Lead Hedging Futures and Options

Commodity Hedging |

Updated on: 23rd June 2021

Hey, we hope you have enjoyed our first article on hedging with futures. For this article, we expect you to have a rudimentary understanding of how Futures and Options work. If you don’t, please reach out The good folks at Quant Art will be happy to explain you.

(In case you don’t want to study Futures & Options, we have explained the entire trade in a simple and lucid manner so you can continue reading anyways)

Options contracts give the buyer of the contract the right but not the obligation to buy (call option) or sell (put option) the asset at a set price. It simply means that you choose to buy or sell at a certain price and if there is an adverse movement (loss), you can back out and say that you don’t want to buy or sell. Sounds amazing, right? To compensate for this advantage, you need to pay the option seller a premium (in cash upfront). This makes the deal fair for the buyer as well as the seller.

We will be speaking strictly in the context of the London Metal Exchange(LME), which is the largest exchange in the world for base metals, and prices discovered here are considered international benchmarks.

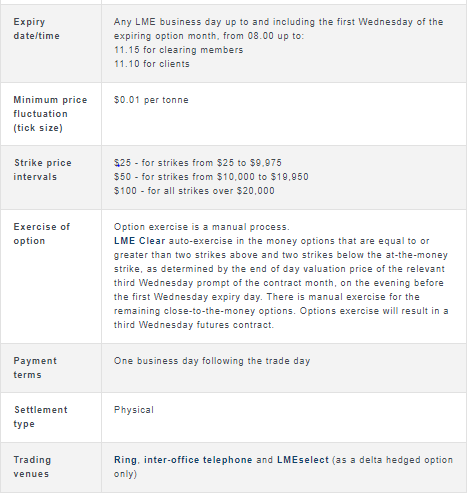

Take a look at the Options contract structure at LME:

(Lead Options Contract; Source: LME Website)

Notice that the underlying contract is LME Lead Futures- third Wednesday prompt (that is to say price on third Wednesday of the contract month) and not LME Cash/Spot Price.

Although the option style mentioned is American we will assume an European Option as it is used by most investors/ brokers and will make our understanding easier. ( Once you enter into an options contract, European Style Options can be exercised only at expiration whereas American Style Options can be exercised at any time prior to expiration.)

Contract Cycle: While the futures contracts are available for 63 months forward, the options contracts are available just 15 months forward (that too just monthly expiries).

Strikes available: Strikes are available at every $25 interval.

Settlement: By Physical Delivery to one of LME Warehouses.

Payments: T+1 (Trade plus one day)

Lot Size: 25 Tonnes

Prices in US$ per tonne.

This an extract of prices from LME website:

(The idea is to show you how prices are depicted on the website )

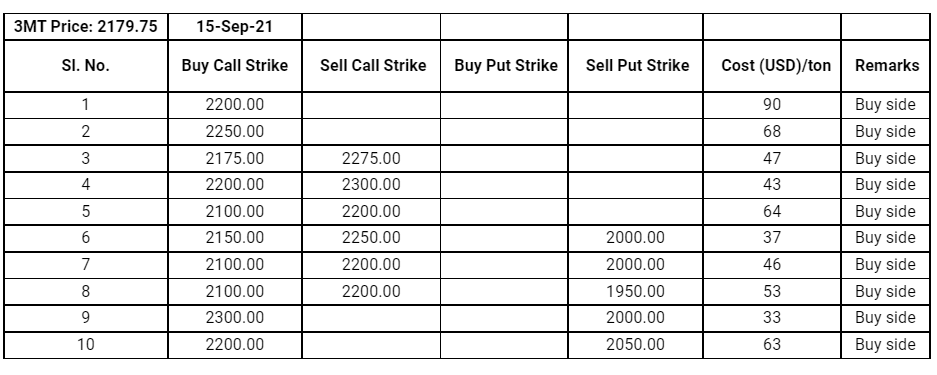

Let’s take a look at the premiums for one such contract: (Note: the data has been provided by Quant Art. Although it resembles market data, the numbers must be viewed for educational purposes only).

We know that the lot size is 25 tonnes.

For understanding purposes, let’s calculate the total premium of 2200 USD/Ton Strike. As you can see from the table (Sl. No.1) the premium is 90 $ per tonne.

