Can coronavirus trigger a big sell-off in global financial markets

What’s keeping global financial markets thriving – Central Bank Liquidity

First let us understand the drivers of financial markets at this stage. While the world is alarmed about coronavirus, financial markets have not been that alarmed so far. Especially since there are few positives like i) a thaw in “trade war”, ii) Brexit is no longer a suspense and iii) geopolitical rift with Iran is not a threat as of now. However, the primary reason behind financial markets stability has been the liquidity support from central banks, especially the Federal Reserve. Fed showed that they can go far when they started to directly provide liquidity in the US repo market from September 2019. In the US repo market even hedge funds participate so providing funds against repo there is partly akin to providing liquidity to traders. During the last two FOMC, Fed justified their stance and re-iterated that support will continue till early April. As an effect of Fed’s repo support, since September 2019, equity rallied in spite of high valuations, EM bond issues thrived, EM carry currencies remained stable. Led by Fed, most other key central banks have also taken soft stance making monetary easing the panacea for all troubles. Latest example is the way PBOC pumped CNY 900 bn or approx USD 130 bn in the reverse repo market to contain the financial market impact of coronavirus.

So How dangerous is coronavirus?

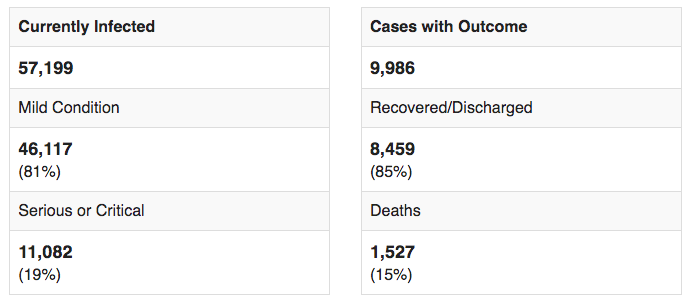

While the death rate calculated as % of total cases is around 2.5%, that number is grossly misleading.If we have to calculate the death rate as % of closed cases, it is around 16%. Still there are 56,000 infected patients ( 85% of total cases ) and 10,000 (around 20% of infected) out of them are in critical condition.

At the time of this writing the virus has affected 29 countries with 99% of the cases still from China. Other countries affected after China are Japan, Singapore, Hongkong. The rate of new cases officially reported from China still continues to be high while the spread in other countries appears relatively smaller. However one needs to understand that the virus takes a longer period of 10-14 days to show effect and a good part of this period, the infected individual has ability to spread the virus. It is highly contagious and it will take time before one can conclude that the danger from the virus is ebbing.

The economic impact – the panic and growth

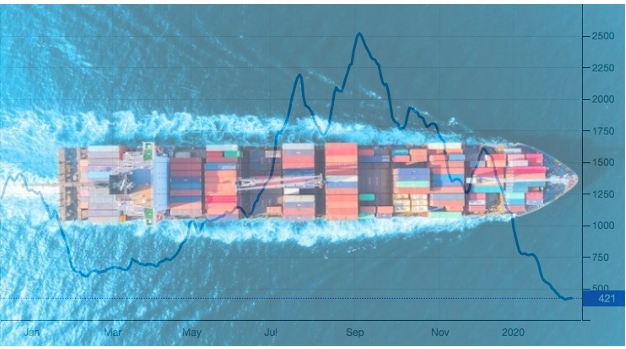

The scare of coronavirus can be seen everywhere. Both business and leisure travel have come down. Many companies have shut factories, closed offices, cancelled conferences, postponed meetings and deal makings etc. Baltic dry index has taken a nosedive as shipping of goods are almost at halt. Many ports have loaded ships but no one is offloading them.

While there are some estimates that coronavirus will derail global growth by 0.2%-0.3%, some other estimates have a much larger impact on global growth.

It’s not the growth but the inflation which is scary

There is another way the impact of coronavirus can be severe for financial markets.

