QuantArt – Hedgenius

Essential for every Treasury

Intelligent Software to Manage Hedging and Risk Smartly

✔ Foreign Exchange hedging

✔ Interest Rate hedging

✔ Commodity hedging

✔ Training on Fx

✔ Training on Commodity

✔ Training on Interest Rates

✔ Minimize Risk

✔ Save Cost

✔ Improve Profitability

✔ Transparency

✔ Know Best Practices

✔ Get Research Report

For Subscription at Special Price or Demo Contact Us:-

All You Need Is In One Place

✔ Live Rates

✔ Calculators

✔ Strategies

✔ Research

✔ Training

✔ Mark to Market

✔ Tools

✔ MIS and More

All You Need Is In One Place

✔ Live Rates

✔ Calculators

✔ Strategies

✔ Research

✔ Training

✔ Mark to Market

✔ Tools

✔ MIS and More

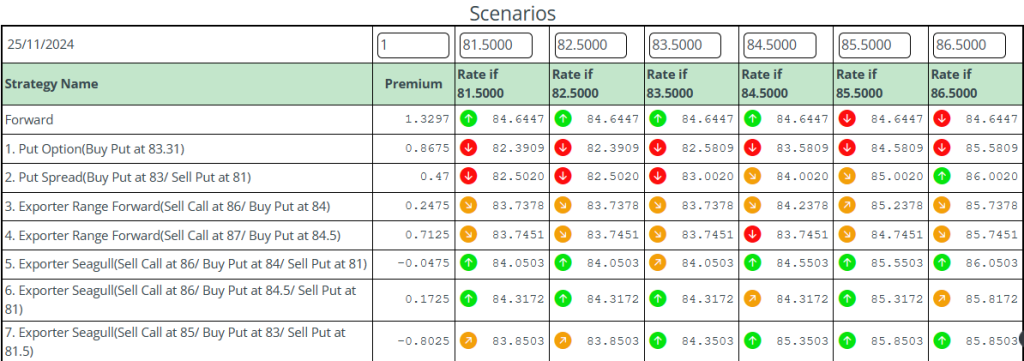

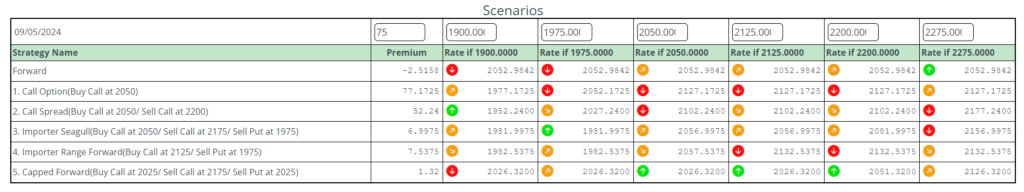

Hedge Strategies with Scenario Analysis

Elevate your decision-making with our Decision Support System, offering a unique feature for a thorough comparison of diverse option strategies at different spot levels. Uncover key metrics like breakeven points, maximum profit, and maximum loss, providing a comprehensive view of the risk and reward associated with each option configuration.

Comprehensive Training Series 2024

A List of Sample Trainings

Global Treasury Trainings on Foreign Exchange, Rates, Commodities Options, Swaps, Derivatives Pricing & Advance Concepts and more..

Here’s what we will cover during the session-

- USDINR Outlook and Hedge strategy for export, import, and Loans

- Reassessment of Global Markets and view on USDINR and other Fx.

- Factors driving financial markets and Fx.

- Hedge strategy for USD Import, EUR Export, Fx/INR Loans, EUR, GBP, CNY, JPY.

Here’s what we will cover during the session-

- Brief history of Fx.

- Current Account, Trade Balance.

- Oil and Gold, Remittances, Invisibles, Capital Account, FDI, Trade, Hot money, IIP, REER.

- Intervention, Hedge positioning, Inflation and Fx.

Here’s what we will cover during the session-

- Concept of an option, call/put payoff diagrams.

- Conventions – expiry/settlement dates, expiry cut, parameters. influencing the price of an option.

- Option structures – constructing payoff profiles.

- Collar, range forward, seagull, butterfly, capped forward, call spreads, etc.

Here’s what we will cover during the session-

- Indian context: Importer option strategies, Exporter option strategies, Loan option hedging strategies, Option trading strategies.

- How to make structures, Intuitive pricing, Pros and cons, practical issues.

- Regulations related to options.

- OTC Vs Exchange.

Here’s what we will cover during the session-

- Fx Risk Management Best Practices & Policy.

- How best treasuries work – checklist.

- Risk identification and measurement – NOP, Hedge ratio, Static and dynamic hedging, Gross vs Net, Profit vs Cost.

- RBI regulations related to risk management and hedging.

- Past performance of various hedging methodologies.

- UFCE, ISDA, and ISDA Negotiation.

Here’s what we will cover during the session-

- Algorithm-based hedging.

- A close look at strategies and data.

Here’s what we will cover during the session-

- Introduction to Black-Scholes-Merton: Overview of the model’s use in FX options pricing.

- Key Inputs: Discuss spot, forward, strike price, time, risk-free rate, and volatility.

- Interest Rates Impact: How changes in interest rates influence option pricing.

- Spot vs. Forward Rates: Relationship and impact on FX options.

- Volatility Basics: Role of volatility in the value of FX options.

