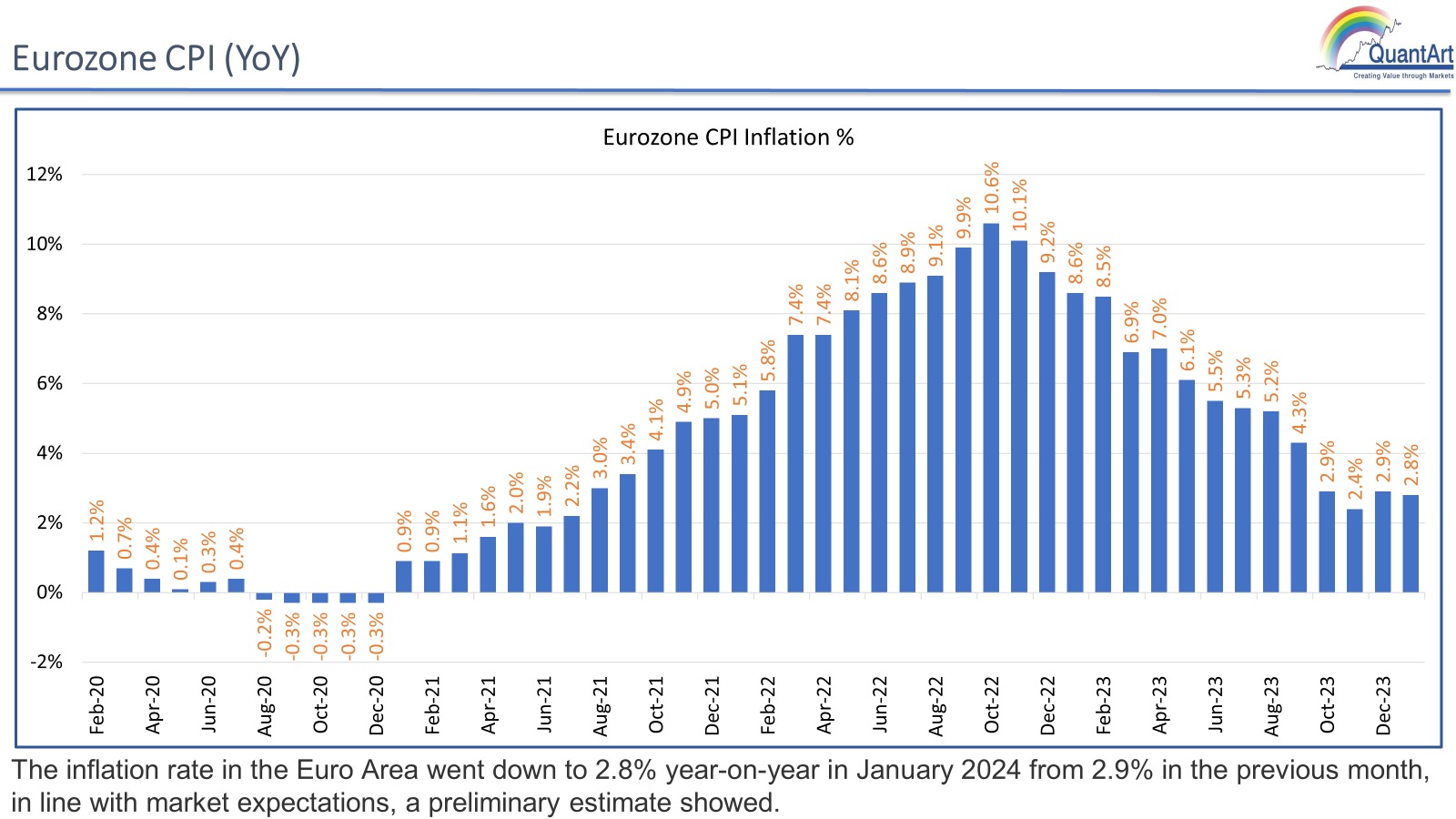

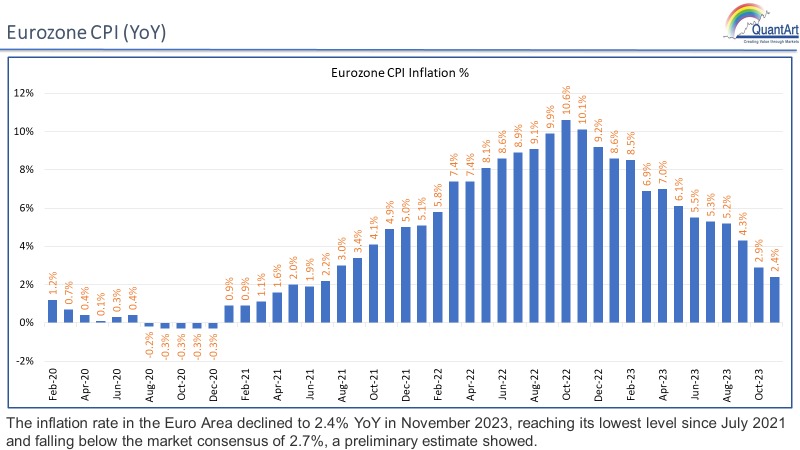

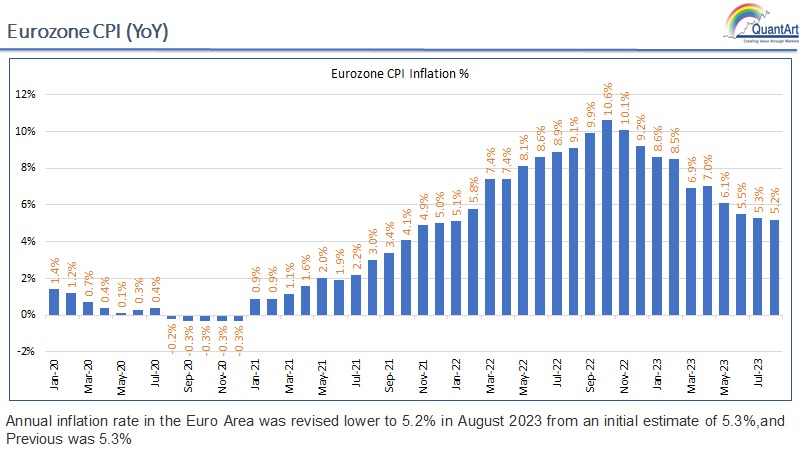

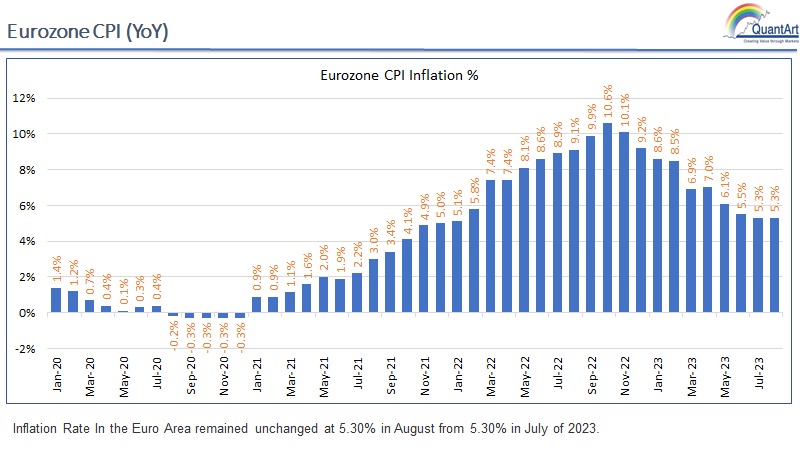

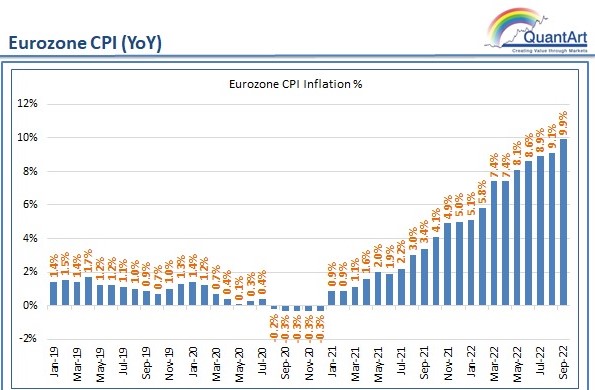

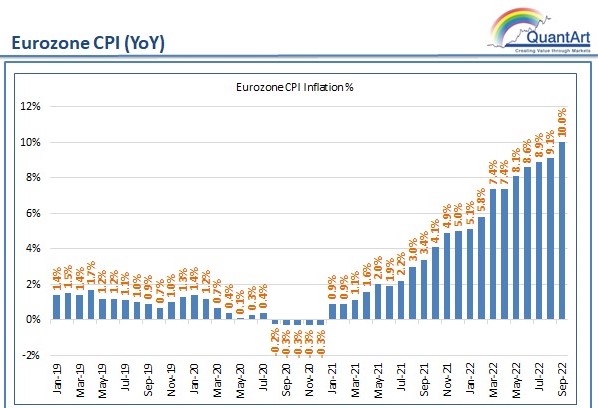

Eurozone CPI (YoY)

