USD 100 Billion Current Account Deficit for India?

Updated on : 23rd February 2021

CONTEXT

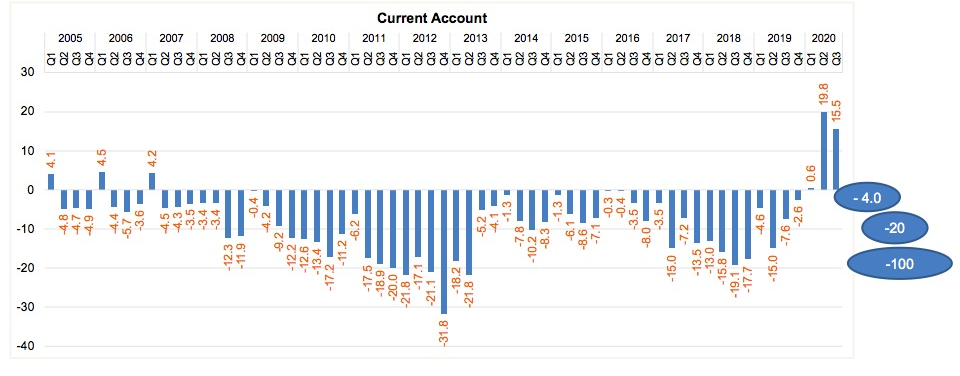

India had witnessed a current account surplus after a long time in the first three quarters of 2021. The CAS of around USD 36 bn. These three quarters came after 13 years or so. The surplus was propelled by the reduced trade deficit due to the lack of demand for crude oil (major import component) at the time when the country was in the state of pandemic ensued lockdown. Also, CAPEX import amongst other items took a severe hit whereas software exports and NRI remittances continued at the usual place.

However, as the markets have opened up, there seems to be a reversal in the trend.

This report aims to cover our analyses and give estimates for the future impact of oil prices on the trade and current account deficit of India.

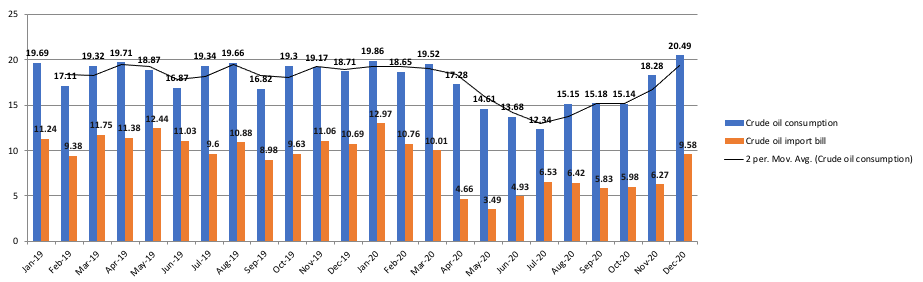

CRUDE OIL VOLUME AND IMPORT BILL

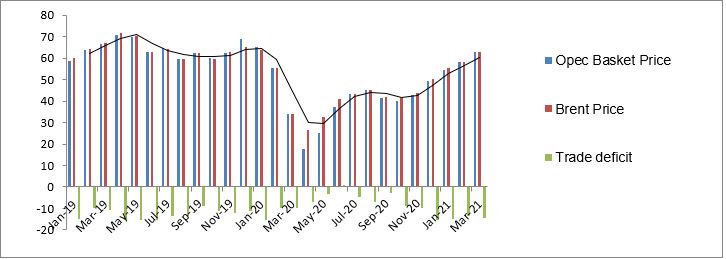

There has been a 12+% increase in Oil consumption volume during December’20 compared to November’20 and that’s 11+% higher than a year earlier. This has notably been a 12-month high record. The growth trajectory suggests that there has been a massive growth in demand post-Covid levels. This can be attributed to the opening up of the markets and the increase in the pent-up demand for crude oil. Not just the consumption volume, but prices of oil also shooting up as the global economy opens and OPEC remains in the collaborated mood. Brent is close to USD 65 per barrel.

ESTIMATES

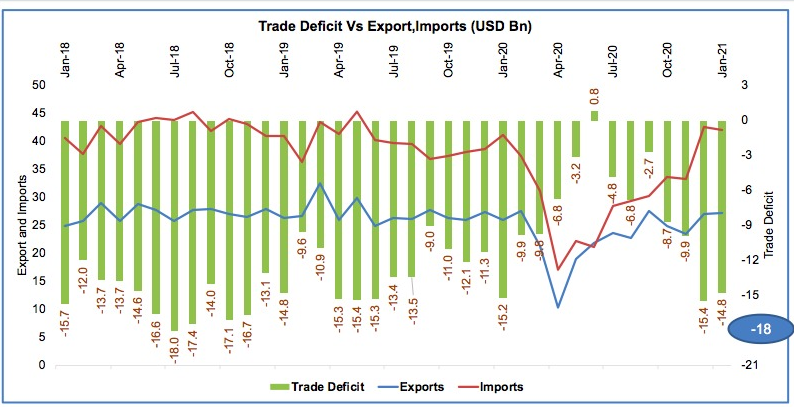

Given this recent spurt in demand for crude oil, the prices of Brent and OPEC Basket Price have been on the rise. Given the assumption that the Brent price and the OPEC Basket price will remain around $60/barrel, the oil import bill is likely to range between 11$-13$ bn. per month for India as per our regression model. Consequently, the trade deficit will be around USD 18 bn. per month as against the current rate of USD 15 bn. a month during Dec20 and Jan21. That translates into around $50 billion for Q1 of 2021 which is the current Quarter. If a similar trend continues then we can expect USD 54 billion of trade deficit during Q2 of 2021. It should not be very surprising since pent-up import demands chip in and exports remain steady and little marred by appreciated INR.

Current Account Deficit data is released by RBI on a bit delayed basis and hence CAD of Oct20-Dec20 will be released on 31st March 2021. However based on the information available, we can estimate that the number will be around USD 4 bn.

However for the current Q1 of 2021, the CAD can be around USD 20 bn. assuming USD 18 bn. of trade deficit materialises during Feb and March thanks to increased Brent prices and consumption.

If similar trend continues then India is not far from a CAD of USD 100 bn. in 2021. What a swing from USD 30 billion surplus to USD 100 bn deficit. Current run rate is somewhat similar on monthly basis.

For a one-on-one video presentation on these points fill-up the form below.