- Understanding the Vol Surface: Explore the structure and use of the volatility surface.

- Understanding smile and skew, strangle and Risk Reversal

- Volatility Concepts: Implied vols, Historical vols and realised volatility.

- Using Black-Scholes Formula: Step-by-step guide to calculate FX option prices.

- Hands-On Pricing Exercises: Practical application using real FX market data.

- Case Studies in Option Pricing: Real-world examples to illustrate pricing strategies.

Here’s what we will cover during the session-

- Introduction to Fx Option Greeks: Overview of Delta, Gamma, Vega, Theta.

- Delta’s Impact in Fx Options: How Delta affects price sensitivity.

- Gamma in Options: Examining Gamma’s role in option curvature.

- Vega and Market Volatility: Vega’s sensitivity to volatility.

- Theta’s Time Decay in Fx Options: How Theta influences option value over time.

- Strategic Use of Fx Greeks: Applying Greeks in Fx strategy, monitoring, and adjustments.

- Understanding Deferred Premiums in Fx: Effects on loan hedging costs.

- Call Spread Strategy for Fx Loans: Setup and benefits for loan hedging.

- Offshore vs Onshore Fx Hedging: Key differences and decision factors.

- Examples of GBP, EUR, USD, JPY, INR options

Here’s what we will cover during the session-

- Fx Exotics – types, payoffs and structuring:

- Pricing and broad structuring given underlying exposures (Imports, exports, Loan, etc).

- Risk assessments and Documentation (Deal Confirmations wording etc to safeguard Bank’s interest).

- Risk Management and MTM simulation in different scenarios.

- General Do’s and don’ts based on past experiences.

Here’s what we will cover during the session-

- How to measure and manage Fx Risk using VaR (Value at Risk) and PaR (Profitability at Risk).

- How to strategize and optimize to ensure minimum VaR and PaR.

- Hedge strategy which maximizes savings and minimizes risks and losses.

Here’s what we will cover during the session-

- Introduction to Swaps – interest rate and currency swaps.

- Concept of FRA (Forward rate agreements)

- Benchmarks and Curve Parameters – SOFR, TONAR, IRS, OIS etc.

- Conventions – Day count, holiday conventions

- Compounding of rates including continuous compounding – Excel

- Parameters – Stub, Fixing, Settlement etc.

- Getting DF from IRS

- Interpolation

- Back of the envelope pricing

- Explained with examples of USD, EUR, GBP, AED, INR

Here’s what we will cover during the session-

- Bootstrapping of swap curves

- Currency Basis

- Pricing of Interest rate swap in Excel

- Pricing of Cross currency swap in Excel

- Pricing of Unwind value of swap in Excel.

- PV01 concept and use

- Risk Bucketing for the curves.

- Case studies involving swaps.

- Explained with examples of USD, EUR, GBP, AED, INR

- Refresher for intuitive swap pricing.

Global Treasury Trainings on Foreign Exchange, Rates, Commodities Options, Swaps, Derivatives Pricing & Advance Concepts and more..

Foreign Currency Loan

Here’s what we will cover during the session-

- Swaps.

- Concept of FRA, interest rate, and currency swaps.

- Conventions and terminologies – LIBOR, day count conventions, holiday conventions, stub, etc.

- CCS, POS, COS, and IRS in the Indian context along with examples.

- Long-term forwards and their equivalence to swaps.

Here’s what we will cover during the session-

- ECB funding, advantages, and regulations.

- Evaluation of multiple ECB hedge strategies, current market spread, the right hedge strategy.

- Pricing of strategies and computation of IRR under various strategies.

- Choose the right strategies with market dynamics & cost in mind, keeping other constraints managed.

Here’s what we will cover during the session-

Hedge Accounting

Here’s what we will cover during the session-

- IndAS – Hedge Accounting

- Hedge effectiveness testing

- Accounting treatment of hedges – Forward contract, Option contract, IRS/CCS, Exports – revenue hedge vs cash flow hedge, Imports – payable hedge vs cash flow hedge

- MTM and CVA DVA

- ISDA Negotiation – going through the clauses and implications. Top clauses for negotiation

- ISDA – Non acceptable clauses

Hedge Accounting

Global Markets

Here’s what we will cover during the session-

- Global Monetary Policy

- Global & Local factors influencing Fx

- Quantitative Easing, Balance sheet easing

- Dollar dynamics . Competition to Dollar

- Global trade and investment currency

- Risk on risk off concepts, market themes

- Multi-Asset correlations

- Geopolitical risks to FX, Liquidity and Credit crisis

- Multi-Currency and Multi Economy – Comprehensive view.