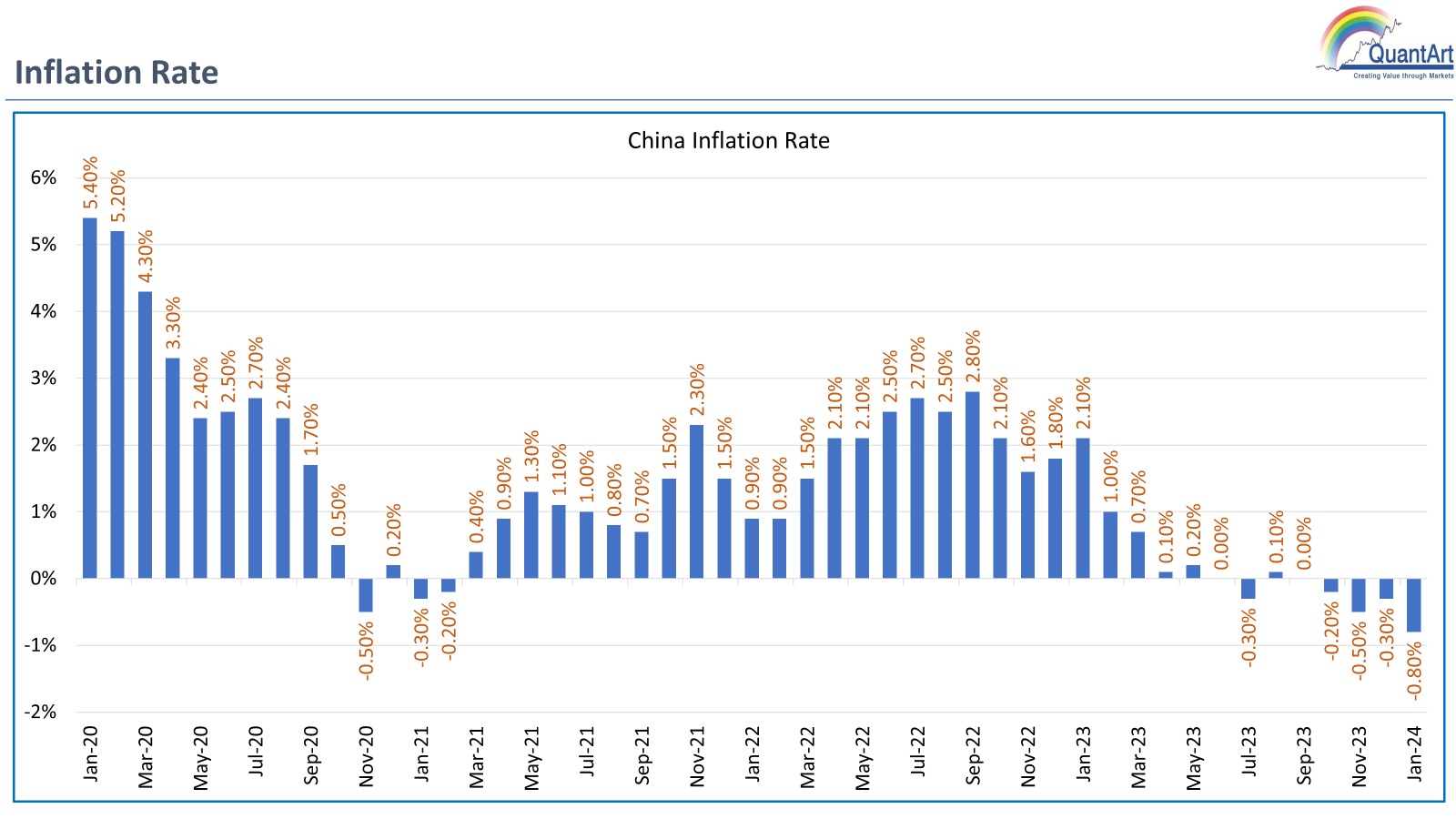

Inflation Rate

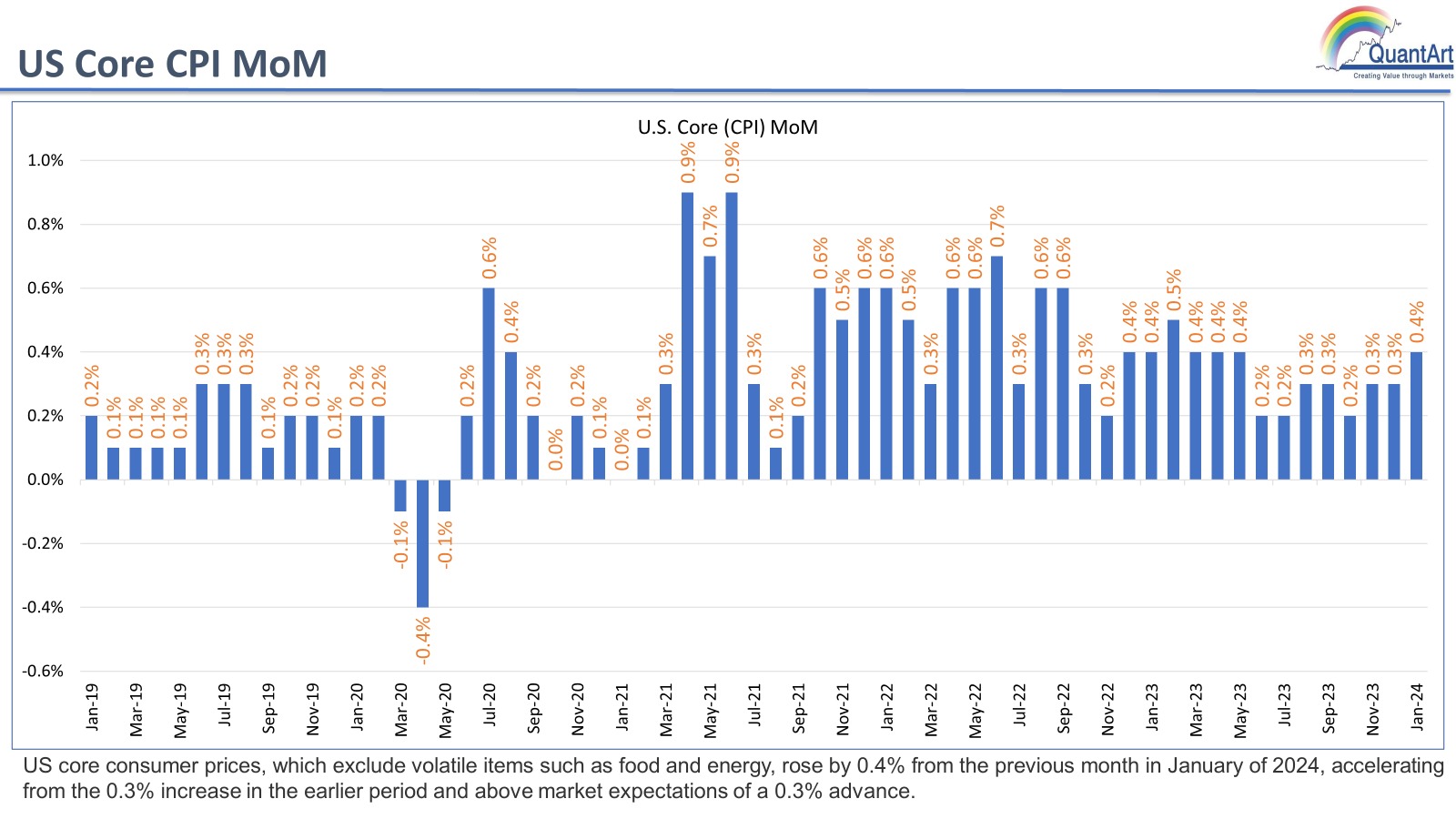

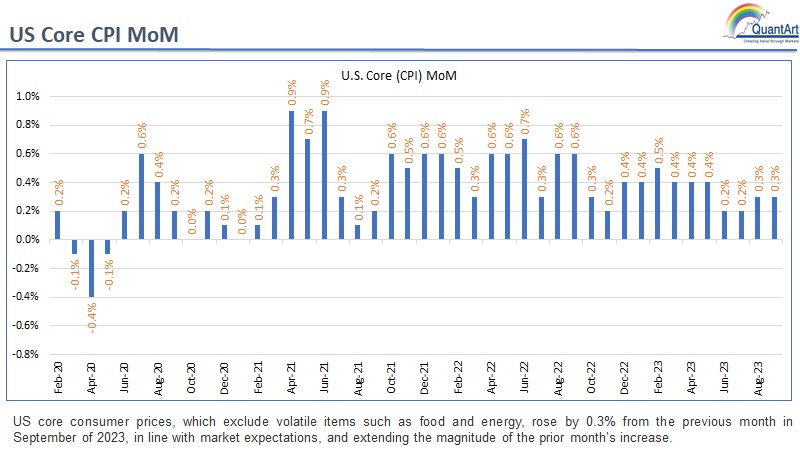

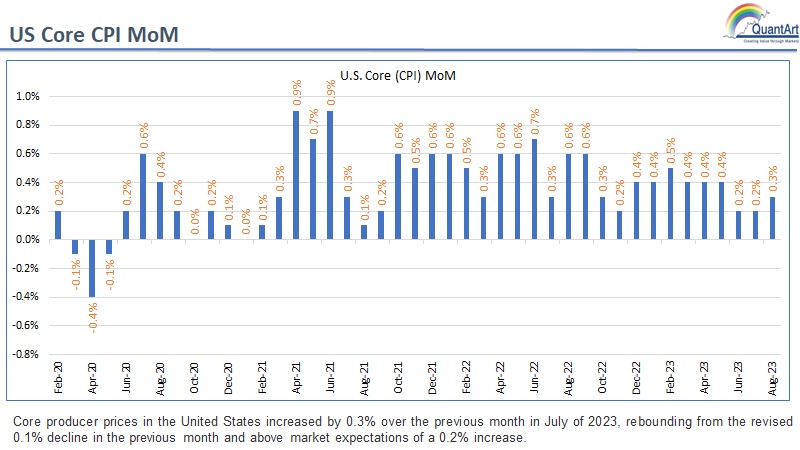

US Core CPI MoM

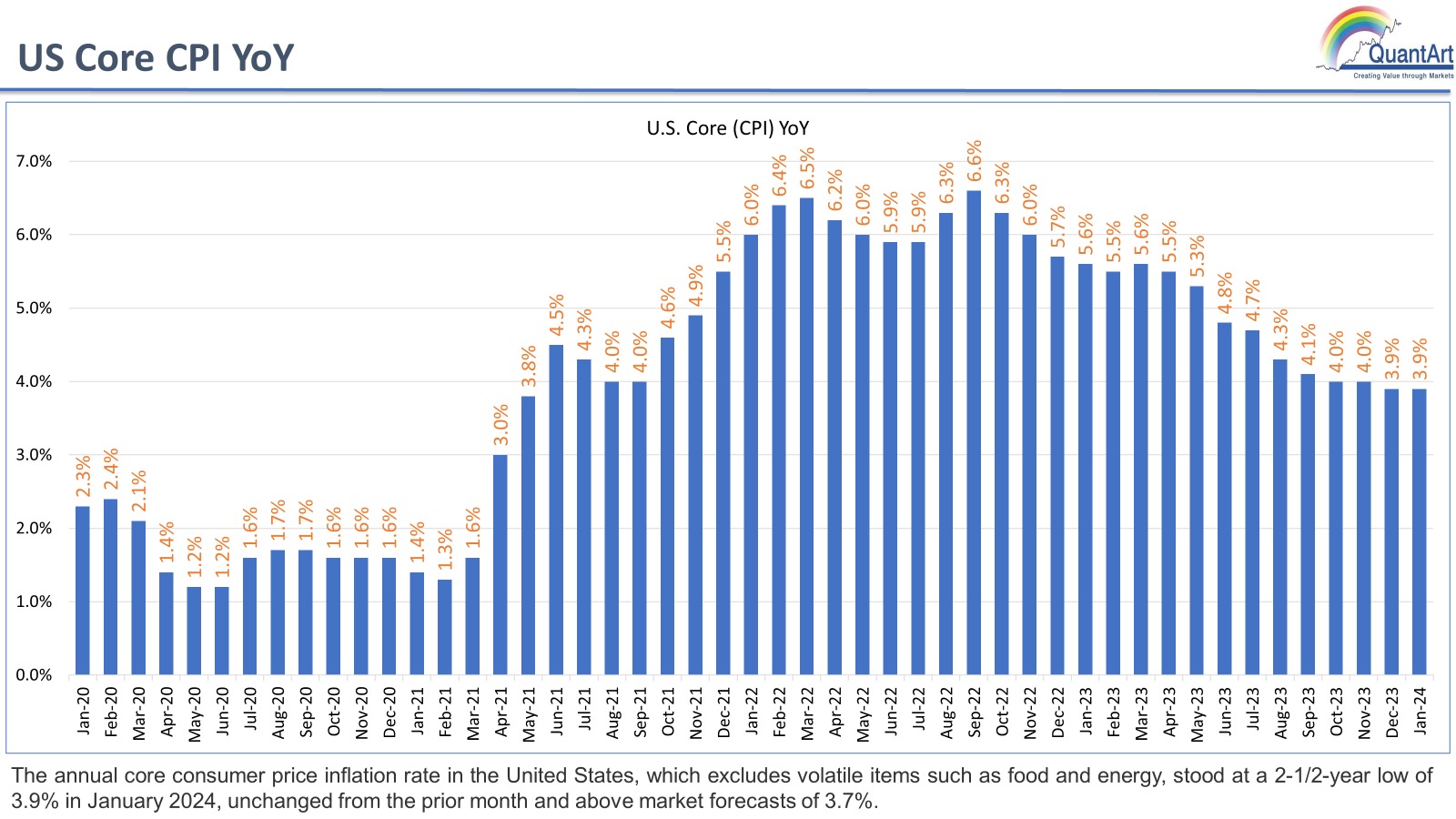

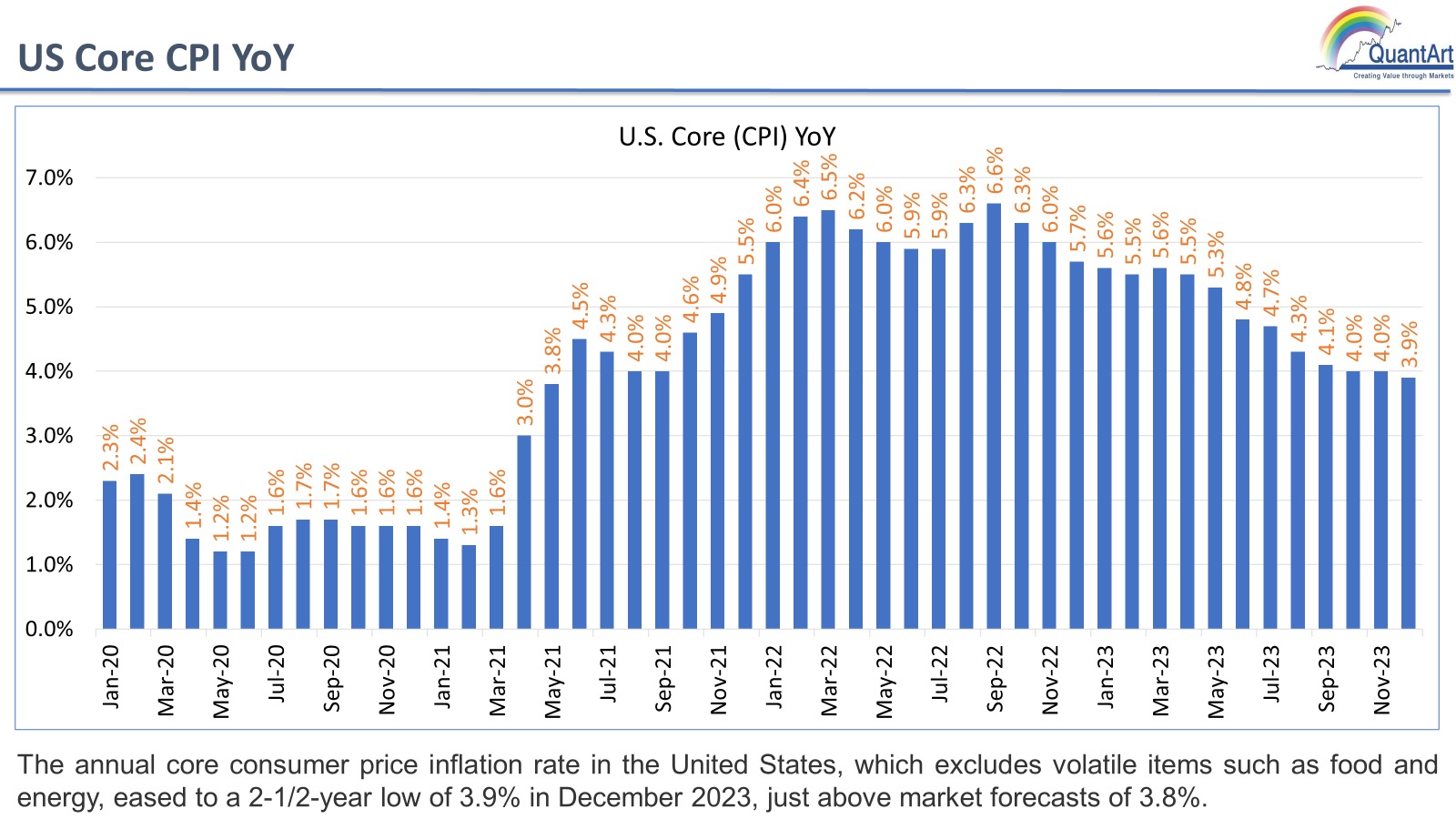

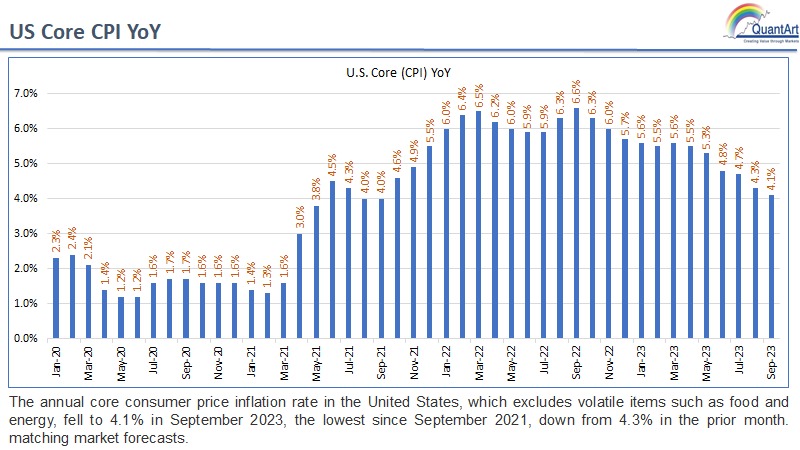

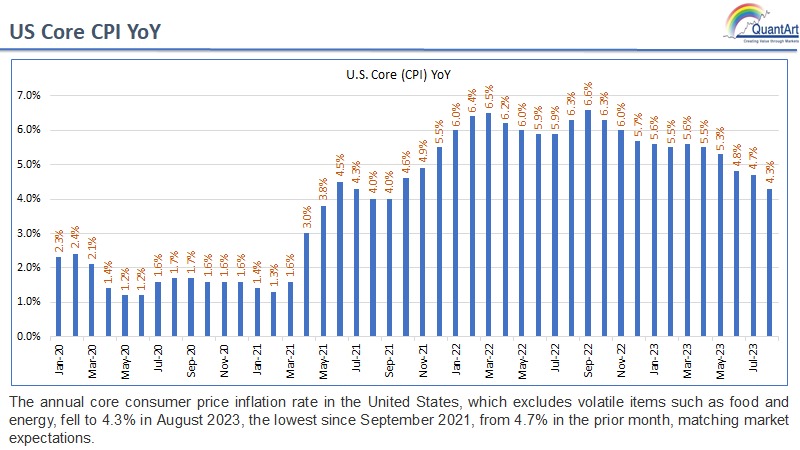

US Core CPI YoY

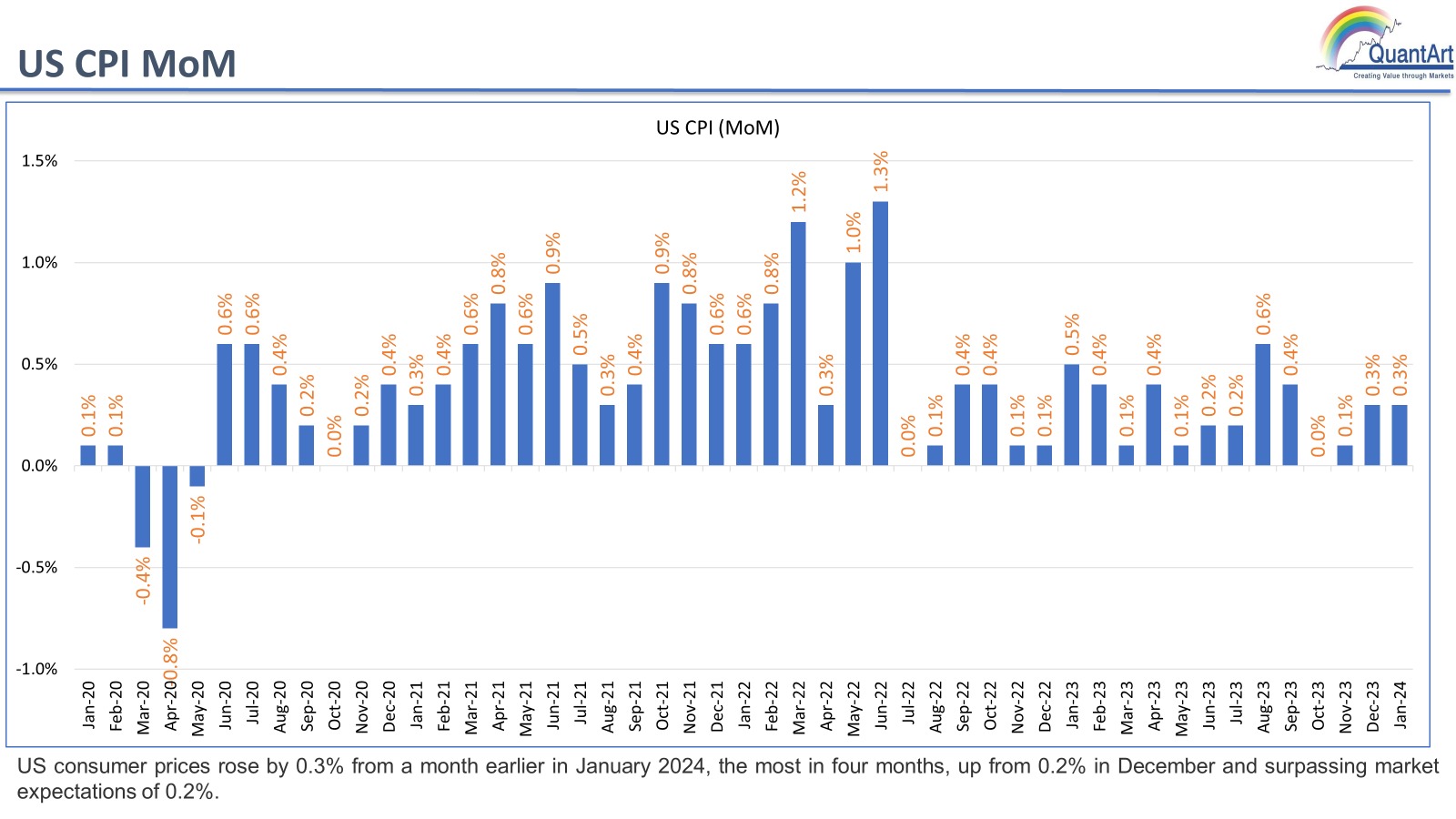

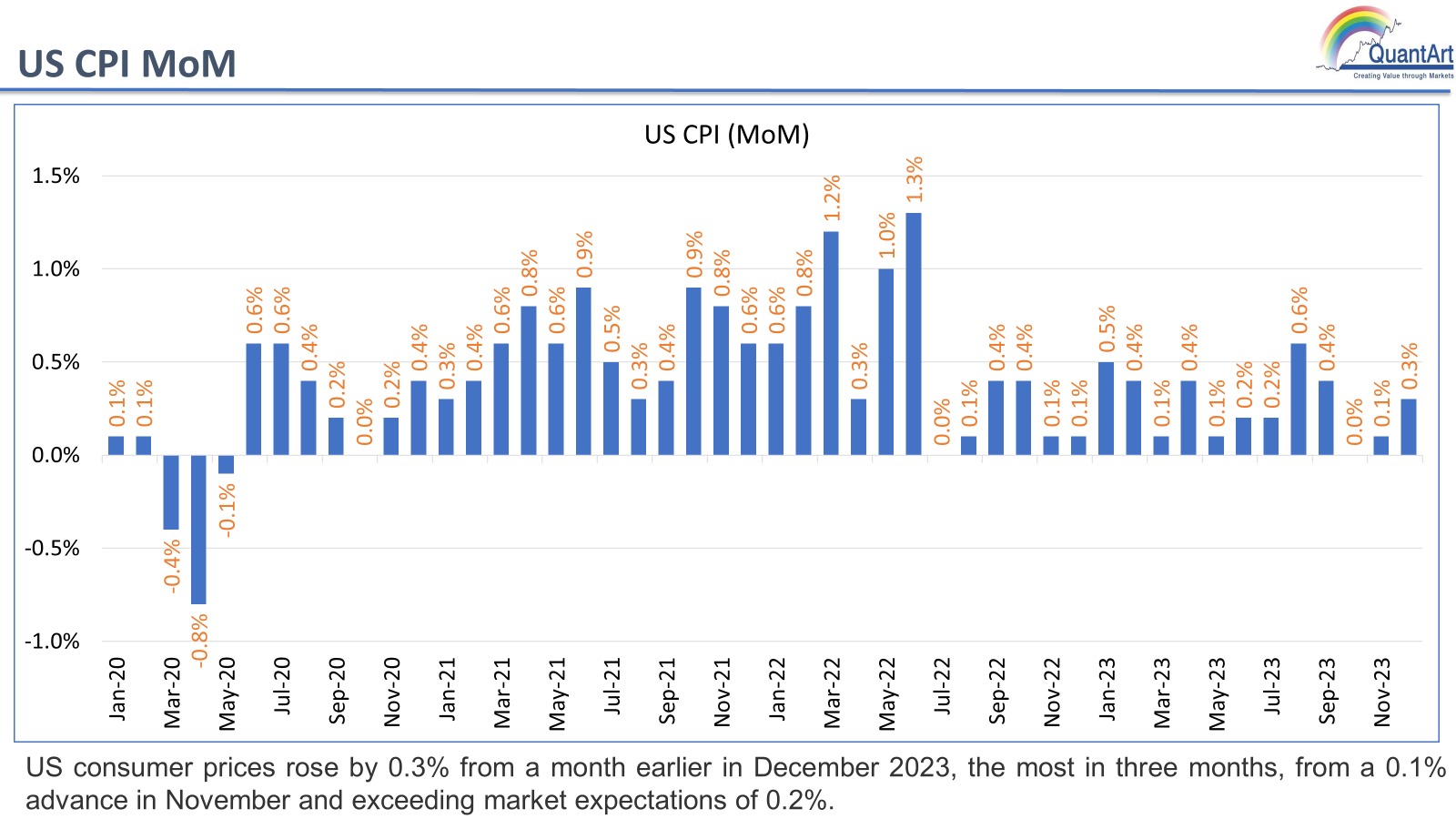

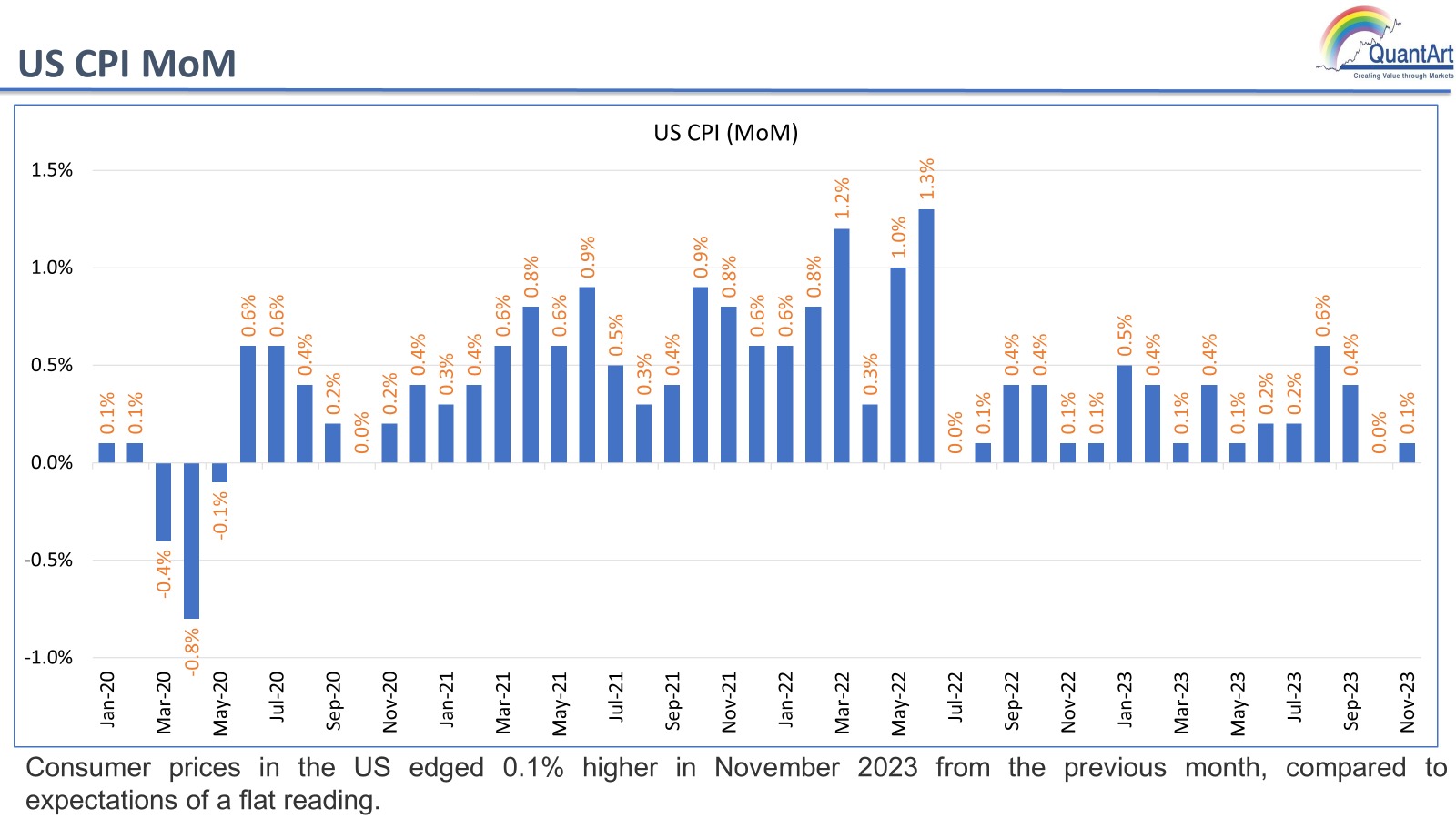

