BOJ Ends the Worlds Last Negative interest rate Regime

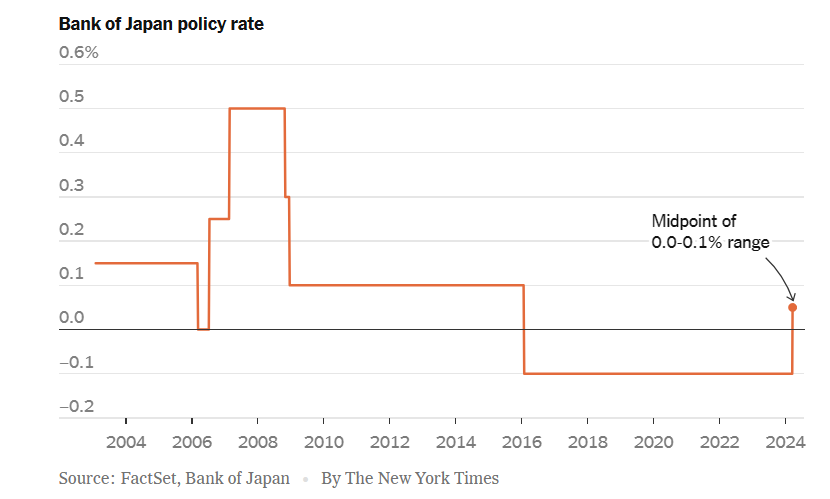

After nearly a decade of unprecedented monetary easing, Japan is navigating a crucial turning point with the Bank of Japan (BOJ) ending the era of negative interest rates.

This move not only signals confidence in Japan’s economic recovery but also marks the end of a global era of radical monetary policy aimed at stimulating growth. Here are the important points and figures:

- The BOJ shifted its policy rate from -0.1% to a range of 0% to 0.1%, marking its first interest rate hike in 17 years and formally concluding eight years of negative interest rates.

- The central bank dismantled its Yield Curve Control(YCC) by removing the 0% target for 10-year government bond yields, signalling flexibility in managing long-term interest rates. It aims for “sustainable, stable” inflation target, with recent inflation above 2%.

- Despite ending YCC, the BOJ committed to maintaining roughly the same level of government bond purchases, ready to ramp up in case of rapid yield increases.

- The decision to halt purchases of exchange-traded funds (ETFs) and real estate investment trusts (REITs) reflects a step away from unconventional monetary measures.

- The BOJ aims to buy long terms bonds at broadly the same rate as before, and it expects “accommodative financial conditions” to be maintained; this suggests that the BOJ will not embark on an aggressive tightening cycle as other central banks.

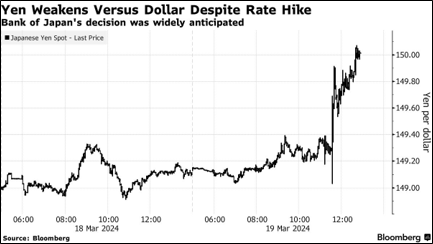

- The weaker currency supported Japanese equities, helping the Nikkei 225 Stock Average reclaim the key 40,000 level.

- The lack of signaling on any future rate hikes weighed on the yen, which slid past the closely watched 150 mark versus the dollar while benchmark government bond yields edged lower.

- With inflation remaining above 2% target , question remains: will BOJ hike rate further or continue its expansionary policy?