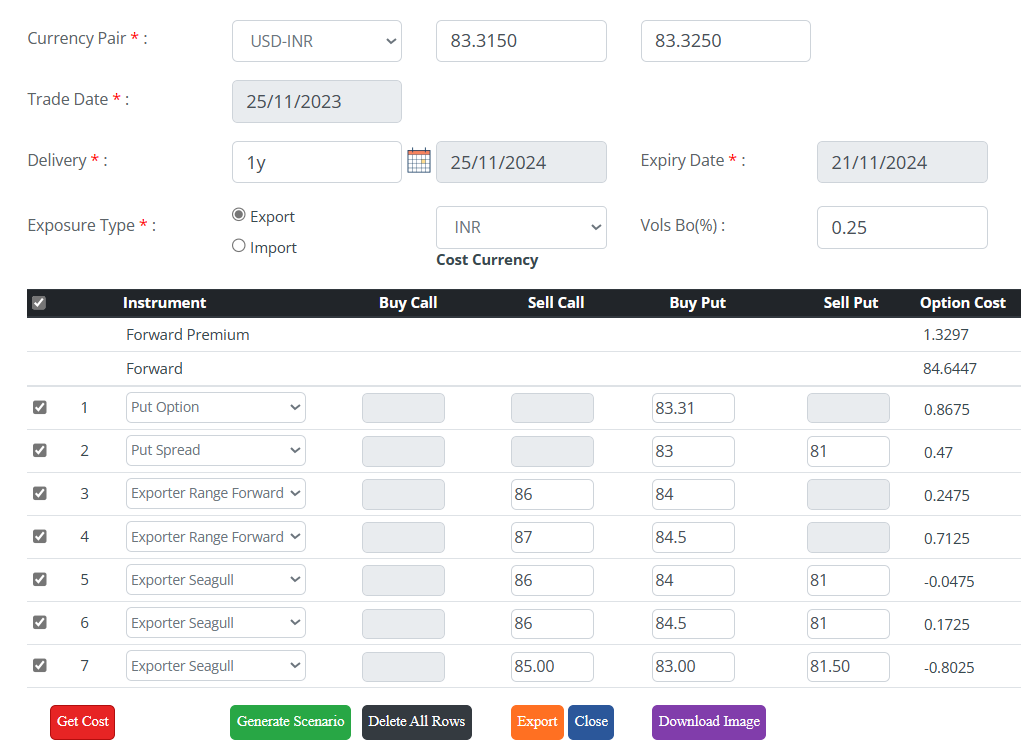

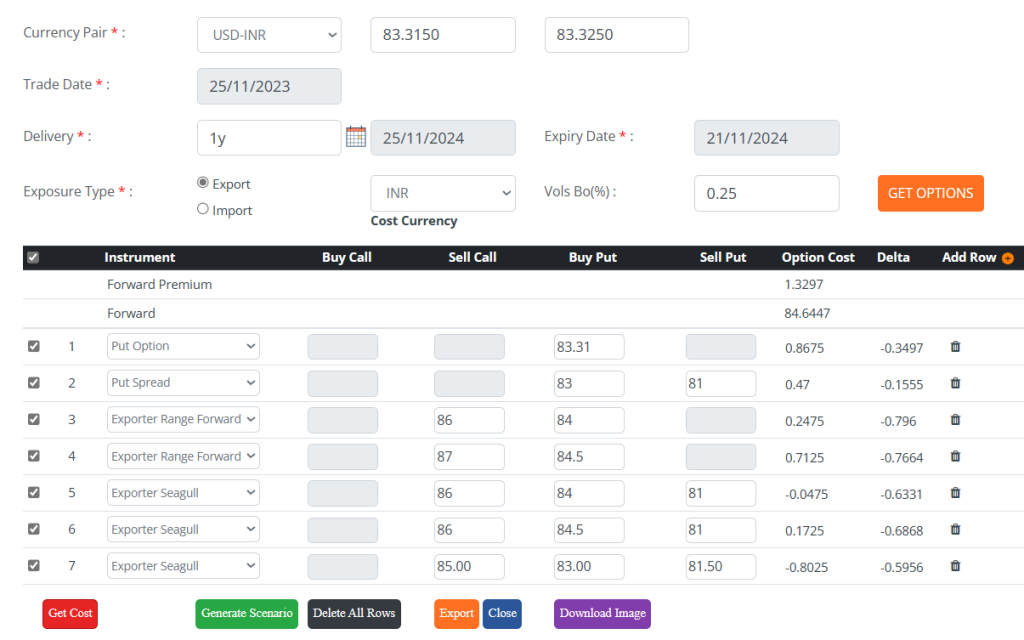

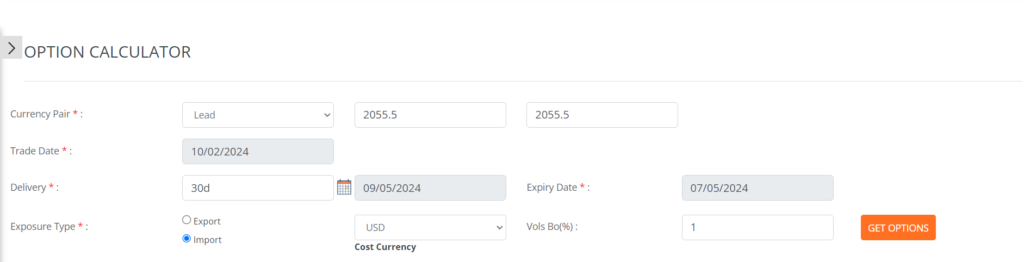

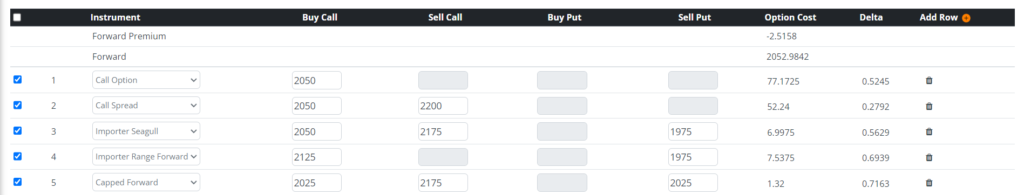

Option Calculator

Revolutionize your Options Strategy with our advanced calculator. Compare, customize, and optimize strategies tailored to your market view. This versatile tool supports multiple currencies and commodities, enhancing pricing accuracy with volatility bid-offer gap input.

