Copper Price Forecast 2023

Recessionary Pressures Likely to Keep Prices Subdued, but China Could Be a Game Changer

Published on: 1st March 2023

Future Copper Price Predictions Show Prices Moving Towards $7500-8500 in the Next 0-6 Months, with Sharp Rebound Expected in 12-15 Months to Reach $10,000

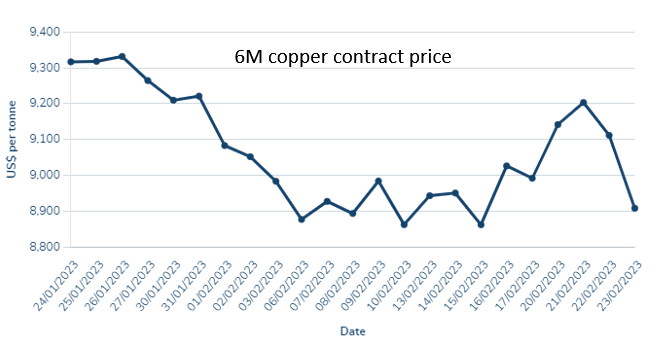

The copper market has been highly volatile in the last 5 years, with prices reacting to central bank policies, inflation concerns, and global economic pressures. Despite expectations that inflation is behind us, recent changes in expectations suggest that inflation is sticky and central bankers may need to do more tightening to control it.

This time, 2-10 yr yield first inverted in Feb 22 for 2 consecutive months and after 3 months of positive spread, it inverted again in July 2022.

This has led to concerns about the potential for a US or global recession, which could keep commodity run-ups in check.

However, there is some sunshine on the horizon, as China could pivot from being a bearish to bullish factor for copper in 2023. Recent policy changes, including lifting pandemic restrictions and injecting money into property developers, have the potential to produce a strong rebound in Chinese demand for copper.

Despite this, copper prices are likely to remain subdued in the short term, with Rio Tinto and BHP declaring losses and the market remaining critically sensitive to unforeseen demand or supply shocks. Future copper price predictions suggest that prices could move towards $7500-8500 in the next 0-6 months.

Looking further ahead, copper price forecast for 2023 and beyond show a sharp rebound with investor interest shifting towards commodities and non-energy commodities. In 12-15 months time frame, we expect $10000 kind of levels for copper.

Copper Option Pricing for April & May – Some Hedge strategies

Seagulls look good structures to hedge from the long side.