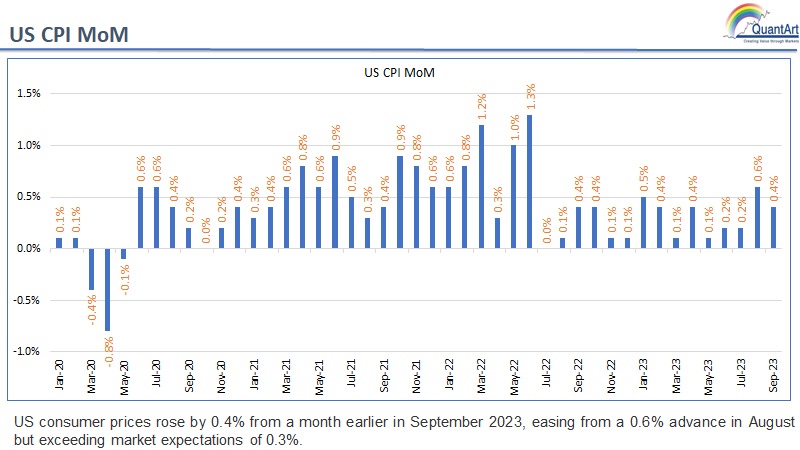

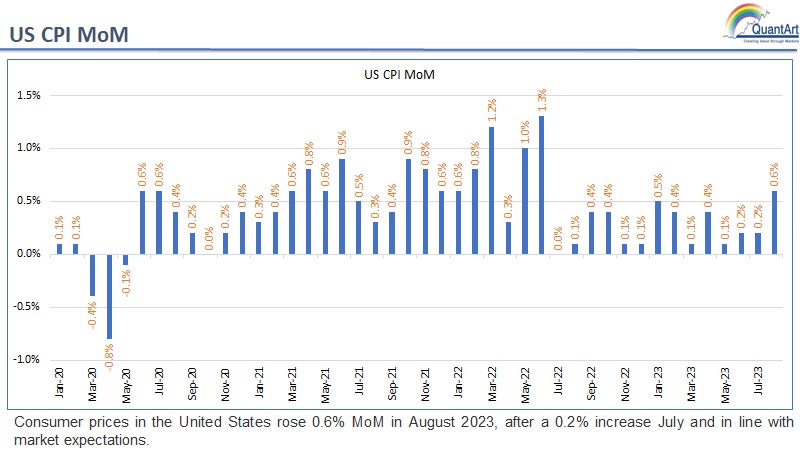

US CPI MoM

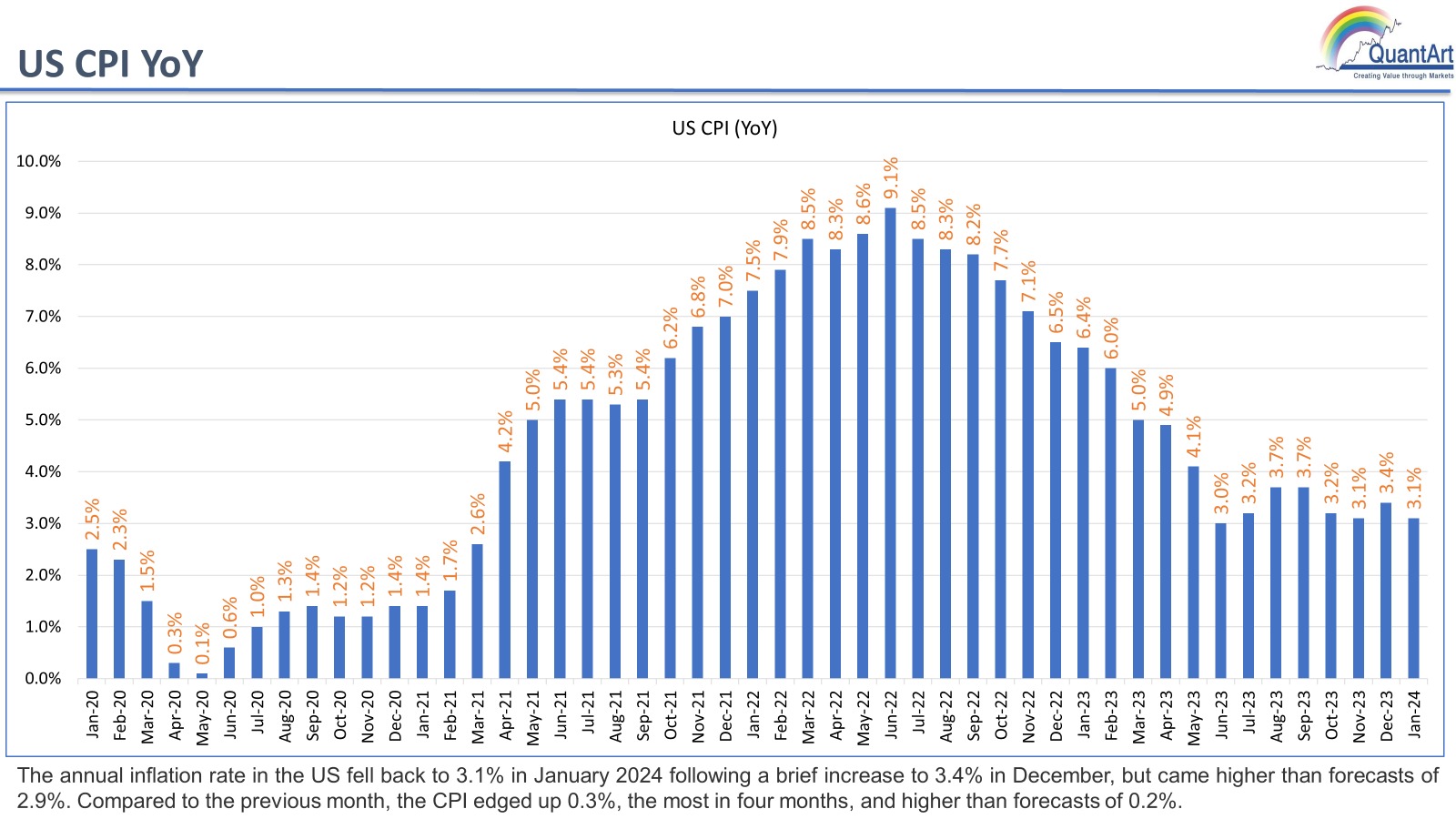

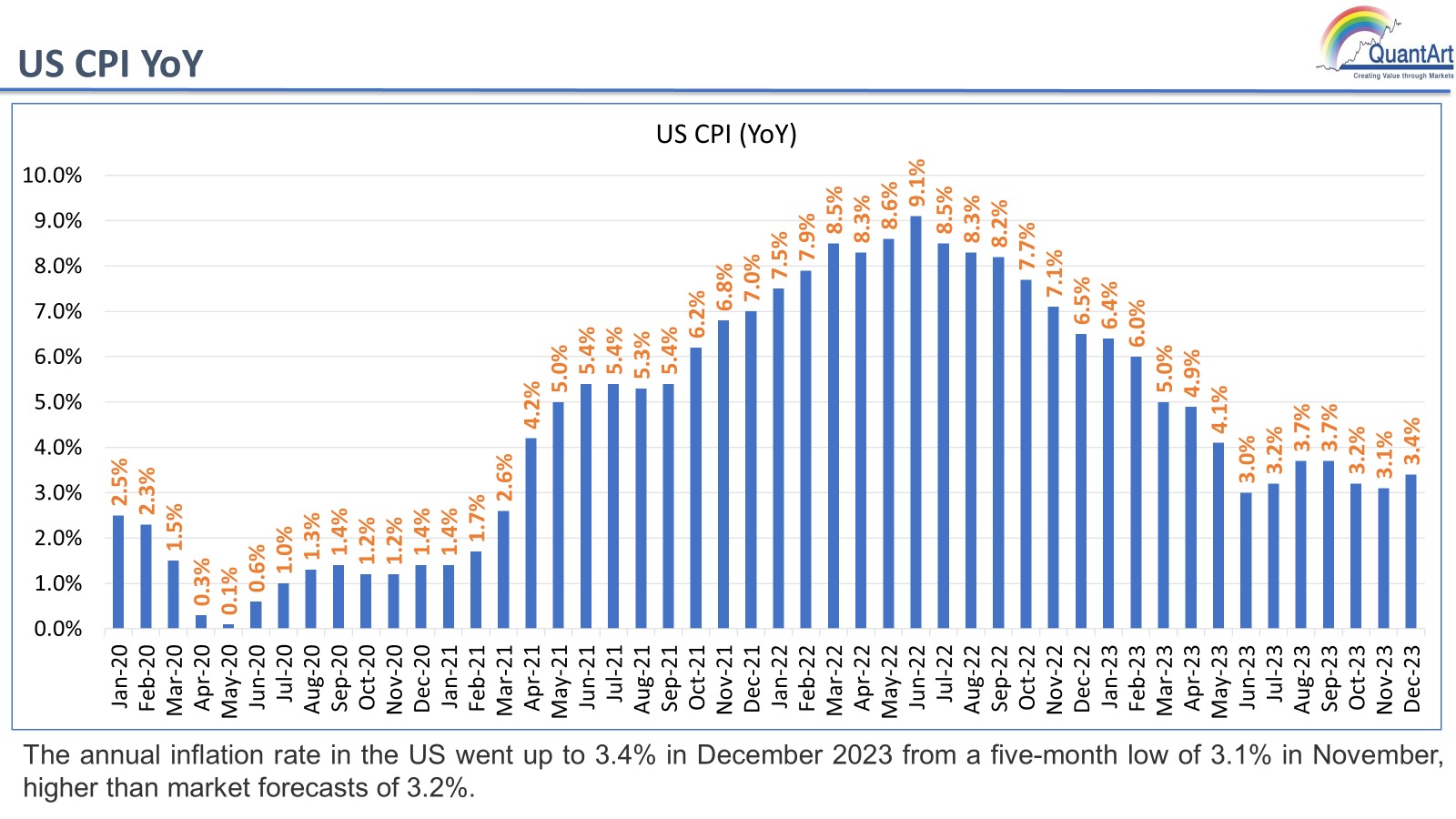

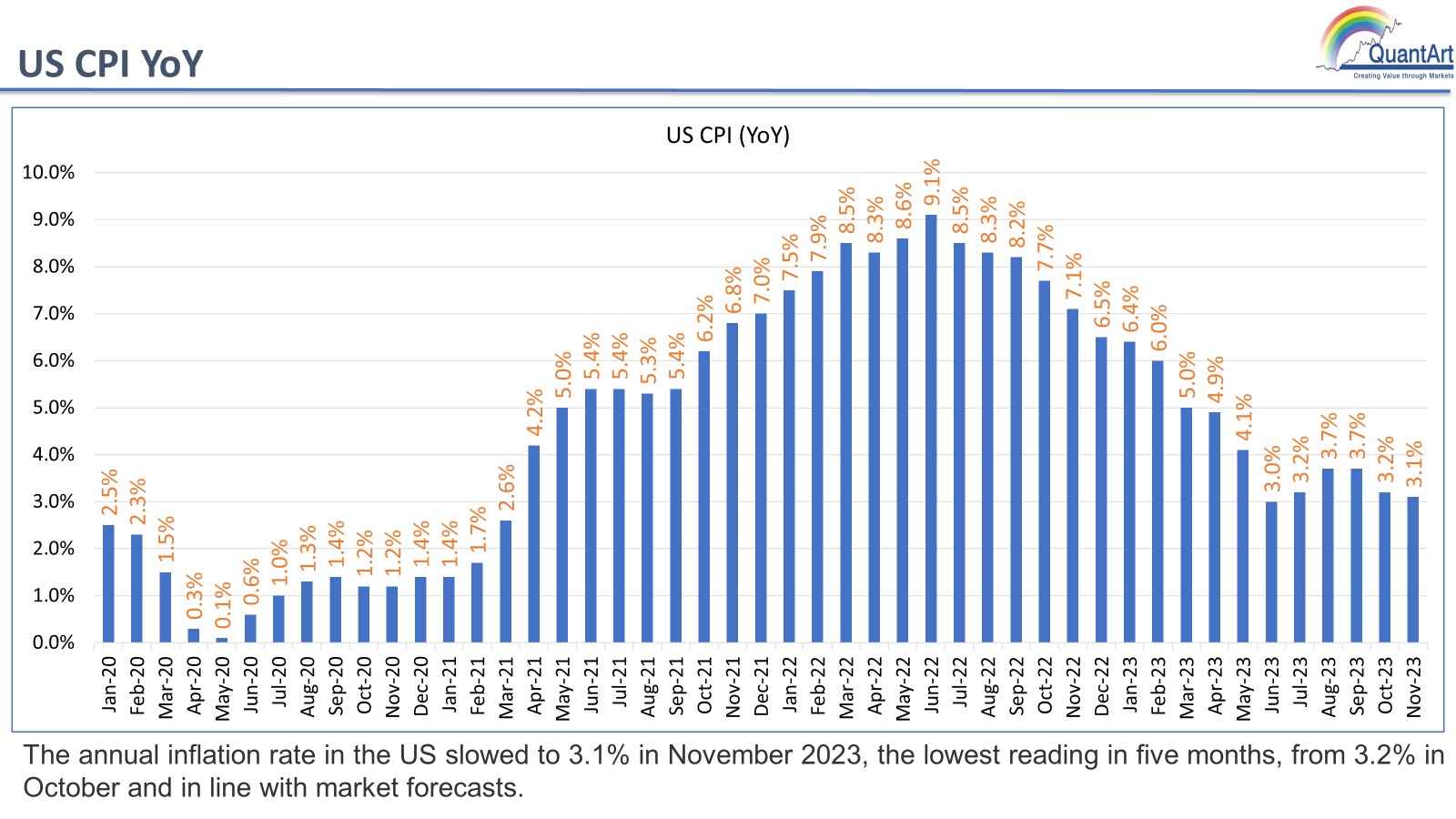

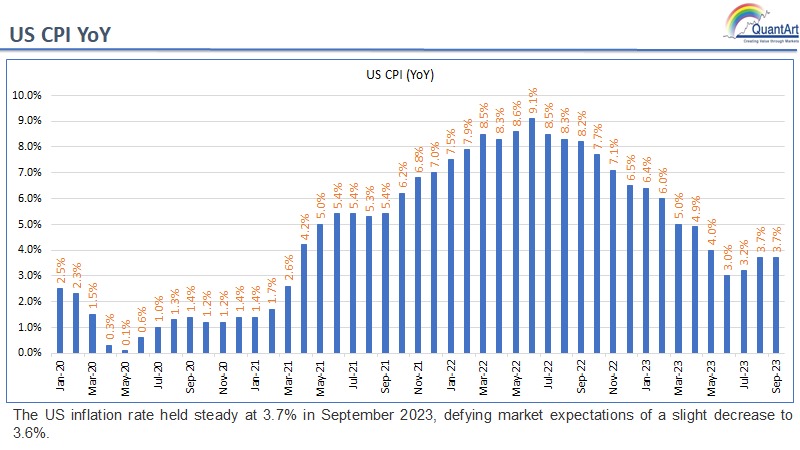

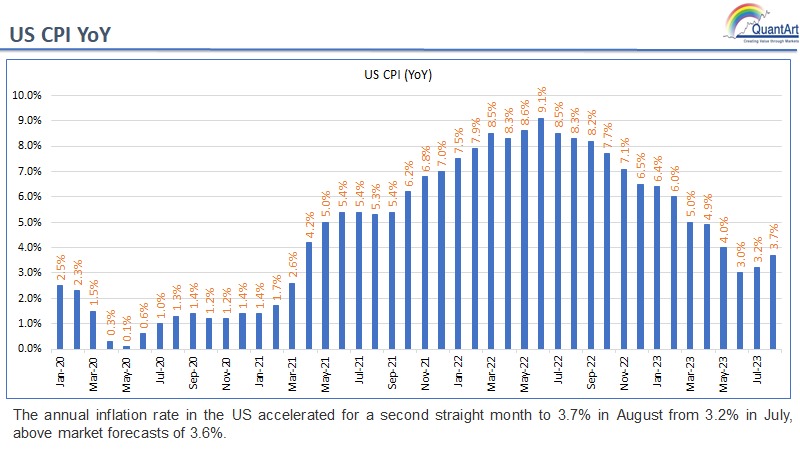

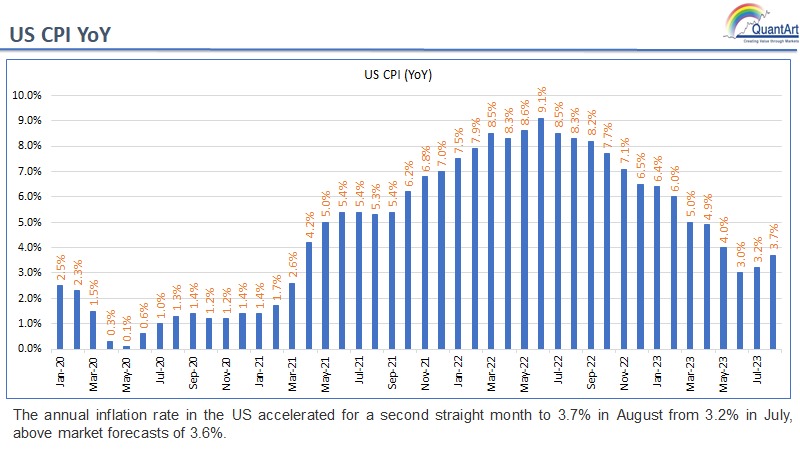

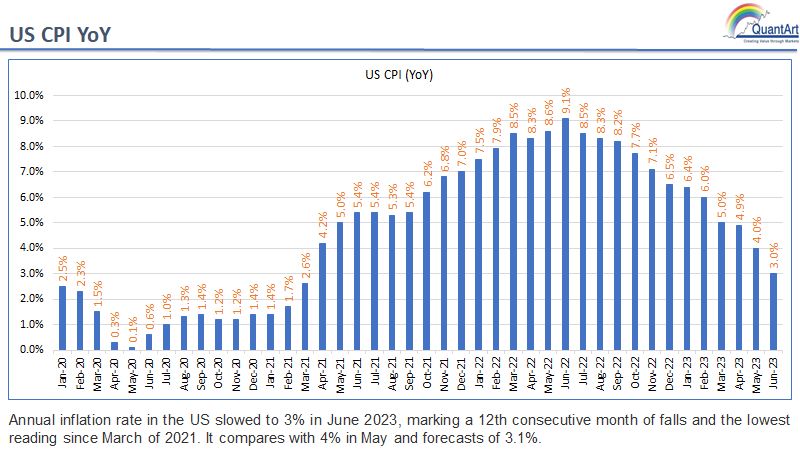

US CPI (YoY)

India: CPI

India Fx Reserves $Bn

India Fx Reserves $Bn

U.K. Interest Rate

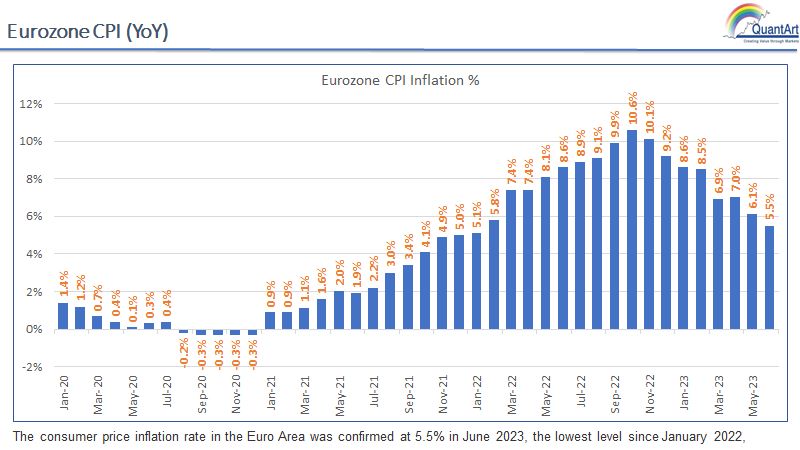

Eurozone CPI (YoY)