Option Calculator

Revolutionize your Options Strategy with our advanced calculator. Compare, customize, and optimize strategies tailored to your market view. This versatile tool supports multiple currencies and commodities, enhancing pricing accuracy with volatility bid-offer gap input.

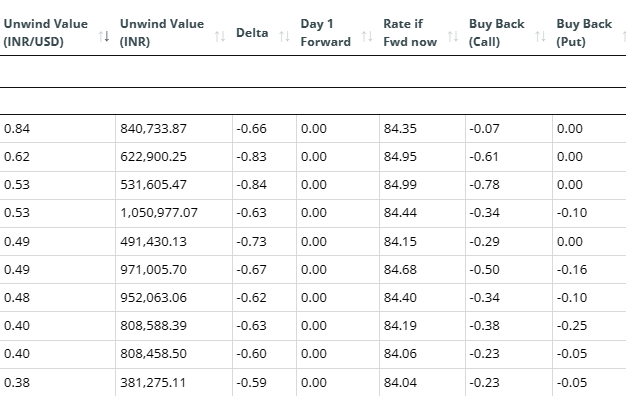

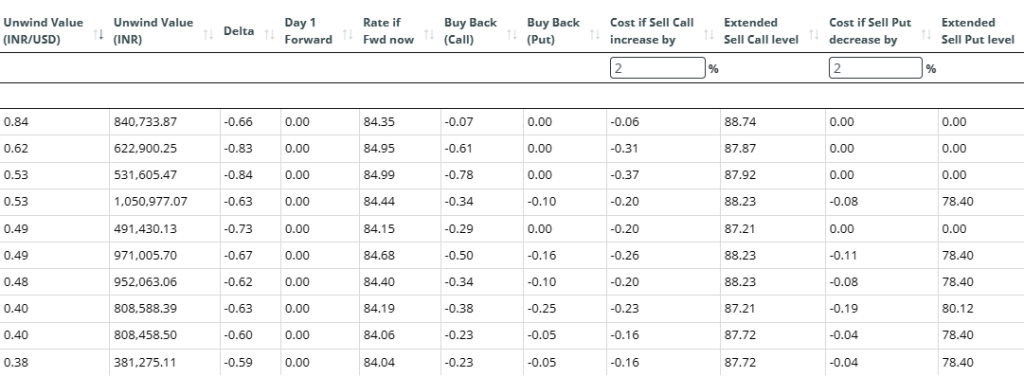

Option Monitoring

QuantArt Hedgenius monitors option hedges in real-time, providing insights into unwind values and essential analytics. Users can evaluate converting options to forwards by comparing unwind and day one forward rates. For strategies like seagulls or cap forwards, the system offers detailed cost analytics for buying back sell calls and puts and extending levels by one rupee or percentage. This empowers users to make informed decisions, ensuring effective risk management in the dynamic options market.

