Managing Fx risk on Masala Bond Investment

Forex Hedging

Published on: 14th December 2020

Updated on: 22nd January 2021

Search for good USD yield is on given the abundant liquidity and near-zero deposit rates in the US. Masala Bonds or in other words INR bonds listed overseas where coupons are paid in INR offers attractive yields. Yields on Masala bonds range between 5.50% to 8.00% in INR. The only risk to be managed to get a decent yield here is the Fx risk of USDINR. If the fx risk is managed well, 3.00%-5.00% of USD yield is possible. Off late we have seen inquiries on Fx risk management related to Masala bonds and hence we are putting up a small note.

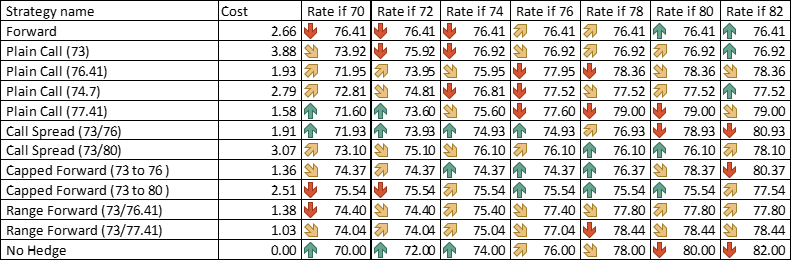

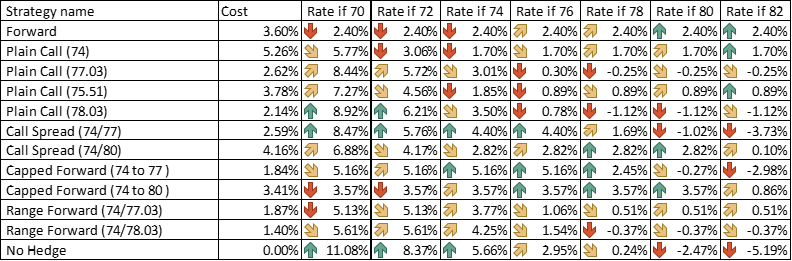

We present here some hedge instruments which are effective and cost less so that your yields are better. Please find few scenarios at different spot levels after one year for various hedge instrument and related return in bond in the tables below

Spot Ref: 73.00

Net return on bond in different scenarios assuming 6.00% yield in Masala bond will be as follows

Characteristics of instruments in short:

- Forwards – locks at a rate.

- Plain call – right to buy at the strike but no obligation if INR appreciates below strike.

- Call spread – no obligation, right to buy at buy call strike and protection ends at sell call level. Above sell call level benefit of spread will be on your account.

- Capped forward – right to buy at buy call strike and protection ends at sell call level. Above sell call level benefit of spread will be on your account, obligation below the Lower leg (sell put/buy call level).

As you can see that a capped forward from spot till 80.00 has a good chance of offering 3.50% yield. Certainly the risk needs to be managed.