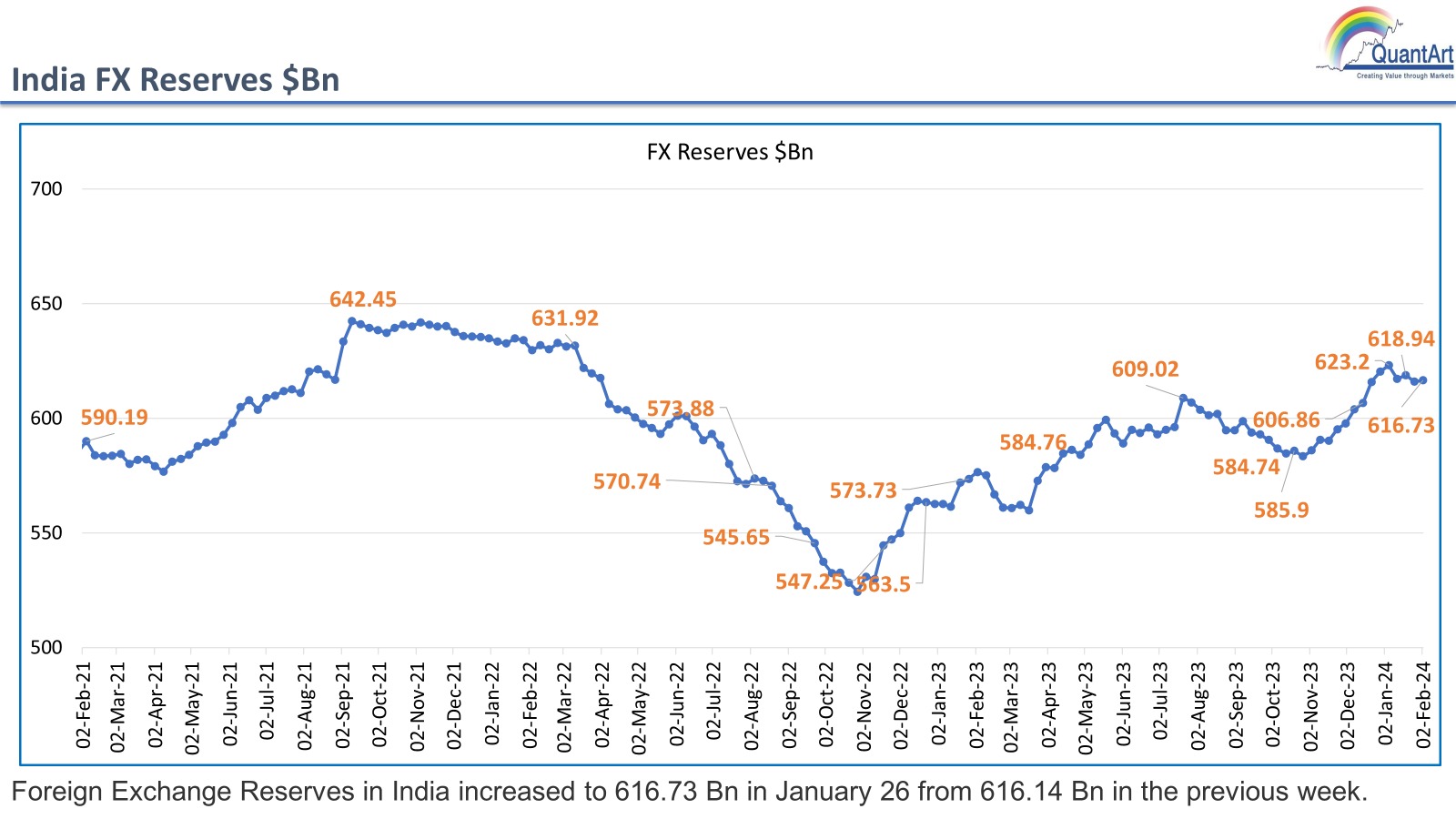

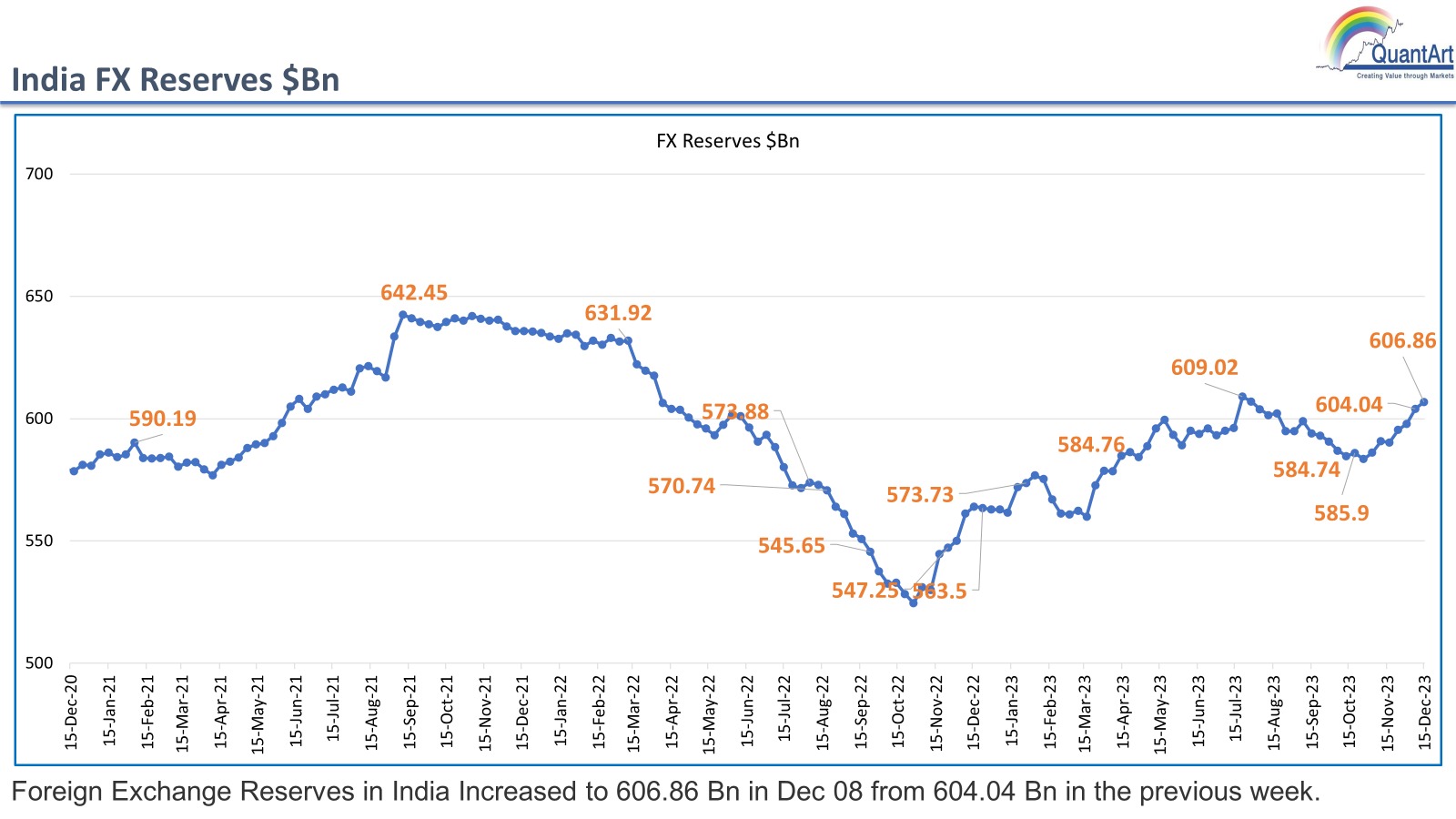

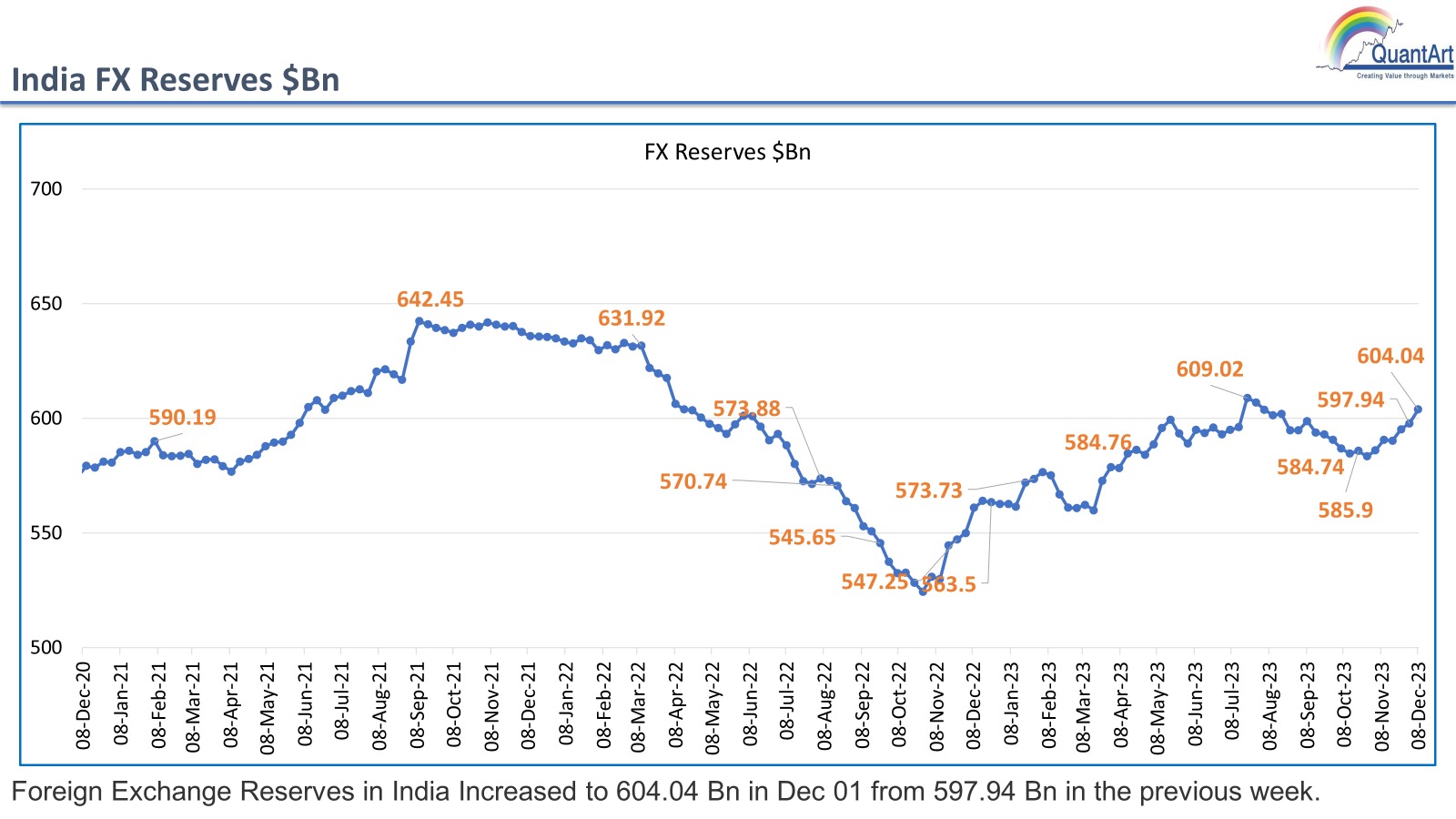

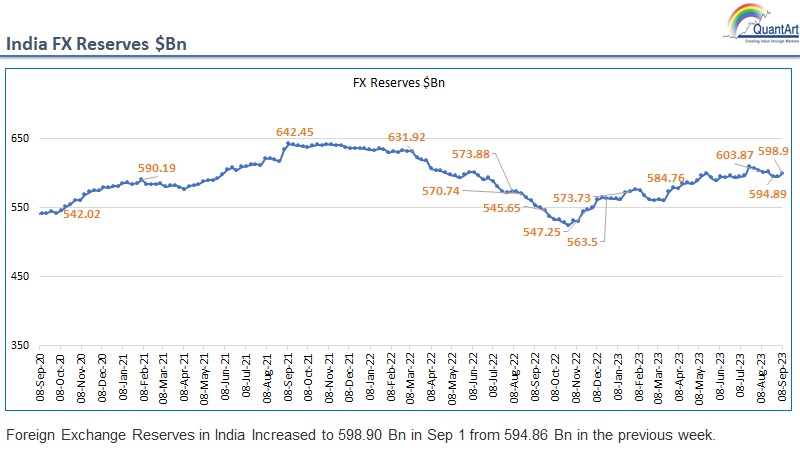

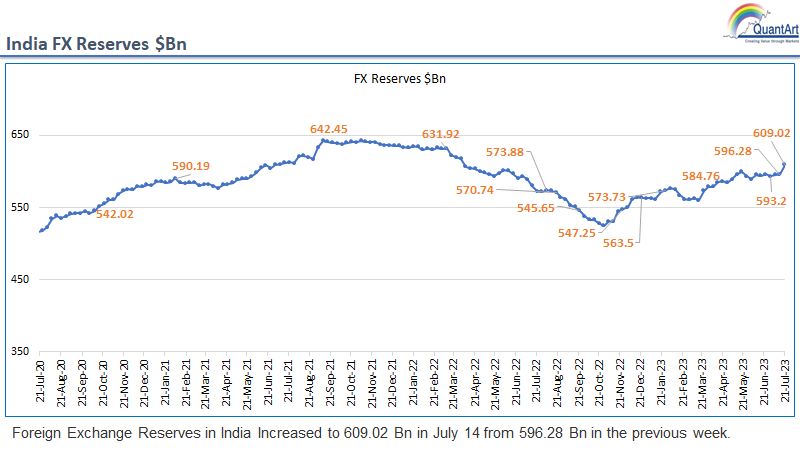

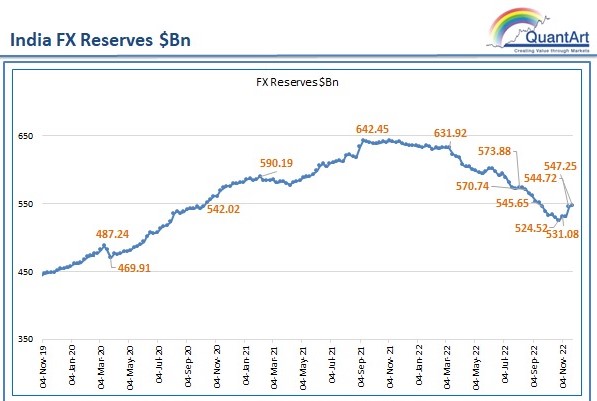

India FX Reserves $Bn

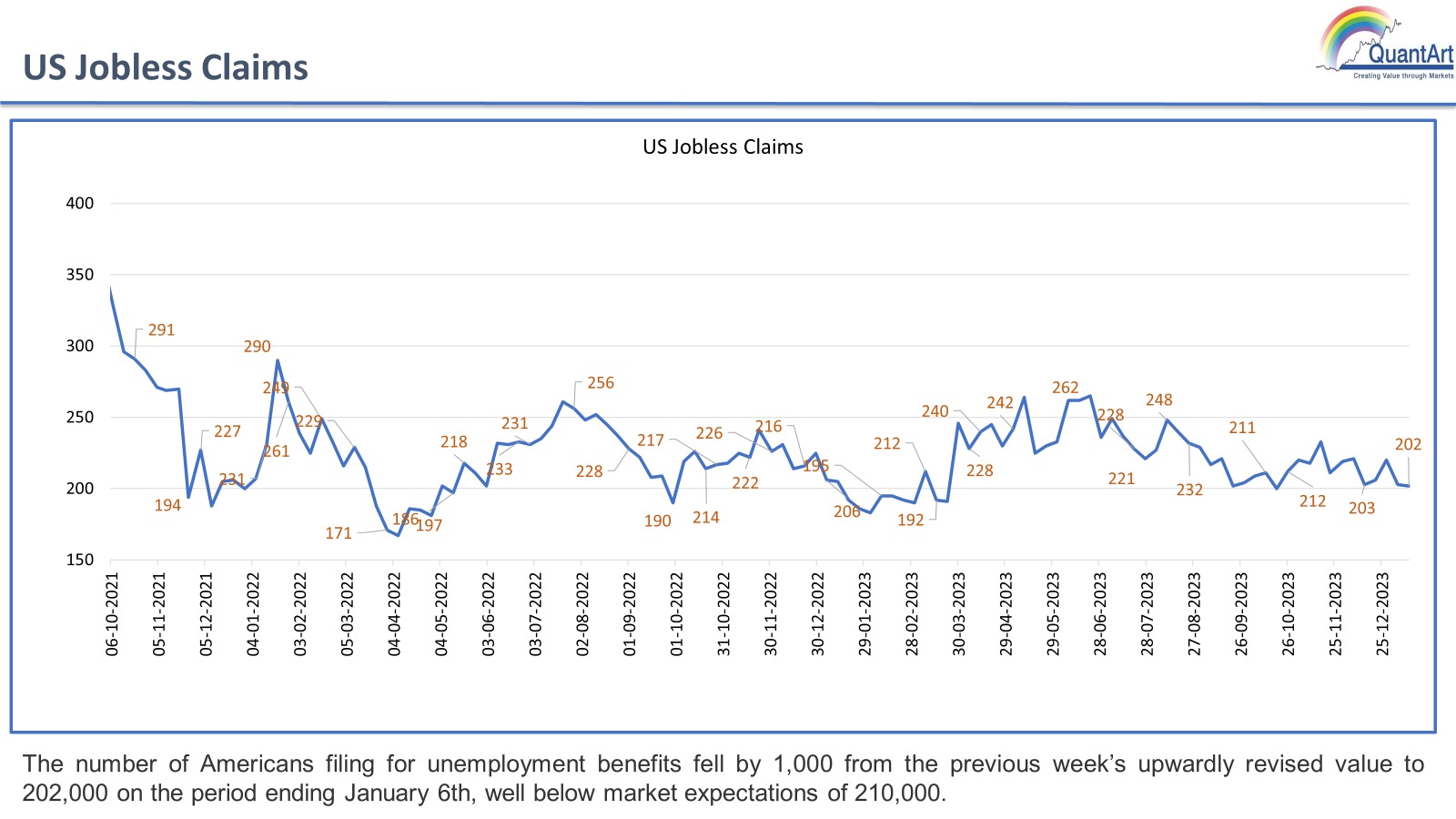

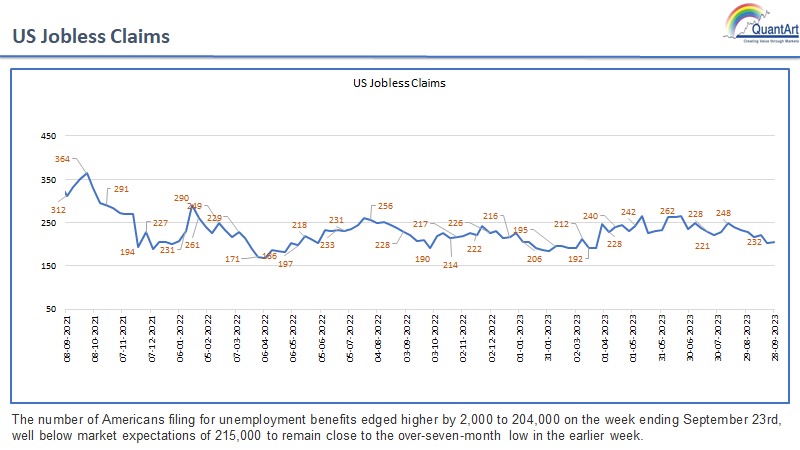

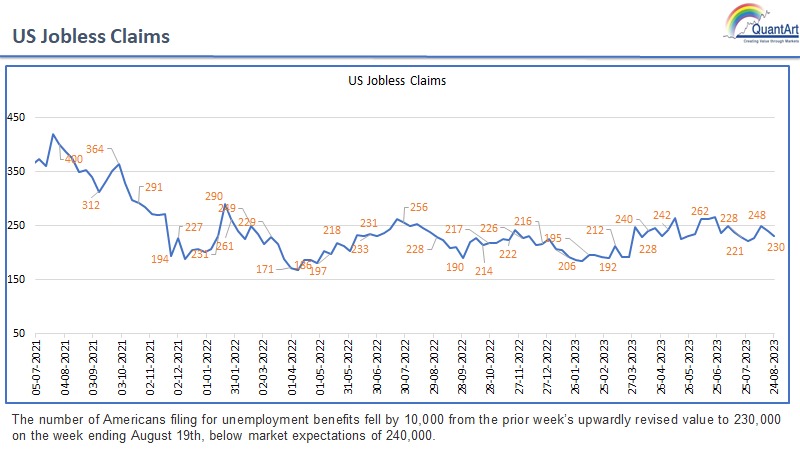

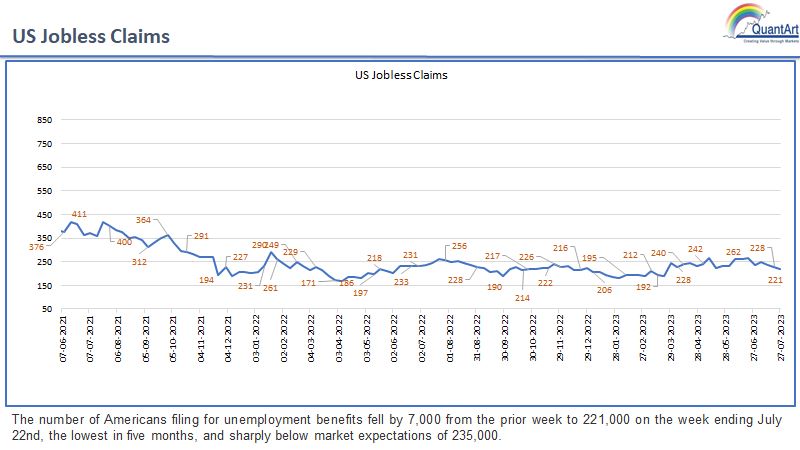

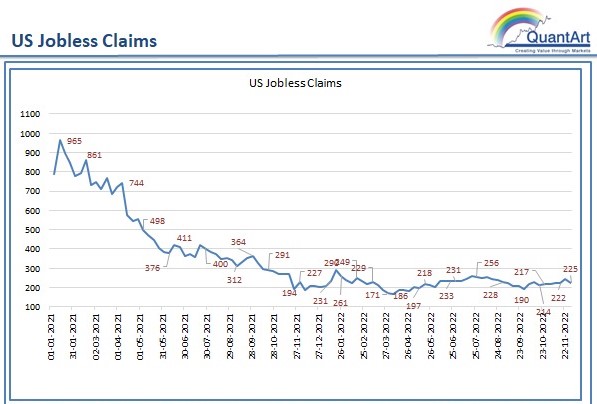

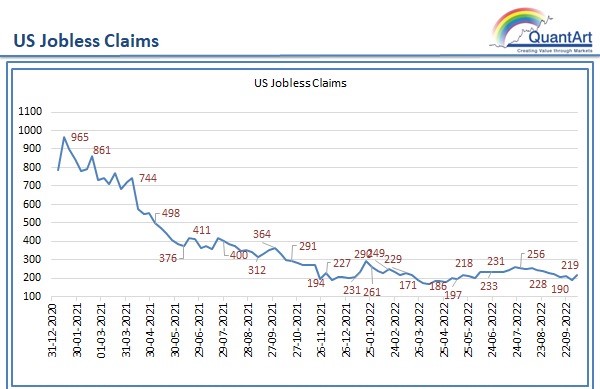

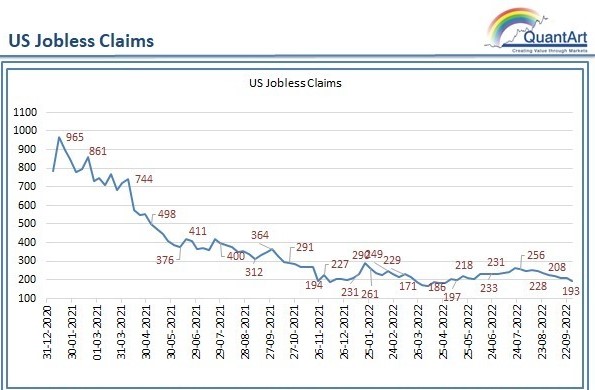

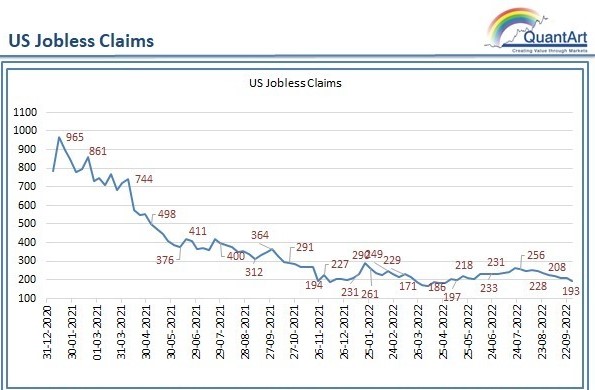

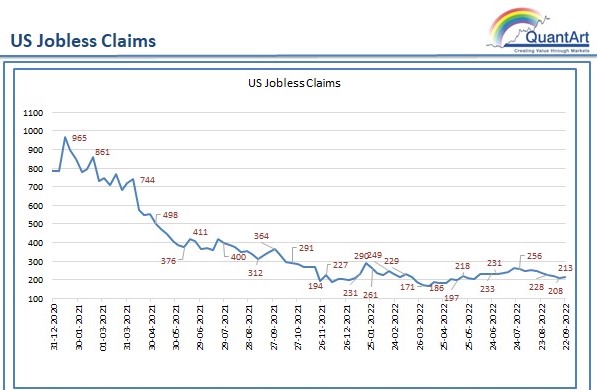

US Jobless Claims

US Core CPI YoY

US CPI MoM

US CPI YoY

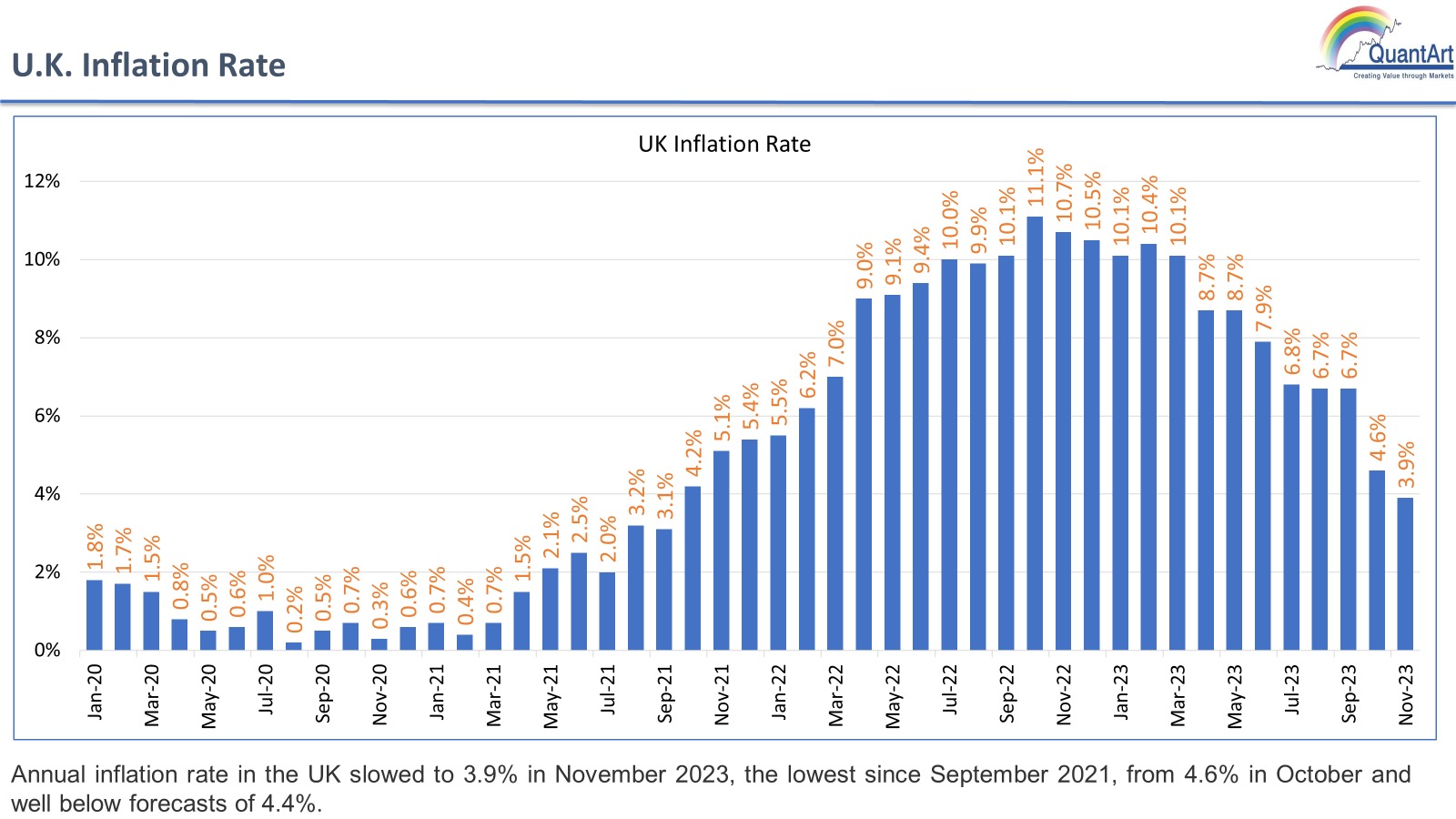

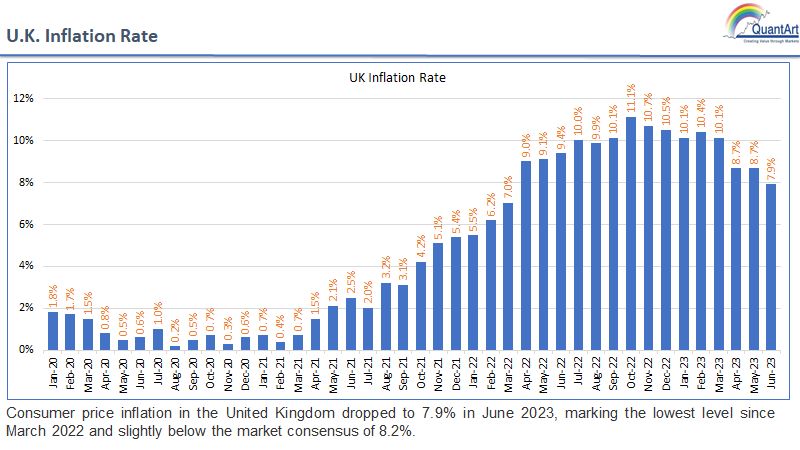

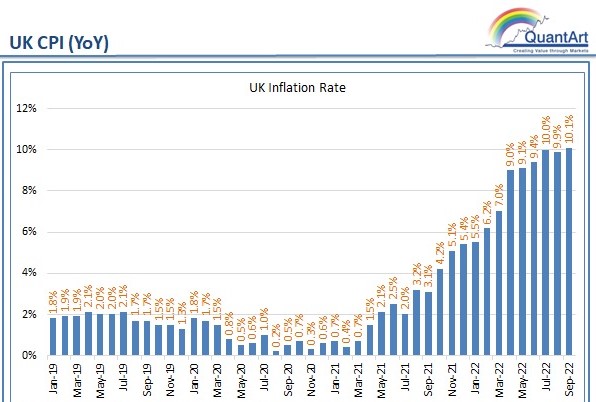

U.K. Inflation Rate

India FX Reserves $Bn

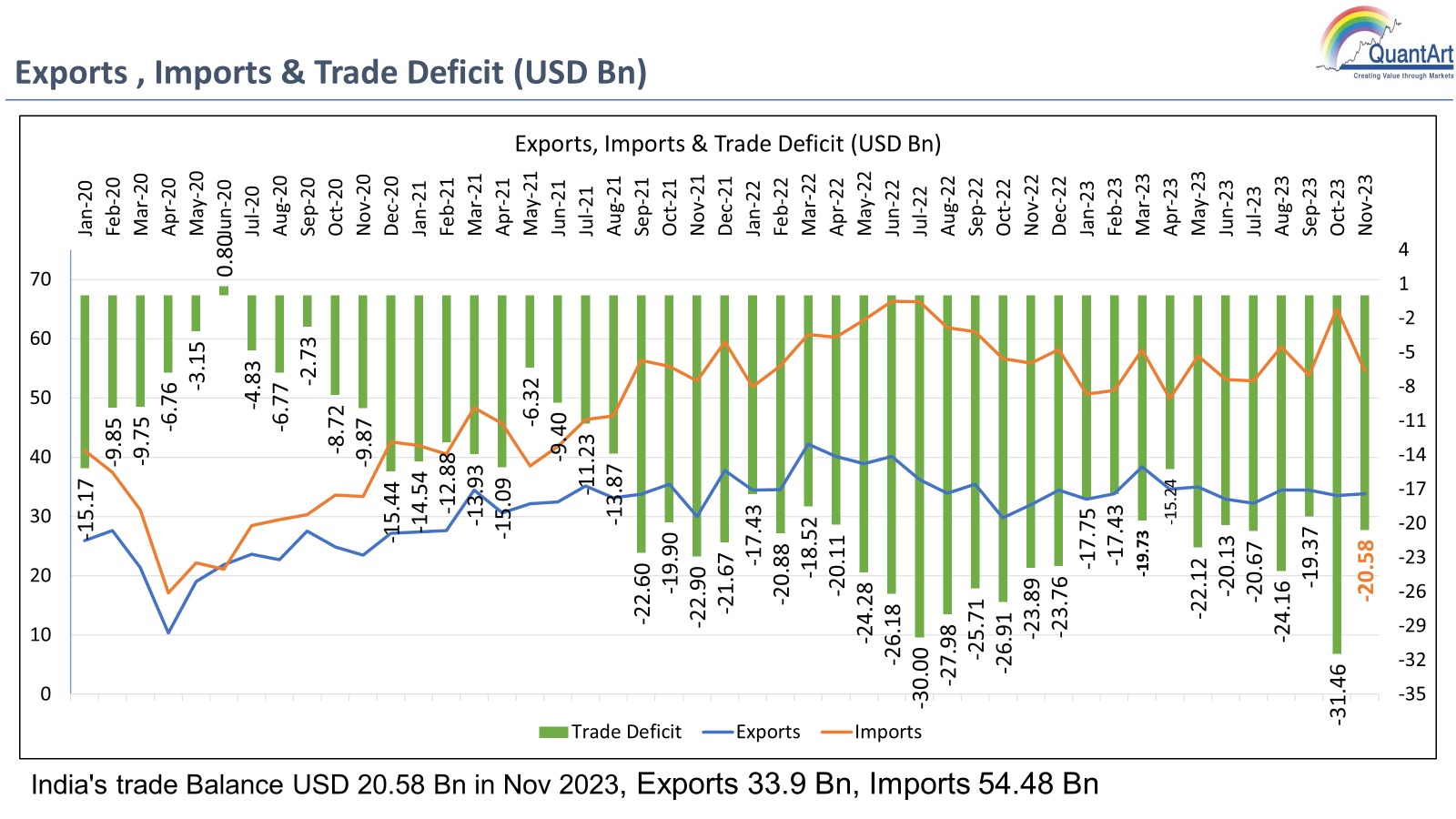

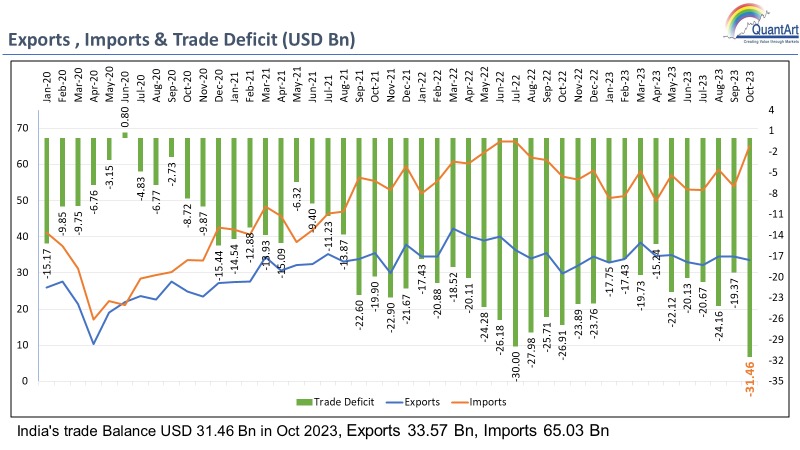

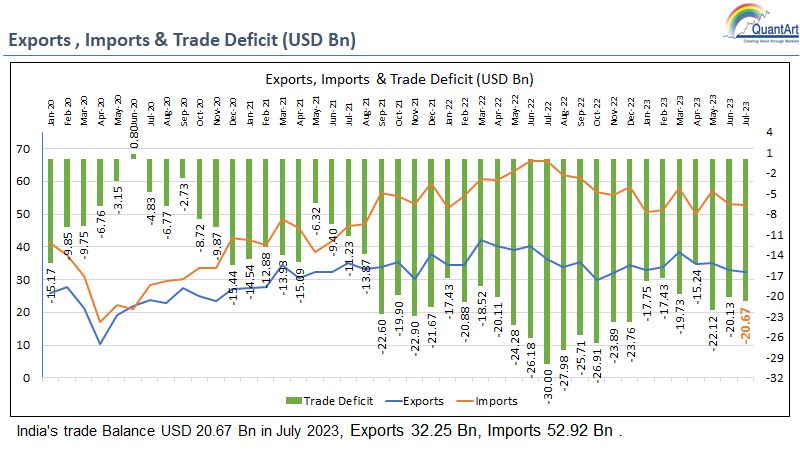