The supply side shock related to China can bring inflation to the world including to the USA. On the ground we can already see supply freeze in many products since China has almost remained shut since lunar new year.

Inflation can be catastrophic for financial markets since markets are maintaining high valuation with support from central banks. Inflation is the only parameters which can force Fed and other central banks to stop being accommodative and thus bringing an end to the liquidity driven boom as explained at the beginning of this article.

It may take some time before inflation shows up in the economic data release as supply chain shocks take time to reach end consumers. But China being the top supplier of the world, impact will certainly be there. First it will show in WPI and then into CPI.

Conclusion

Hence we need to watch carefully for the next 15-20 days. Coronavirus has shown no signs of slowing down so far and if the trend continues for another 15-20 days then we can expect a prolonged supply chain disruption and hence inflationary trend in coming months. An inflationary environment will impair Fed’s ability to print and thus may derail leveraged financial markets.

Need to keep close watch on data and news related to the virus. We will keep updating our analysis on this page as new information flows in.

Update as on 18th Feb 2020 2:30 AM GMT

Coronavirus continues at its usual pace of 2000 infections every day, at 73,300 now. While the % increases in China it trending lower, the number of cases outside China is showing an upward trend (900 in total now). Still 59,000 people are infected with the disease and out of them 12,000 in severe or critical condition. WHO said that the fall in cases in China is not enough to consider the epidemic contained.

The panic continues as travel, meetings, schools, factories, offices remain shut in key countries in Asia like Japan, HongKong, Singapore, China etc. Good part is that new cases (outside China and Diamond Princess ship) shows signs of slowdown.

Update as on 19th Feb 2020 11.30 AM GMT – including possible impact on USDINR

The increase in new cases have consistently come down but it is important to note that increase outside China has been high. New infections in Diamond Princess have increased by 12% wheres in rest of the world have increased by 5.6% as against 2.4% increase in China. The numbers show that it will be too early to say the panic will start ebbing now.

INR continues to be stable backed by huge amount of inflows and steady global markets. However the comfort may not last for long if the corona virus related panic keeps factories, transportations, supplies, offices, deal making shut for some more time. The pattern of USDCNY movement shows that there must be heavy intervention from PBOC to keep the fixing optically below 7.00. However we believe China has to sooner or letter give up the 7.00 levels and that will also impact USDINR by taking it higher towards 72.00. Now since RBI has been aggressively buying USD, they can be expected to sell out of reserves and keep INR from moving to 73.00/ 74.00 in the other direction. So likely narrow range for USDINR can be 71.00-72.50 and the bias of the range will depend on coronavirus related data in the coming weeks. If the data shows that rate of increase in infection is increasing, then we will need to widen range and brace for wider global sell off.

Update as on 25th Feb 2020 11.30 AM GMT – including possible impact on USDINR

As we write, coronavirus has started impacting financial markets. Notably the way infections surged in South Korea and Italy in the last 5 days is alarming and scary. Any country can suddenly come into radar and from few infections to many infection will be matter of days. The virus scare is shutting down normal life wherever it’s presence is seen. All economic and human activities almost come to a standstill like school, offices, factories, cultural programs, shipments, deal makings, sports events, business summits, travel & tourism all come to an halt.

Dow fell 3.00% in a day with the virus scare and we expect more sell off in coming days and weeks. USDINR has moved up to around 71.90 levels and from here on 72.50 looks more likely than 71.30. Most likely 73.00 will be traded because of fear related to coronavirus. US10 Y yield trades at 1.37 while dollar index showing continued signs of strength and is close to 100. This is typical of a scenario when market expects policymakers to act on rate front whereas investments move to safe haven. Japanese Yen ideally should have appreciated by now but Japan’s troubles related to coronavirus is working for JPY’s depreciation and hence as a final effect JPY remains stable.

On the USDINR, it is important to have a safe strategy and refer here for more details

Enter your Details to Get Started

100% No Obligation. We reserve the right to grant access