EUR Outlook and Strategy

Published on - 10th April 2024

Navigating The EURO Landscape: Key Insights

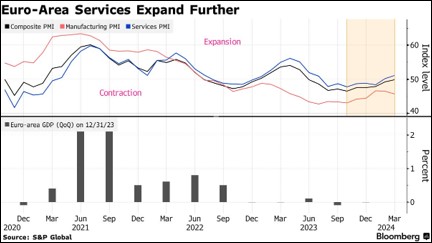

Euro Area Economic Stagnation Amid Varied Performance: The Euro Area economy grapples with stagnation, fueled by high borrowing costs and subdued external demand. Germany saw a contraction of 0.3%, mainly attributed to industrial weakness, while France’s GDP stalled. However, Spain and Italy experienced growth acceleration, reaching 0.6% and 0.2% respectively. Despite this, the manufacturing sector across the Eurozone weakened, with Germany notably suffering a significant decline, marking a five-month low in PMI.

Revised Growth Projections for Major Eurozone Economies: Germany’s growth forecast for 2024 was slashed to 0.2% from the initial 1.3%, with a modest 1% projection for 2025. France expects moderate growth of 0.7% in 2024, down by 0.2%, but anticipates a rebound to 1.3% in 2025. Italy’s GDP growth is projected at 1% for 2024, slightly lower than previously anticipated, with a marginal increase to 1.2% in 2025. Spain’s growth remains steady at 1.7% in 2024 and is expected to rise to 2% in 2025.

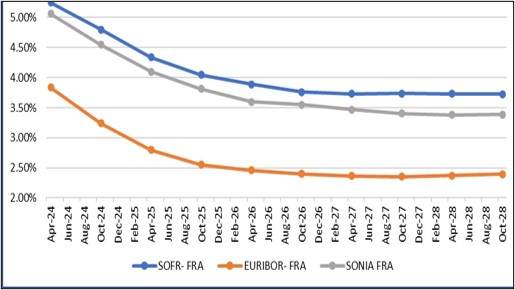

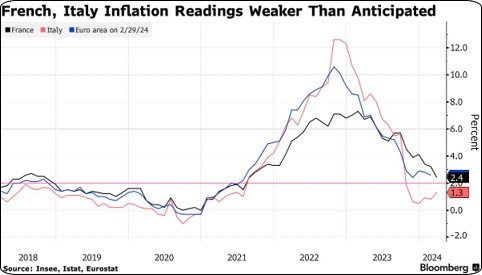

Inflation Trends and Monetary Policy Response: Inflation rates vary across major Eurozone economies, with Germany and France experiencing declines while Italy saw a modest increase. Easing inflation towards the 2% target signals potential relief for consumers and potentially sets the stage for a rate cut in June. The ECB introduces a new monetary policy framework, aiming to give banks more control over liquidity needs. However, liquidity challenges persist for Italian and Spanish banks, necessitating significant additional accumulation by year-end.

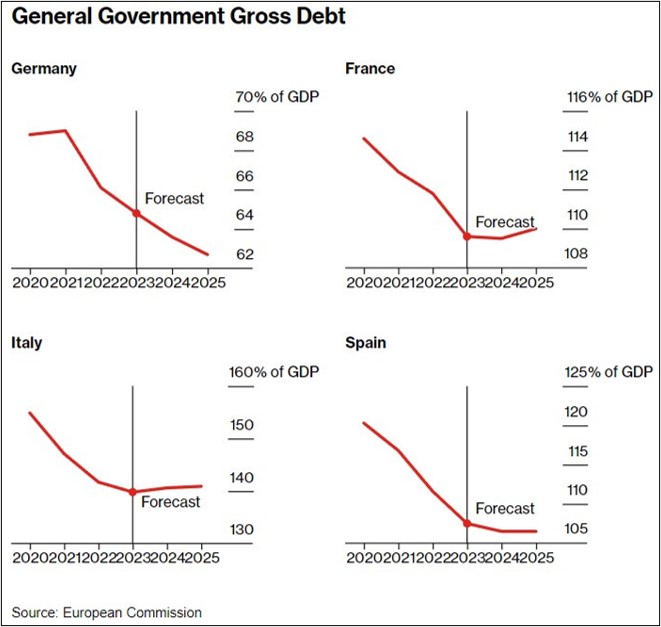

Fiscal Reform and Monetary Policy Dynamics: Preliminary fiscal reform agreements within the EU aim to reduce debt and guide investments, targeting nations with debt over 60% GDP or deficits above 3%. Flexibility and member state control over public finances are emphasized, reflecting lessons learned from past crises. The ECB’s future monetary policy actions remain pivotal for market dynamics, with debates revolving around the timing and frequency of rate cuts post-June.

Outlook and Market Implications: The Eurozone faces a recessionary scenario, contrasting with the stronger US economy. The ECB is expected to adopt a more dovish stance compared to the Fed to revive growth, potentially leading to further rate cuts. Consequently, the Euro may weaken against the USD, with long-term projections suggesting a direction towards 1.03 for EURUSD. Amidst these challenges, adopting a well-rounded hedge strategy is advocated for optimal performance rather than relying solely on economic outlooks.