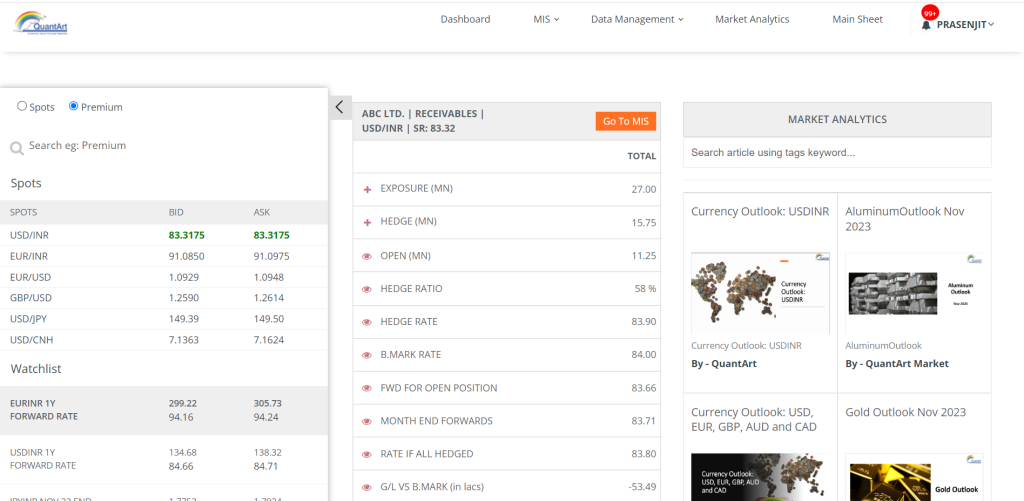

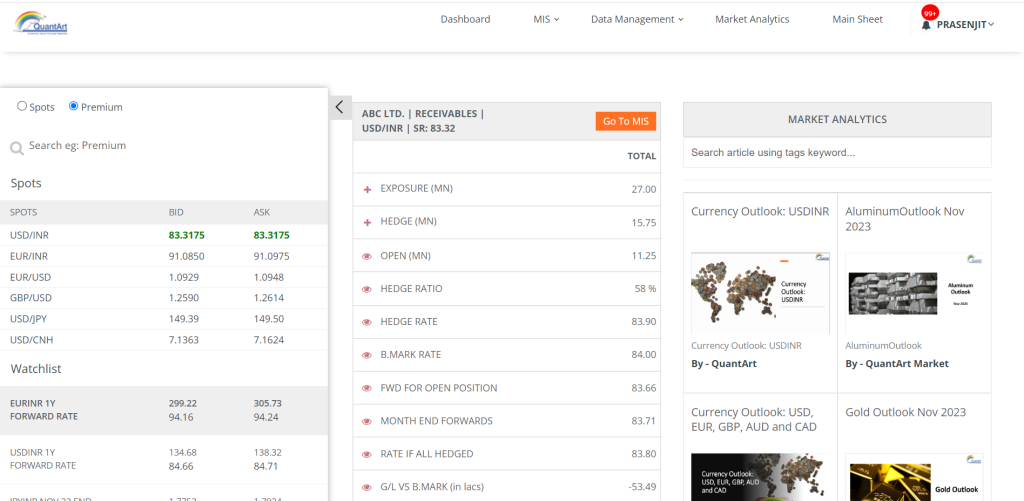

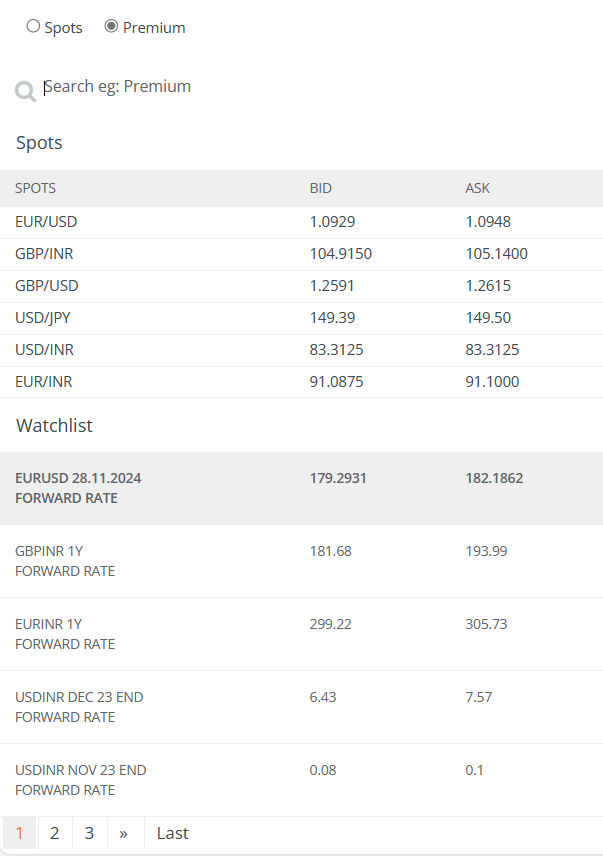

Live Spot and Forward Premium

Enhance your hedging decisions with real-time spot and forward rates, aiding swift negotiations. Tailor your experience with a personalized Watchlist, ensuring close monitoring of relevant rates. The live data feature ensures accuracy, facilitating efficient decision-making for cash flow management and negotiations.

Live Spot and Forward Premium

Enhance your hedging decisions with real-time spot and forward rates for multiple global currency pairs, aiding swift negotiations. Tailor your experience with a personalized Watchlist, ensuring close monitoring of relevant rates. The live data feature ensures accuracy, facilitating efficient decision-making for cash flow management and negotiations.

