Zinc Outlook

Published on - 12th April 2024

Navigating The Zinc Landscape: Key Insights

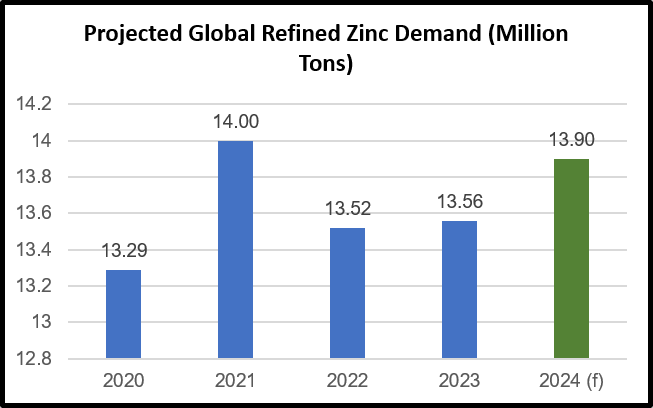

Global refined zinc demand expected to improve in 2024 – Global refined zinc demand is forecasted to rise by 2.5% in 2024 to 13.9 million tons. Increased demand is expected from China due to growth in sectors like galvanized plates, passenger cars, and home appliances, and recovery is anticipated in European countries like Italy, Norway, Poland, and the Czech Republic.

Sector-wise demand projections for 2024 – Zinc is primarily used in construction for steel galvanization and in automobiles for die-casting alloys. Demand from these sectors is projected to grow significantly in 2024, with construction sector demand expected to reach $14.9 billion and automobile sector demand growing to $9.1 billion.

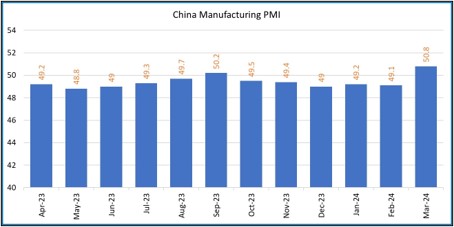

China March 2024 Manufacturing PMI raises hopes of Chinese demand recovery – In March 2024, China’s Manufacturing PMI rose to 50.8 from 49.1 in February 2024, marking the highest reading in a year and indicating factory output expansion for the first time in six months. This boost in factory activity, along with growth in new export orders after 11 months of contraction, led to increased downstream zinc purchases in April 2024, potentially driving up zinc prices in the near future.

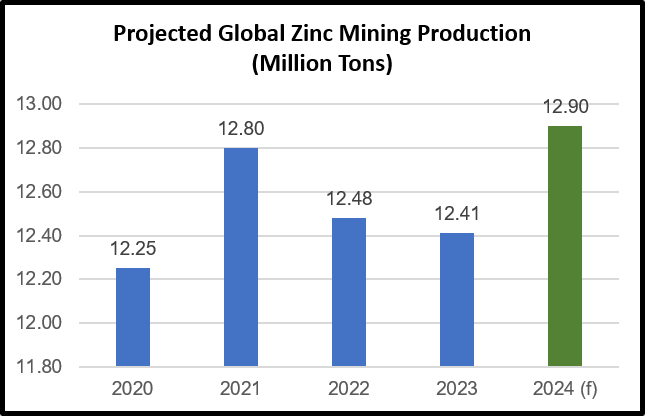

Rise in global supply expected over increased output from China, Australia and Norway – Global zinc mine production is forecasted to increase by 3.9% in 2024 to 12.9 million tons, driven by growth in Australia, Brazil, Russia, China, and Mexico. Refined zinc metal production is also expected to rise by 3.3% to 14.3 million tons, resulting in a global surplus of 400,000 tons this year. The growth in refined zinc output will mainly be led by China, with a 4.1% increase, while production outside of China will see robust growth, particularly in Australia and Norway with the completion of the Odda smelter expansion anticipated in the second half of 2024.

Zinc inventories rose in Q1-2024 due to a supply surplus – Zinc inventories in LME and SHFE warehouses increased notably in Q1-2024 due to a supply surplus. LME zinc inventories saw a significant 18% rise during this period, from 223,325 tons on January 2nd, 2024, to 263,550 tons by March 28th, 2024. Singapore-based LME warehouses now hold 83% of global LME zinc inventories, reflecting an accumulation of zinc stockpiles, which suggests an oversupply relative to global demand.

Temporary ceasing of operations by Glencore-controlled zinc mines could tighten global supply – Glencore’s temporary halt of operations at its McArthur River zinc mine in Australia, one of the world’s largest zinc mines, due to heavy rainfall, along with the suspension of three Volcan zinc mines in Peru, may tighten global zinc concentrate supply and support prices in the near term.

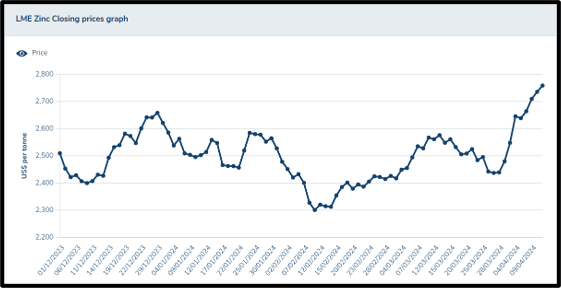

Outlook on zinc – Zinc prices are expected to be stable to bullish in the near term due to strong China factory data and supply disruptions from Glencore’s McArthur River zinc mine closure. However, increased zinc inventories may exert downward pressure. In the medium term, prices are likely to stay stable, with potential support from expected Fed rate cuts but limited upside due to projected supply surplus. Near-term LME 3M zinc price outlook: $2,450/ton – $2,850/ton. Medium-term outlook: $2,600/ton – $3,000/ton, contingent on Chinese demand recovery indicators.