KRW Outlook and Strategy

Published on - 5th March 2024

Navigating The KRW Landscape: Key Insights

Introduction – As global economic dynamics continue to shift, attention turns to the performance of currencies, with the Korean Won (KRW) under scrutiny in this analysis. Examining recent economic indicators provides insight into the trajectory of the KRW and its potential implications.

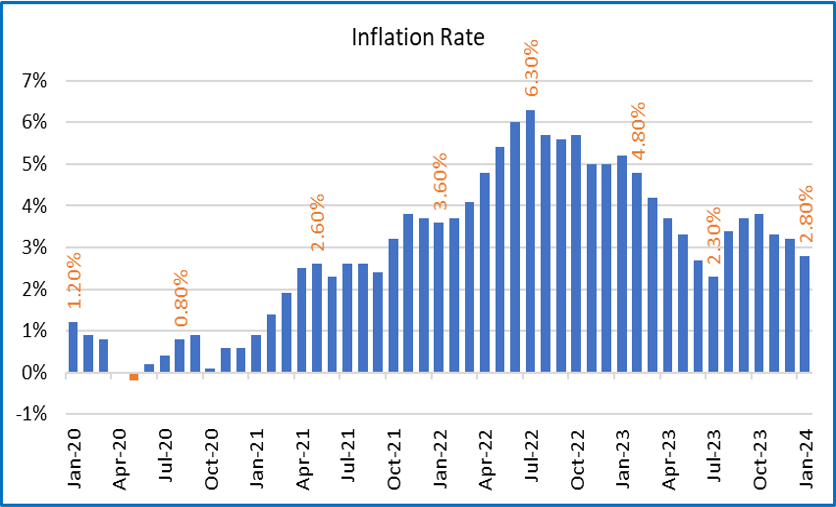

Inflation and Monetary Policy – The recent slowdown in South Korea’s inflation rate, dropping to 2.8% in January 2024, reflects a concerted effort by the Bank of Korea (BOK) to temper price pressures. With transport costs decreasing and core inflation moderating to 2.5%, the BOK remains steadfast in its pursuit of stabilizing inflation within its 2% target range. This measured approach is underscored by the decision to maintain the key interest rate at 3.5%, signaling a commitment to supporting economic stability amidst evolving global conditions.

Economic Growth and Manufacturing Sector – Against the backdrop of stable GDP growth, registering a 2.2% increase in Q4 2023, South Korea’s manufacturing sector demonstrates resilience. The uptick in the Manufacturing Purchasing Managers’ Index (PMI) to 51.2 in January 2024 indicates a return to expansion, buoyed by growth in output, new orders, and exports. Particularly notable is the robust performance of semiconductor exports, fueled by demand from sectors such as smartphones and artificial intelligence.

Trade Surplus and Export Outlook – South Korea’s consistent trade surplus, exemplified by a USD 4.3 billion surplus in February 2024, underscores its export prowess. Despite potential geopolitical risks and economic challenges in key trading partners, such as China, South Korea’s semiconductor exports remain a driving force. Forecasts of up to a 9% increase in overall shipments for the first quarter further bolster confidence in the resilience of South Korea’s export-oriented economy.

Unemployment Rate and Foreign Direct Investment – A declining unemployment rate, falling to 3% in January 2024, reflects ongoing labor market improvements. Concurrently, South Korea’s attractiveness to foreign investors is evidenced by record foreign direct investment (FDI) inflows, reaching $18.8 billion in 2023. Notably, the electronics sector, particularly semiconductor and rechargeable battery industries, attracted significant FDI, highlighting confidence in South Korea’s technological prowess.

Infrastructure Development and Construction Sector – In tandem with efforts to bolster economic growth, South Korea embarks on ambitious construction projects, aiming to accelerate infrastructure development through public-private partnerships. With plans to increase construction spending by 20% in the first half of 2024, South Korea seeks to address concerns of a potential housing shortage while stimulating economic activity.

Outlook and Conclusion – Amidst a backdrop of favorable trade balances and dovish monetary policies globally, the Korean Won’s performance is poised for stability. With a bias towards strengthening against the Chinese Yuan (CNY), the KRW is expected to range moderately between 1275-1350 for the month of March, with a focal point around 1300. As South Korea navigates both domestic and external economic challenges, prudent fiscal and monetary policies, coupled with robust export performance and strategic infrastructure investments, position the Korean Won for resilience in the evolving global landscape.