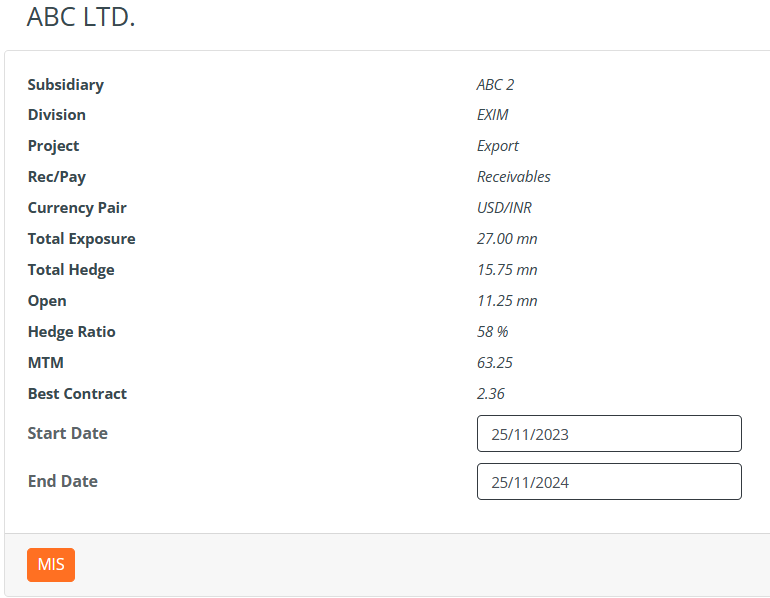

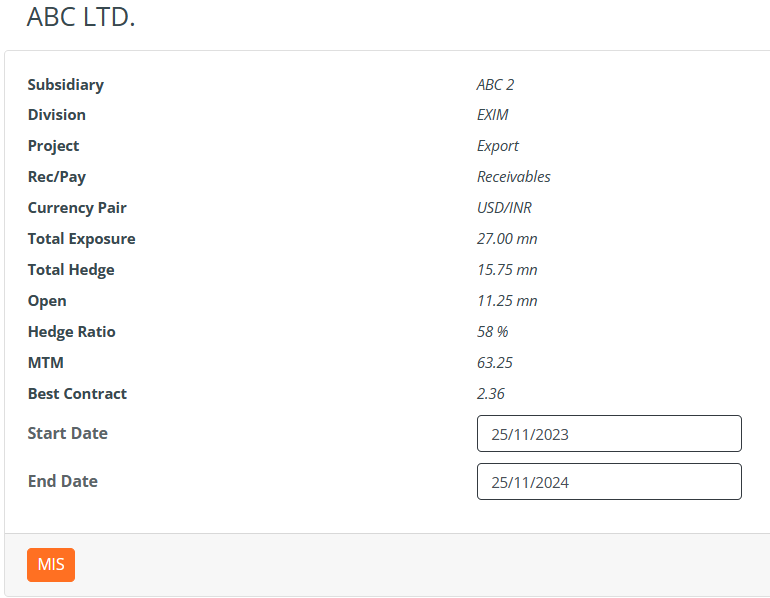

Hedge MIS

Efficiently manage foreign exchange risk with our Monthly MIS feature, allowing users to monitor and optimize their exposure regularly. Evaluate hedging strategy performance by comparing Month-Wise Gain/Loss against a benchmark and Spot (MTM).

Hedge MIS

Efficiently manage foreign exchange risk with our Monthly MIS feature, allowing users to monitor and optimize their exposure regularly. Evaluate hedging strategy performance by comparing Month-Wise Gain/Loss against a benchmark and Spot (MTM).