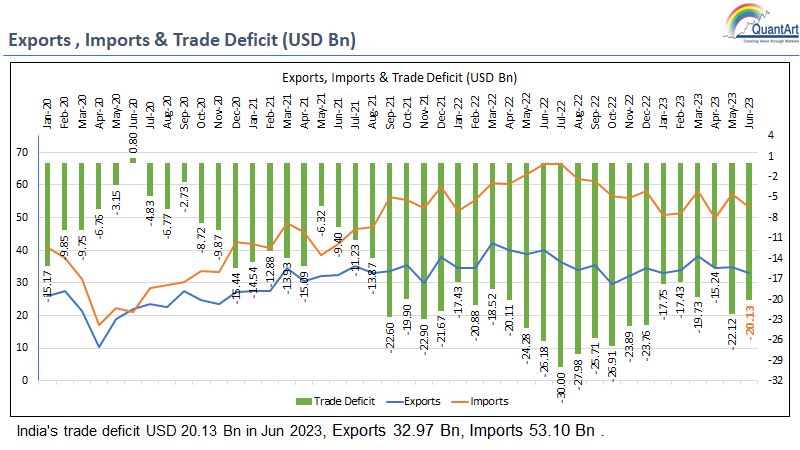

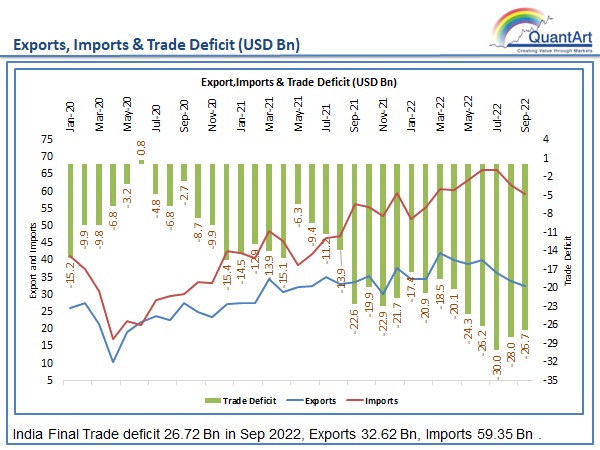

Exports, Imports & Trade Deficit

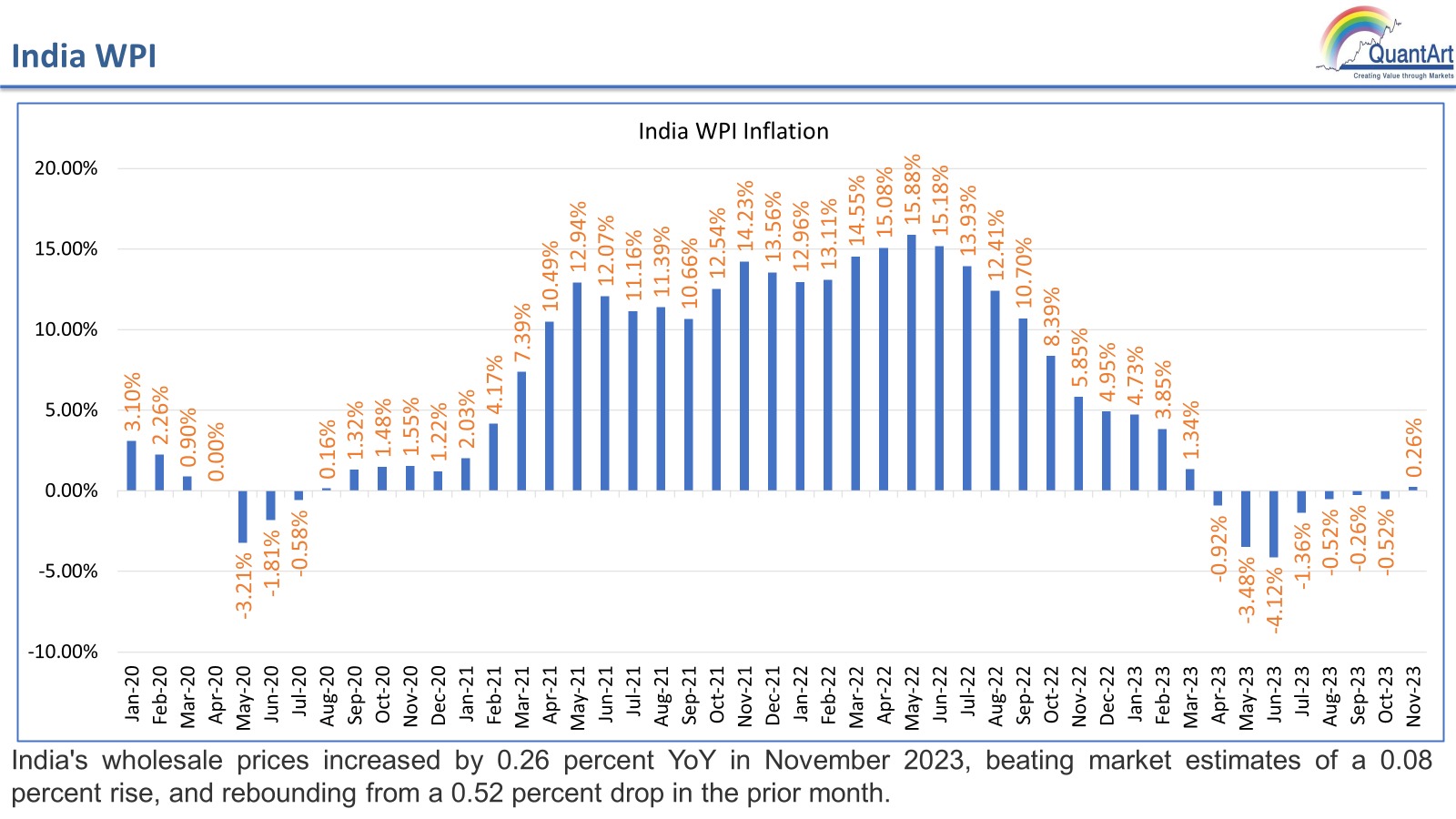

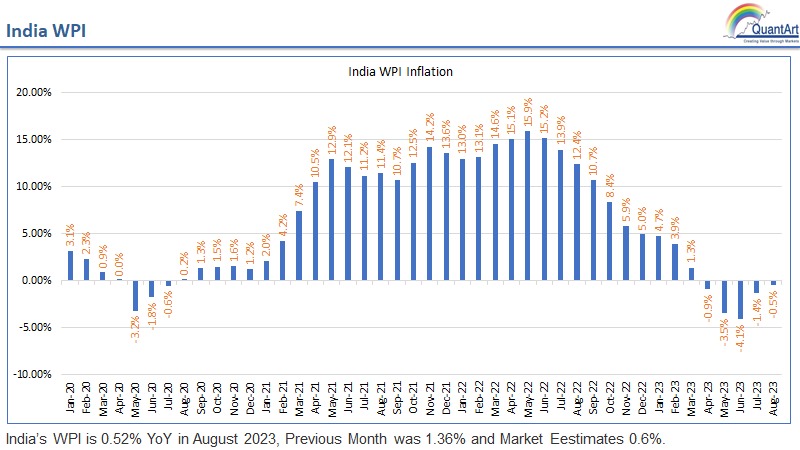

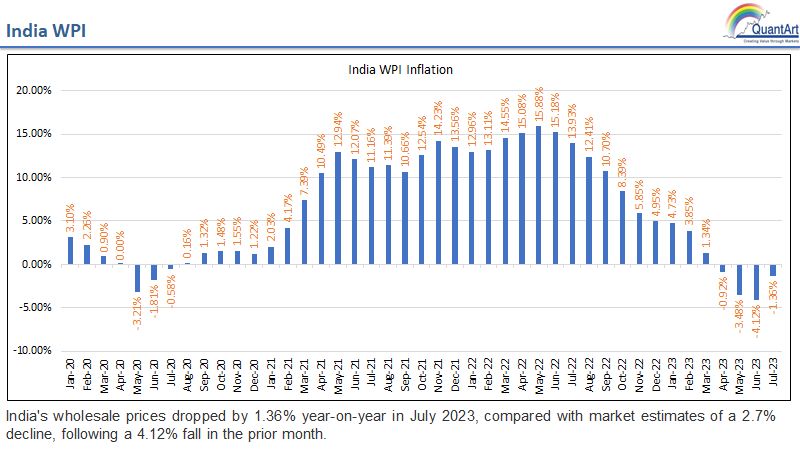

India WPI

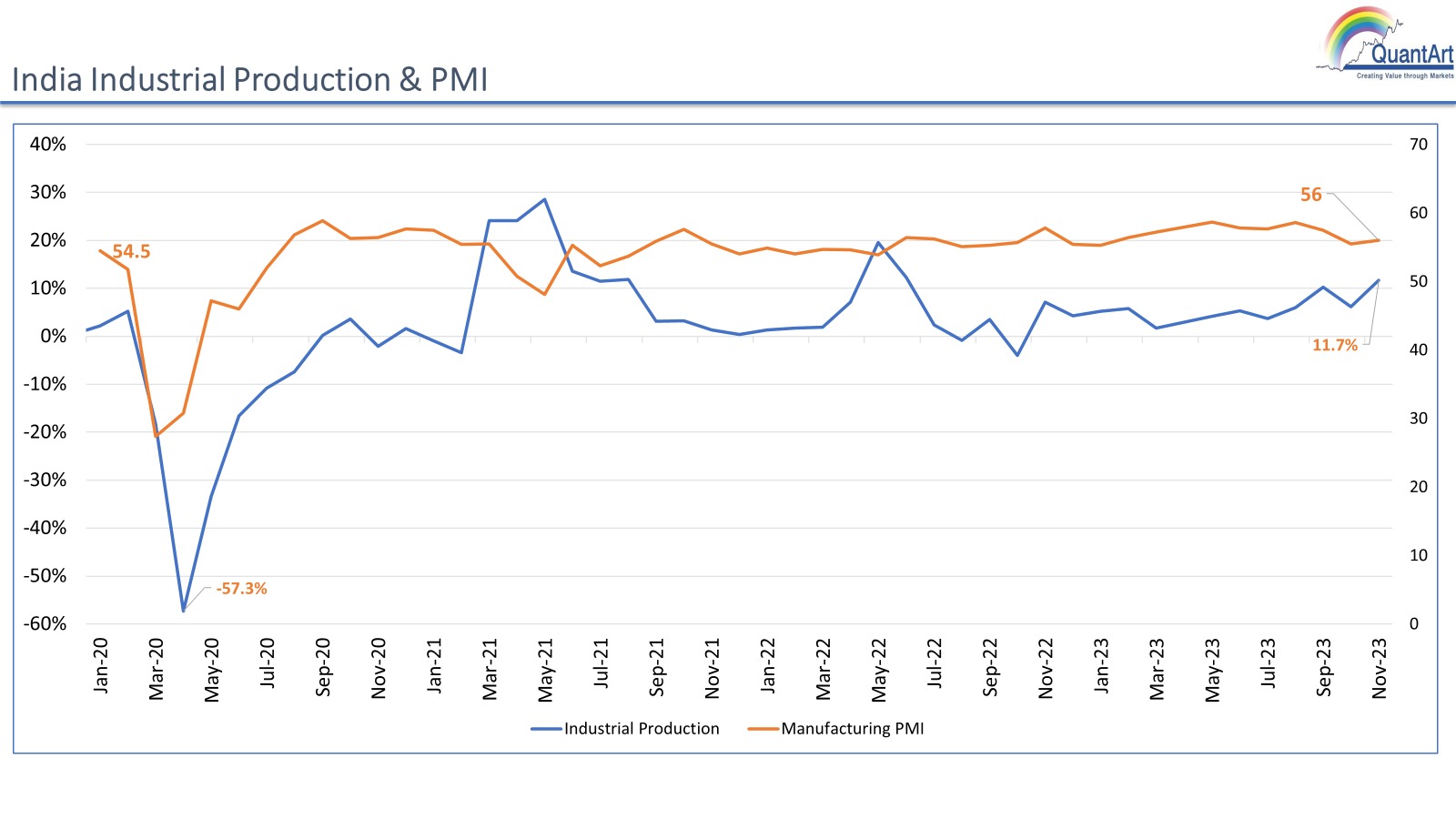

India Industrial Production & PMI

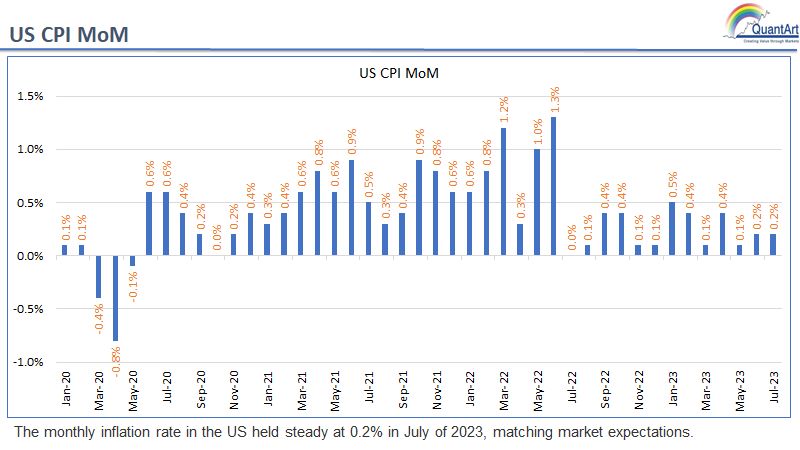

US CPI MoM

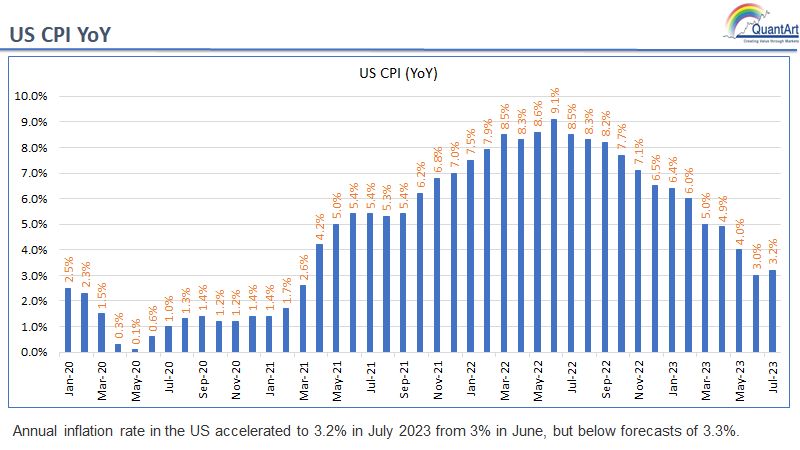

US CPI YoY

India: CPI

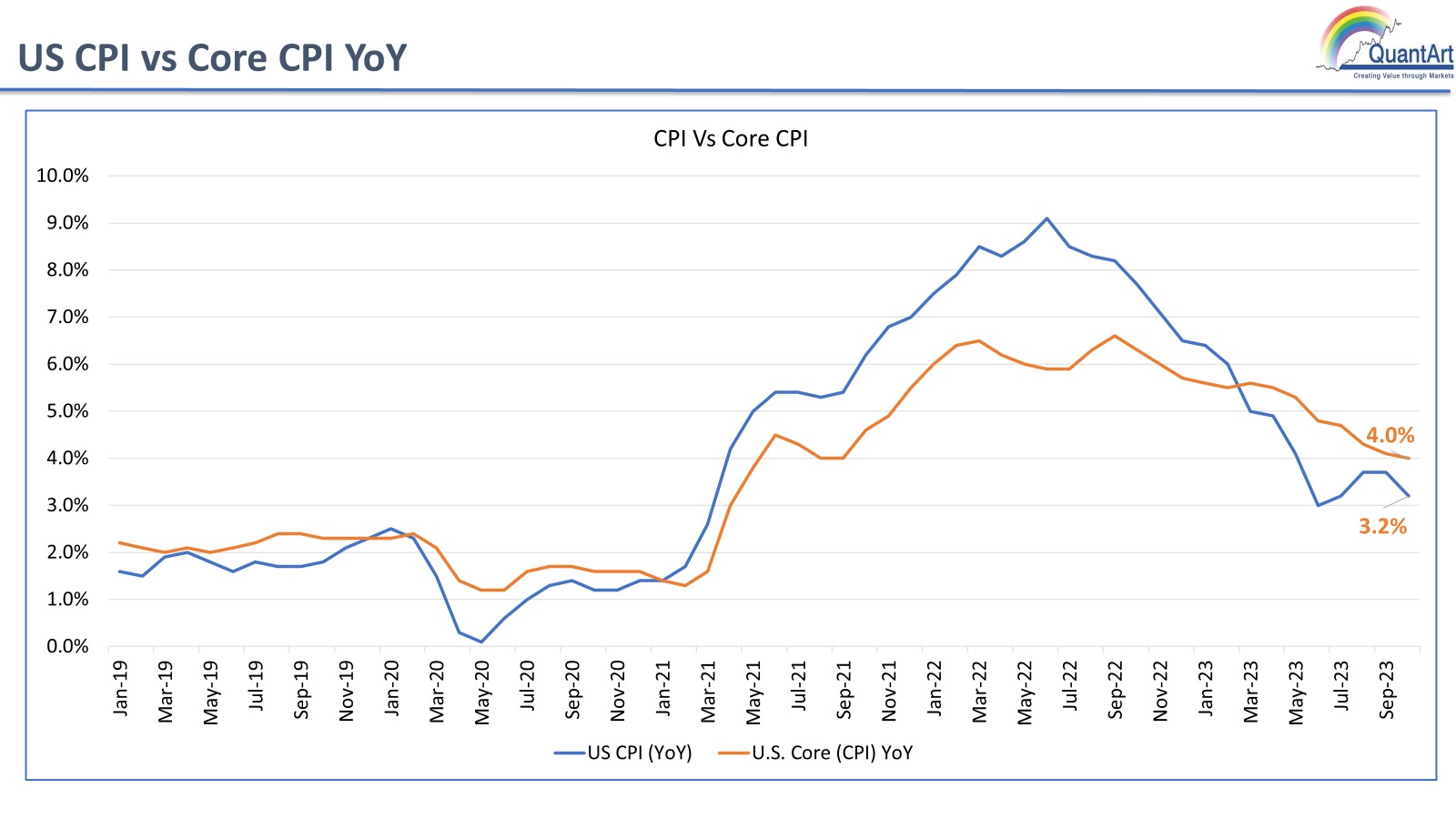

US CPI vs Core CPI YoY

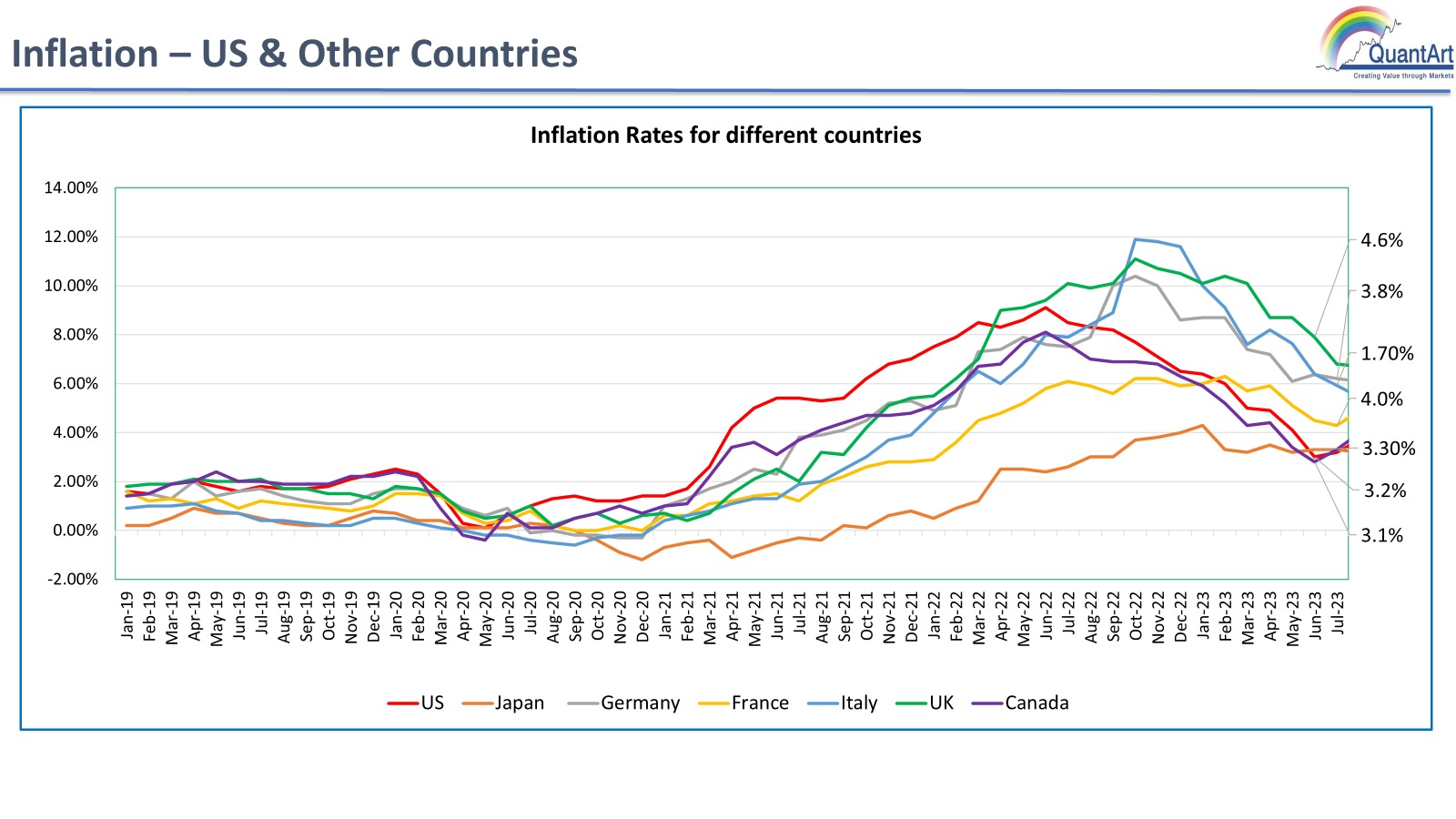

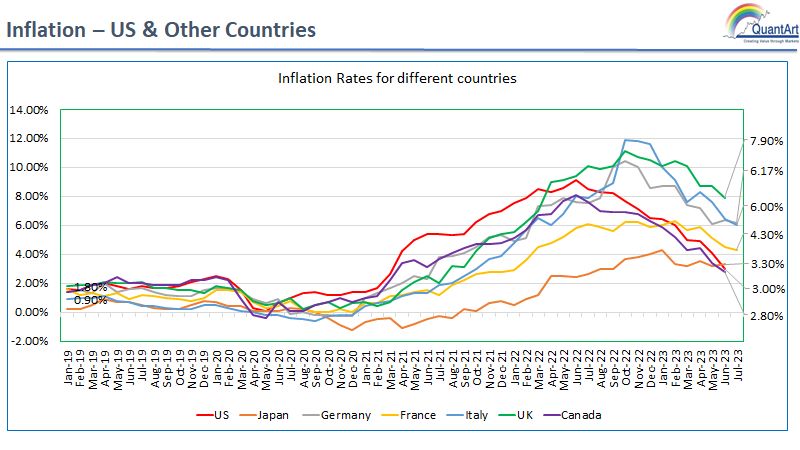

Inflation – US & Other Countries

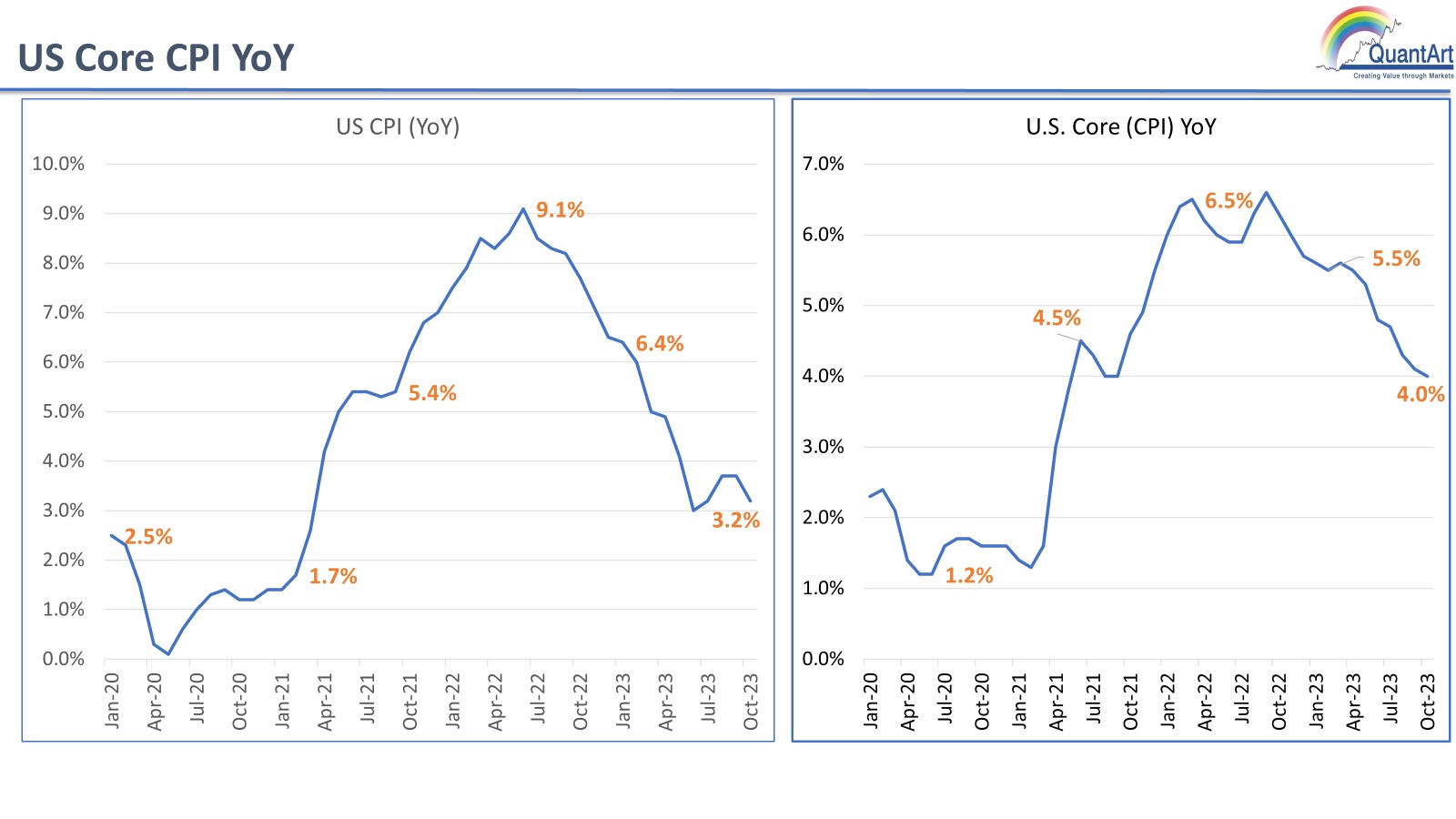

US Core CPI YoY

India Fx Reserves $Bn

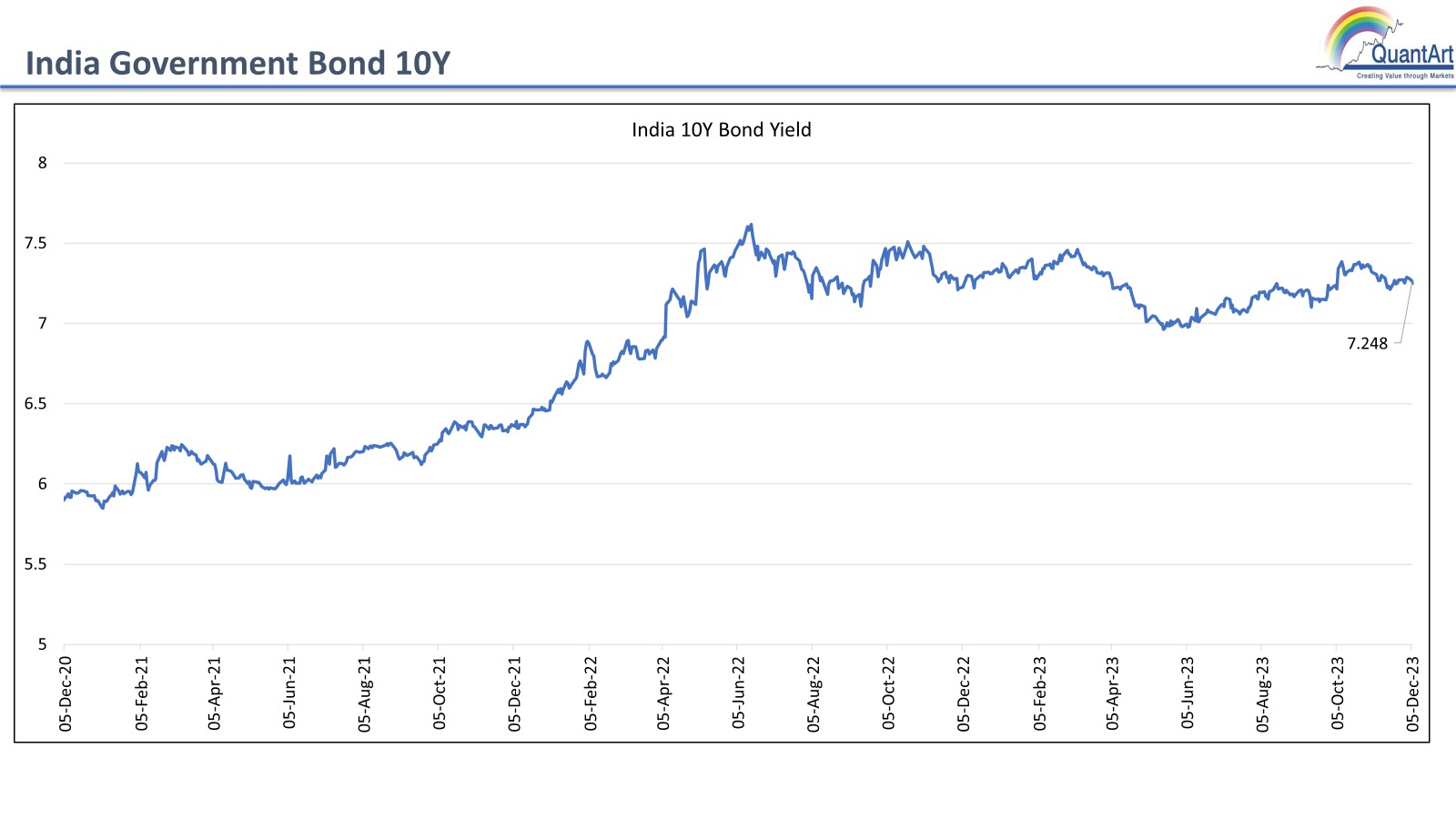

India Goverment Bond 10Y

India Fx Reserves $Bn

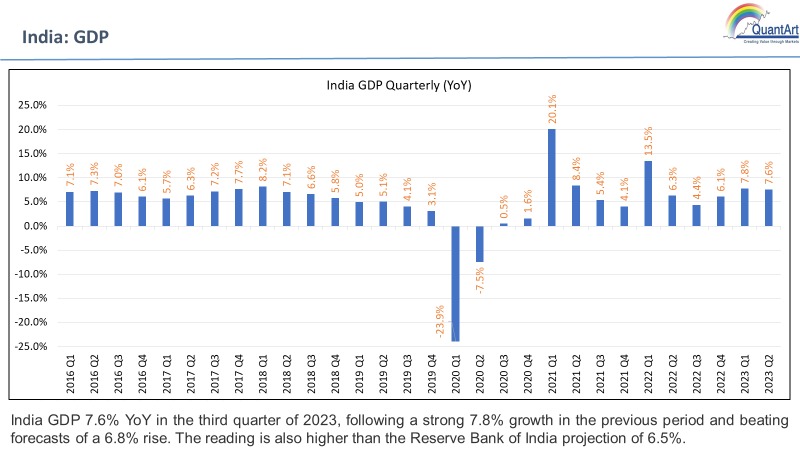

India: GDP

Eurozone Core CPI (YoY)

Eurozone CPI (YoY)

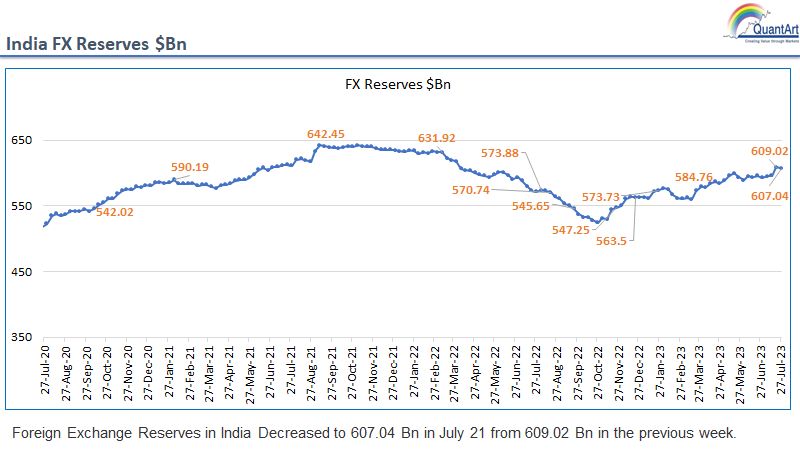

FX Reserves $Bn

India FX Reserves $Bn

Eurozone CPI (YoY)

