Coking Coal Outlook

Published on - 19th March 2024

Exploring the Future of Coking Coal: A Comprehensive Overview

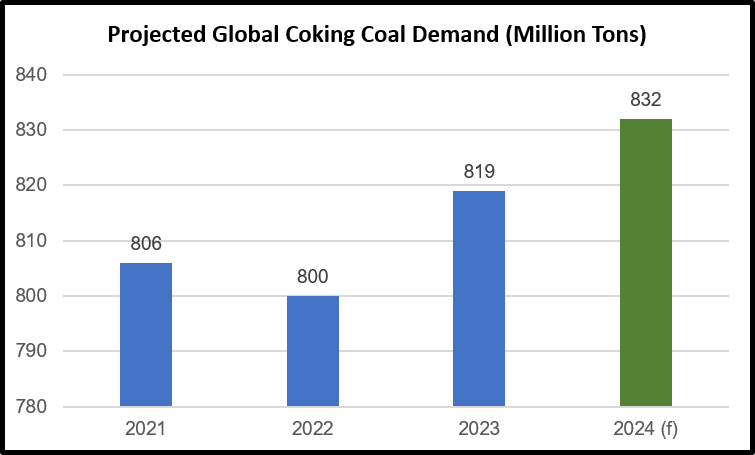

Stable global demand in 2023; Chinese demand remained flat – Global coking coal consumption rose by 2.3% in 2023 to 819 million tons, with China’s met coke demand growing by 2% to 590 million tons due to subdued domestic steel demand. Indian steel companies used around 81 million tons of coking coal in FY23, up by approximately 5.2%, driven by strong steel production and new blast furnaces commissioning.

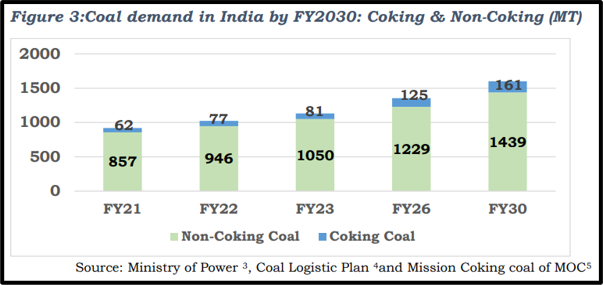

Global demand expected to slow down in 2024 – Global coking coal demand is expected to dip by 1.6% in 2024 to 832 million tons, with Australian prices declining due to reduced demand in China. Chinese demand is projected to fall from 2023 levels due to weaker steel demand and emission reduction efforts, while India’s demand is set to reach 161 million tons by FY30, driven by its expanding steel sector.

Chinese coking coal imports to remain flat or decline in 2024 – China’s coking coal imports in 2024 may remain flat or decline to 90-95 million tons from 100 million tons last year due to tariff implementations. Imports from Mongolia and Russia are expected to increase, while those from Australia are likely to decline amid weak steel demand expectations.

India expected to increase imports over demand surge – India imports 85% of its coking coal due to strong domestic demand and lower-quality reserves, importing 56 million tons in FY23 mainly from Australia. With plans to achieve a steelmaking capacity of 300 million tons annually by FY30, India aims to increase imports, establishing a state-backed consortium to diversify import sources away from reliance on Australia.

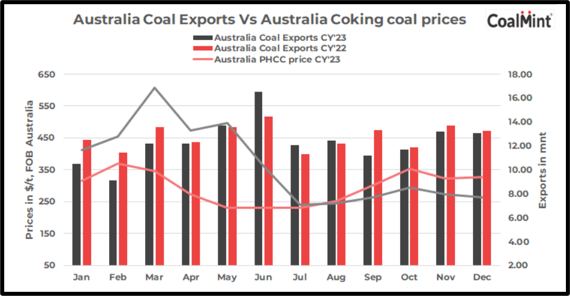

Strong global supply recorded in 2023 – Global coking coal supply reached a record 1.13 billion tons in 2023, growing by 1.8%. Australia, China, India, Indonesia, and Mongolia contributed to the surge. Australia’s output rose by 6% to 178 million tons, while China’s production increased by 3.6% to 490 million tons. India’s output reached 60 million tons, up by 17.3% driven by Coal India.

Higher supply and Australian export volumes expected over several new mines opening – Australia’s coking coal supply is expected to rise by 9.6% in 2024 to 172 million tons due to new mine openings. Despite this, export values are forecasted to drop from AUD 62 billion to AUD 47.2 billion, mainly due to declining prices. China’s imports from Australia decreased in 2023, leading Mongolia and Russia to increase met coke exports due to proximity and rail connectivity.

China plans to reduce coking coal supply in 2024 – China’s coking coal supplies in 2024 are anticipated to decrease compared to 2023 levels, potentially due to steel production curbs amid weak demand. Shanxi, China’s leading coking coal producing province, plans to reduce output this year and is unlikely to approve new mines as part of efforts to address overproduction and lower emissions from the fossil fuel.

India targets to increase coking coal production till FY30 – India’s Ministry of Coal has outlined Coal India’s coking coal production targets to meet the projected domestic demand of 161 million tons by FY30. The targets are set as follows: 80 million tons for FY24, 103 million tons for FY26, and 140 million tons for FY30, indicating India’s aim to enhance production to meet the growing demands of its steelmaking industry.

Outlook on Coking Coal – SGX Australian hard coking coal prices are expected to stay bearish due to slowing demand from China and stable global supply. Indian demand might rise, but it could be outweighed by reduced Chinese demand, putting downward pressure on prices. Near-term prices are forecasted at $270 to $290 per ton, while medium-term prices are expected to range from $255 to $275 per ton.