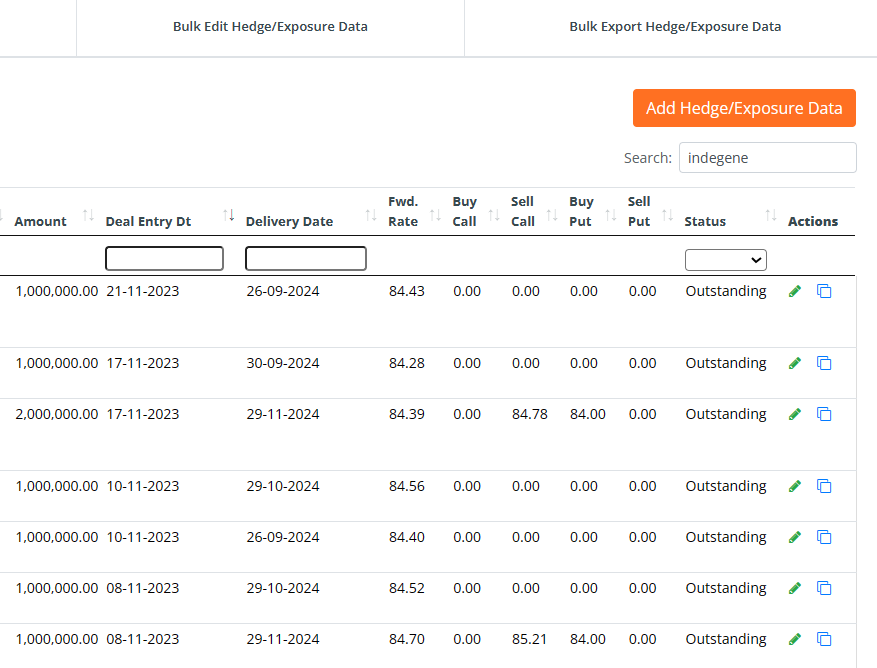

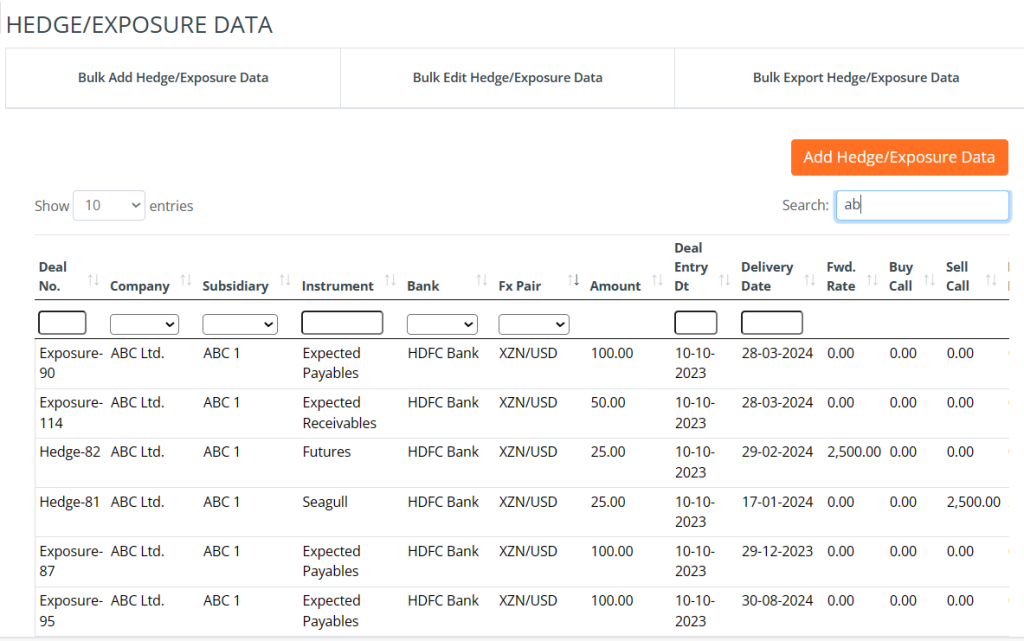

Data Management

Experience seamless data management, ensuring a holistic view of financial activities and positions. Simplify data entry with Bulk Data Uploading, saving time and minimizing errors associated with manual input. Stay ahead in decision-making and risk management with Expiry Reports for Exposure and Hedges, providing detailed insights into impending maturities.

Data Management

Experience seamless data management, ensuring a holistic view of financial activities and positions. Simplify data entry with Bulk Data Uploading, saving time and minimizing errors associated with manual input. Stay ahead in decision-making and risk management with Expiry Reports for Exposure and Hedges, providing detailed insights into impending maturities.

Knowledge Hub

Access in-depth Research Reports for valuable insights into currency trends, guidelines, and regulatory frameworks. Enhance your understanding through recorded webinars on global market conventions, derivative instruments, and hedging strategies, ensuring you stay informed on complex financial subjects and current market conditions. The research reports include currencies like USD, Euro, GBP, and commodities like steel, aluminum, and copper, along with assigned researchers and the frequency of report releases, which is primarily monthly.

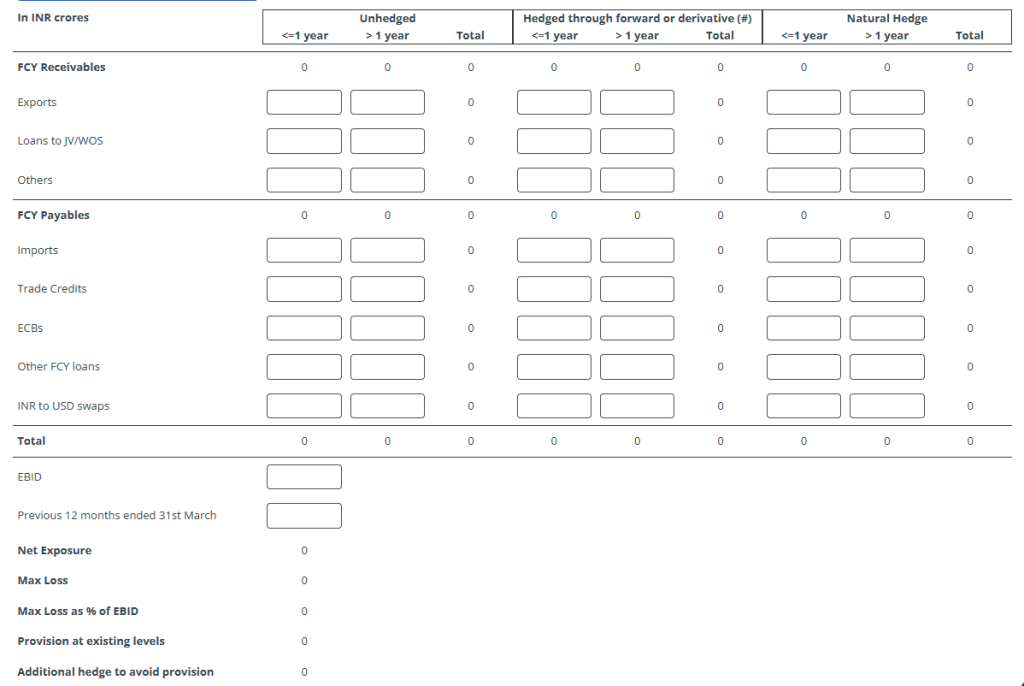

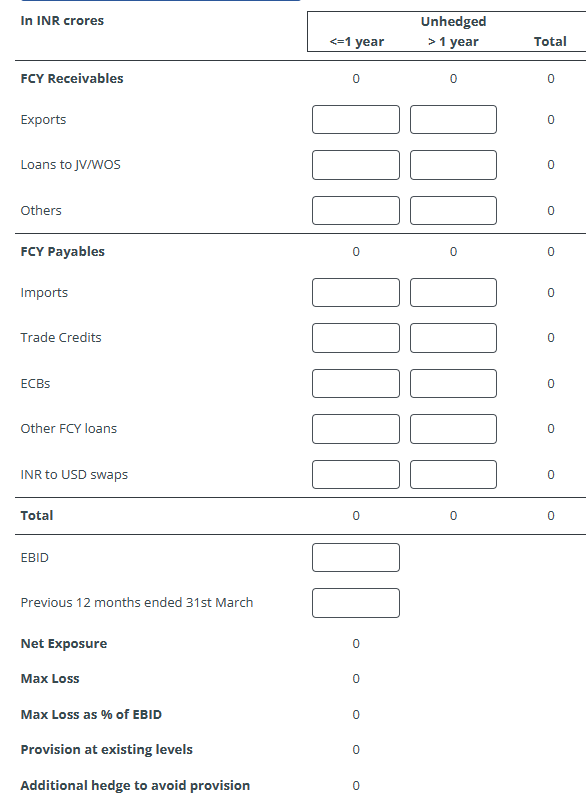

UFCE Calculator

Optimize your foreign currency risk management with our UFCE Calculator, designed to evaluate and analyze exposures in accordance with RBI guidelines.