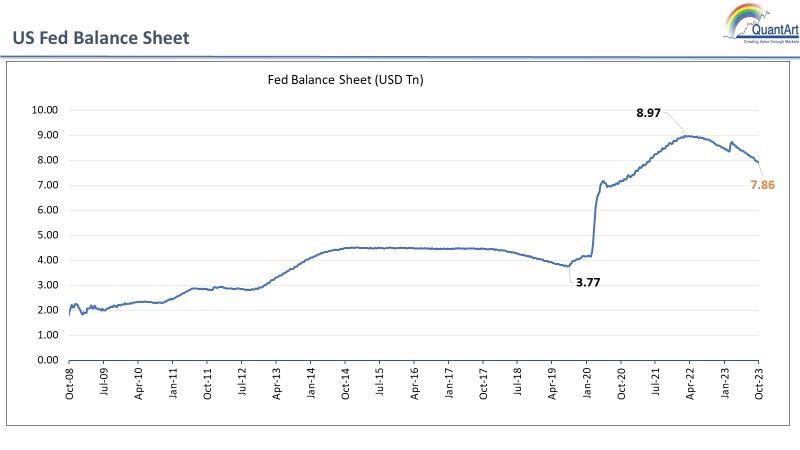

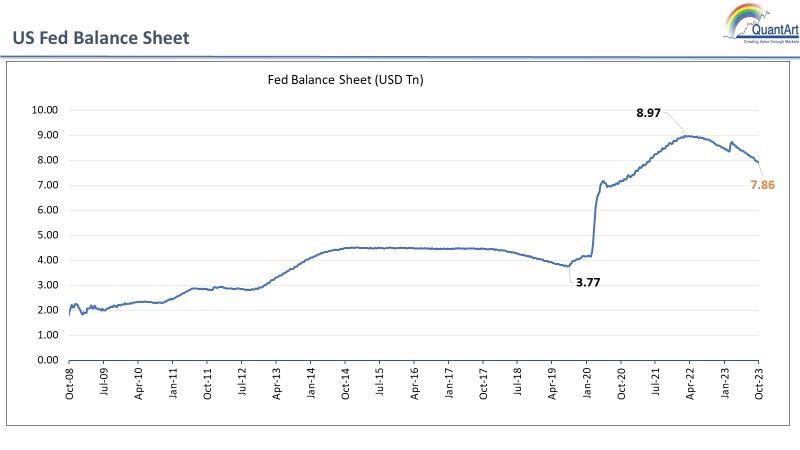

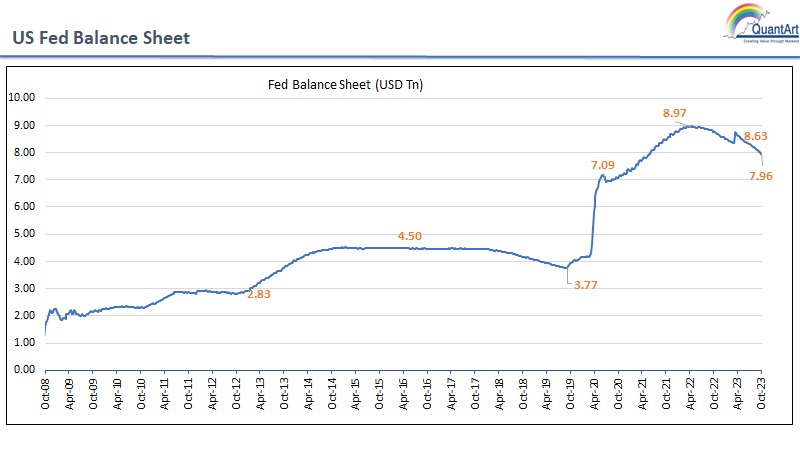

US Fed Balance Sheet

Exports, Imports & Trade Deficit(USD Bn)

India: CPI

India FX Reserves $Bn

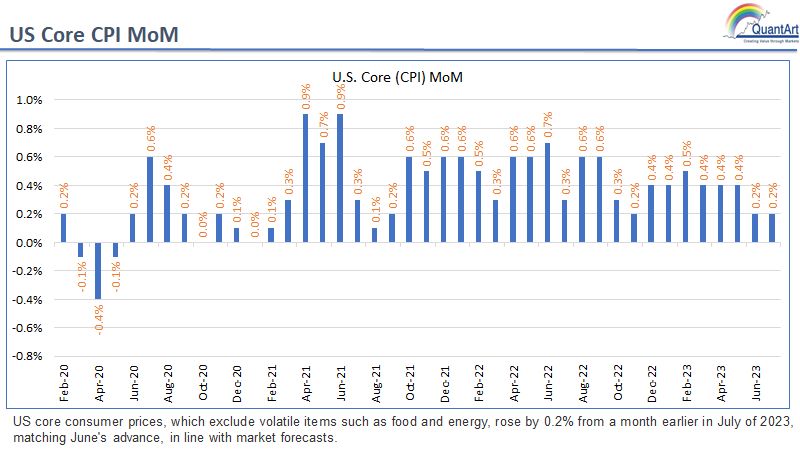

US Core CPI MoM

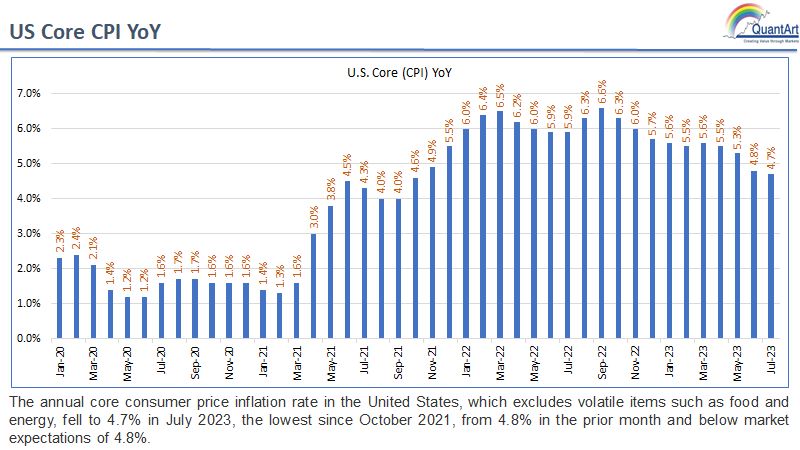

US Core CPI YoY

US CPI MoM

US CPI YoY

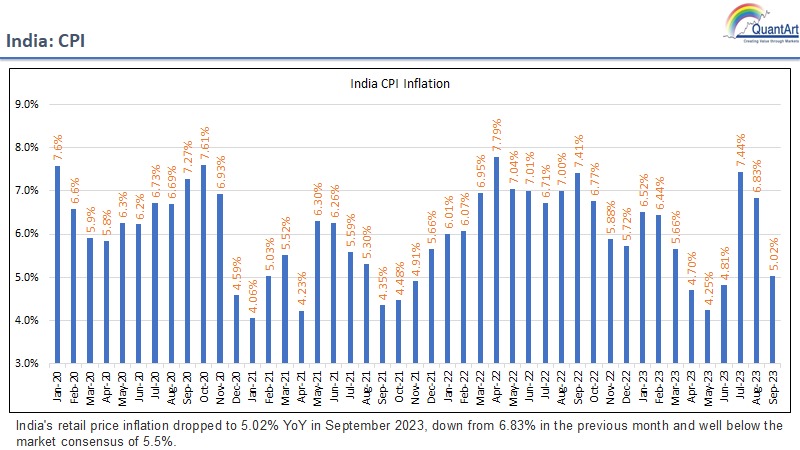

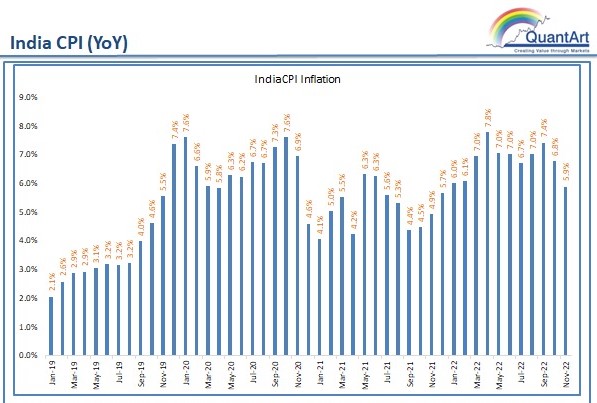

India CPI YoY

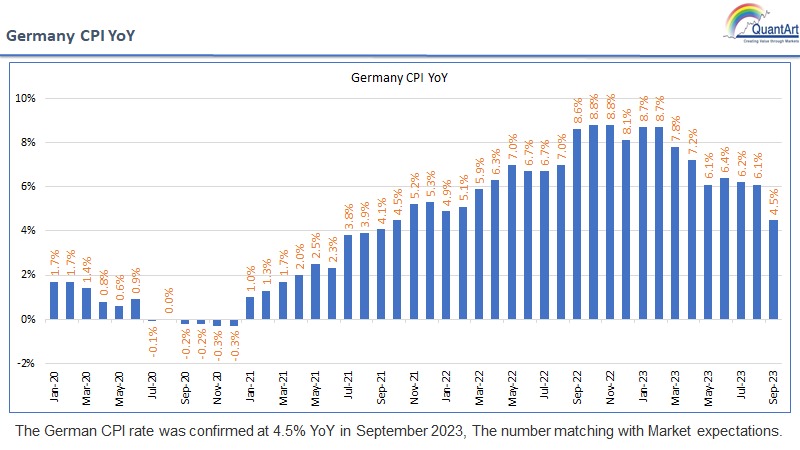

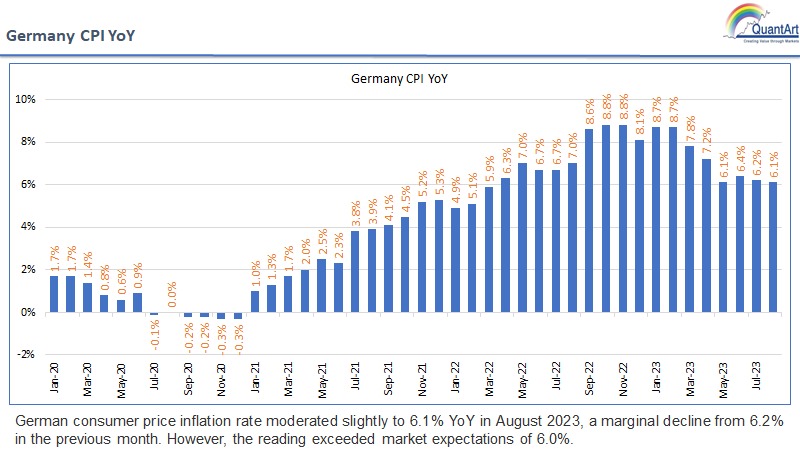

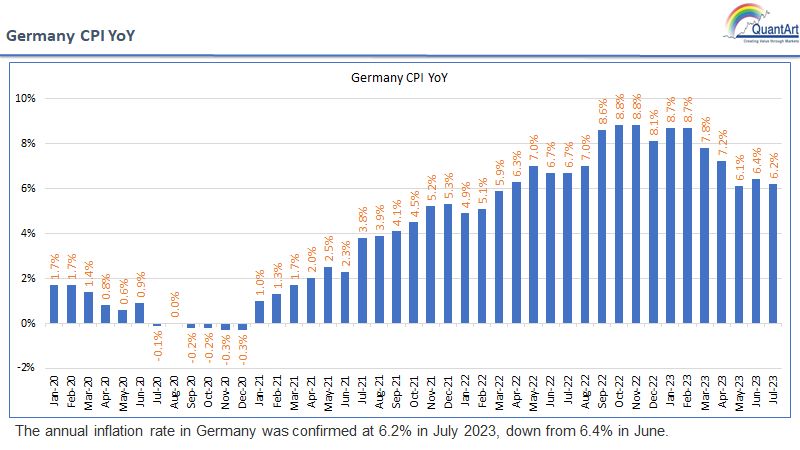

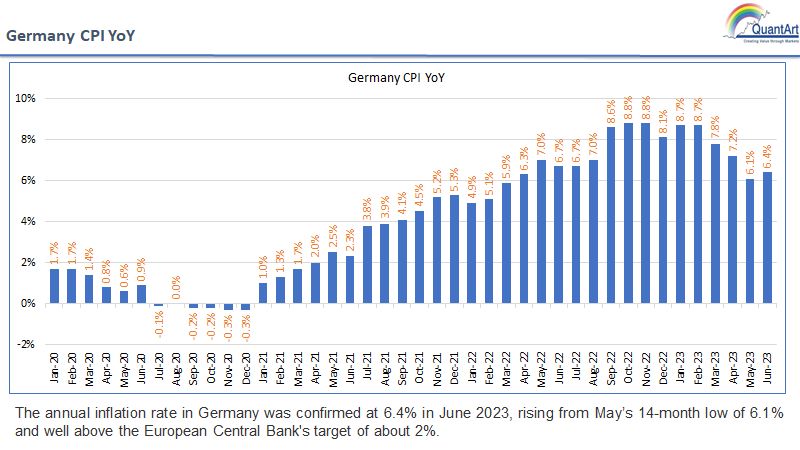

Germany CPI YoY

US Fed Balance Sheet

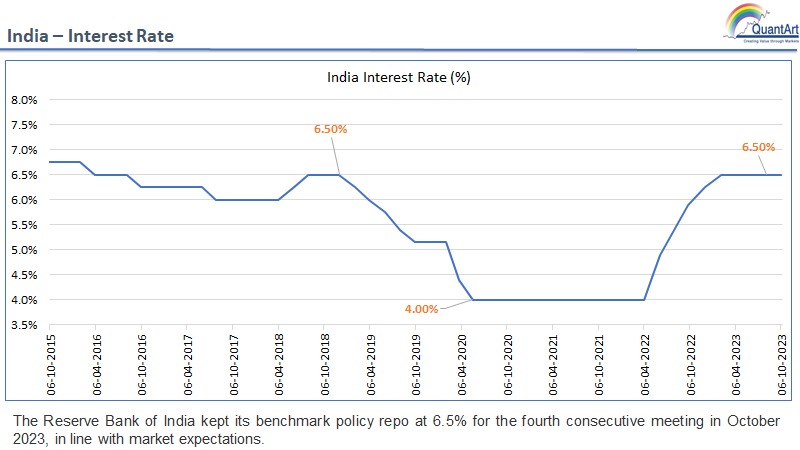

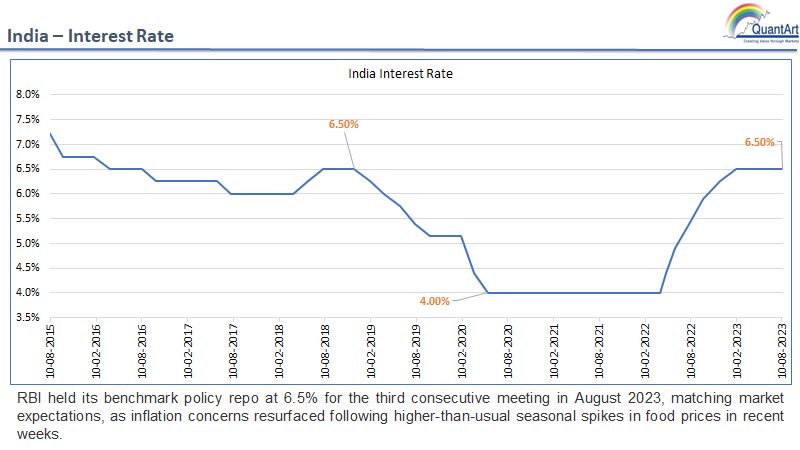

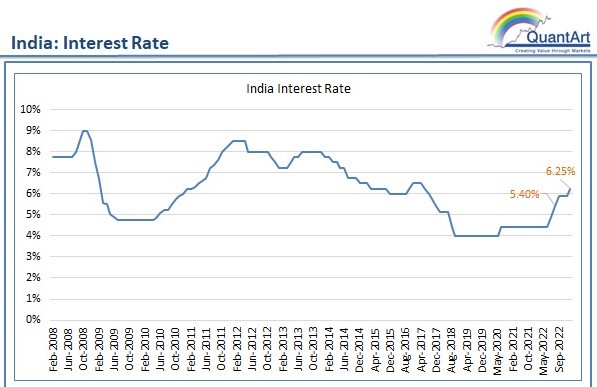

India Interest Rate

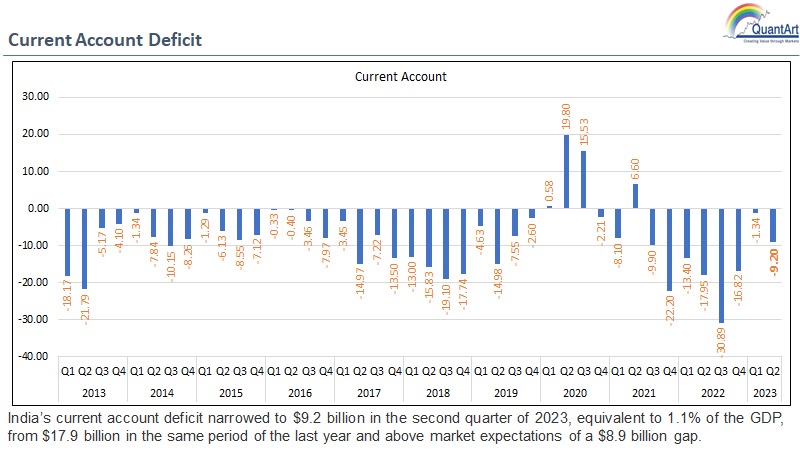

Current Account Deficit

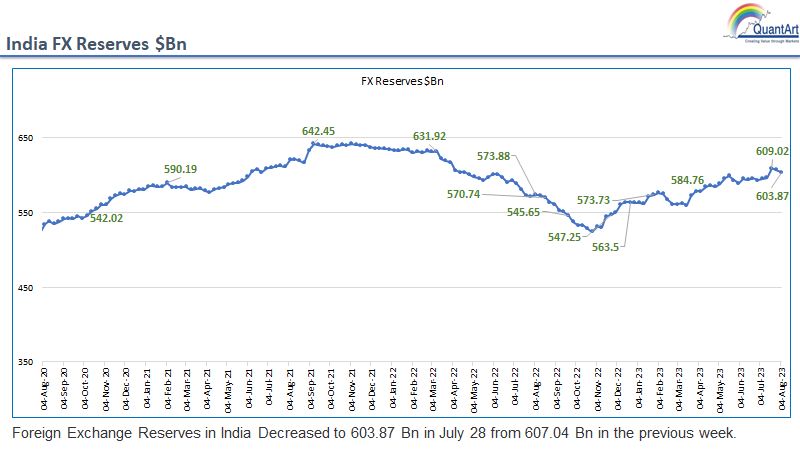

India FX Reserves $Bn

Eurozone Core CPI (YoY)

Eurozone CPI (YoY)

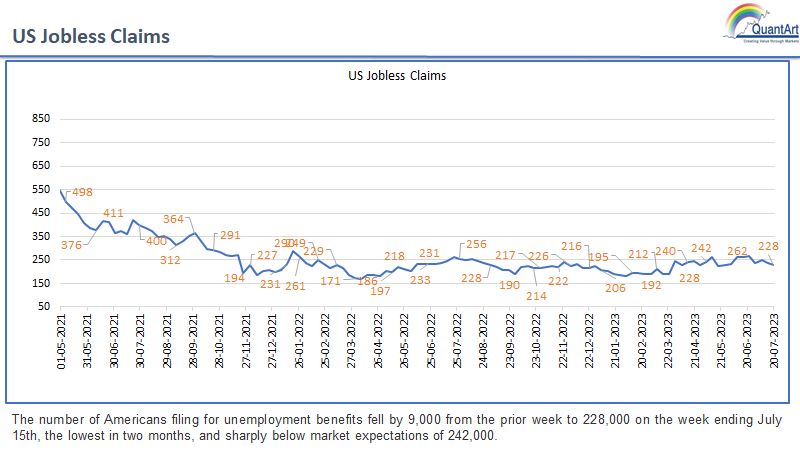

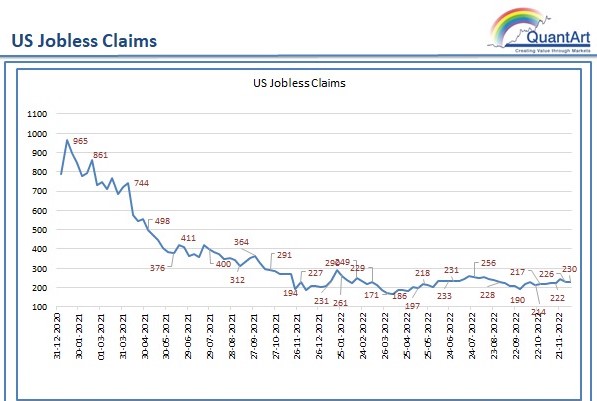

US Jobless Claims

India FX Reserves $Bn

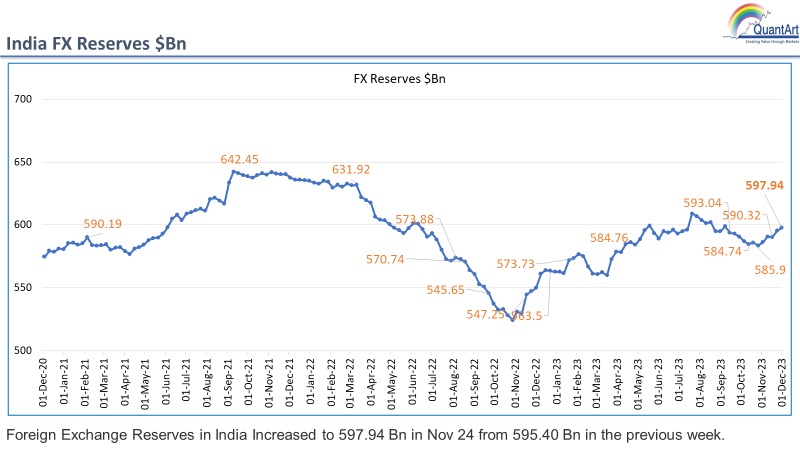

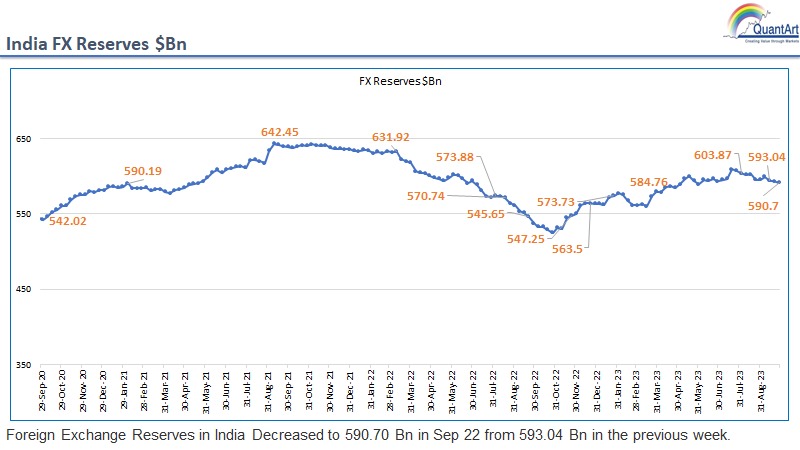

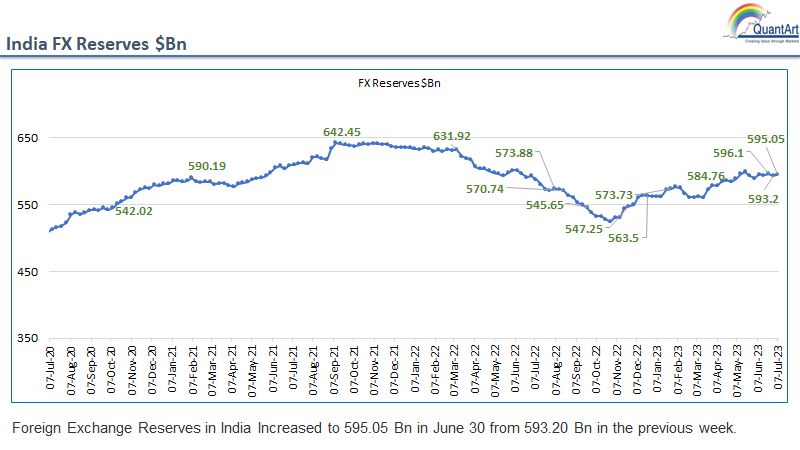

The Foreign Exchange Reserves in India decreased to 593.04 Bn in Sep 16 from 593.90 Bn in the previous week.

