USD CAD Outlook

Published on: 27 November 2021

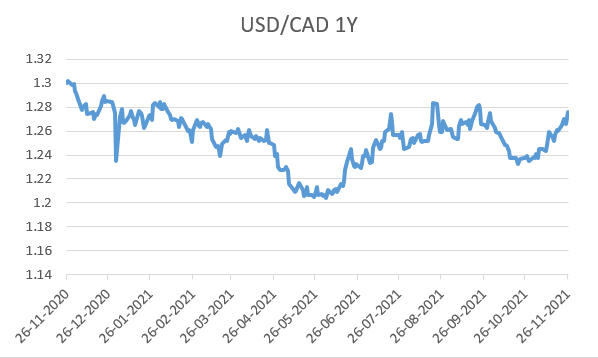

The Canadian Dollar (CAD) has been in the range of 1.2300-1.2750 for the past month, primarily due to the surging Dollar. CAD has recouped a significant portion of the massive losses it suffered due to the Oil slump and the covid impact last year. But, the recent move back above 1.27 levels is due to the sharp Dollar move driven by the FOMC taper decision. The latest news on a new Covid variant of concern, could hurt CAD more given that any covid related issue has a direct impact on commodities and Oil.

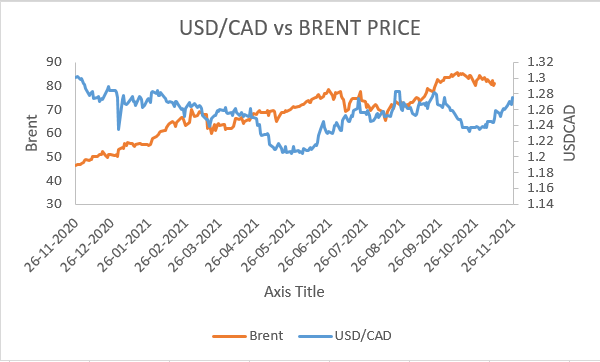

Canadian economy is primarily driven by oil and real estate. Oil being Canada’s major export, has historically had a significant impact on the economy as well as the currency.

USDCAD has a positive correlation with oil prices and as a matter of fact, Canada earns most of its dollar inflow through sale of oil.

Supply chain concerns had led to high oil prices and Brent had surpassed levels of 86+ in the past few months. Though it has cooled down now, analysts see it going potentially higher, unless Covid related stress does not come to the fore again. Canadian economy being majorly focused on commodity production and exports of petroleum, minerals, wood products and grains, is expected to strengthen further relative to other currencies of the world, if this view plays out.

Inflation concerns in Canada (latest at 4.7%) have buffered the Dollar strength gainst the CAD. CAD has gathered support and remained relatively stronger than most other currencies, though the recent move did put a dent into its strength. But, decent growth in Canada, higher interest rates than much of the rest of the G-7, and firm commodity prices, are supportive of the currency.

Despite positive factors like high economic growth and recovery, and moderately high oil prices, CAD remains vulnerable against broad based Dollar strength.

Our outlook for the Canadian Dollar is that it should stay depreciated with a slight negative bias, as US inflation, bond tapering and interest rate hikes are more predominant factors than the domestic Canadian economy related aspects. The new Covid variant is a risk factor for CAD, in that any material concerns around the variant can lead to a fall in oil prices due to lockdown fears.

We expect USDCAD to move towards 1.2850-1.2900 levels as a top, but retreat to current or lower levels soon, once the Dollar strength stabilizes. This view is contingent upon the new Covid strain fizzling out soon. But, if the Covid strain causes another large wave, all bets are off when it comes to USDCAD. The FOMC taper and the potential Covid impact are mutually exclusive in that if Covid related stress cools off, FOMC taper would on schedule and if Covid related concerns flare up, markets would price out any possibility of a taper. The Covid scenario is more detrimental to CAD than the taper alternative.

ALSO READ