AUD Outlook and Strategy

Published on - 3rd April 2024

Navigating the Australian Dollar (AUD) Landscape: Key Insights

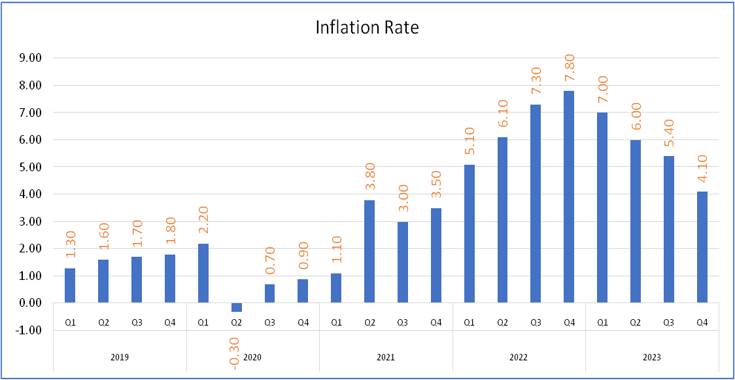

Inflation Moderates Amidst Easing Pressures – In Australia, the inflation rate has shown a notable decline, dropping to 4.1% from its previous level of 5.4%. This moderation can be attributed to the easing of both goods and service inflation. Additionally, commodity prices experienced a year-on-year decrease of 10.4% in January 2024, further contributing to the downward trend in inflation. The Reserve Bank of Australia (RBA) maintained its cash rates at 4.35% in January, a decision widely anticipated by market observers.

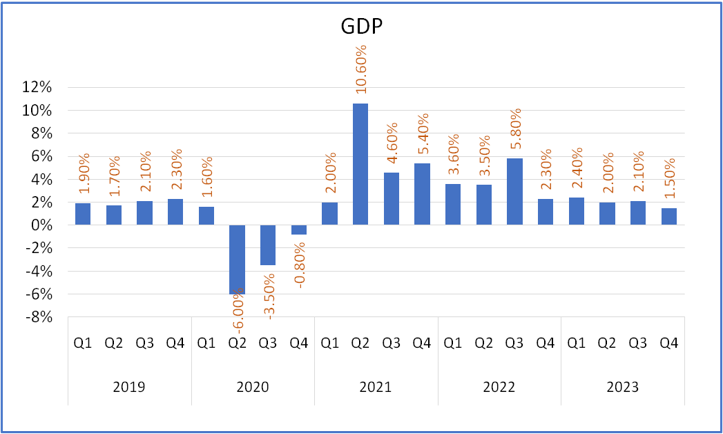

Challenges Persist Despite Easing Pressures – Despite the moderation in inflation, challenges persist for the Australian economy. Inflation remains above the target range of 2-3%, primarily due to the sticky prices of services. The RBA has cautioned that inflation is increasingly driven by excessive domestic demand rather than supply shocks from abroad. Despite efforts to stimulate economic growth, the Australian economy expanded by only 1.5% in the fourth quarter of 2023, marking a slowdown from previous quarters.

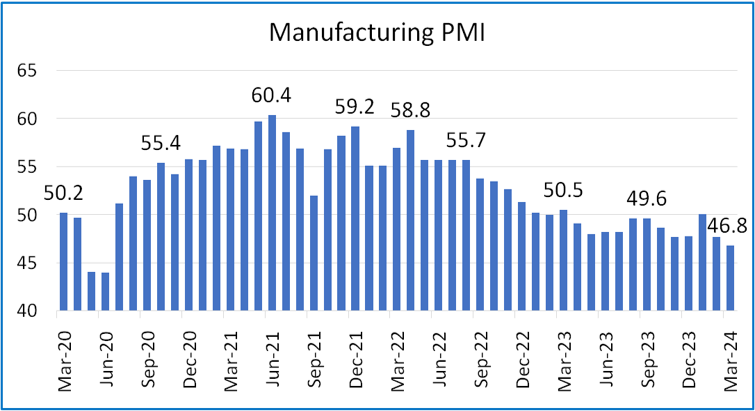

Headwinds for Household Spending and Manufacturing Sector – Household spending in Australia remains subdued, reflecting efforts by consumers to prioritize essential items amidst economic challenges. Moreover, the manufacturing Purchasing Managers’ Index (PMI) fell to 46.8 in March 2024, indicating a contraction in the sector. Weak economic conditions have led to a decline in new work inflows and export orders, further exacerbating the challenges faced by the manufacturing industry.

Resilience in the Services Sector – Despite challenges in other sectors, the services industry has shown resilience. The services PMI inched slightly higher to 53.5 in March 2024, driven by sustained new business growth and improving demand conditions. This resilience underscores the importance of the services sector in supporting overall economic activity in Australia.