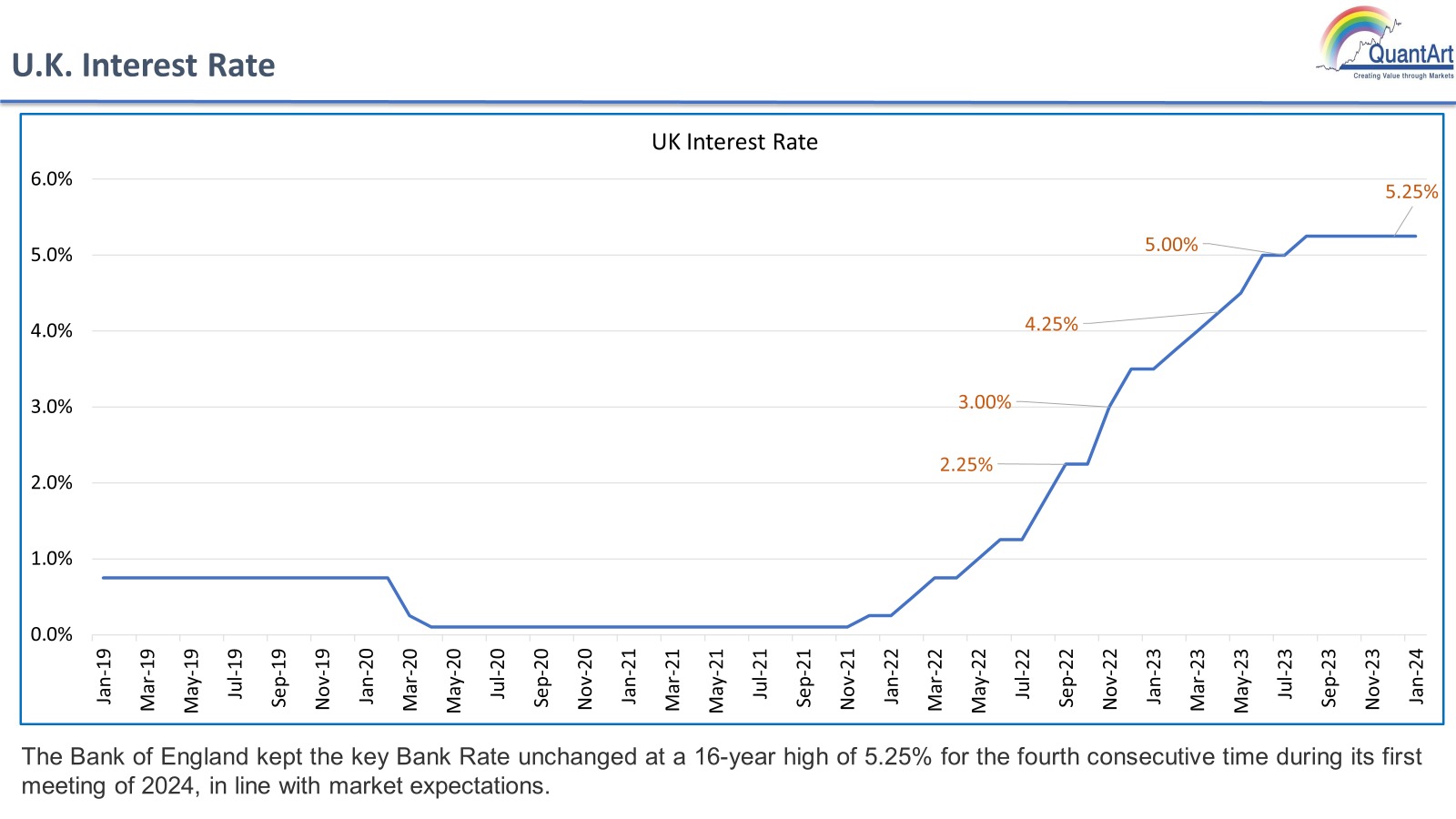

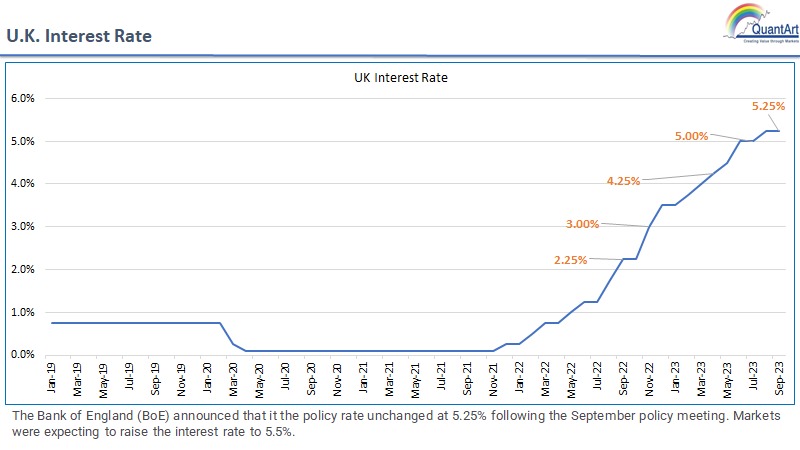

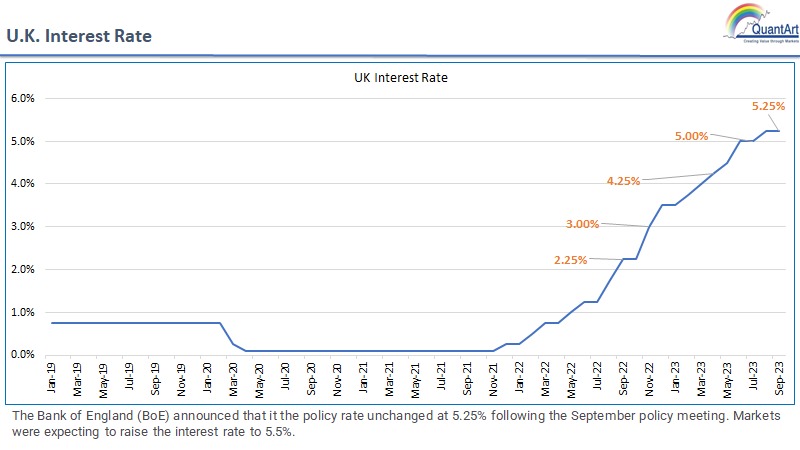

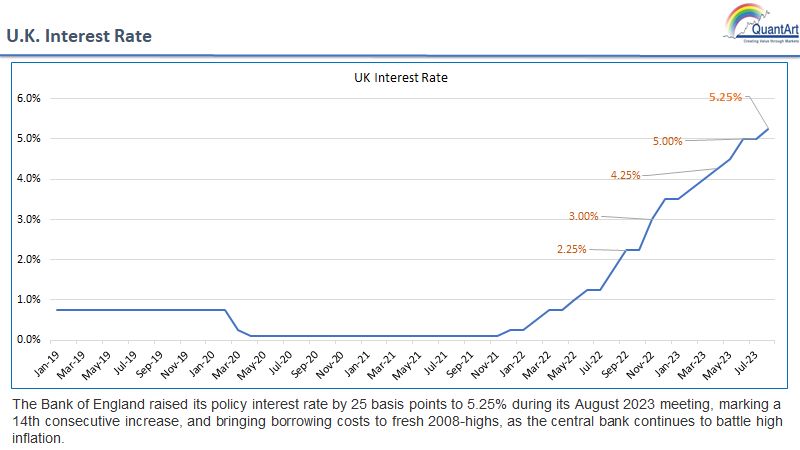

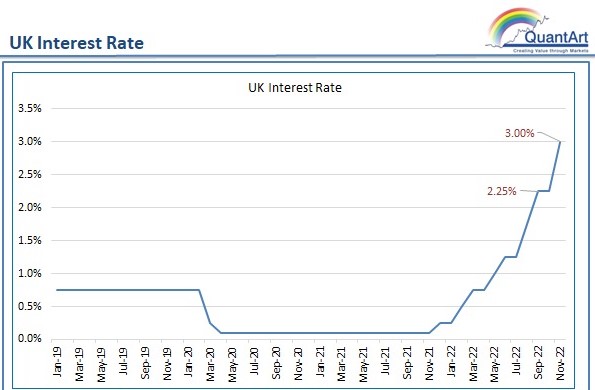

U.K. Interest Rate

The Interest Rate in the UK is expected to be 5.25% by the end of this quarter.

Federal Reserve issues FOMC statement

The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

Released on:- September 20, 2023

By:- The Federal Reserve System

To read the entire document tap on the link:- https://www.federalreserve.gov/newsevents/pressreleases/monetary20230920a.htm

The FOMC has nullified any hopes of rate cuts in the medium-term, which also means an inverted yield curve over a longer horizon. The inversion in the yield curve does not bode well for the economy and keeps open the possibility of a sharp recession.

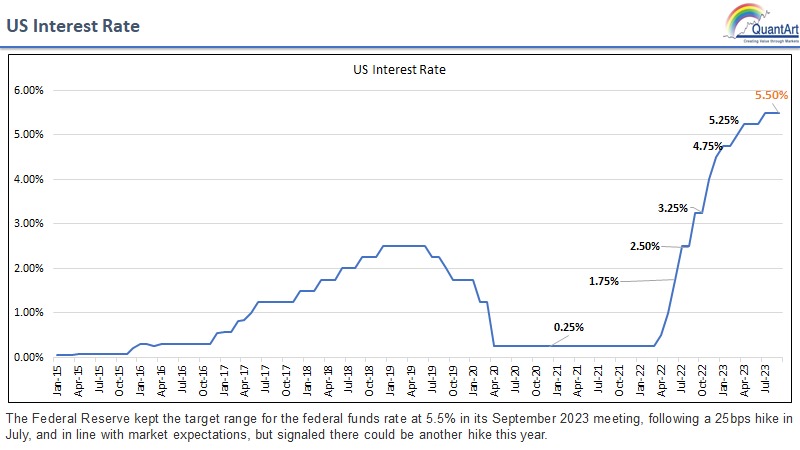

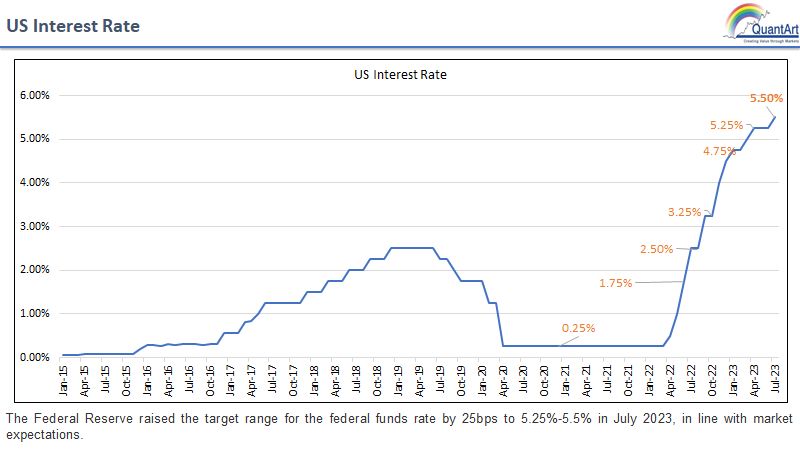

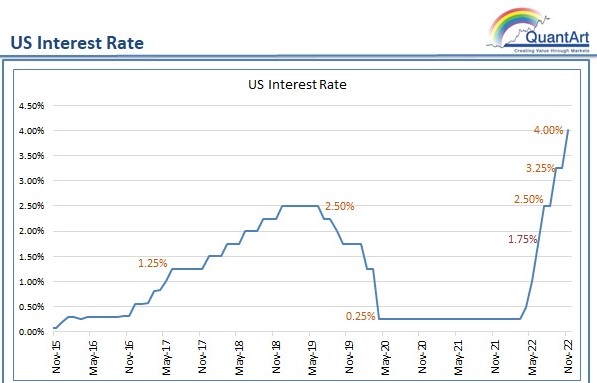

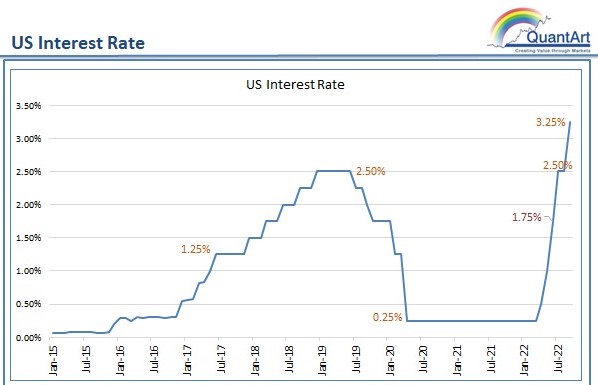

US Interest Rate

The Interest Rate in the United States is expected to be 5.50% by the end of this quarter.

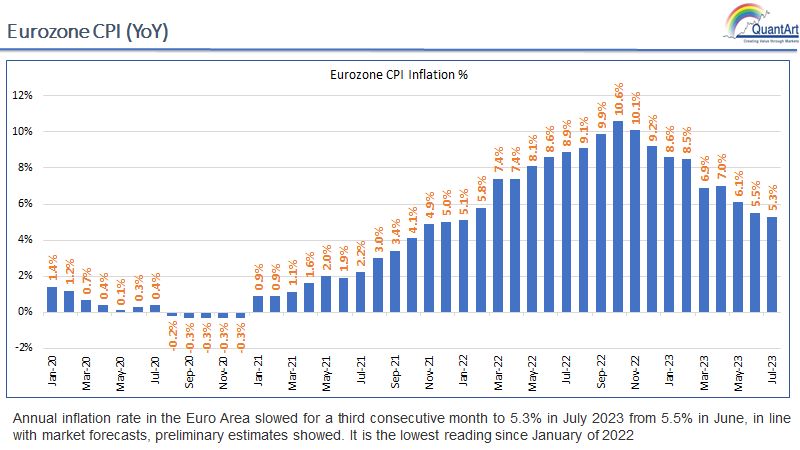

European Consumer Price Index (CPI) YoY- July 2023

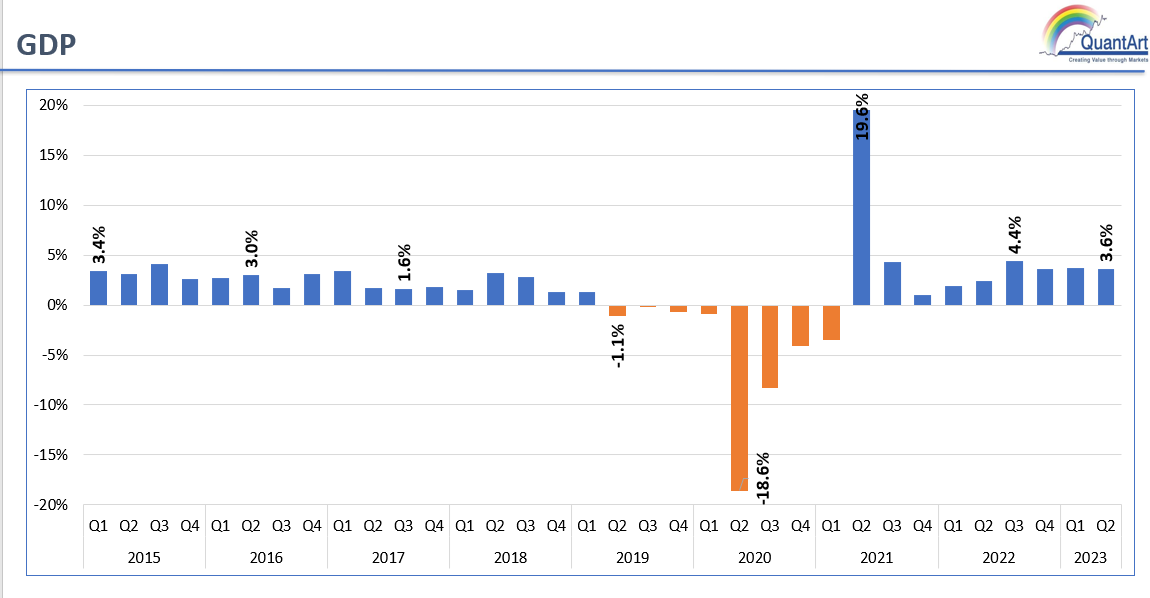

GDP of Mexico- 2023

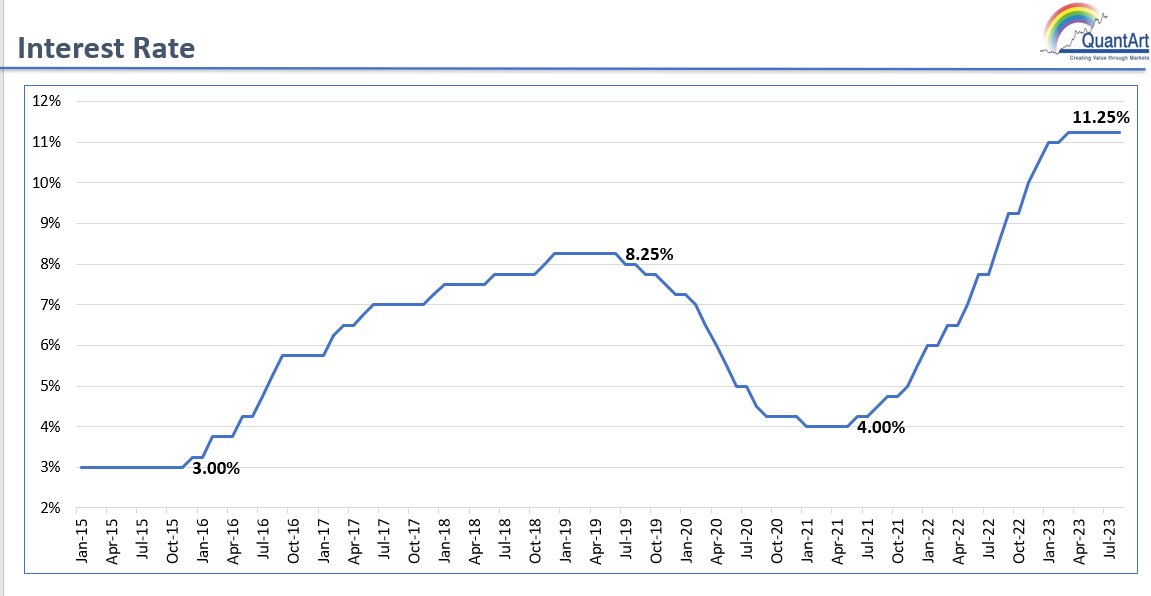

Interest Rate- July 2023

The Mexico Interest Rate Data is released from January 2015- July 2023. You can refer to it here.

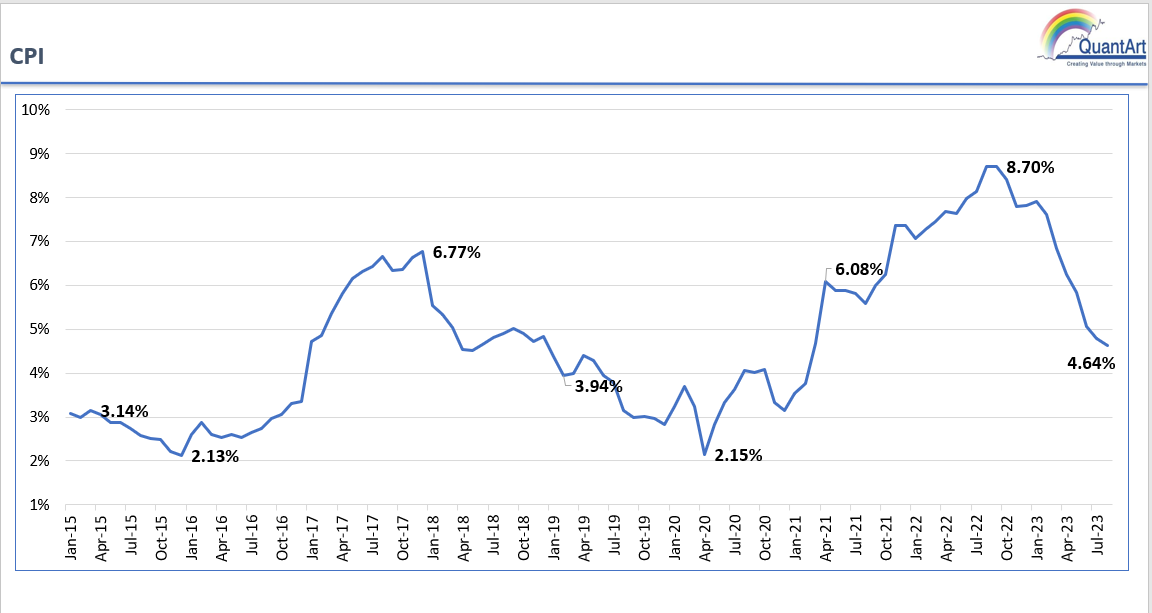

CPI Index- July 2023

The Mexico CPI Index Data is released from January 2015- July 2023. You can refer to it here.

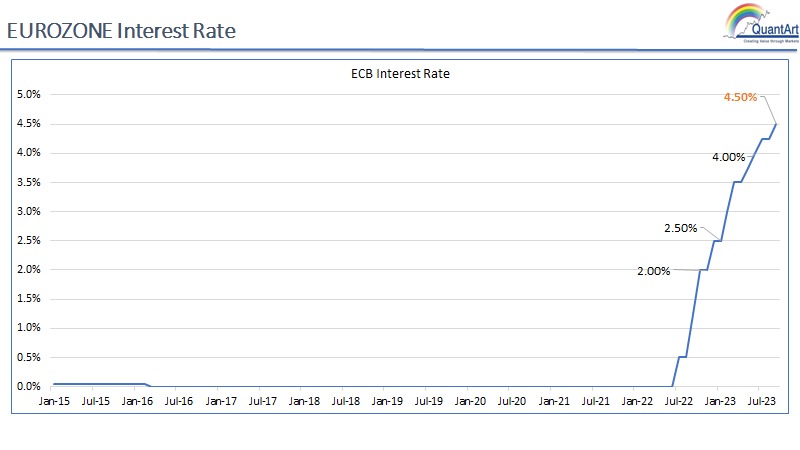

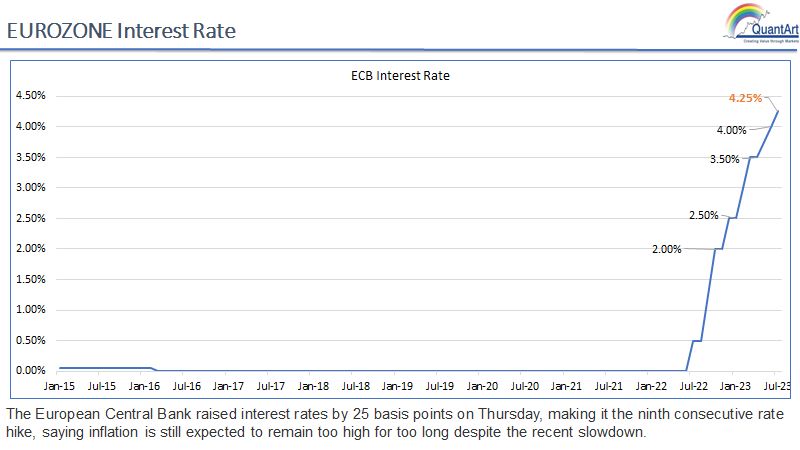

EUROZONE Interest Rate

India WPI

US Core CPI MoM

US CPI MoM

US Core CPI YoY

US CPI YoY

India: CPI

India FX Reserves $Bn

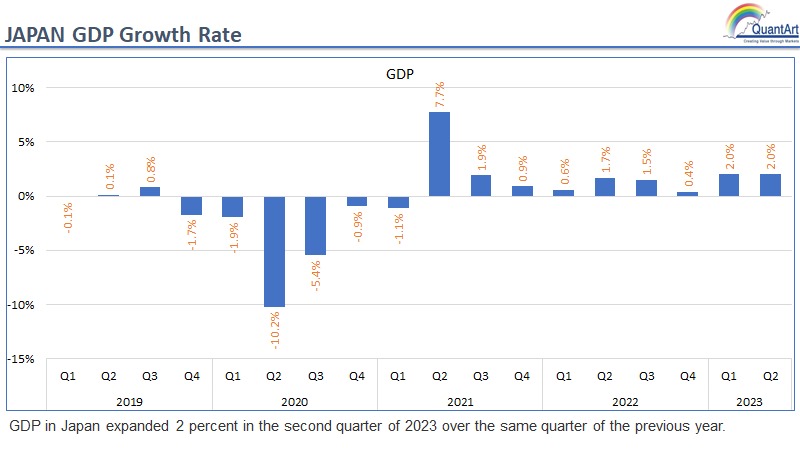

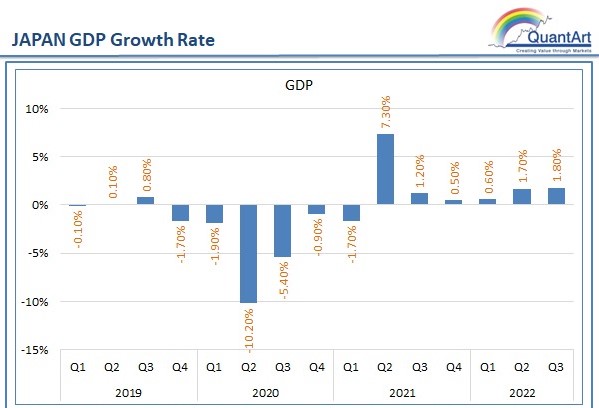

JAPAN GDP Growth Rate

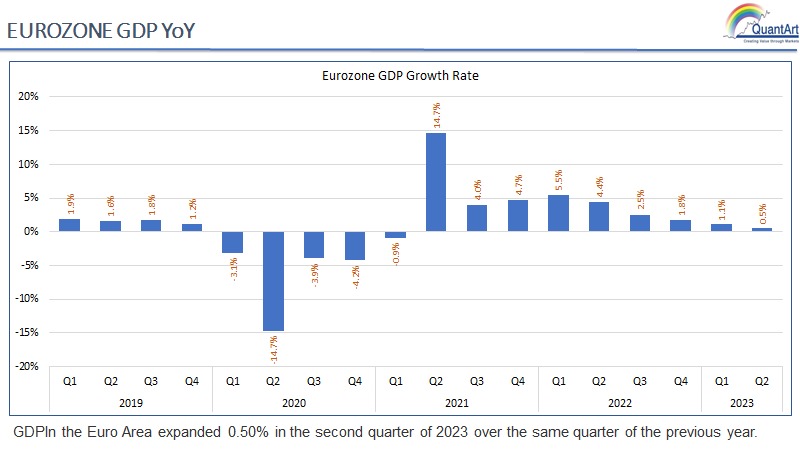

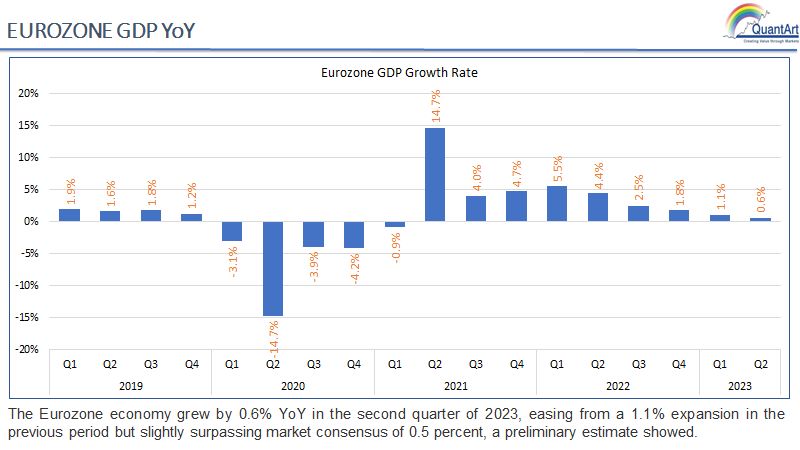

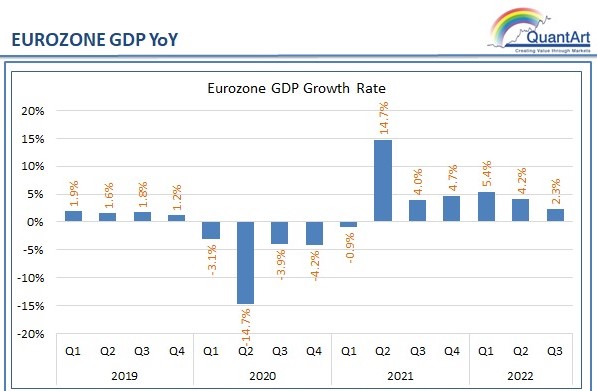

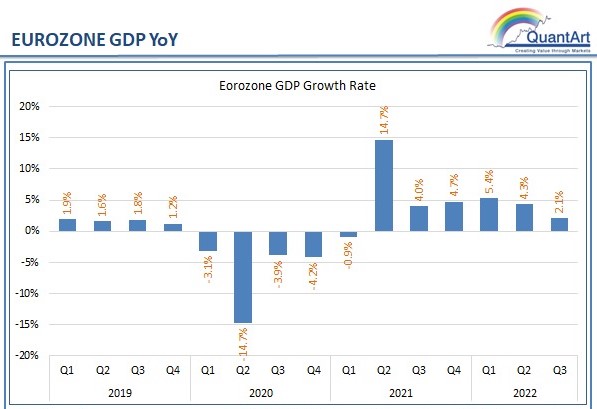

EUROZONE GDP YoY

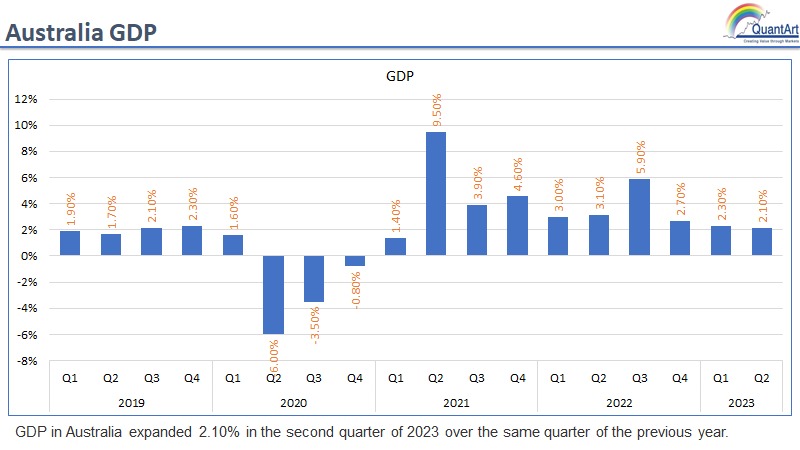

Australia GDP

US Unemployement Rate

US Non Farm Payrolls

Eurozone Core CPI (YoY)