UFCE Calculator

Optimize your foreign currency risk management with our UFCE Calculator, designed to evaluate and analyze exposures in accordance with RBI guidelines.

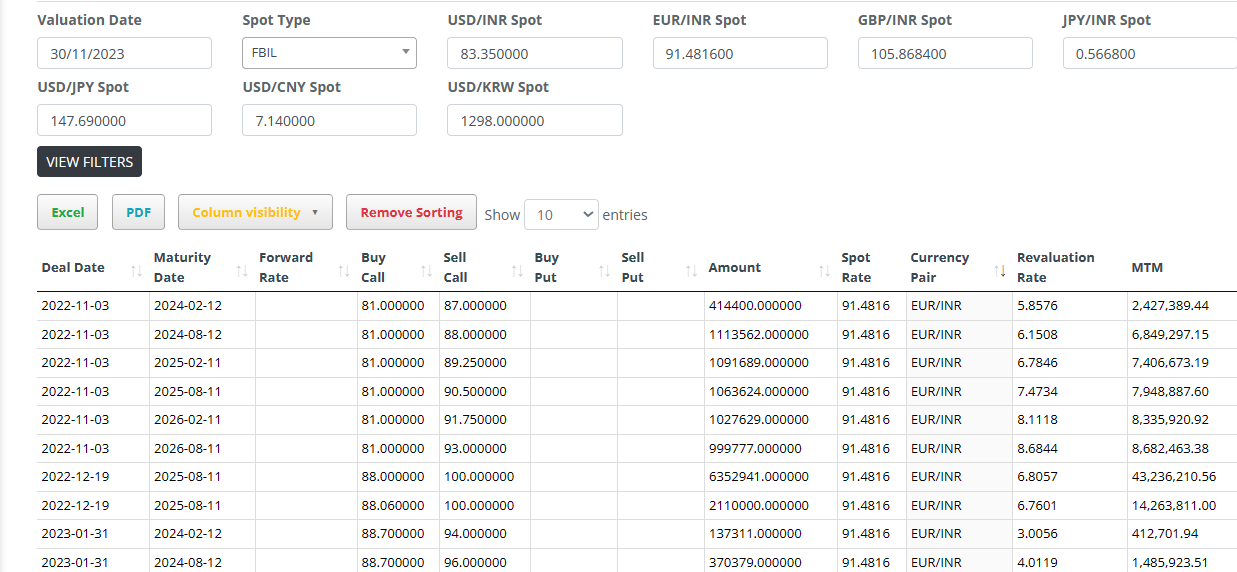

Mark to Market Valuations

Empower your financial decisions with real-time valuation of forward contracts and options, ensuring accuracy based on current market conditions. Our system’s flexibility to use FBIL or FEDAI reference rates aligns valuations with recognized standards, enhancing credibility.

Mark to Market Valuations

Empower your financial decisions with real-time valuation of forward contracts and options, ensuring accuracy based on current market conditions. Our system’s flexibility to use FBIL or FEDAI reference rates aligns valuations with recognized standards, enhancing credibility.

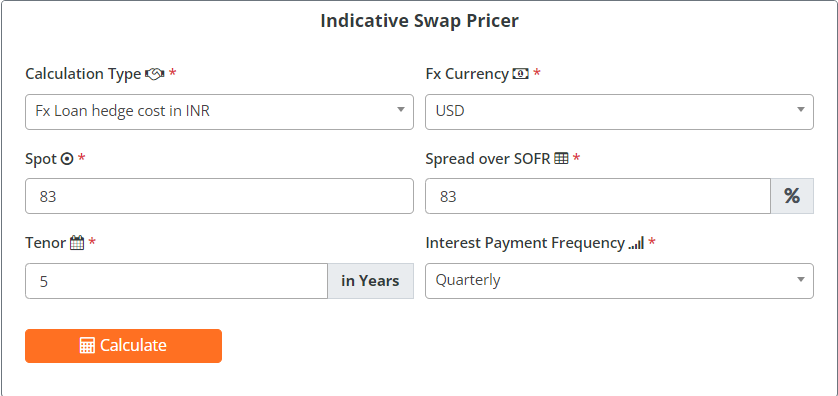

Swap Calculator

You Can Calculate FC Loan or ECB Hedge cost using our software indicative price tool.

Swap Calculator

You Can Calculate FC Loan or ECB Hedge cost using our software indicative price tool.

LME Base Metal Calculators

A comprehensive tool which allows the user to select and accurately price the costs of multiple options strategies for hedging base metals exposure in LME. The tool also generates multiple scenarios of LME settlement prices and assists in analyzing each scenario to make decisions in selecting the best possible options strategy under different market conditions. The user can also choose the volatility bid-offer gap to get a more accurate pricing, especially in less liquid markets.

Petro and Base Metal Commodities

This monitoring tool empowers the user to track live data of spot and futures prices of petro and base metal commodities being traded on domestic and international exchanges.

Expiry Report

Get timely informed about outstanding exposure and hedge contracts with the “Expiry Report” Feature. It provides the list of contracts to be expired within a given timeframe.