New beginning or end of glory for Great Britain?

Uploaded on: 01 February 2021

The currency hit an all-time high before the 2007-08 financial crisis and has been on a downward spiral ever since, exacerbated even more by Brexit, and the uncertainties that came with it. Up until now, Brexit was a major determinant of Fx rates. Brexit has been voted for over 4 years ago and speculation on trade deals with the EU led to wild swings in currency rates. The GBP relatively lost out to EUR in the last few years even though knee-jerk losses to the dollar have recovered partially. Finalizing the Brexit deal should now lead to a much more stable currency, with GBP gaining some strength in short term. However now, with Brexit out of the way, the COVID-19 situation will become the major issue to be dealt with. The issue of vaccines will take frontal importance as well the ramifications of the trade deals with the EU.

Coming to the blows dealt by the pandemic to UK’s GDP, it has contracted by approximately 11% in 2020. The GDP will not be back to pre-pandemic levels until at least 2022. Negative interest rates are boosting the economic outlook but progress is still slow. In comparison to other G7 countries, the UK economy was more severely hit, reflected on a steeper decline and a slower pickup for domestic stocks. The relative lack of technology stocks on the FTSE has meant that it missed out on the pandemic tech stock rally. However, it is better positioned to take advantage of the rotation into value stocks that goes hand in hand with the COVID-19 vaccine recovery rally.

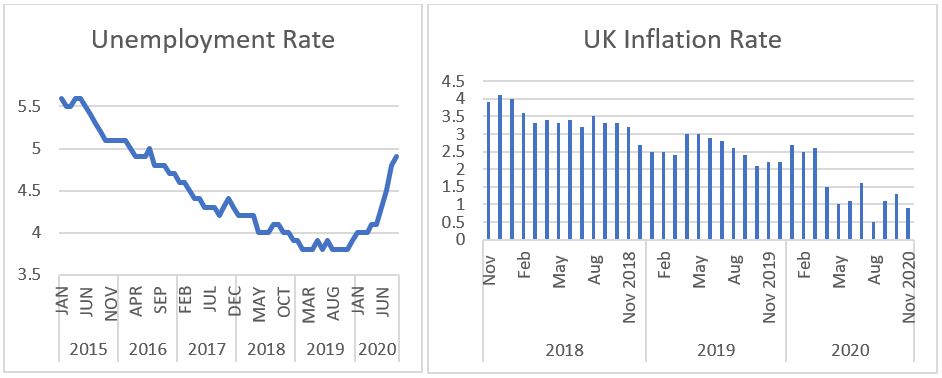

Coming to the other macro factors, unemployment has been on the rise, reaching almost 5%. JRS scheme, where employers can place employees on temporary leave on a full time or flexible basis & claim 80% of monthly wage costs in respect of employees’ unworked hours from HMRC, subject to a cap of £2,500 per employee per month has been extended till March 2021. Unemployment is expected to top out at 6%. The greatest unemployment risk is to hospitality and tourism workers, brick – mortar stores, and the manufacturing sector. Target inflation for the Bank Of England is 2%. An MPC meeting is also scheduled for February 2021. It is expected that BOE will reduce rates, further tending to zero. The inflation target should be met by Q1 2021 according to our estimates.

The Brexit deal has brought forward its own challenges for the UK. Let’s look at the main points of the deal at a glance:

Trade agreement :

• There will be no taxes on goods (tariffs) or limits on the amount that can be traded (quotas) between the UK and the EU.

• New checks will be introduced at borders, such as safety checks and customs declarations, leading to supply chain issues and red-tapism.

Movement of people :

• EU pet passports will no longer be valid.

• UK nationals will need a visa for stays of longer than 90 days in the EU in a 180-day period.

Passporting of services to be discontinued

•Banking, architecture, and accounting will lose their automatic right of access to EU markets and will face some restrictions. Banking, architecture, and accounting will lose their automatic right of access to EU markets and will face some restrictions.

• Automatic recognition of professional qualifications for people such as doctors, chefs, and architects to be discontinued

• UK air carriers to apply for licenses separately for EU • Separation of energy transfer projects with EU as well as all nuclear projects

Fishing

•Over the next five-and-a-half years, the UK will gradually gain a greater share of the fish from its own waters.

• Will lead to more trade wars since the agreement expires in 2026.

Justice Systems

- There will be no role in the UK for the European Court of Justice (ECJ), which is the highest court in the EU.

- Disputes that cannot be resolved between the UK and the EU will be referred to an independent tribunal instead.

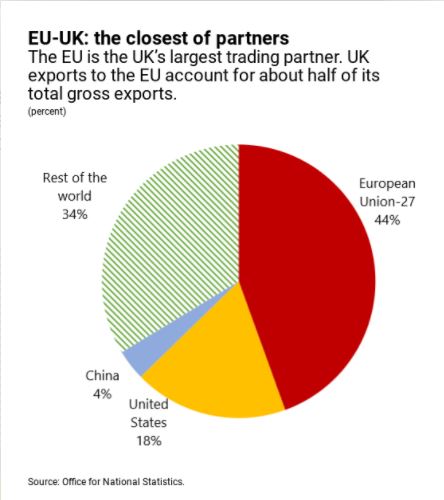

The EU makes up about half of all trade with UK and thus trade will be impacted greatly despite the free trade deals that have been signed. Elimination of frictionless trade will hence impact all businesses, albeit heterogeneously about £1000 per capita. A 2.5% – 4% reduction in GDP growth in the long run can also be expected. The new points-based system will impact sectors such as retail, and hospitality, and leisure most due to the skills requirements. In financial services and tech, reliance on EU-based subsidiaries to give access to local markets may increase the need for weekly international commutes. Change in immigration status will also impact businesses as some employees become ineligible to continue working as visas expire and the new system lags to approve new visas.

The most worrisome is the status of London as the financial capital of the world. The UK services industry is heavily reliant on the financial sector. Passporting is to come to an end, which means that approximately 5500 UK firms and 8000 EU firms reliant on this to sell products and services in banking, insurance and asset management sectors will have to set up new systems and organizations. The medium-term outlook is grim with many large investment banks looking at options to move to Frankfurt and Paris, the best places to conduct business in EU after London. In fact, over 1.6 trillion in assets have already shifted to EU amid concerns over service continuation. JPM is moving 230 billion USD in assets to Frankfurt, Goldman and Morgan Stanley have also committed to move some business, with Goldman already moving 100 employees. All in all, more than 60 international banks have also signed up with German financial regulator BaFin.

The US dollar broadly expected to weaken under the new US administration and widespread distribution of a vaccine will support GBP further, We estimate a three-month GBP/USD rate of 1.32, a six-12 month forecast of 1.37 and a long-term forecast of 1.42. A significant mark for price action is 1.335 and one significant indicator to look for is further pressure on negative interest rates.