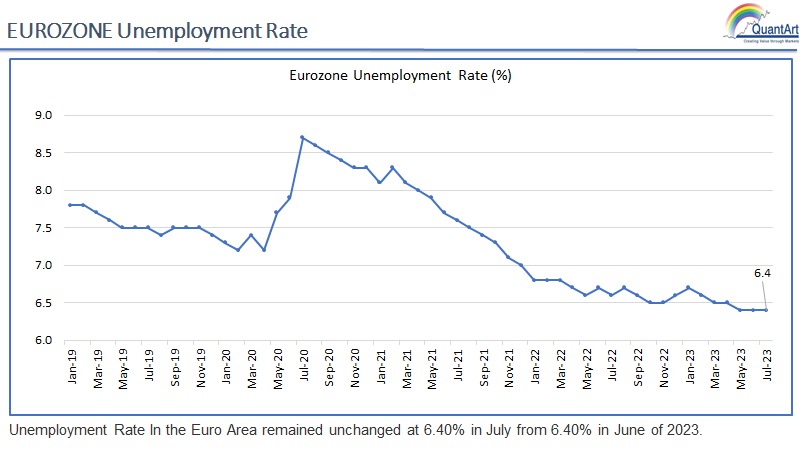

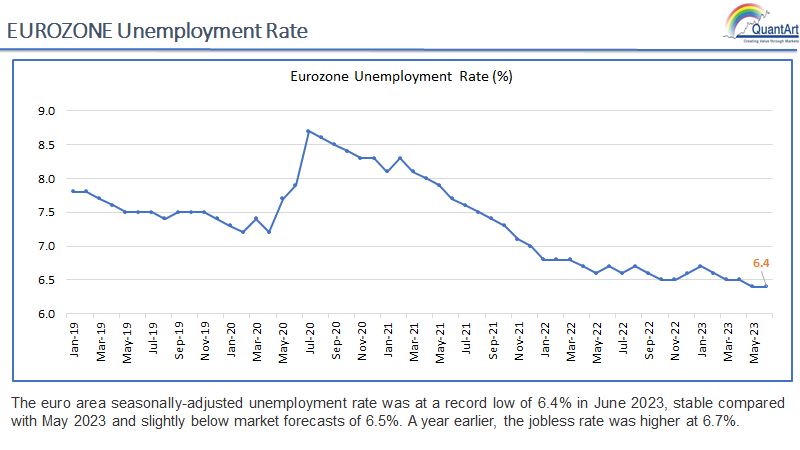

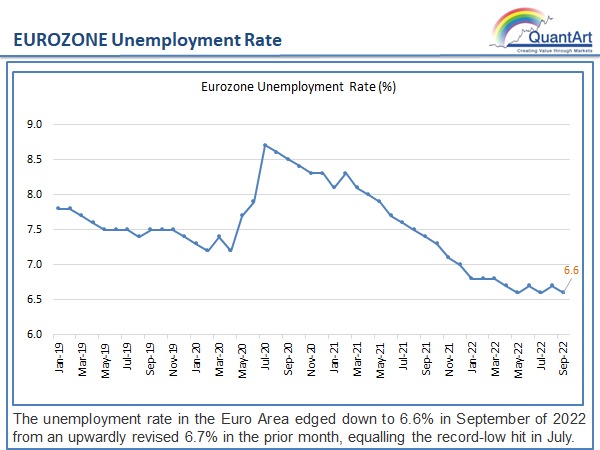

EUROZONE Unemployement Rate

Eurozone CPI Inflation%

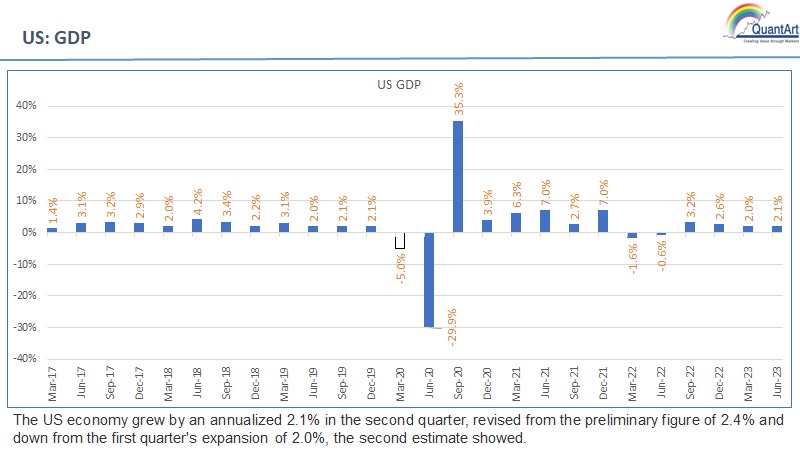

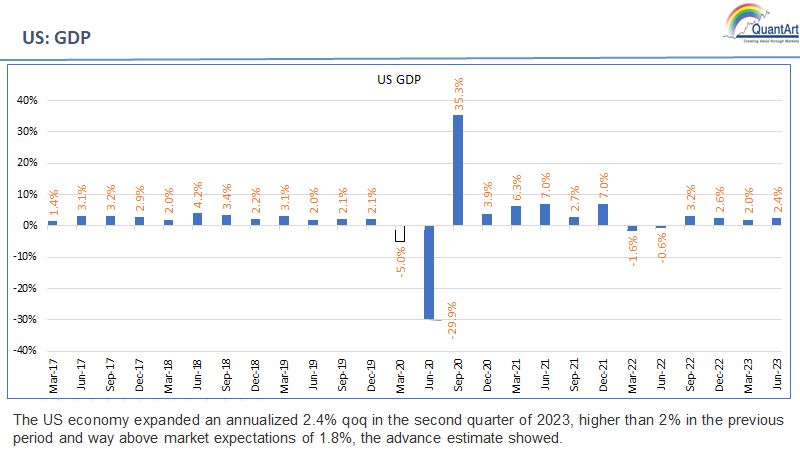

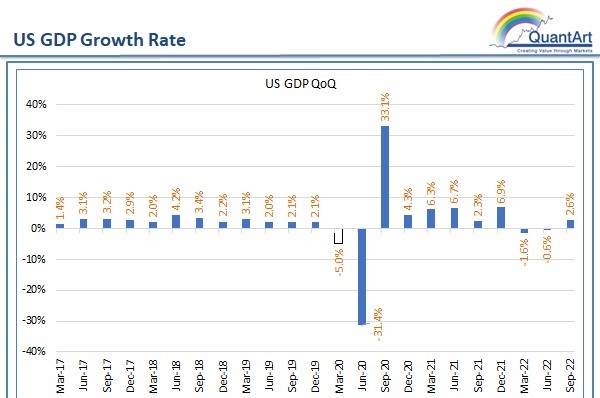

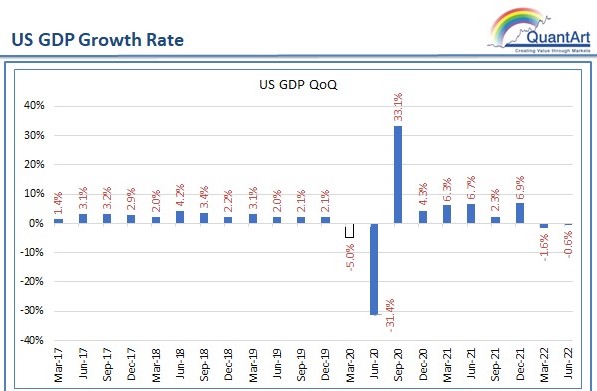

US: GDP

Germany CPI YoY

India Fx Reserves $Bn

US Jobless Claims

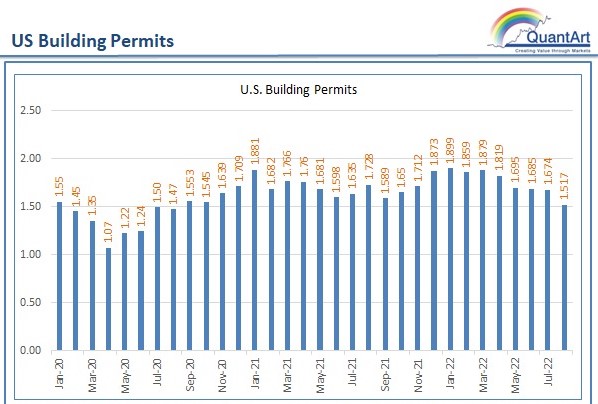

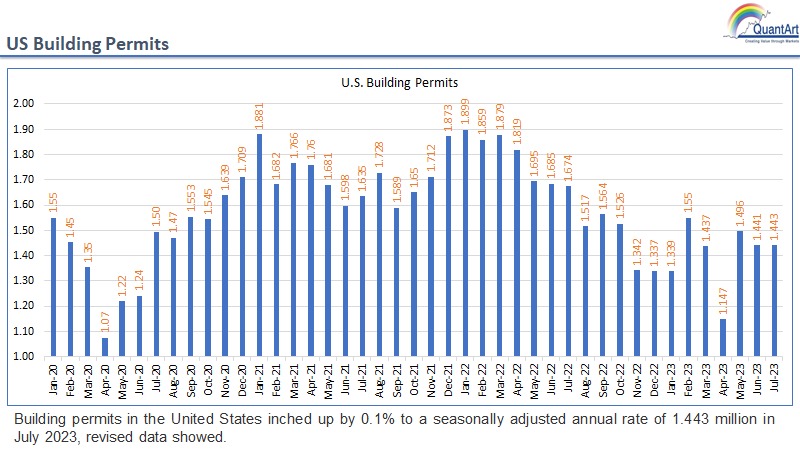

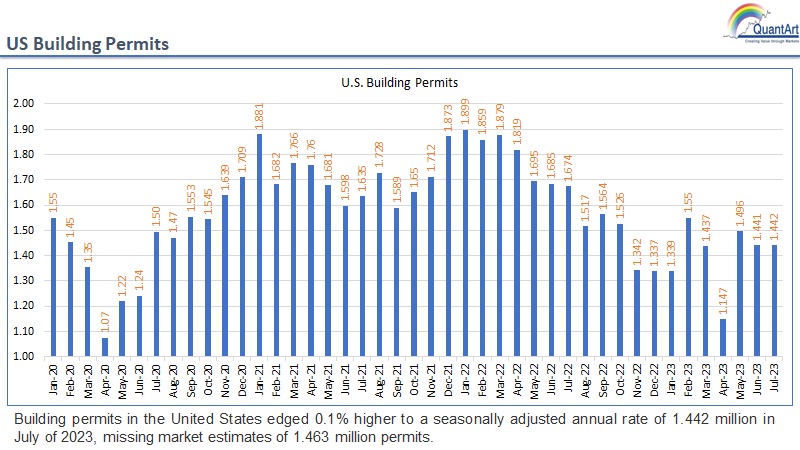

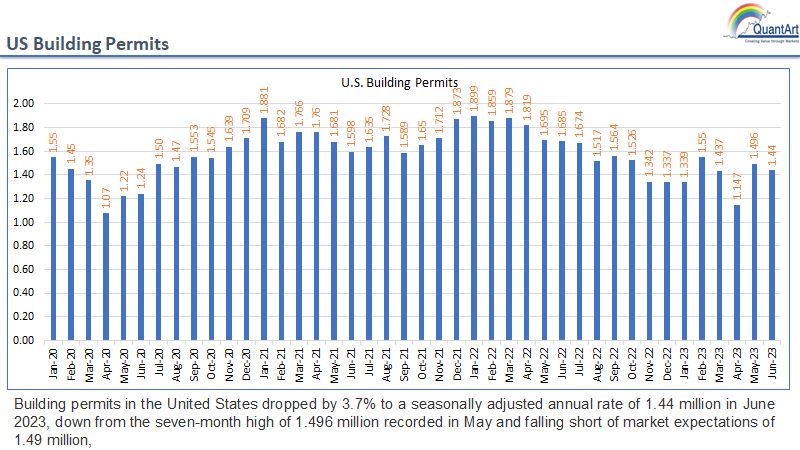

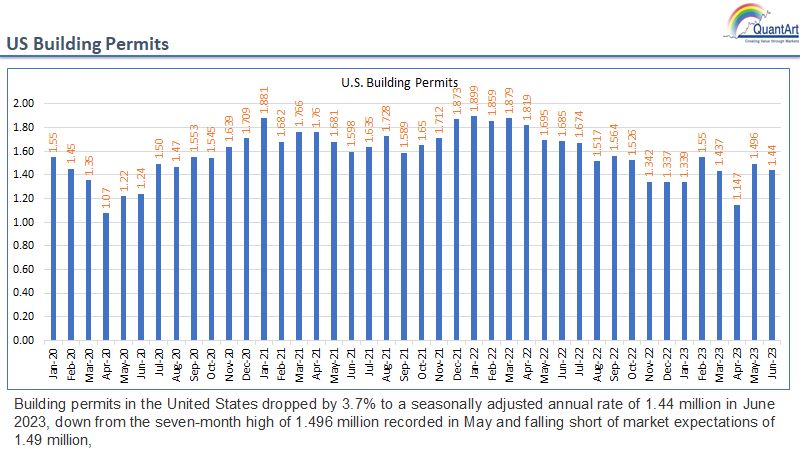

U.S. Building Permits

India Fx Reserves $Bn

US Building Permits

India: CPI

India WPI

Exports, Imports & Trade Deficit(USD Bn)

India FX Reserves $Bn

U.S. PPI (MoM)

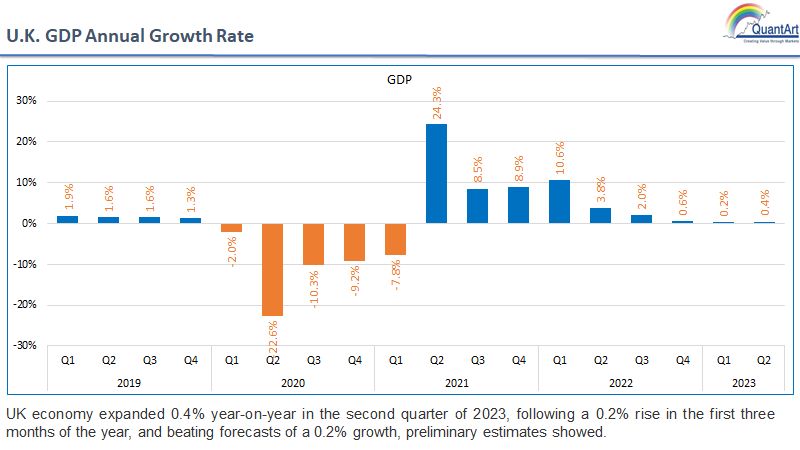

U.K. GDP Annual Growth Rate

US Core CPI MoM

US Core CPI YoY

US CPI MoM

US CPI YoY

India- Interest Rate

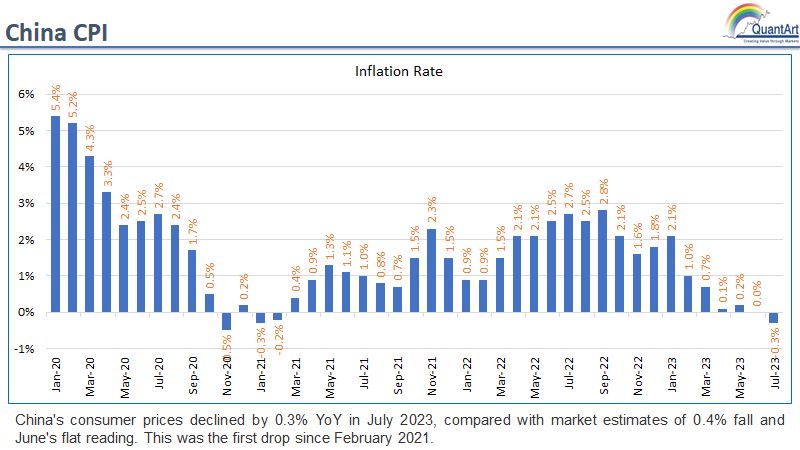

China CPI

Germany CPI YoY

India FX Reserves $Bn

US Non Farm Payrolls

US Unemployement Rate

U.K. Interest Rate

Inflation – US & Other Countries

EUROZONE Unemployement Rate

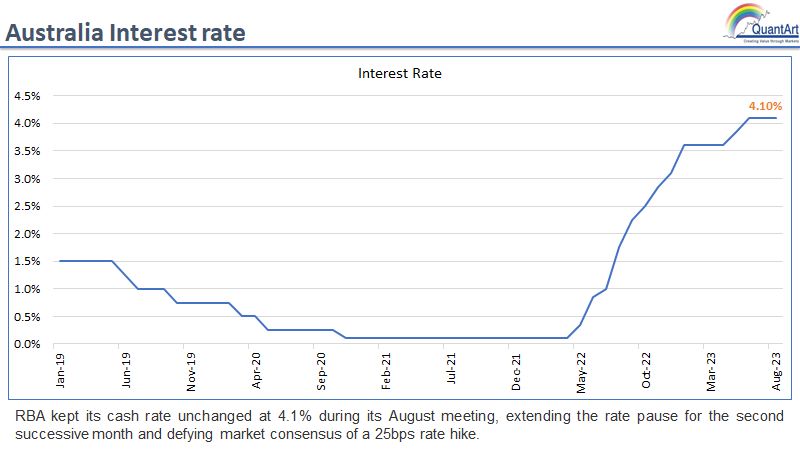

Australia Interest Rate

Eurozone GDP YoY

Eurozone CPI (YoY)

India FX Reserves $Bn

US: GDP

US Jobless Claims

EUROZONE Interest Rate

US Interest Rate

US Building Permits

India FX Reserves $Bn

US Jobless Claims

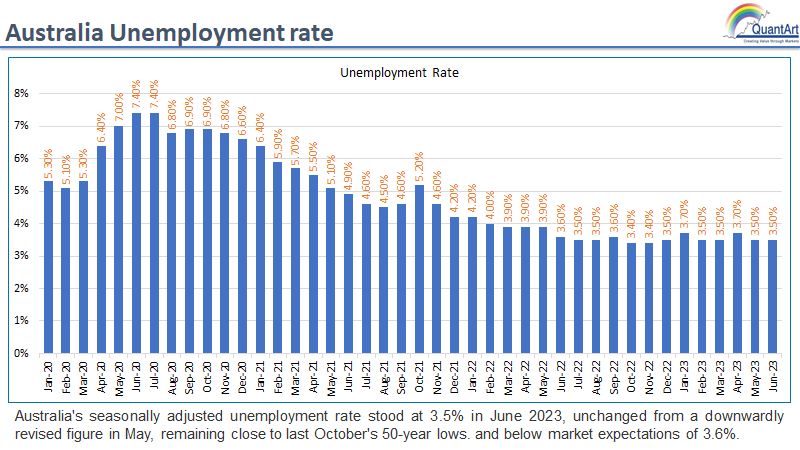

Australian Unemployement Rate

US Building Permits

Eurozone Core CPI (YoY)

U.K. Inflation Rate

Eurozone CPI (YoY)

Exports,Imports & Trade Deficit (USD Bn)

US CPI YoY

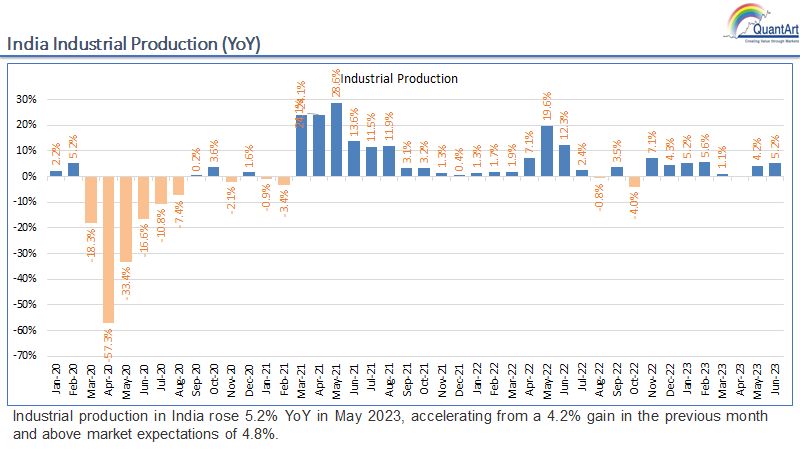

India Industrial Production (YoY)

India: CPI

US Unemployement Rate

US Non Farm Payrolls

India FX Reserves $Bn

Germany CPI (YoY)

India CPI (YoY)

India FX Reserves $Bn

US Jobless Claims

Japan GDP Growth Rate

EUROZONE GDP YoY

India: Interest Rate

Non Farm Payrolls in (000)

US Unemployment Rate

India FX Resrves $Bn

US Jobless Claims

India FX Reserves $Bn

UK Interest Rate

Eurozone Unemployment Rate

US Interest Rate

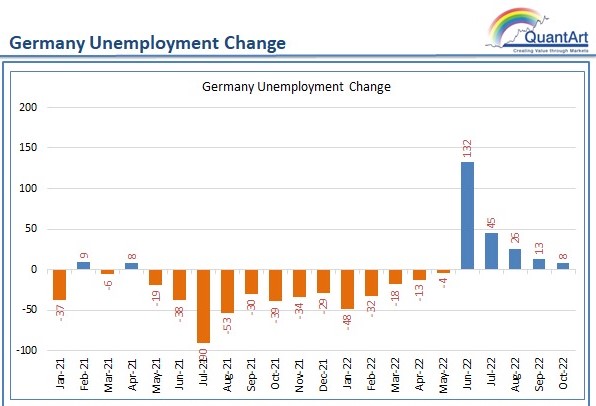

Germany Unemployment Change

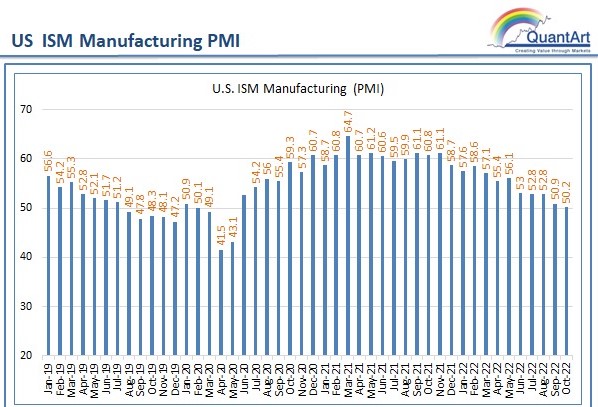

US ISM Manufacturing PMI

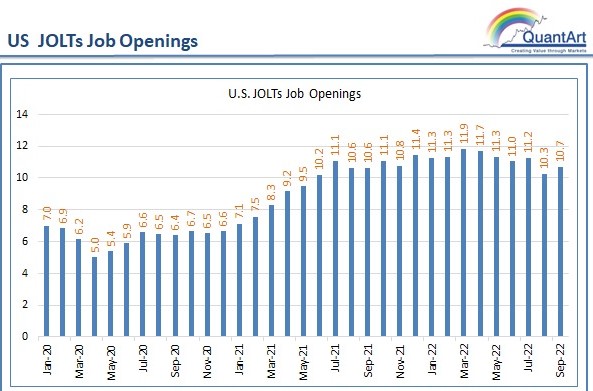

US JOLTs Job Openings

Eurozone Core CPI (YoY)

Eurozone GDP (YoY)

EuroZone CPI (YoY)

US GDP Growth Rate

UK CPI(YoY)

US Eurozone CPI(YoY)

US Jobless Claims

Exports, Imports & Trade Deficits(USD Bn)

India FX Reserves $Bn

EUROZONE CPI (YoY)

US Jobless Claims

US GDP Growth Rate

India FX Reserves $Bn

US Jobless Claims

US Interest Rate

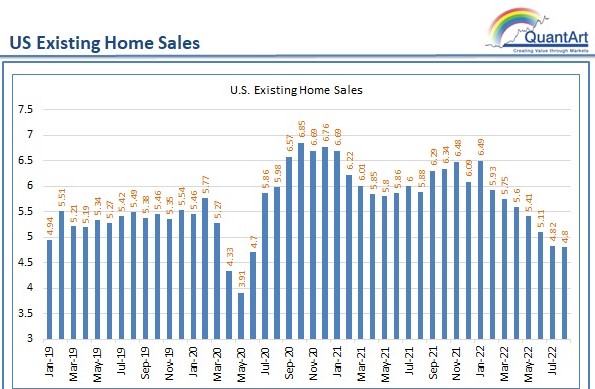

US Existing Home Sales

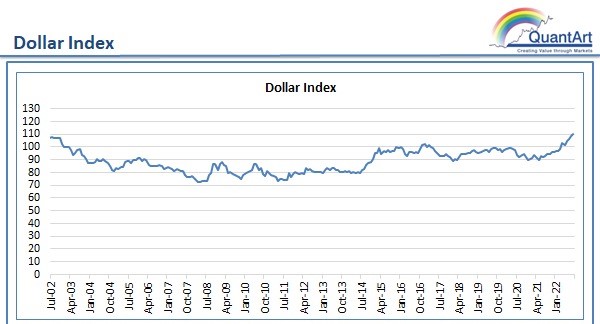

Dollar Index

US Building Permits