Now, if you were to buy this option, what would be the premium outlay? Well, this is fairly easy to calculate –

Premium to be paid = lot size * premium

= 25 * 90 $

= 2250 $

I hope you have understood the structure of the options contract at LME so far. Let’s look at a few strategies and how an actual trade is executed:

(Note: the strategy mentioned here are for educational/understanding purpose only)

We will be take the example of company X who is a battery manufacturer and purchases refined lead (raw material). Purchase manager agrees to buy one tonne of refined lead from a lead smelter for September delivery at September price. Since he doesn’t know the price after three months, he is taking a price risk. To hedge this uncertainty in prices, he tells the finance manager to enter into an options contract. He is feared of prices rising. Hence, he takes a position that will safeguard him if prices rise. (We will say he is long on lead)

1. Range Forward

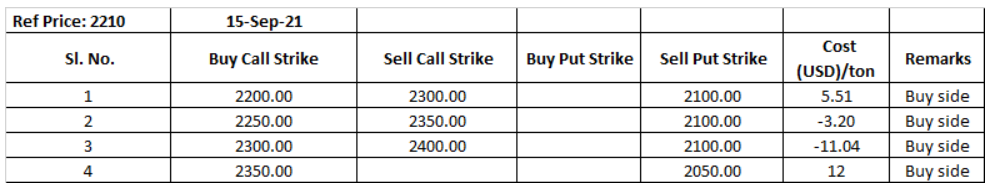

We will be using the above table to design our trade.

Note that the reference price used is 2179.75$

Expiry Date – 15th September 2021 (roughly three months from today 14th June)

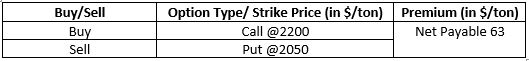

The trade goes like this: (look the row in the red box in the above chart)

(Call Buyer pays premium whereas put seller receives premium)

There will be an initial net cash outflow of $63 since we are buying one tonne.

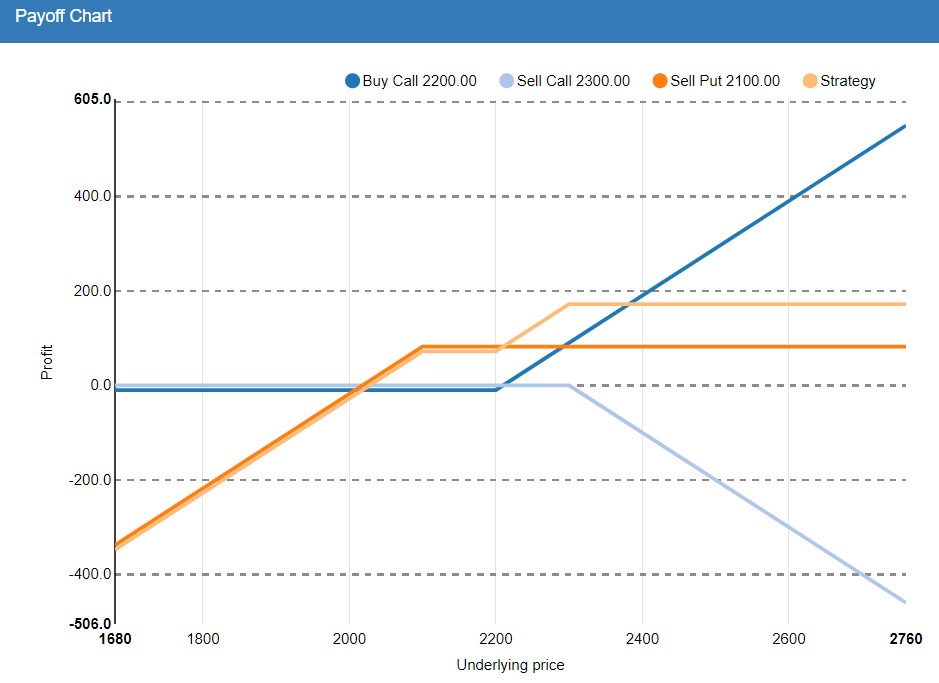

Please understand the payoff structure below:

(Ignore the numbers in Y-axis)

The current Price is $2179.75. If actual prices after 3 months go above $2200 we are protected. Below that, till $2050 can take benefit of price falling. If prices go below $2050, we have to buy at 2050- we cannot take benefit of lower prices.

If you didn’t understand, try this way:

Formal Definition: A range forward is a derivative contract that protects buyers against adverse market movements, allowing them to benefit from favorable spot rate movements within a certain range that lies between the strike and barrier rate.

Here, (for the buyer) the adverse movement being priced going up. The range being $2050 to $2179.5- the buyer can take advantage of falling prices. The “barrier rate” being 2050 below which the buyer is at a loss.

To sum up, we are paying a small premium to protect our loss if the prices go up and at the same time take benefit of prices falling up to a certain limit.

(Note in the above example for the range between $2179.50 and $2200, we have to buy at $2200. This is because strike prices aren’t available for all price points. In an actual trade, we ensure that this difference is minimized).

