CAD Outlook and Strategy

Published on - 13th May 2024

Navigating The CAD Landscape: Key Insights

Canadian Economic Overview: Canada’s Consumer Price Index (CPI) rose to 2.9% in March, slightly below the anticipated 3.0%. The Bank of Canada (BoC) maintained the interest rate at 5% in April due to persistent inflationary pressures, refraining from hints on rate cuts. Price pressures have eased, but higher-than-expected commodity prices hinder disinflation efforts. The BoC expects inflation to hover near 3% in the first half of 2024, targeting 2% by 2025. Market expectations now lean towards a BoC rate cut in June.

GDP and Domestic Demand: Canada’s GDP grew by 0.4% in January, outpacing the BoC’s forecast of 0% for Q4. Domestic demand weakened, with significant declines in business and housing investments. Retail sales remained stagnant since the start of 2024, indicating subdued consumer spending, potentially influenced by high interest rates dampening discretionary spending.

Housing Market: Canadian home sales stabilized in March with a 0.5% increase, but the benchmark home price dropped by 0.3%, suggesting a slight downturn. Despite expectations of moderate price increases, the BoC warns against sharp rises posing inflation risks. Increased housing demand is anticipated following potential BoC rate cuts and high immigration rates.

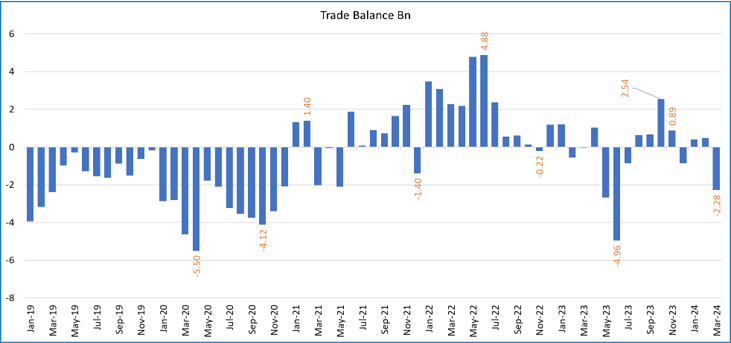

Trade Deficit and Exports: Canada faced a goods trade deficit of C$2.28 billion in March, the largest since June 2023, contrary to expectations of a surplus. Exports saw a broad 5.3% decrease, particularly in sectors like metals, minerals, energy, and motor vehicles. Gold and energy exports experienced significant drops due to refinery shutdowns and reduced shipments. Imports declined by 1.2%, with decreases in electronics, metals, minerals, and aircraft.

Job Market and Monetary Policy: Canada’s robust April jobs report, with the highest employment increase in 15 months, reduced the probability of a June BoC rate cut. However, economists caution against interpreting this strength as indicative of a tightening market, citing demographic shifts. Slow wage growth supports a potentially more dovish BoC stance. Despite stable employment, the economy faces risks of slow growth, weakened by reduced domestic demand and cooling housing sales.

Currency Outlook: The Fed’s rate cut and weakness may support CAD, though growth divergence may require a more dovish BoC stance and that will weigh on CAD. The USDCAD is expected to be stable in the short term, with possible depreciation towards 1.3900 in the medium term. CADINR is forecasted to range between 61.0-62.0 in the short term, potentially biased towards 61.00, and between 61.0 to 63.00 in the medium term, with a bias towards 63.00.