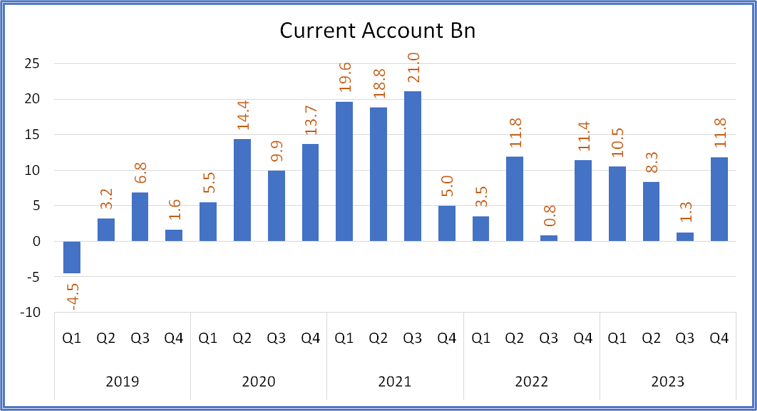

Strong External Account Performance – Australia’s external accounts have shown strength, with the current account surplus surging to AUD 11.8 billion in the fourth quarter of 2023. This increase was primarily driven by a rise in the trade surplus and a decline in the net primary income deficit. The trade surplus on goods continued to expand in January 2024, with exports outpacing imports, particularly in non-monetary gold.

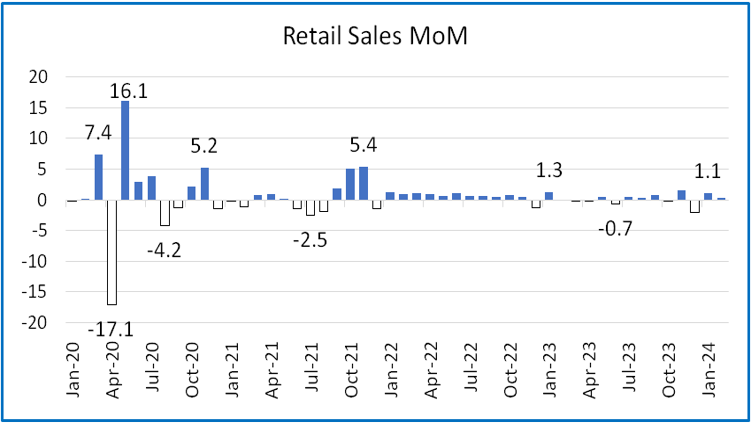

Challenges for the Retail Sector – The retail sector in Australia continues to face challenges amidst economic headwinds. Retail sales increased by a modest 0.3% month-over-month in February 2024, reflecting a slowdown from previous growth rates. Higher interest rates and cost-of-living pressures have weighed on consumer spending, contributing to the struggles of the retail industry.

Labor Market Resilience and Wage Growth – Despite economic challenges, the labor market in Australia has shown resilience. The unemployment rate fell to 3.7% in February 2024, the lowest since September. Additionally, wage growth reached 4.2% in the fourth quarter of 2023, surpassing inflation and economists’ expectations. This strong wage growth may have implications for future monetary policy decisions by the RBA.

Cooling Housing Market – Australia’s housing market has shown signs of cooling, with home-price growth slowing down. Deteriorating affordability and rising borrowing costs have contributed to this trend, posing challenges to the broader economy. The cooling of the housing market adds to the array of challenges faced by policymakers and economic stakeholders in Australia.

RBA’s Monetary Policy Outlook – The RBA’s monetary policy outlook remains cautious amidst global economic uncertainties. Wage growth above inflation may reinforce expectations that the RBA will maintain borrowing costs at their current level of 4.35% in upcoming meetings. However, the RBA remains vigilant, emphasizing the need for credible signs of inflation returning to target before considering any adjustments to monetary policy.

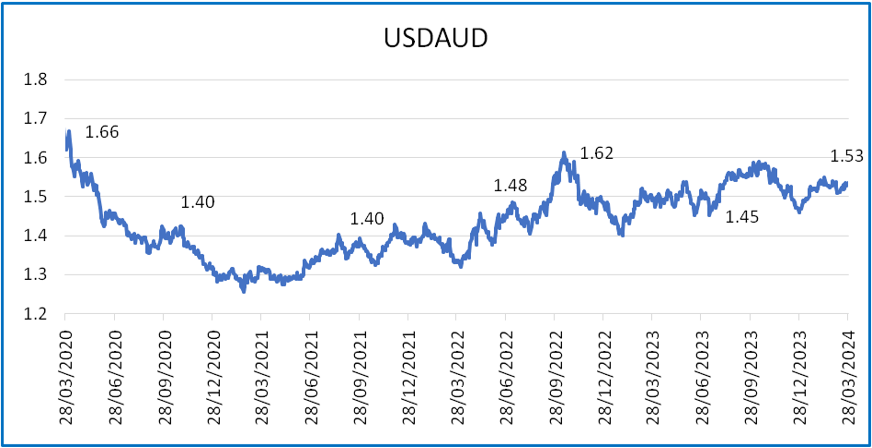

Currency Outlook – The USD/AUD exchange rate is expected to remain within the range of 1.52-1.55 in the near term, with a bias towards Australian dollar depreciation. This outlook reflects the broader economic dynamics and uncertainties facing Australia’s economy.