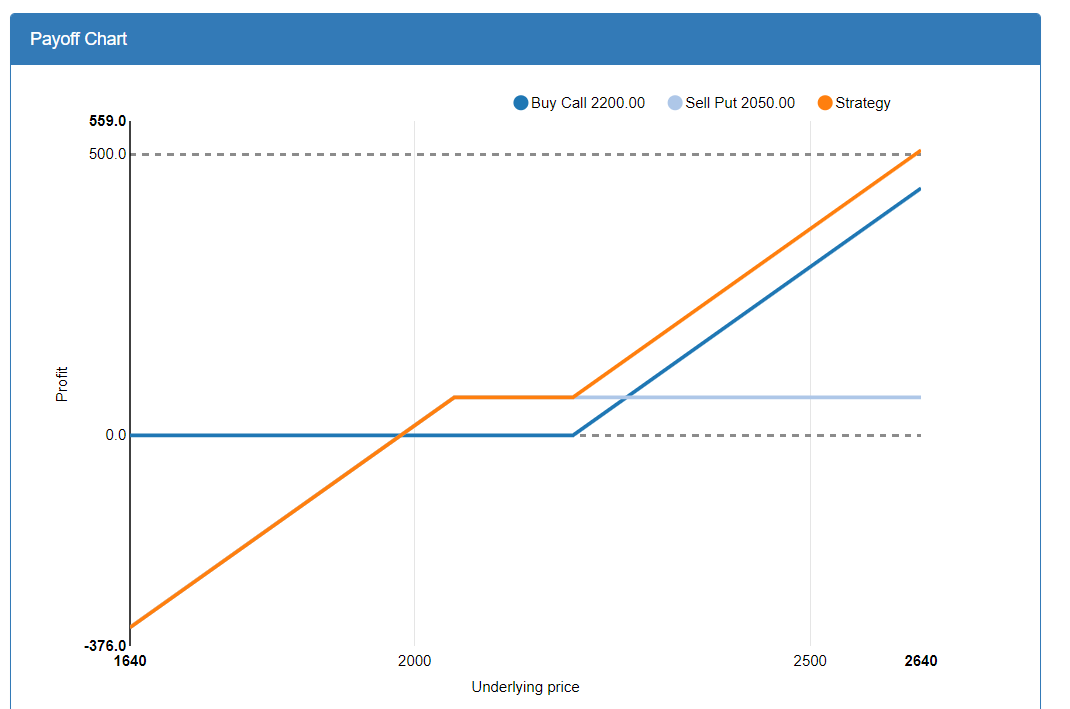

1. Seagull :

Notice that in Range Forward, the premium to be paid initially was very high i.e. 63$. Also, note that we are fully protected if prices go upwards to any level. Realistically speaking, prices couldn’t rise to very high levels in a very short period (in fact you can statistically find out the maximum level to which prices can rise based on past data). So in this strategy, we will be using this point to reduce our premium.

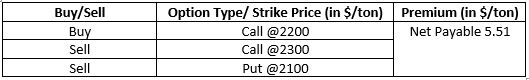

Look at the red box in the above chart (Note that here the reference price is different but that’s okay since it won’t make much difference and the objective is to understand)

Here the premium is reduced considerably i.e. $5.51 only. That’s a whopping 91% drop from the premium we paid at Range Forward strategy. You may ask to what trade-off do we owe such benefit? Well, this is to compensate your profits if prices rise to very high levels ( that is you won’t be protected anymore after a point).

(Ignore the numbers in Y-axis)

Formally:

A seagull option is a three-legged option trading strategy- a long seagull consists of a bull spread using calls (long ATM/shallow OTM call, short high OTM call) + short OTM put. This strategy is used when you think an asset is going up but stops just at the short high OTM exercise price. The strategy provides inexpensive protection at the cost of losing upside potential.

Here, Long ATM: Call 2200

Short High OTM: Call 2300 (Let’s assume we consider $2300 to be highly unlikely)

Short OTM: Put 2100

The current Price is $2210. If actual prices after 3 months go above $2200 we are protected till $2300. Below that, till $2100, we can take benefit of price falling. If prices go below $2100 or above $2300, we cannot take benefit/ we are not protected. – All this by paying a very small premium!

We will discuss more strategies in future articles.

Note:

1. Difference between futures and options: If you have noticed the payoff chart of futures tend to be symmetrical with the possibility of both profits and losses at various price points. However, in the case of options, we can limit our losses. That’s what makes options interesting. There can be so many wonderful combinations according to our needs.

2. Initially we can do Partial hedging instead of fully hedging our exposure. (provided we are ready to take a little loss, this is done to save costs and absorb losses in a low volatile/ unpredictable market)

3. There is no such rule as to what level of premium is ideal. As a rule of thumb, a premium of less than 10$ is considered good.