JPY Outlook and Strategy

Published on - 5th March 2024

Exploring the Future of the Japanese Yen: A Comprehensive Overview

In the world of global economics, the Japanese yen holds a significant position, with its future influenced by many factors. Let’s delve into the details of Japan’s economy, looking at key trends and data points that affect the outlook for the yen.

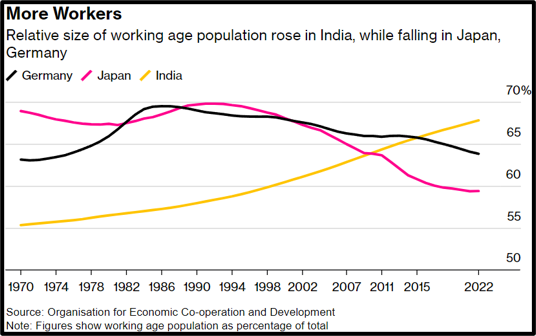

The Economic Trends – Japan’s recent economic performance shows a mix of good and bad signs. While the economy grew by 1% in Q4 2023, there are challenges like not having enough workers due to an aging population, which could slow down growth. The decrease in manufacturing activity, shown by the Manufacturing PMI dropping to 47.2, suggests the economy might not be doing so well.

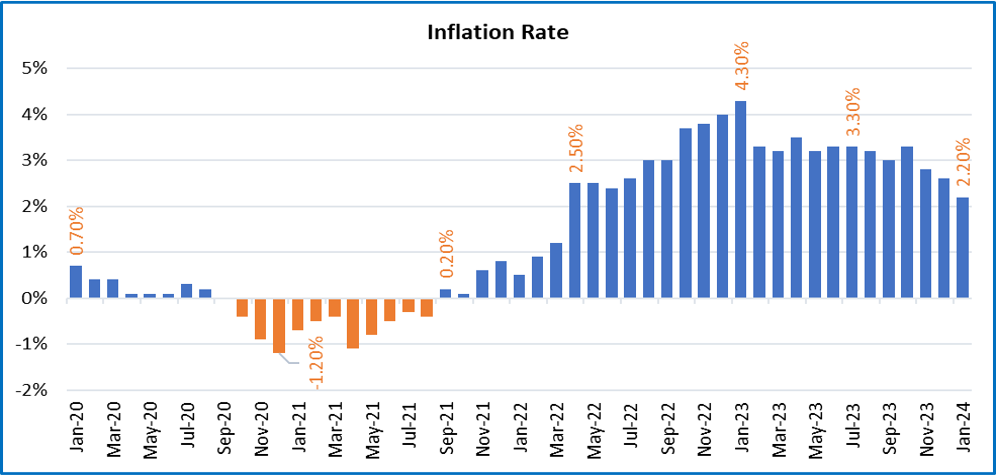

Inflation is another complicated issue. Although prices went up by 2.2% in January 2024, core CPI was even higher than expected, staying within the Bank of Japan’s target range of 2% for over 21 months. This shows that keeping inflation under control is a tough job for policymakers.

Trade Deficits and Problems with Monetary Policy – Japan’s trade deficit story shows different trends. While there was a big improvement in January 2024, driven by strong demand from countries like the US and China, the Bank of Japan still worries that the global slowdown might hurt the economy.

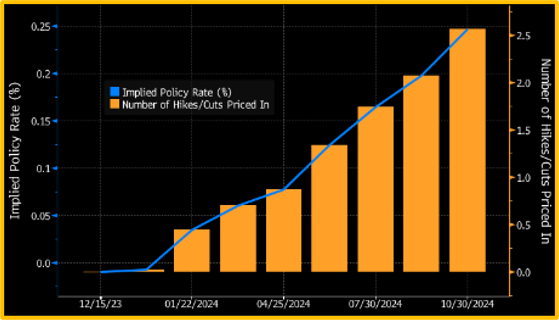

Deciding on monetary policy is also tricky. The Bank of Japan wants to keep short-term interest rates at -0.1% and 10-year bond yields at 0% to make things stable. But there’s talk about changing this to keep things from getting too uncertain.

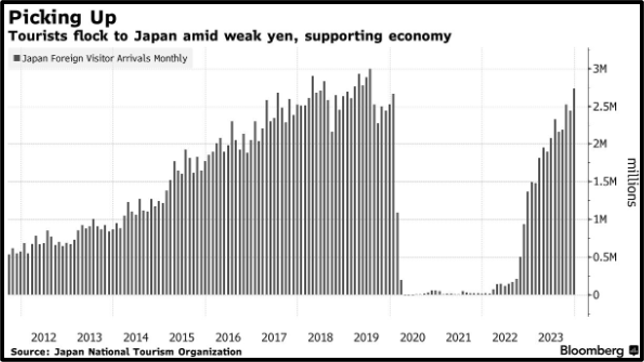

Tourism, Money, and External Influences – Japan’s tourism boom in 2023, with a record 25 million tourists visiting, helped the economy. But it also made the yen weaker, especially because of things like carry trades happening in the world’s economy.

Conclusion: Dealing with Uncertainty in the Yen’s Future – In short, Japan’s economy has good and bad sides, which affect what happens to the yen. Policymakers have to deal with a lot of problems like slow growth and high prices. The yen’s path is tied to what happens in the world, so we have to be careful and keep an eye on things as they change.

The future of the yen depends on both what’s happening in Japan and what’s going on in the rest of the world. It might stay around 155-160 yen per US dollar because of carry trades and other economic pressures. But if there are big problems like wars or economic crises, it could jump up to 135 yen per dollar.