India’s Inclusion in Global Bond Indices

Updated on: 10th May 2022

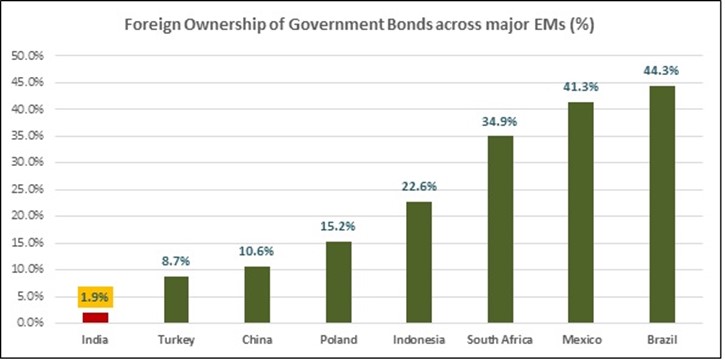

The Indian bond market which is estimated to have a size of around USD 1 trillion is a major emerging economy in the world but has absolutely no presence in any of the global bond indices. Moreover, only about 2% of Indian government bonds are owned by foreign investors.

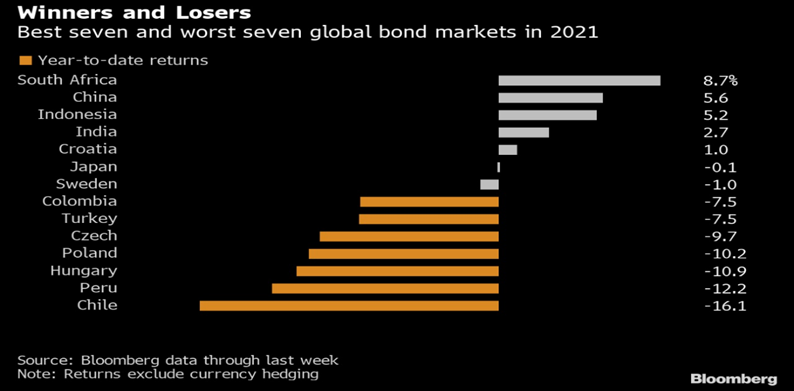

Sovereign bonds issued by South Africa, China, Indonesia, India, and Croatia topped the rankings of 46 markets around the world in 2021. The positive returns generated by the five markets should give investors at least some confidence that the Federal Reserve will be able to wind down asset purchases and start to raise interest rates without setting off a spike in global volatility. The biggest losses were seen in Hungary, Peru, and Chile: three countries in which central banks raised interest rates during the year. There has been a lot of improvement in fiscally challenged countries in emerging markets this year, including South Africa, such improvements pave way for India and bring forth a picture that depicts a developing economy with Indian bonds listed in the top of global bond index.

India’s inclusion in global market indices most certainly has a number of direct and indirect benefits which the country will enjoy in the years to come. With the government of India committed to push corporate investment driven growth, India could expect around USD 150 billion of inflows in the next decade with upto USD 40 billion in one year upon inclusion in global indices. Moreover, this inclusion could trigger immediate inflows of around USD 20 billion into Indian government bonds and increase foreign ownership of government bonds to around 9%.

Larger inflows into the country would directly impact the country’s balance of payments by significantly lowering the trade deficit which may further strengthen the Indian Rupee. Furthermore, lower cost of capital, improved debt sustainability and higher demand for fixed income securities are amongst the other direct benefits. A stronger debt market will most certainly give a boost to the Indian Equity Market. All of these factors together will together give a major push to the Indian Economy.

One of the major positives about the Indian public debt market is that it is denominated in the local currency and while an inclusion could attract greater investments, it would also expose the country to higher exchange rate risk and much higher volatility during adverse conditions. Moreover, there will always be a risk of sudden cash outflows from the country which may affect the stability of the Indian Rupee. The central bank has tended to see international debt inflows as volatile and adding to the headache of managing a partially convertible rupee, as opposed to a fully floating one like most Group of 10 economies have.

Furthermore, there would be a considerable rise in the systematic risk as India would become more sensitive to the global markets which may further hamper the stability of the Indian Economy.

Till now India hasn’t been a part of the global bond indices due to operational difficulties like capital control, custody and settlement. Apart from the capital controls, custody/settlement, legacy trading and operational requirements have been cited by benchmarked investors as hurdles for accessing the onshore bonds.

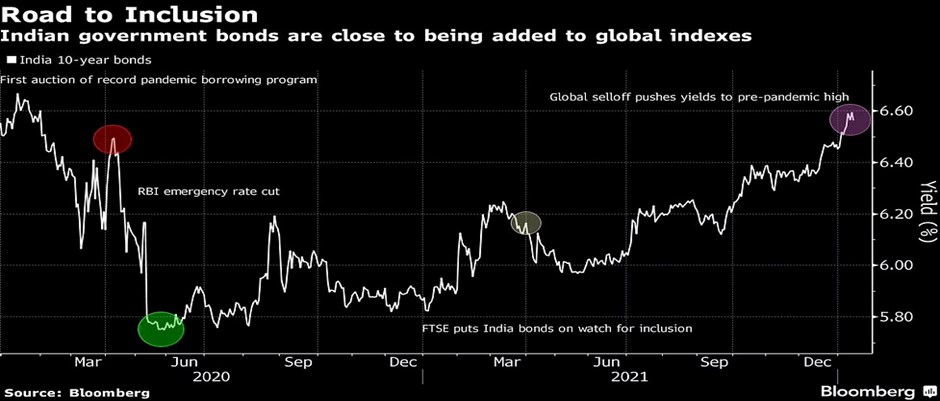

India had been preparing for its bonds to be included in the global bond markets for quite a long time and it had made efforts to enable international settlement of transactions in government bonds, opened up a window, with the help of RBI, called FAR(Fully Accessible Route) under which specific securities would remain qualified for investment and the tax authorities had also agreed to exempt taxes on international transactions which would have taken place on the international clearing and settlement platform Euroclear.

It was anticipated that India would announce its inclusion in the global indices in the Budget Session of 2022 and get included in the indices as early as the start of the fiscal year.

However, after the OECD (Organisation for Economic Cooperation and Economic Development) announced a global minimum rate to address tax issues in 2021, India had changed its stance towards the right to tax capital gains depending on the location of the underlying assets. In discussions related to index inclusion, certain Hindu nationalist groups had also approached the government and opposed the exemption of taxes on international bond transactions claiming this move to be unfair for the domestic investors.

In all, India has ruled out the path to exempt taxes on international bond transactions for the time being and issues related to taxes and compliance are the major reasons behind India’s current non-inclusion in the global indices.

The chances of Inclusion in the near term are bleak but many believe that India will eventually get included in the global bond indices, but questions related to how and when remain unanswered.

The delay in India’s inclusion has already impacted India’s bond market. In recent months, yields rose amid a surge in international crude prices. Key banks are adjusting interest rates to keep pace with inflation. That’s a probable concern for the government as it has plans to borrow a record amount from the markets to bridge a wide fiscal gap.